Business

More than 850 penny stocks rose over 100% in the past 18 months

Some penny stocks or low-priced stocks have given massive returns in the past 18 months with 102 stocks rising over 1000 per cent and 10 stocks rising over 5000 per cent.

The misfeasance is now widespread and IANS has been throwing into stark relief how circular trading and pump and dump schemes are being run brazenly. It is high time that SEBI and the two exchanges start looking at the data and improve their surveillance mechanisms.

As per data by BP Wealth, Equipp Social Impact Technologies rose by a whopping 29385 per cent, Simplex Papers by 14479 per cent, TTI Enterprise by 13335 per cent, HCP Plastene Bulkpack by 9620 percent. These were among the top performing penny stocks in the last 18 months.

As per data by BP Wealth, among the other top gainers in the last 18 months, Digjam Limited gave returns of 7197 per cent, GRM Overseas at 6469 per cent, Tata Teleservices at 6448 per cent, Cosmo Ferrites at 6130 per cent, Banas Finance at 6021 per cent, B&A Packaging at 5013 per cent, ARC Finance at 4942 per cent, Adinath Textiles at 4764 per cent, SEL Manufacturing Company at 4720 per cent, Waaree Renewable Technologies at 4227 per cent, Automotive Stampings and Assemblies at 3891 per cent, Rohit Ferro-Tech at 3867 per cent, Raghuvir Synthetics at 3827 per cent, Ashiana Agro Industries at 3757 per cent, Indian Infotech and Software at 3689 per cent and Pan India Corporation at 3569 per cent.

Swapnil Shah, Head of Research, BP Wealth, said that investors in penny stocks have garnered huge returns after the Covid-induced market crash in March 2020.

Shah said looking at the return data of penny stocks (share price in the range of Rs 0 to 20 as of July 2020), more than 850 stocks listed on the BSE have risen over 100 per cent in the past 18 months. Astonishingly, 102 stocks have risen over 1000 per cent in the same time period and 10 stocks have risen over 5000 per cent.

Shah said penny stocks are much riskier than larger stocks due to lower information and liquidity, but they do offer higher growth potential.

During rosy times, penny stocks tend to do extremely well. However, when things turn sour, they tend to tank, especially trapping retail shareholders. Thus, one should be careful and invest in penny stocks only after analysing their fundamentals and knowing their risks, Shah said.

Shah said penny stocks are generally considered those which trade in a single-digit or penny price or those which have a very low market cap. It’s because they trade at lower prices that investors believe they can buy a huge chunk of shares and have that psychological satisfaction of owning them, he added.

Generally, a stock trading in penny price could be due to either very small size of the company, collapse of the business which resulted in heavy decline in shares, or financing problems.

In the last three years, we have witnessed a large number of companies of decent size losing more than 90 per cent of their market cap due to various reasons, especially high debt, business failure etc. In most cases, the promoters pledge their shares with bankers against the loan, Shah said.

Business

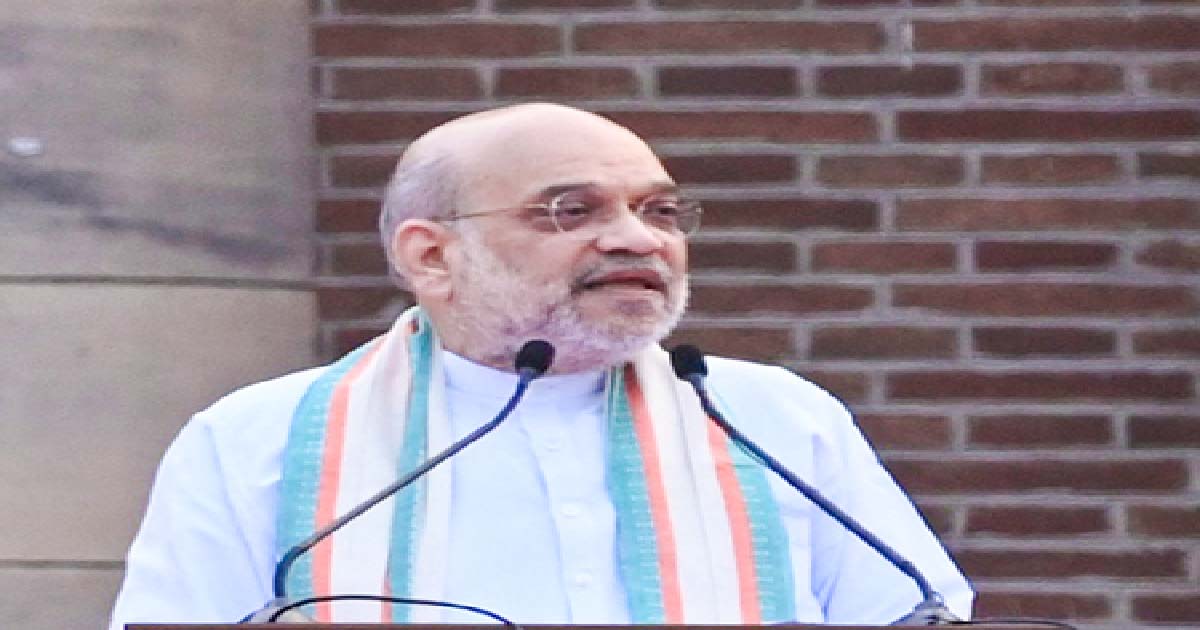

HM Amit Shah congratulates Amul, IFFCO for landmark achievement among world cooperatives

New Delhi, Nov 5: It is a testament to the boundless potential of the cooperatives, Union Home Minister and Minister of Cooperation, Amit Shah, congratulated daily giant Amul and Indian Farmers Fertiliser Cooperative Limited (IFFCO) for occupying the first two ranks among the top 10 cooperatives in the world.

