Business

Adani Groups Repays Loans Worth $2.65 Billion, Along With Interest Payment Of $203 Million

Embattled Adani Group on Monday said it has repaid loans aggregating USD 2.65 billion to complete a prepayment programme to cut overall leverage in an attempt to win back investor trust post a damning report of a US short seller. In a Credit Note released on Monday, Adani Group said it has made a full prepayment of USD 2.15 billion of loans that were taken by pledging shares in the conglomerate’s listed firms and also another USD 700 million in loans taken for the acquisition of Ambuja Cement.

Interest Payment of $203 Million

“The prepayment was done along with interest payment of USD 203 million,” it added. Further, the credit update states that the promoters completed the sale of shares in four listed group entities to GQG Partners, a leading global investment firm, for USD 1.87 billion (Rs 15,446 crore).

“The deleveraging programme testifies to the strong liquidity management and capital access at sponsor level even in volatile market conditions, supplementing the solid capital prudence adopted at all portfolio companies,” Adani Group said in the credit update. US short-seller Hindenburg Research in January released a damning report alleging accounting fraud and stock price manipulation at Adani Group, triggering a stock market rout that had erased about USD 145 billion in the conglomerate’s market value at its lowest point.

Adani Group’s Comeback Strategy

Adani Group has denied all allegations by Hindenburg and is plotting a comeback strategy. The group has recast its ambitions as well as prepaid some loans to assuage investors. The credit update further highlights major improvements in key financial metrics – the portfolio’s combined Net Debt to EBITDA ratio has decreased from 3.81 in FY22 to 3.27 in FY23, run rate EBITDA surged from Rs 50,706 crore in FY22 to Rs 66,566 crore in FY23.

The credit update further states that the banking lines of Adani Group continue to show confidence by disbursing new debt and rolling over existing lines of credit. Moreover, rating agencies both domestic and international rating agencies have reaffirmed their ratings in all the group companies.

Debt Service Cover Ratio (DSCR) has improved to 2.02x during FY23 from 1.47x during FY22. Gross Assets increased to Rs 4.23 lakh crore, up by Rs 1.06 lakh crore. Gross Asset / Net Debt cover has improved to 2.26x in FY23 from 1.98x in FY22.

Continued investments in core infra projects

Continued investments in core infra with gross assets of Rs 3.77 lakh crore (89 per cent of the portfolio) provide long-term multi-decadal visibility of cash flow, it said, adding cash balance was higher by 41.5 per cent at Rs 40,351 crore against Rs 28,519 crore. Free Flow from operations – FFO – (EBITDA less finance cost less tax paid) was Rs 37,538 crore.

Cash Balance and FFO (together at Rs 77,889 crore) are much higher than debt maturity cover for FY24, FY25 and FY26 of Rs 11,796 crore, Rs 32,373 crore and Rs 16,614 crore, respectively, at the combined portfolio level.

