Business

Markets precariously poised

Markets gained during the week after losing ground for the previous two consecutive weeks. BSESENSEX was up 989.85 points or 1.68 per cent to close at 51,793.18 points. NIFTY gained 293.90 points or 1.68 per cent to close at 17,833.35 points. The broader indices saw BSE100, BSE200 and BSE500 gain 1.60 per cent, 1.67 per cent and 1.73 per centrespectively. BSEMIDCAP was up 1.86 per cent while BSESMALLCAP was up 2.53 per cent.

Indian Rupee gained 22 paisa or 0.28 per cent to close at Rs 79.58. Dow Jones lost on the first two days and then gained on the remaining three days to end the week with gains of 833.27 points or 2.66 per cent to close at 32,151.71 points.

In primary news, there was one listing, one issue which had opened for subscription and also closed and a third which had its roadshow. The issue from Dreamfolks Services Limited listed on Tuesday and fared well on expected lines. Shares which were issued at Rs 326, saw a discovered price of Rs 505 on BSE, a high of Rs 550 and closed at Rs 462.65. By Friday, shares lost some ground and closed lower at Rs 430.80.

The issue from Tamilnad Mercantile Bank had tapped the markets with its fresh issue in a price band of Rs 500-525. The issue was subscribed 2.85 times with QIB portion subscribed 1.62 times, HNI portion was subscribed 2.94 times and Retail portion was subscribed 6.43 times. There were 1.33 lakh applications. Considering the issue, the response from QIB’s could at best be said as tepid.

The issue from Harsha Engineers Limited opens on Wednesday the 14th of September and closes on Friday the 16th of September. The price band is Rs 314-330. The company makes bearing cages as its key product and supplies to leading bearing manufacturers not only in India but also globally. Japanese manufacturers have begun to buy from Harsha and this could be a big boost in revenues going forward.

The company reported revenues of Rs 1,321.48 crore for the year ended March 2022 and a profit after tax of Rs 91.94 crore. The PE at the top end of the band is 27.73 times. The company has undergone a restructuring exercise and has amalgamated all its businesses under one name. This has diluted the equity to some extent and while the basic EPS for the year ended March 22 was 16.06, on a diluted basis it works out to Rs 11.09. The share and the business look attractive.

Coming to the markets in the week ahead, our markets would find strong resistance at the 17,750-800 levels and 59,450-59,550 levels. While we have almost closed at the above levels, we need to break out of them and sustain at higher levels. In case they do manage to break these levels for any reason, the previous tops made at 18,000 and 60,400 would be very strong resistances in the period coming up. Strong support exists at 17,350 and 58,200. If these break then the next level would be 17,000-17,050 and 57,250-57,350. For a clear trend to emerge, 17,000 and 57,250 on the lower side and 18,000 and 59,550 on the upper side need to be decisively broken. Currently we have no news or momentum in the markets to break these levels.

The strategy would be to buy on dips and sell on rallies. One interesting development that has taken place in the last week, was that shorts in the futures were squared off to a large extent and to that effect markets have become hollow. In case there is any bad news and markets take a beating, the fall could become sharper than expected. Trade cautiously.

Business

India Set To Lead The World In 6G, Says Telecom Minister Jyotiraditya Scindia

In a bold declaration at the inaugural address of the Indian Mobile Congress 2024 (IMC) on Tuesday, Union Telecom Minister Jyotiraditya M. Scindia has said that India will lead the world in the adoption of 6G.

In his address at the event, Scindia emphasized that India is now prepared to lead the world in the development of 6G technology.

India’s Technological Rise: From Following to Leading

“It is our belief and commitment that India, which followed the world in 4G and marched with it in 5G, will lead the world in 6G,” Scindia stated.

The minister highlighted India’s remarkable achievements in the telecommunications sector over the last ten years, the country has become a global leader in innovation and technology.

“It’s a fundamental change in approach towards technology development,” he said, attributing this transformation to Prime Minister Narendra Modi’s leadership.

Telecom Sector Growth Under PM Modi’s Leadership

“Prime Minister who has always put people at the heart of progress Sabka Sath, Sabka Vikas Sabka Vishvas aur Sabka Prayas combined with his second motto, One Earth, One Family and One Future. It is combination of these two mottos that leads India under PM Narendra Modi leadership one of the leading sectors in the committee of Nations,” Scindia said.