In a landmark achievement for India’s cooperative sector, two of India’s leading cooperatives, Amul and IFFCO, have secured the first and second ranks in the global ranking for cooperatives, respectively.

In a post on X social media platform, HM Shah said, “A proud moment for Bharat! Heartiest congratulations to Amul and IFFCO for occupying the first two ranks among the top ten cooperatives in the world”.

“It is an honour to the tireless dedication of millions of women associated with Amul and farmers contributing to the IFFCO. It is also a testament to the boundless potential of the cooperatives, which is being transformed into a global model of empowerment and self-reliance by Prime Minister Narendra Modi,” HM Shah posted.

Meanwhile, the India’s dairy sector is the backbone of rural livelihoods and a symbol of inclusive growth. As the largest milk producer in the world, India has combined farmer-led cooperatives, women’s participation and scientific practices to achieve remarkable progress.

Notably, while safeguarding existing gains, there is continued support to the sector through subsidies, credit facilities, R&D in fodder and animal health, among others, to ensure India’s dairy sector remains resilient, inclusive, and capable of meeting future domestic and international demand.

Moreover, the National Co-operative Exports Limited (NCEL), set up by the Government in 2023, has achieved the impressive milestone of exporting Rs 5,403.01 crore worth of agricultural commodities, including rice, fresh red onion, sugar, baby food, processed food, spices and tea.

Also, NCEL has been promoted by five leading co-operatives — Indian Farmers Fertiliser Co-operative Limited (IFFCO), Krishak Bharati Co-operative Limited (KRIBHCO), National Agricultural Co-operative Marketing Federation of India Limited (NAFED), Gujarat Co-operative Milk Marketing Federation (GCMMF–Amul) and the National Co-operative Development Corporation (NCDC).

Business

Indian stock markets closed on Nov 5 for Guru Nanak Jayanti; trade to resume tomorrow

Mumbai, Nov 5: The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) remained closed on Wednesday on account of Prakash Gurpurb Sri Guru Nanak Dev, also known as Guru Nanak Jayanti.

Trading across segments, including equities, derivatives, securities lending and borrowing (SLBs), currency derivatives, and interest rate derivatives, stayed shut for the day.

The commodity derivatives market was also closed in the morning session between 9 am and 5 pm but will open for the evening session from 5 pm to 11:30/11:55 pm.

Regular trading on both exchanges will resume on Thursday (November 6).

On Tuesday, Indian stock markets ended lower, with the Nifty slipping below the 25,600 mark amid broad-based selling pressure.

The Sensex fell 519.34 points, or 0.62 per cent, to close at 83,459.15, while the Nifty dropped 165.70 points, or 0.64 per cent, to end at 25,597.65.

The BSE Midcap index declined 0.2 per cent, and the Smallcap index fell 0.7 per cent.

Among major Nifty stocks, Power Grid Corp, Coal India, Tata Motors Passenger Vehicles, Bajaj Auto, and Eternal were the top losers.

On the other hand, Titan Company, Bharti Airtel, Bajaj Finance, HDFC Life, and M&M gained during the session.

Barring telecom and consumer durable sectors, all other indices ended in the red. IT, auto, FMCG, metal, power, realty, and PSU indices slipped between 0.5 to 1 per cent.

Market analysts said that the Nifty has retested its 20-day exponential moving average (EMA). A sustained move below this level could weaken the positive sentiment and extend the correction toward 25,400.

“On the higher side, 25,800 is likely to act as an immediate resistance level. Traders have been advised to remain cautious and focus on risk management until a clear market direction emerges,” experts said.

Business

Indian Hotels clocks 48.6 pc drop in Q2 net profit to Rs 285 crore

Mumbai, Nov 4: Tata Group’s hospitality arm, Indian Hotels Company Limited (IHCL), on Tuesday reported a 48.6 per cent year-on-year (YoY) drop in net profit to Rs 285 crore for the quarter ended September 2025 (Q2 FY26).

The company had posted a profit of Rs 555 crore in the same quarter last financial year (Q2 FY25), according to its stock exchange filing.

Despite the fall in profit, IHCL’s revenue from operations rose 11.8 per cent to Rs 2,040.8 crore, compared with Rs 1,826 crore in the corresponding period of the previous financial year.

The company’s EBITDA (earnings before interest, tax, depreciation, and amortisation) also showed improvement, rising 14.2 per cent year-on-year (YoY) to Rs 572 crore from Rs 501 crore a year ago.

The EBITDA margin improved slightly to 28 per cent, compared with 27.4 per cent in the same quarter last financial year.

On the market front, IHCL shares ended at Rs 743.75 on the BSE, down Rs 3.30 or 0.44 per cent on Tuesday.

Over the last five days, the stock gained Rs 2.35 or 0.32 per cent, while in the past month, it rose Rs 20.65 or 2.85 per cent.

However, over a longer period, the stock has faced some pressure. In the last six months, IHCL shares fell Rs 57.60 or 7.18 per cent, and on a year-to-date (YTD) basis, they are down Rs 129.40 or 14.81 per cent.

Still, over the past one year, the stock has gained Rs 77.65 or 11.65 per cent.

The Indian Hotels Company Limited (IHCL) is South Asia’s biggest hospitality group. It was founded in 1903 by Jamsetji Tata, who started it with the opening of The Taj Mahal Palace in Mumbai.

The company is best known for its Taj hotels and its unique culture called “Tajness,” which combines Indian tradition with modern hospitality.

Today, IHCL runs more than 550 hotels across four continents and focuses on being both innovative and sustainable.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra12 months ago

Maharashtra12 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report