National

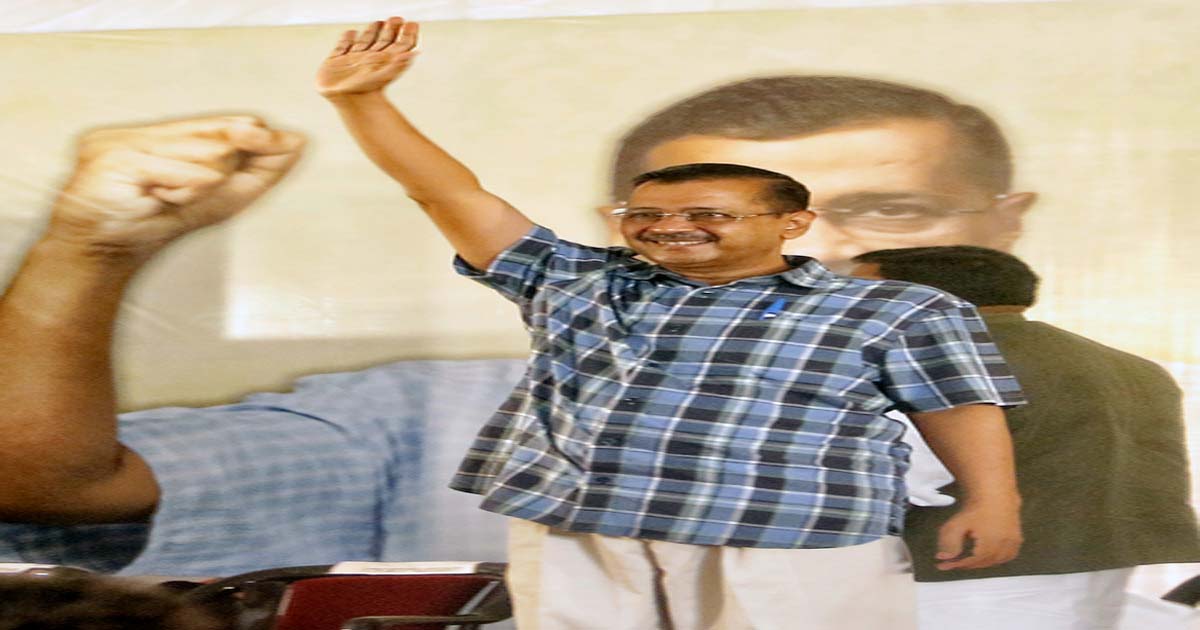

AAP’s decision to go solo in Bihar polls draws ‘publicity stunt’ jibe from INDIA bloc ally

New Delhi, July 3: Aam Aadmi Party (AAP) chief Arvind Kejriwal’s announcement of contesting the upcoming Bihar Assembly elections alone has invited a slew of reactions from political parties. Various parties, its ally or adversary, reacted on expected lines; however, the harshest one came from the Congress party, its erstwhile alliance partner in the INDIA bloc.

From JD(U) to Congress and others, all elicited a common view that AAP remains a non-player in the Bihar electoral landscape and its political plunge will have no impact on the power equations there.

JD(U) leader Rajiv Ranjan said that AAP’s decision to contest all 243 seats in Bihar shows clear and deep cracks in the INDIA bloc.

“This alliance is already in ruins and is now headed for further decline, as Kejriwal has himself said that the INDIA bloc was formed for the 2024 elections,” he said.

He added that AAP’s foray into the Bihar arena will have a bearing on the INDIA bloc partners, including RJD, as Tejashwi Yadav and his party will find it difficult to rally support.

Congress leader Akhilesh Prasad Singh said this looks nothing more than a ‘publicity stunt’.

“AAP has no presence in Bihar, people don’t even know Kejriwal’s party name. By such announcements, he is trying to stay in the news. Kejriwal may be known to people here, but his party is non-existent in Bihar, he said.

Another Congress leader, Tariq Anwar, said AAP was welcome to contest elections in Bihar but warned of more backlash than support.

“Every party is independent to contest elections as per its own choice. AAP can also decide its fortunes in upcoming elections, but it is a fact that AAP has no base in Bihar, it has no elected representative in Bihar, even at the panchayat level,” he said.

“Deciding to take a political plunge in such a situation could incur more losses than benefits,” he added.

Notably, AAP supremo Arvind Kejriwal, addressing a press conference in Gujarat’s Gandhinagar on Thursday, said, “AAP will contest Bihar polls alone. The INDIA bloc was only for the Lok Sabha polls; there is no alliance with Congress now.”

When probed further, he said, “If there was any alliance, then why did Congress contest in Visavadar bypolls. They came to defeat us. BJP sent Congress to defeat us and cut the votes.”

National

Rahul Gandhi questions Maha govt over farmer suicides, BJP counters with facts during Cong-NCP rule

New Delhi, July 3: Leader of Opposition (LoP) in the Lok Sabha Rahul Gandhi on Thursday criticised the BJP-led Maharashtra government over farmer suicides and accused the Centre of ignoring their plight. This prompted a swift response from the BJP, which cited findings and facts about farmer deaths in the state during the Congress-NCP rule to set the record straight.

The political blame game on farmer suicides began over the Fadnavis government’s admission that 767 farmers committed suicide in the state in the past three months. The state government told the Legislative Assembly on Tuesday that 767 farmer suicides were reported in the state, primarily in the Vidarbha region.

The Congress MP used the farmers’ deaths to mount an attack on the Centre, accusing it of callousness and gross indifference to their plight. He said that 767 families have been devastated and shattered, but the government remains unmoved.

“Is this just a statistic? No. These are 767 shattered homes. 767 families that will never recover. And the government? Silent. Watching with indifference,” he asked on X.

Rahul further said the farmers are sinking deeper into debt every day, but the government continues to look away. Their plight remains ignored while there is no government assurance or promise on the Minimum Support Price (MSP) for agricultural products.

BJP IT cell chief Amit Malviya was quick to counter Rahul’s charge with facts and figures of farmers’ suicides, when the state was ruled by Congress-led governments in the past.