Scindia underscored government’s initiatives to bridge the digital divide, particularly through the BharatNet program, the world’s largest rural broadband connectivity initiative to connect every panchayat of the nation. Over the past three years, the government has invested more than USD 10 billion and laid 7 lakh kilometres of fiber across rural India.

Digital Payments and UPI: Pillars of India’s Digital Economy

He cited staggering growth in mobile and broadband connectivity, with mobile connections rising from 94 million to 1.16 billion, and broadband users growing from 60 million to 924 million in just a decade. India’s optical fibre cable (OFC) networks has expanded from 11 million kilometers to 41 million kilometres over the last ten years, he added.

The minister further said that this growth is accompanied by the success of India’s digital payment systems, the 4G stack, and the Unified Payments Interface (UPI), which serve as pillars of India’s digital economy are expected to contribute significantly to the global digital infrastructure.

Scindia further noted that the government’s efforts to ensure that policy frameworks keep pace with the rapidly evolving digital landscape. “The recent changes to the Telecommunications act 2023 is a case in point. It has been drawing light upon hither to undressed areas such as a high potential sector of satellite communications, addressing the challenges of the digital leader. The most important being cyber security. The telecom sector much like other growth critical sectors in India is aggressive, is ambitioushe said.

“The telecom sector much like other growth critical sectors in India is aggressive, is ambitious and its outlook in our Journey from Amritkal to Shatabdikal is to lead the world,” Scindia said. By mid-next year, India will have achieved 100 per cent saturation of 4G across the entire country, covering even the most remote villages, the minister said.

He emphasised PM Modi’s vision of India as a first mover in 6G technology, underscoring the nation’s resolve to lead the world in future telecom innovations.

“The attitude put forward by the prime minister of not just embracing, but raising ourselves to becoming the first mover in the 6G technology,” he added.

Business

Indian Markets Gave Better Returns Than China In Last 5 Years, Says Sebi Member

Sebi Whole-time Member Ananth Narayan G on Monday reminded investors that Indian equities have consistently delivered 15 per cent returns over the last 5 years whereas the same has been zero or even negative in China.

Terming the Indian markets “sone pe suhaga” for delivering higher returns for lower risks, Narayan also flagged a few areas of caution for investors and asked them to be conscious of the risks.

“There’s a lot of talk about China markets over the last few days. But over the last five years, while Indian markets have given around 15 per cent compound annual growth rate consistently, Chinese markets are nowhere close to that. It’s almost zero. In fact, in some cases, like in Hong Kong, it’s actually negative,” Narayan said.

Speaking at an event marking the start of the Investor Awareness Week at NSE, Narayan said FY24 was a “remarkable” year for India, with the benchmark indices returning 28 per cent and the volatility just 10 per cent.

“That’s like ‘sone pe suhaga’. It’s like the best of all worlds: low risk and very high return,” Narayan said, underlining that there are side effects of this as well.

Making it clear that it will not be the same going forward and investors should not assume it to be a one-way street, Narayan said such handsome returns can lead to complacency and pointed to a lot of youngsters opening up demat accounts to join the bandwagon.

Educating people about risks is very important, Narayan said, giving the analogy of driving a car. “There has to be a light push on the accelerator to get more investors to provide risk capital for the economic growth, we also need to be aware of risks and use the brakes if need be.” He said that 40 per cent of the small and midcap scrips have shot up by 5 times in the last five years, because of an imbalance between inflow of investor money and supply of new paper.

On its part, the capital markets regulator is trying hard to ensure that fund-raising clearances are done early so that there is a steady stream of quality paper supply in the market.

From a broader, longer-term perspective, Indian markets will only go north from here given the economic growth prospects in the country, Narayan said, issuing specific advice to investors.

Investors need to have the right intermediaries to capitalise on this opportunity presented by India, and not fall for the unregistered and fly-by-night ‘finfluencers’ who might be driven by vested interests, he said.

Using the oft-repeated idiom of “all roads lead to Rome”, Narayan remarked that Rome is not a traveller-friendly place and one may get scammed there as well. Therefore, it is important to seek advice from the right people for the investors, he said.

He also said that it is in investors’ interests to trade less and stay invested for longer for higher returns, and added that studies prove the same.

Sebi, which has flagged certain areas like derivatives recently, is not against speculation or participants taking short-term trades, but it would want investors to understand the risks, Narayan said.

Business

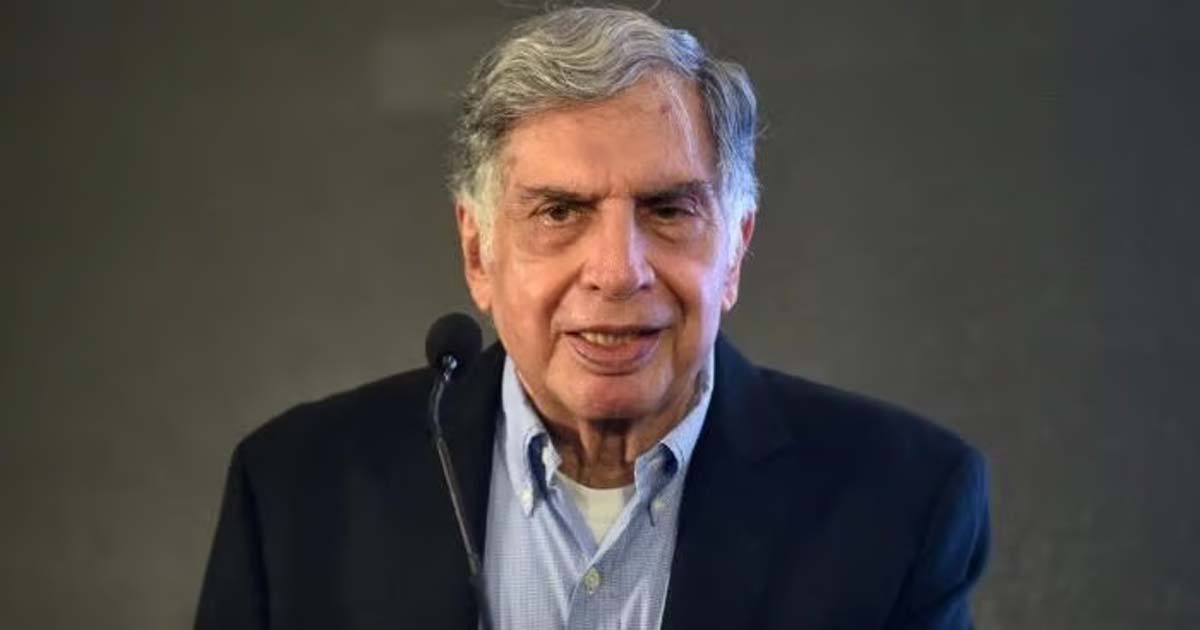

Ratan Tata Rubbishes Rumors Of ‘Critical Health’; Says No Cause For Concern

Tata Group’s Ratan Tata has denied rumours of his critical health that have been reported and have surfaced in the recent hours.

Ratan Tata’s associates took to his official Instagram account to debunk the news of him being ‘Critical’.

In the post, Ratan Tata said, “I am aware of recent rumors circulating regarding my health and want to assure everyone that these claims are unfounded. I am currently undergoing medical check-ups due to my age and related medical conditions.

There is no cause for concern. I remain in good spirits and request that the public and media respect refrain from spreading misinformation.

For more than fifty years, Ratan Tata has led the Indian business community’s entrance hall. The 86-year-old has been suffering from illnesses associated with ageing. Tata has participated in social life to the best of his limited ability despite his health issues.

Recently, on the occasion of Gandhi Jayanti, on October 2, Ratan Tata, expressed his congratulations to the Prime Minister on this occasion. “I congratulate the honourable Prime Minister on the 10-year commemoration of programmes that have benefitted millions in rural India.”

-

Crime2 years ago

Crime2 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra3 weeks ago

Maharashtra3 weeks agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra4 weeks ago

Maharashtra4 weeks agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 month ago

National News1 month agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Bollywood1 month ago

Bollywood1 month agoAditya Roy Kapur, Anil Kapoor’s The Night Manager Gets Nominated In Emmys 2024

-

Bollywood1 year ago

Bollywood1 year agoJawan Leaked Online! Shah Rukh Khan’s Film Falls Prey To Piracy Within Hours Of Release

-

International1 year ago

International1 year agoAsia Cup 2023: Body Blow For Sri Lanka As Lead Spinner Likely To Miss Final Against India

-

Maharashtra1 month ago

Maharashtra1 month agoNair Hospital Dean obstructed implementation of POSH law, didn’t co-operate, says BMC’s POSH committee