Business

Mukesh Ambani with a net worth of $ 92.7 billion tops 2021 Forbes list of India’s richest

A soaring stock market propelled the combined wealth of members of the 2021 Forbes list of India’s 100 Richest to a record US$775 billion, after adding $257 billion — a 50 per cent rise — in the past 12 months.

In this bumper year, more than 80 per cent of the listees saw their fortunes increase, with 61 adding $1 billion or more.

At the top of the list is Mukesh Ambani, India’s richest person since 2008, with a net worth of $92.7 billion.

Ambani recently outlined plans to pivot into renewable energy with a $10 billion investment by his Reliance Industries.

Close to a fifth of the increase in the collective wealth of India’s 100 richest came from infrastructure tycoon Gautam Adani, who ranks No. 2 for the third year in a row. Adani, who is the biggest gainer in both percentage and dollar terms, nearly tripled his fortune to $74.8 billion from $25.2 billion previously, as shares of all his listed companies soared.

At No. 3 with $31 billion is Shiv Nadar, founder of software giant HCL Technologies, who saw a $10.6 billion boost in his net worth from the country’s buoyant tech sector.

Retailing magnate Radhakishan Damani retained the fourth spot with his net worth nearly doubling to $29.4 billion from $15.4 billion, as his supermarket chain Avenue Supermarts opened 22 new stores in the fiscal year ending March.

India has administered over 870 million Covid-19 vaccine shots to date, thanks partly to Serum Institute of India, founded by vaccine billionaire Cyrus Poonawalla, who moves into the top five with a net worth of $19 billion. His privately held company makes Covishield under license from AstraZeneca and has other Covid-19 vaccines under development.

India’s recovery from a deadly second wave of Covid-19, which broke out earlier this year, restored investor confidence in the world’s sixth-largest economy.

There are six newcomers on this year’s list, with half of them from the booming chemicals sector. They include Ashok Boob (No. 93, $2.3 billion) whose Clean Science and Technology listed in July; Deepak Mehta (No. 97, $2.05 billion) of Deepak Nitrite and Yogesh Kothari (No. 100, $1.94 billion) of Alkyl Amines Chemicals. Arvind Lal (No. 87, $2.55 billion), the executive chairman of diagnostics chain Dr Lal PathLabs, also debuted on the list after a pandemic-induced surge in testing caused shares of his company to double in the past year.

The country’s IPO rush returned property magnate and politician Mangal Prabhat Lodha (No. 42, $4.5 billion) to the ranks, following the April listing of his Macrotech Developers. Among the four other returnees is Prathap Reddy (No. 88, $2.53 billion), whose listed hospital chain Apollo Hospitals Enterprise has been testing and treating Covid-19 patients.

Eleven listees from last year dropped off, given the increased cut-off for gaining entry to this year’s list. The minimum amount required to make this year’s list was $1.94 billion, up from $1.33 billion last year.

Naazneen Karmali, Asia Wealth Editor and India Editor of Forbes Asia, said: “This year’s list reflects India’s resilience and can-do spirit even as Covid-19 extracted a heavy toll on both lives and livelihoods. Hopes of a V-shaped recovery fueled a stock market rally that propelled the fortunes of India’s wealthiest to new heights. With the minimum net worth to make the ranks approaching $2 billion, the top 100 club is getting more exclusive.”

National

NDA to contest Bihar polls under Nitish Kumar’s leadership: Jitan Ram Manjhi

Mumbai, July 4: Union Minister and Hindustani Awam Morcha (HAM) leader Jitan Ram Manjhi on Friday confirmed that the National Democratic Alliance (NDA) will contest the upcoming Bihar Assembly elections under the leadership of Chief Minister and Janata Dal-United leader Nitish Kumar.

“All the leaders of the NDA have agreed that with five parties in the alliance, including ours, the Bihar elections scheduled for November 2025 will be fought under the leadership of Nitish Kumar. Traditionally, the leader under whom the elections are contested becomes the Chief Minister. So naturally, Nitish Kumar will be our face for the CM post. There is no doubt – we are confident of winning under his leadership,” Manjhi said.

Asked whether he harbours any desire to become Chief Minister again, the 79-year-old leader ruled out the possibility due to his age and current responsibilities.

“As far as age is concerned, I had earlier decided not to be active in electoral politics beyond 75. Still, due to certain circumstances, I contested in 2015 and again in 2020. But now, I am not in a position to contest elections,” he added.

Manjhi said that he “doesn’t consider myself eligible for the Chief Ministerial post”.

“PM (Narendra) Modi has entrusted me with ministerial responsibilities, and I am fully committed to fulfilling them. Even at this age, I am not sitting idle—I’m working hard to strengthen my department. As for the Chief Minister’s post, I do not consider myself eligible anymore. I won’t be able to dedicate the time and energy required, so I have no such ambition,” he said.

He further reaffirmed his party’s unwavering commitment to the NDA, highlighting its contribution and influence within the alliance.

“Hindustani Awam Morcha has four MLAs, one MLC, a minister, and a Lok Sabha member. We have always stood firmly with the NDA and continue to do so. In Bihar, the focus is on development, and under Nitish Kumar’s leadership, the state has seen notable progress in electricity supply, law and order, and education. At the national level, PM Modi has emerged as a towering figure who has transformed India’s image both at home and abroad,” he said.

Manjhi emphasised the power of the “double-engine government” and its appeal to voters across Bihar.

“People here believe that a government led by both Nitish Kumar and PM Modi is best for the state’s future. Every child in Bihar is now thinking that it’s time to support the NDA again. We are united and ready to move forward,” he said.

Crime

Kolkata law college rape: Monojit Mishra made 16 calls in 3 hours, police probe details

Kolkata, July 4: Monojit Mishra, one of the three accused and reportedly the main architect in the law college student gang-rape case, made as many as 16 calls in three hours after the crime incident took place on the evening of June 25.

Those call details are currently being examined by the investigating sleuths, and at the same time, the process of interrogation of those with whom Mishra conversed during that period has started.

The tower locations of the mobile phones of the three accused, namely Mishra, Jaib Ahmed and Pramit Mukhopadhyay, during that period are being tracked by the investigating officials to have an idea of the places they went to immediately after the crime.

Sources said that one of the calls that Mishra made from his mobile phone during that period was to a member of the governing body of the same college. Although the governing body member concerned has already been questioned by the investigating officials, the latter are not willing to disclose anything on the interrogation findings for the sake of the investigation.

This week, the investigation into the case was handed over to the Detective Department of the city police, which has started the probe process by adding new sections against the three prime accused persons.

Before Detective Department took over the charge of the investigation, the three accused persons were charged under sections on rape. However, with the Detective Department taking over the investigation sections relating to abduction and causing injuries with weapons were also slapped on the three.

On Friday morning, around 3 a.m., the sleuths of the detective department reached the campus of the law college in Kolkata along with the three accused for reenactment of the incident.

Sources said that the findings of the reenactment process will be cross-checked with the statement given by the victim soon after the event of sexual harassment took place last week. Earlier, a member of the special investigation team, which was initially investigating the matter, had gone to the college campus with the victim for reenactment purposes.

The woman, a student of the South Calcutta Law College, was allegedly raped by two senior students and an alumnus of the institute in the guard’s room on June 25. Apart from the three, the college guard has been arrested in the case so far.

National

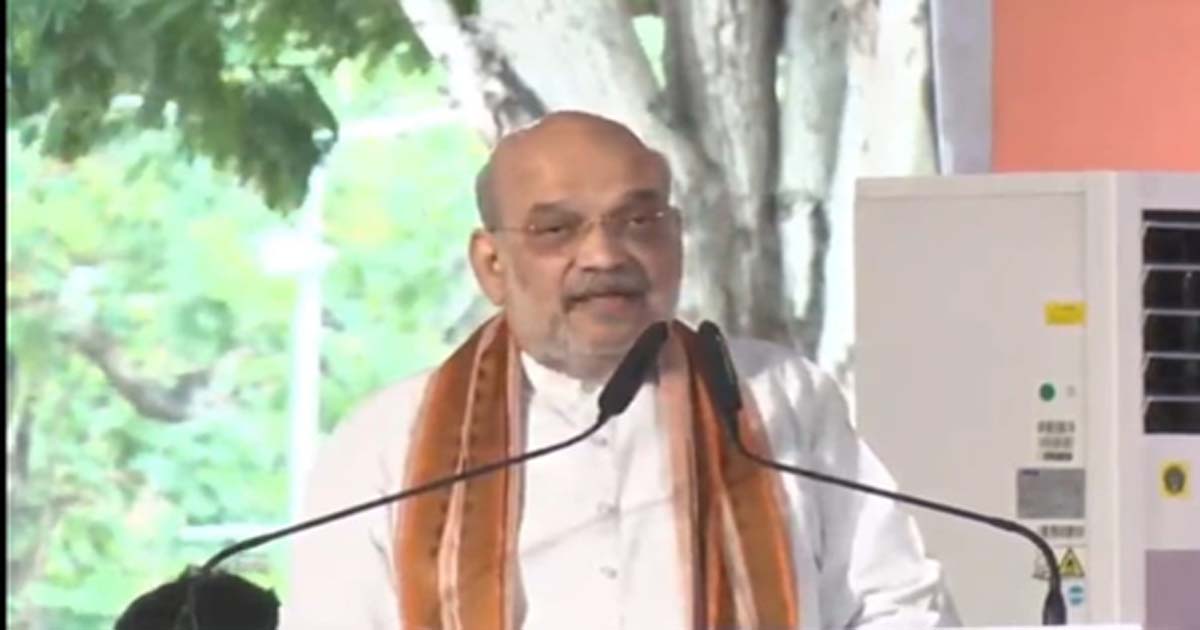

Op Sindoor an example to show when fight to maintain Swaraj is needed, says HM Shah

Pune, July 4: Union Home Minister Amit Shah on Friday said the responsibility of creating the India of Shivaji Maharaj’s dreams rested with 140 crore Indians, and sometimes, there is a need to fight to protect our ‘Swaraj’. He cited Operation Sindoor as an example of this.

“When there was a need to fight for Swaraj, we fought. If there is a need to fight to preserve Swaraj, we will fight. Operation Sindoor is an example of this. But alongside Swaraj, the idea of a great India also encompasses the concept of Shivaji Maharaj,” he stated in his speech after unveiling the statue of the great patriot and symbol of Maratha pride, Shriman Bajirao Peshwa, on the premises of the National Defence Academy.

Chief Minister Devendra Fadnavis, Deputy CMs Eknath Shinde and Ajit Pawar, Higher and Technical Education Minister Chandrakant Patil, and Union Minister of State for Civil Aviation Murlidhar Mohol were among others present on the occasion.

“Our goal should be to create an India where we are number one in the entire world. If there is a personality that inspires effort, dedication and sacrifice for this, it is Shrimant Bajirao Peshwa,” he noted.

“PM Modi has given the formula of development and heritage. There have been many personalities in our thousand-year-old culture who keep inspiring us. Their history needs to be given to today’s youth. Bajirao never fought for himself. He fought for the country and Swarajya. The British distorted history. Despite having so much prowess and power, Bajirao was a lifelong Peshwa. He fought for Swarajya. In his 40 years of life, he wrote an immortal history that no one will be able to write for many centuries,” said the Home Minister.

“The inspiration that will come from installing the statue of Shrimant Bajirao at the National Defence Academy, where the chiefs of all three armed forces train and graduate, will ensure that no one can touch India’s borders,” he asserted.

“Some rules of the art of war never become outdated. The importance of strategy in war, the importance of swiftness, the spirit of dedication, the spirit of patriotism, and the spirit of sacrifice are important. These are what lead armies to victory; only the weapons keep changing. The most exemplary embodiment of all these qualities in 500 years of Indian history is found only in Shrimant Bajirao Peshwa,” said HM Shah.

He further stated, “Shrimant Bajirao Peshwa fought 41 battles in 20 years and did not lose a single one, a record no other commander could match. The most fitting place to install the statue of such a brave warrior, who never let defeat come near him until his death, is the National Defence Academy.”

He said the land of Pune is the birthplace of the values of Swaraj. In the 17th century, it was from here that the concept of Swaraj spread across the nation.

“When the time came to fight for Swaraj again in the face of the British, it was Tilak Maharaj who first roared like a lion — ‘Swaraj is my birthright’. The example of how much a person can do for their country in their lifetime was also set by Veer Savarkar from this sacred land of Maharashtra,” he added.

HM Shah also connected Bajirao’s legacy to the broader historical context, crediting the Maratha warrior and the Peshwas for preserving India’s cultural and structural identity through their resistance against external forces.

He stated, “Had the battle for Independence that was started by Shivaji Maharaj and taken forward by the Peshwas for 100 years not been fought, India’s basic structure would have ceased to exist.”

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra9 months ago

Maharashtra9 months agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

Crime9 months ago

Crime9 months agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report

-

National News9 months ago

National News9 months agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra8 months ago

Maharashtra8 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News10 months ago

National News10 months agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface