Business

CARE Ratings places NDTV’s bank facilities on ‘credit watch’, shares gallop

The shares of Adani group’s takeover target satellite channel company New Delhi Television Ltd (NDTV) continued to hit the upward circuit on Monday with the price touching Rs 540.85.

The 52-week low price for the scrip was Rs 72.

Meanwhile, credit rating agency CARE Ratings has placed ratings assigned to NDTV’s bank facilities on credit watch with developing implications following takeover decision by the Adani group.

NDTV, which had postponed its 34th annual general meeting (AGM)to September 27 from the earlier fixed date of September 20, said it has completed the dispatch of notice for the shareholders meeting on September 3, 2022.

Due to change in the date of the AGM, the Register of Members and the Share Transfer Book of the Company will now remain closed September 20-27 (both days inclusive), NDTV had said.

The scrip has been on the upswing since August 23, the day on which the Adani group’s AMG Media Networks announced its subsidiary Vishvapradhan Commercial Private Ltd’s (VCPL) decision to exercise its rights to acquire 99.5 per cent of equity shares of RRPR Holding Private Ltd, the investment company of NDTV promoters – Prannoy Roy and Radhika Roy.

The VCPL holds 1,990,000 warrants of RRPR Holding entitling it to convert them into 99.99 per cent stake in the latter.

The VCPL has exercised its option in part, resulting in acquisition control of RRPR Holding — 1,990,000 equity shares or 99.50 per cent.

RRPR Holding holds 29.18 per cent stake in NDTV that has three national television channels.

This triggered the issue of open offer to acquire shares of NDTV from the public as per SEBI’s (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.

Placing the credit ratings of NDTV’s bank facilities on credit watch with developing implication, CARE Ratings said it will continue to monitor the developments in this regard and will take a view on the ratings once the exact implications of the acquisition on the credit risk profile of the company are clear.

According to CARE Ratings, the ratings continue to remain constrained by high exposure towards group companies and revenue concentration risk as the company majorly generates revenue from advertisement which in turn exposes the company’s revenue profile to the business cycle of the advertisers.

“The ratings are also constrained on account of uncertainty over ongoing litigations against the company and its promoters especially pertaining to tax demand, hence the impact of the same on operational and financial risk profile of the company is not clear,” CARE Rating said.

According to CARE Ratings, NDTV had a total investment of Rs 335.13 crore in its subsidiaries/joint ventures/associates as on March 31, 2022 (Rs 325.03 crore as on March 31, 2021) as against its tangible net worth of Rs 345.09 crore as on March 31, 2022, majority of which are in NDTV Networks Limited, having an investment of Rs 315.70 crore as on March 31, 2022 (NDTV Networks Limited have a negative net worth of Rs 28.48 crore as on March 31, 2022).

“There are a number of ongoing litigations against the company especially pertaining to tax demand, the outcome of which will be crucial, particularly in the matter pertaining to transaction with Universal Studios International BV (a General Electric company) wherein a tax demand of

Rs 450 crore had been raised against the company for AY 2009-10,” CARE Ratings said.

“Further, the company had also received demand notice from SEBI for alleged non-disclosure of tax demand dated November 22, 2019, against which the company filed an appeal and matter is likely to be listed on September 12, 2022. Company also received show cause notice from the Directorate of Enforcement (ED) for the alleged contraventions under Foreign Exchange Management Act, 1999 (“FEMA”),” the credit rating agency said.

The CARE Ratings said the company also received notice dated August 20, 2018, from SEBI in regard to alleged violation of Clause 36 of erstwhile Listing Agreement for non-disclosure of loan agreements entered into by Prannoy Roy, Radhika Roy and RPRR Holding with VCPL in 2009-10.

“Further, the investigation by CBI is also pending with respect to the FIR registered against the company, promoters and other officials on August 19, 2019, in a case of alleged violation of foreign direct investment rules in one of their companies under section of Indian Penal Code, 1980 and Prevention of Corruption Act, 1988. In addition to this, there are few other investigations also pending w.r.t. income tax demand. Any adverse developments in relation to these ongoing legal cases having a material impact on the operational or financial risk profile of the company shall remain negative from the credit perspective,” CARE Ratings said.