Amit Malviya said the Congress leader must think before blurting out baseless charges. He said that Rahul must look at the utter failures and misgovernance of the Congress-NCP governments, which saw a spate of farmer deaths during their reign.

Sharing details of farmers’ deaths, Amit Malviya stated that more than 55,000 deaths took place in the 15-year rule of the Congress-NCP government and asked, ‘Who was accountable for this?’

The graph shared by him, compiled with data gathered from NCRB and P. Sainath, shared details of ‘mass suicides’ in different government tenures, starting from 1999 to 2014.

“From 1999-2004, about 16,512 farmers committed suicide while from 2004-2009, about 20,566 farmers committed suicide while from 2009 to 2014, 18,850 farmers killed themselves,” it pointed out.

Notably, the Vidarbha region in Maharashtra has gained infamy over the years because of an abnormally high number of suicides by farmers. For decades now, the region has been hogging headlines over sorry state of affairs for the farming community.

Rahul Gandhi, further escalating his attack on the Centre, said that farmers’ demand for loan waivers remains ignored, but the Modi government continues to give big loans to corporates and billionaires.

“Modi ji promised to double farmers’ income – today, the reality is that the lives of those who feed the nation are being cut in half. This system is killing the farmers,” Congress MP claimed.

Giving a firm retort, Amit Malviya said that the politics of counting the dead looks repulsive, but it’s important to show Rahul Gandhi and Congress the mirror.

National

‘Dedicate it to bright future of India’s youth, their aspirations’: PM Modi on receiving Ghana’s top national honour

pm modi

Accra, July 3: After receiving the ‘Officer of the Order of the Star of Ghana’, the country’s national honour by Ghana President John Dramani Mahama, Prime Minister Narendra Modi dedicated the honour to the “bright future of Indian youth, their aspirations, India’s rich cultural diversity and the historical ties between India and Ghana”.

The Prime Minister also thanked the people and the government of Ghana for conferring the country’s highest award to him.

Taking to social media platform X, PM Modi said: “”I thank the people and Government of Ghana for conferring ‘The Officer of the Order of the Star of Ghana’ upon me. This honour is dedicated to the bright future of our youth, their aspirations, our rich cultural diversity and the historical ties between India and Ghana. This honour is also a responsibility; to keep working towards stronger India-Ghana friendship. India will always stand with the people of Ghana and continue to contribute as a trusted friend and development partner.”

Prime Minister Modi received Ghana’s highest national honour in recognition of his “distinguished statesmanship and influential global leadership”.

“Honoured to be conferred with ‘The Officer of the Order of the Star of Ghana’,” the Prime Minister said in an X post.

“A testament to the deep and long standing India-Ghana ties. President @JDMahama conferred upon PM @narendramodi ‘The Officer of the Order of the Star of Ghana’, the national award of Ghana dedicated the award to the 1.4 billion people of India and the historic and deep rooted India-Ghana relations. He thanked the government and people of Ghana for this exceptional honour,” Ministry of External Affairs (MEA) Spokesperson Randhir Jaiswal said in a post on X.

“Fitting that PM @narendramodi has been conferred with Ghana’s national honour — the ‘Officer of the Order of the Star of Ghana’. It is a recognition of his steadfast efforts in strengthening the voice of the Global South. Also a testament to our cooperation and friendship with Ghana,” EAM Jaishankar wrote in a post on X.

Accepting the award on behalf of 1.4 billion Indians, Prime Minister Modi dedicated the honour to the aspirations of the youth of India, its cultural traditions and diversity, and to the historical ties between Ghana and India, the MEA said in an official statement.

The Prime Minister thanked the people and government of Ghana for this special gesture.

Noting that the shared democratic values and traditions of the two countries would continue to nurture the partnership, Prime Minister Modi said that the award further deepens the friendship between the two countries and places new responsibility on him to embrace and advance bilateral ties, the MEA statement noted.

The Prime Minister affirmed he was confident that his historic state visit to Ghana would impart a new momentum to India-Ghana ties.

Earlier, PM Modi held wide-ranging talks with President Mahama, after which India and Ghana elevated their ties to the level of a comprehensive partnership.

The Prime Minister is in Ghana on the first leg of his five-nation tour.

It is the first Prime Ministerial visit from India to Ghana in three decades.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra9 months ago

Maharashtra9 months agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

Crime9 months ago

Crime9 months agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report

-

National News9 months ago

National News9 months agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra8 months ago

Maharashtra8 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News10 months ago

National News10 months agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface