Business

How Ruias are reinventing the Essar Group

For the last three years, the Mumbai headquartered Essar Group, founded by Shashi and Ravi Ruia, has deliberately kept a low profile. They were busy putting into action their deleveraging and monetisation strategy to free the group of all its debt and start on a clean state.

And they managed to do just that by monetising assets worth $25 bn by selling Essar Oil, Essar Steel, Essar Power and Essar Ports. Perhaps, for the first time in the country such huge debts have been paid off by a business house.

Leading from the front is the 54-year old Prashant Ruia, director, Essar Capital. He is working at a feverish pace to take the group to the next level. Between June 2022 and March 2023 the group made several big announcements. The group, it seems, is now approaching all its businesses with the mindset of a PE player.

According to sources, “The group has paid off 100% debt. Basically, the group has put in place the strategy of deleveraging and monetisation of assets, consolidation of operating companies, and getting into a new growth cycle.” And that is paying rich dividends.

Now with all debts paid, the mood at the Essar House is upbeat. The group has chalked up ambitious plans to be in the same areas where they have domain expertise. It will be Energy, Infrastructure & Logistics, Metals & Mining, and Technology & Retail.

To go with it, the group has identified three themes: Decarbonisation, Decentralisation and Digitisation. For instance, decarbonisation means the group wants to move away from fossil fuel to green fuel. To make this happen, Essar Oil UK, a 10 MTPA refinery acquired in 2011 which serves 16% of UK’s road fuel demand has entered into an agreement with Vertex Hydrogen. Vertex is part of Essar Energy Transition which is planning an investment of $3.6 bn in India ($1.2 bn) and the UK ($2.4 bn) to develop a range of low carbon energy transition projects which would include blue and green hydrogen, biofuels, battery storage, solar PV etc.

The investment in the UK will play a key role in supporting their government’s decarbonisation strategy.

Essar 2.0 sees the group focusing on transitioning existing assets to green businesses, while investing in creating new-age ESG-centric sustainable businesses.

Besides oil refineries and storage terminals in the UK, it has exploration and production facilities in Vietnam; Iron ore plant in USA, coal mine in Indonesia. It has entered into an agreement with Saudi Arabia to set up a 4 MTPA greenfield steel plant in Ras Al-Khair. In India, it has plans to set up 14 MTPA iron ore pellet plants close to Paradip port, Odisha and triple its CBM productions in West Bengal.

Essar Group which currently has a turnover of $15 bn and $1 bn profit will see most of its new initiatives becoming operational by December 2025 or early 2026. Looks like the second innings of the Ruias will be better than the first.

Business

Stock markets end week on a strong note as NDA secures landmark win in Bihar

Mumbai, Nov 15: Indian equity markets ended the week on a strong note, with benchmark indices gaining on the resolution of the US government shutdown, supported by strong domestic fundamentals, better-than-expected Q2 earnings, easing inflation and NDA’s historic victory in Bihar, according to analysts.

Record-low October inflation reinforced expectations of an RBI rate cut, adding momentum to domestic equities.

According to Vinod Nair, Head of Research, Geojit Investments Limited, sectoral momentum was broad-based, led by gains in IT, Pharma, healthcare and Auto stocks.

“Toward the week’s close, the NDA’s Bihar election victory bolstered investor confidence, but fading expectations of a U.S. Fed rate cut triggered profit booking in IT stocks, tempering their earlier gains,” he mentioned.

The indices remained under pressure for most of the session on Friday, oscillating between losses and brief recoveries, before a strong late-afternoon rebound pushed them into the green.

Volatility picked up as markets tracked the Bihar election outcome, the day’s key trigger.

Sentiment was also weighed down by weak global cues after Wall Street fell sharply overnight, led by declines in Nvidia and other tech majors as investors dialled back hopes of near-term rate cuts amid lingering inflation worries, according to a note by Bajaj Broking Research.

At close, the Sensex ended 84 points or 0.1 per cent higher at 84,563, while the Nifty finished 31 points up at 25,910. Sectoral trends were mixed, with PSU banks leading gains at 1.17 per cent, followed by firm moves in pharma and FMCG.

Energy and infrastructure saw mild upticks. On the downside, IT declined 1.03 per cent, while auto, metal, and realty ended lower.

Among the broader market space, Nifty Small-cap 100 rose 0.38 per cent, while the Midcap 100 gained 0.08 per cent.

According to analysts, Nifty on the weekly chart has formed a strong bull candle with a higher high and a higher low signaling pullback after two weeks of corrective decline, “in line with our expectations from the key support area of 25,400-25,300”.

Going ahead, bias continues to remain positive and a follow through strength above last month high of 26,100 will open upside towards the previous all-time high of 26,277 in the coming week.

Looking ahead, market direction will hinge on key macro triggers such as India’s PMI data, US jobless claims, FOMC minutes and progress on US–India trade negotiations.

Business

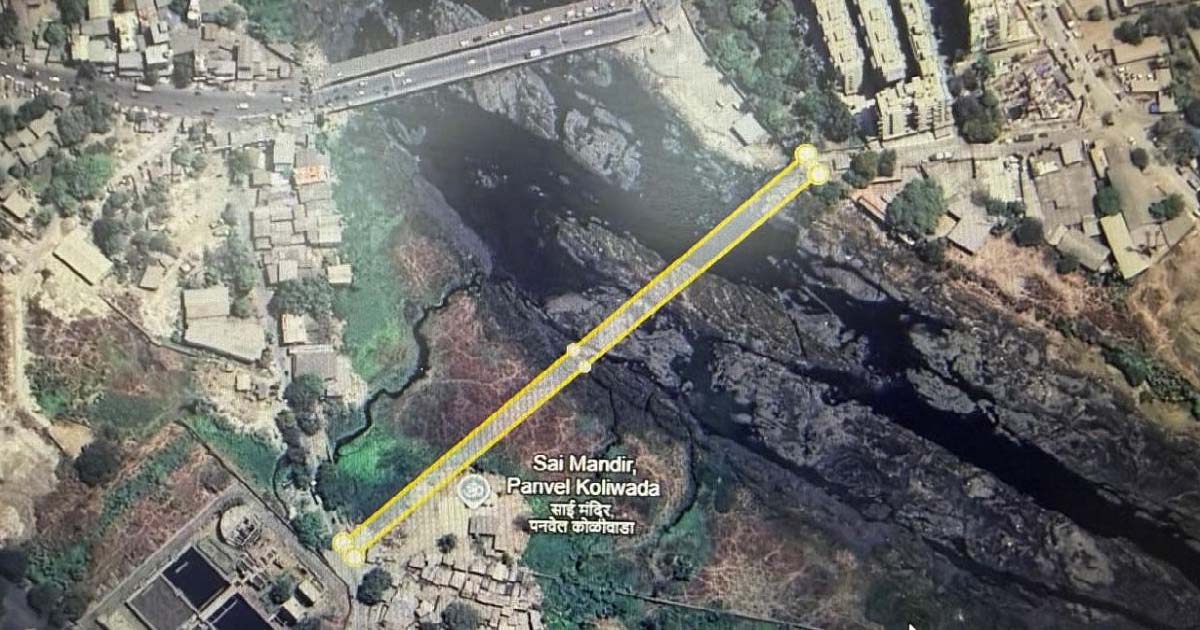

Panvel Municipal Corporation Clears ₹48.40 Crore Gadhi River Bridge Project To Ease Traffic Congestion On Panvel–Karanjade Stretch

Panvel, November 14: In a major infrastructure push aimed at reducing traffic congestion and improving connectivity, the Panvel Municipal Corporation has cleared a proposal to construct a new bridge over the Gadhi River near the Karanjade sewage pumping station.

Municipal Commissioner and Administrator Mangesh Chitale approved the plan following demands raised by Panvel MLA Prashant Thakur and Uran MLA Mahesh Baldi, who highlighted the daily inconvenience faced by commuters travelling between Panvel, Karanjade and Vadghar’s CIDCO colonies.

According to civic officials, the existing bridge toward Karanjade routinely experiences heavy traffic, often resulting in prolonged congestion. With the upcoming Navi Mumbai International Airport expected to increase traffic volumes even further, the civic body believes the new bridge will be a “critical link” on the Panvel–Karanjade stretch.

The project, with an estimated cost of Rs 48.40 crore, received administrative approval in the General Body. Construction is expected to begin soon.

As per the sanctioned plan, the bridge will feature four lanes, a length of 240 metres, and a width of 21.5 metres. “It will connect Panvel Municipal Corporation’s 40-feet-wide road on the eastern side with CIDCO’s 20-metre-wide road leading to the Karanjade node on the western side.

This connection will significantly streamline traffic and support future vehicular growth,” said Additional Commissioner Ganesh Shete.

For the project, No Objection Certificates (NOCs) will be sought from CIDCO, the Water Resources Department, and the Public Works Department. The conceptual design will undergo technical review and approval by either IIT Mumbai or VJTI Mumbai, City Engineer Sanjay Katekar confirmed.

The civic administration expects the bridge to provide major relief to residents and improve overall mobility in the rapidly developing Panvel–Karanjade region.

Business

Stock market ends on positive note over NDA’s huge victory in Bihar polls

Mumbai, Nov 14: Indian equity indices recovered from early losses to end the session on a positive note on Friday as the National Democratic Alliance (NDA) headed towards a landslide win in the Bihar elections.

The key indices remained volatile throughout the session as counting for votes for Bihar’s Assembly election continues.

Sensex settled at 84,562.78, up 84.11 points or 0.10 per cent. The share index started the session at 84,060.14, falling over 400 points against last day’s closing of 84,478.67 amid caution ahead of Bihar election results. However, the index jumped over 550 points from the day’s low to close in green.

Nifty closed at 25,910.05, up 30.90 points or 0.12 per cent.

“Indian markets today witnessed a roller-coaster session with the benchmark index Nifty showing sharp two-sided moves. In the first half, Nifty surged and tested the crucial 26,000 level before facing resistance and slipping lower later in the day,” Ashika Institutional Equities said in its note.

Volatility remained elevated as investors stayed cautious ahead of Bihar election results, which hold significant political importance.

Tata Motors, Eternal, Axis Bank, BEL, Trent, SBI, Sun Pharma, Bajaj Finance, Adani Airports, Hindustan Unilever, Asian Paints, ITC and NTPC were the top gainers from the Sensex basket. Infosys, Tata Steel, Tata Motors PV, ICICI Bank, Maruti Suzuki and Tech Mahindra ended the session lower.

Sectoral indices experienced a mixed approach with selling in the IT and auto sectors and buying in the FMCG, banking and finance stocks. Nifty Bank rose 135 points or 0.23 per cent, Nifty Fin Services jumped 95 points or 0.35 per cent, and Nifty FMCG closed 317 points or 0.57 per cent higher. While Nifty IT slipped 378 points or 1.03 per cent, and Nifty Auto fell 143 points or 0.52 per cent.

Broader market followed suit as well, with Nifty Midcap 100 closed flat, Nifty Small Cap 100 rose 68 points or 0.38 per cent, and Nifty 100 ended the session slightly up.

Rupee traded in a narrow range near 88.70 as the dollar index remained flat around $99.20, offering limited directional cues.

“With no major U.S. data releases due to the recent shutdown, the market stayed largely dependent on flows, where mixed FII activity and consistent DII buying kept the rupee in a confined band. Crude prices have begun to rebound, and if WTI sustains above $60, it may add fresh pressure on the rupee in the coming sessions. Overall, the rupee is expected to remain range-bound with levels seen between 88.45–88.95,” said Jateen Trivedi of LKP Securities.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report