National

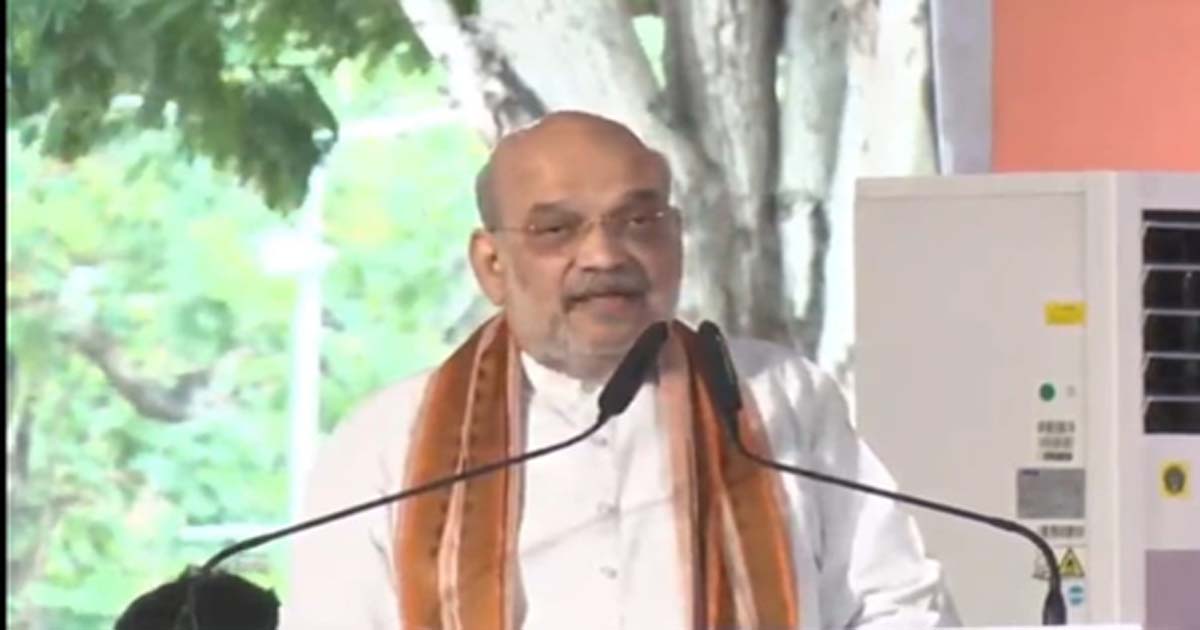

Op Sindoor an example to show when fight to maintain Swaraj is needed, says HM Shah

Pune, July 4: Union Home Minister Amit Shah on Friday said the responsibility of creating the India of Shivaji Maharaj’s dreams rested with 140 crore Indians, and sometimes, there is a need to fight to protect our ‘Swaraj’. He cited Operation Sindoor as an example of this.

“When there was a need to fight for Swaraj, we fought. If there is a need to fight to preserve Swaraj, we will fight. Operation Sindoor is an example of this. But alongside Swaraj, the idea of a great India also encompasses the concept of Shivaji Maharaj,” he stated in his speech after unveiling the statue of the great patriot and symbol of Maratha pride, Shriman Bajirao Peshwa, on the premises of the National Defence Academy.

Chief Minister Devendra Fadnavis, Deputy CMs Eknath Shinde and Ajit Pawar, Higher and Technical Education Minister Chandrakant Patil, and Union Minister of State for Civil Aviation Murlidhar Mohol were among others present on the occasion.

“Our goal should be to create an India where we are number one in the entire world. If there is a personality that inspires effort, dedication and sacrifice for this, it is Shrimant Bajirao Peshwa,” he noted.

“PM Modi has given the formula of development and heritage. There have been many personalities in our thousand-year-old culture who keep inspiring us. Their history needs to be given to today’s youth. Bajirao never fought for himself. He fought for the country and Swarajya. The British distorted history. Despite having so much prowess and power, Bajirao was a lifelong Peshwa. He fought for Swarajya. In his 40 years of life, he wrote an immortal history that no one will be able to write for many centuries,” said the Home Minister.

“The inspiration that will come from installing the statue of Shrimant Bajirao at the National Defence Academy, where the chiefs of all three armed forces train and graduate, will ensure that no one can touch India’s borders,” he asserted.

“Some rules of the art of war never become outdated. The importance of strategy in war, the importance of swiftness, the spirit of dedication, the spirit of patriotism, and the spirit of sacrifice are important. These are what lead armies to victory; only the weapons keep changing. The most exemplary embodiment of all these qualities in 500 years of Indian history is found only in Shrimant Bajirao Peshwa,” said HM Shah.

He further stated, “Shrimant Bajirao Peshwa fought 41 battles in 20 years and did not lose a single one, a record no other commander could match. The most fitting place to install the statue of such a brave warrior, who never let defeat come near him until his death, is the National Defence Academy.”

He said the land of Pune is the birthplace of the values of Swaraj. In the 17th century, it was from here that the concept of Swaraj spread across the nation.

“When the time came to fight for Swaraj again in the face of the British, it was Tilak Maharaj who first roared like a lion — ‘Swaraj is my birthright’. The example of how much a person can do for their country in their lifetime was also set by Veer Savarkar from this sacred land of Maharashtra,” he added.

HM Shah also connected Bajirao’s legacy to the broader historical context, crediting the Maratha warrior and the Peshwas for preserving India’s cultural and structural identity through their resistance against external forces.

He stated, “Had the battle for Independence that was started by Shivaji Maharaj and taken forward by the Peshwas for 100 years not been fought, India’s basic structure would have ceased to exist.”

Business

Lilavati Trust’s FIR: SC tells HDFC Bank CEO to pursue his plea before Bombay HC

suprim court

New Delhi, July 4: The Supreme Court on Friday declined to entertain a plea of HDFC Bank CEO and Managing Director Sashidhar Jagdishan to quash an FIR lodged against him, following a complaint by the Lilavati Kirtilal Mehta Medical Trust, which runs Mumbai’s Lilavati Hospital, that he has accepted a bribe of Rs 2.05 crore.

A Bench of Justices P.S. Narasimha and R. Mahadevan opined that it would be improper on the part of the apex court to intervene in the matter when Jagdishan’s plea to quash the criminal complaint is tentatively listed before the Bombay High Court for hearing on July 14.

Following the recusal by judges of the Bombay High Court at least on three different occasions, Jagdishan approached the Supreme Court over the delay in listing of his petition and prayed for an immediate interim relief.

Senior advocate Mukul Rohatgi, appearing on behalf of Jagdishan, argued that the reputation of HDFC Bank is affected because of an internal dispute between the trustees of the Lilavati Trust, requiring an interim protection order. However, the Justice Narasimha-led Bench declined to pass any interim order and asked Rohtagi to raise all contentions before the Bombay High Court.

“We sympathise that the Bench after the Bench (of the Bombay HC) have recused. It is unfortunate! But, now it is listed,” remarked the apex court, hoping that the matter would be taken up by the Bombay High Court for hearing on July 14.

On Thursday, the top court agreed to urgently list Jagdishan’s plea for hearing on July 4 (Friday) after it was contended that a “frivolous” FIR was filed as “part of an arm-twisting tactic” to prevent the HDFC Bank from recovering money from the Lilavati Trust.

Jagdishan’s plea had come up for hearing in the Bombay High Court on June 30; however, noting that there was no urgency in the matter, it listed the matter on July 14, prompting him to move the Supreme Court for relief.

The FIR, registered last month at the Bandra police station in Mumbai under Sections 406 (criminal breach of trust), 409 (criminal breach of trust by a public servant), and 420 (cheating), levels serious allegations against Jagdishan.

The Lilavati Trust has claimed in its complaint that Jagdishan accepted a bribe of Rs 2.05 crore as a quid pro quo for providing financial advice to help the Chetan Mehta Group retain illegal and undue control over the governance of the Trust. It has accused Jagdishan of misusing his position as the head of a leading private sector bank to interfere in the internal affairs of a charitable organisation.

On the other hand, Jagdishan has strongly denied the allegations, calling the case a malicious attempt to defame him and HDFC Bank. He stated that HDFC, along with a consortium of banks, had granted loans to Splendour Gems Limited in 1995.

When the firm defaulted, recovery proceedings were launched in 2002 against its guarantors, including Kishor Mehta, Prashant Mehta’s father. An arrest warrant was issued in 2020, and though Kishor Mehta passed away in 2024, the proceedings continued against his sons.

Crime

ED raids eight locations linked to ex-Cong MLA Amba Prasad in Jharkhand

Ranchi, July 4: The Enforcement Directorate (ED) on Friday carried out raids at eight locations linked to close associates of former Congress MLA Amba Prasad from Jharkhand’s Barkagaon Assembly constituency.

The raids are part of an ongoing money laundering probe involving a prominent company engaged in coal transportation, infrastructure, and the power sector.

According to sources, simultaneous searches were conducted in Ranchi, Hazaribagh, and Barkagaon.

Among the locations searched are the residence of Amba Prasad’s aide Sanjeet in Kishoreganj (Ranchi) and the homes of her personal assistants — Sanjeev Sao, Manoj Dangi, and Pancham Kumar — in Barkagaon.

Security forces have been deployed in large numbers at all the premises where raids are being conducted.

This move comes months after the ED conducted a similar crackdown between March 12 and March 14 this year, targeting Amba Prasad, her father, and former Minister Yogendra Sao, brother Ankit Raj, and several other relatives and associates.

During those raids, the agency had seized Rs 35 lakh in cash, digital devices, fake stamps of banks and government offices, handwritten receipts, diaries, and other incriminating documents.

Officials believe that the current searches are based on evidence and leads gathered during the earlier raids. The ED is now closely examining documents related to financial transactions, land deals, and mining activities.

Ten companies reportedly registered in the names of Amba Prasad and her family members are under scrutiny.

Earlier, the ED had questioned Amba Prasad, her father Yogendra Sao, and her brother Ankit Raj at its zonal office in Ranchi in connection with the same case.

Amba Prasad was elected to the Jharkhand Assembly from Barkagaon in 2019 on a Congress ticket. Her parents — Yogendra Sao and Nirmala Devi — have also represented the same constituency in the past.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra9 months ago

Maharashtra9 months agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

Crime9 months ago

Crime9 months agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report

-

National News9 months ago

National News9 months agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra8 months ago

Maharashtra8 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News10 months ago

National News10 months agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface