Business

Mukesh Ambani with a net worth of $ 92.7 billion tops 2021 Forbes list of India’s richest

A soaring stock market propelled the combined wealth of members of the 2021 Forbes list of India’s 100 Richest to a record US$775 billion, after adding $257 billion — a 50 per cent rise — in the past 12 months.

In this bumper year, more than 80 per cent of the listees saw their fortunes increase, with 61 adding $1 billion or more.

At the top of the list is Mukesh Ambani, India’s richest person since 2008, with a net worth of $92.7 billion.

Ambani recently outlined plans to pivot into renewable energy with a $10 billion investment by his Reliance Industries.

Close to a fifth of the increase in the collective wealth of India’s 100 richest came from infrastructure tycoon Gautam Adani, who ranks No. 2 for the third year in a row. Adani, who is the biggest gainer in both percentage and dollar terms, nearly tripled his fortune to $74.8 billion from $25.2 billion previously, as shares of all his listed companies soared.

At No. 3 with $31 billion is Shiv Nadar, founder of software giant HCL Technologies, who saw a $10.6 billion boost in his net worth from the country’s buoyant tech sector.

Retailing magnate Radhakishan Damani retained the fourth spot with his net worth nearly doubling to $29.4 billion from $15.4 billion, as his supermarket chain Avenue Supermarts opened 22 new stores in the fiscal year ending March.

India has administered over 870 million Covid-19 vaccine shots to date, thanks partly to Serum Institute of India, founded by vaccine billionaire Cyrus Poonawalla, who moves into the top five with a net worth of $19 billion. His privately held company makes Covishield under license from AstraZeneca and has other Covid-19 vaccines under development.

India’s recovery from a deadly second wave of Covid-19, which broke out earlier this year, restored investor confidence in the world’s sixth-largest economy.

There are six newcomers on this year’s list, with half of them from the booming chemicals sector. They include Ashok Boob (No. 93, $2.3 billion) whose Clean Science and Technology listed in July; Deepak Mehta (No. 97, $2.05 billion) of Deepak Nitrite and Yogesh Kothari (No. 100, $1.94 billion) of Alkyl Amines Chemicals. Arvind Lal (No. 87, $2.55 billion), the executive chairman of diagnostics chain Dr Lal PathLabs, also debuted on the list after a pandemic-induced surge in testing caused shares of his company to double in the past year.

The country’s IPO rush returned property magnate and politician Mangal Prabhat Lodha (No. 42, $4.5 billion) to the ranks, following the April listing of his Macrotech Developers. Among the four other returnees is Prathap Reddy (No. 88, $2.53 billion), whose listed hospital chain Apollo Hospitals Enterprise has been testing and treating Covid-19 patients.

Eleven listees from last year dropped off, given the increased cut-off for gaining entry to this year’s list. The minimum amount required to make this year’s list was $1.94 billion, up from $1.33 billion last year.

Naazneen Karmali, Asia Wealth Editor and India Editor of Forbes Asia, said: “This year’s list reflects India’s resilience and can-do spirit even as Covid-19 extracted a heavy toll on both lives and livelihoods. Hopes of a V-shaped recovery fueled a stock market rally that propelled the fortunes of India’s wealthiest to new heights. With the minimum net worth to make the ranks approaching $2 billion, the top 100 club is getting more exclusive.”

Business

Relief for Vodafone Idea as SC allows Centre to reconsider AGR dues issue

New Delhi, Oct 27: In a relief for Vodafone Idea, the Supreme Court on Monday allowed the Centre to reconsider the issue of Adjusted Gross Revenue (AGR) dues worth Rs 9,450 crore to ease the burden of the loss-making telecom company. The court reasoned that this matter falls in the Union’s policy domain.

The Supreme Court noted that the decision was made keeping in mind the interest of 20 crore consumers of the telecom company.

In a landmark 2019 verdict, the Supreme Court endorsed the Centre’s definition of AGR and allowed the Centre to collect dues worth Rs 92,000 crore which came as a huge setback for telecom majors such as Vodafone and Bharti Airtel.

Vodafone’s latest petition flagged a fresh AGR demand of Rs 9,450 crore raised by the Department of Telecommunications. The petition contended that a substantial portion of the demand pertained to the pre-2017 period, which had already been settled by the Supreme Court.

Solicitor General of India Tushar Mehta told the court that “there is a huge change in circumstances” of the case because the government has infused equity in Vodafone.

“The government’s interest is public interest. There are 20 crore consumers. If this company is to suffer, it would lead to issues for consumers,” he said.

The Supreme Court noted in its order that the Centre is willing to examine the issue. “The government is also willing to reconsider and take an appropriate decision if the court permits. In the peculiar facts, we see no impediment in government reconsidering the issue. We clarify that this is a matter of policy, there is no reason as to why the Union should be prevented from doing so,” the apex court said.

AGR refers to a fee-sharing mechanism under which telecom operators must share a part of their revenue with the Centre as licensing fees and spectrum usage charges. There was a longstanding dispute between telecom companies and the Centre over the definition of AGR. While the telecom giants stressed that AGR should be based just on core services, the Centre argued it should also factor in non-telecom services provided by the telecom giants.

Business

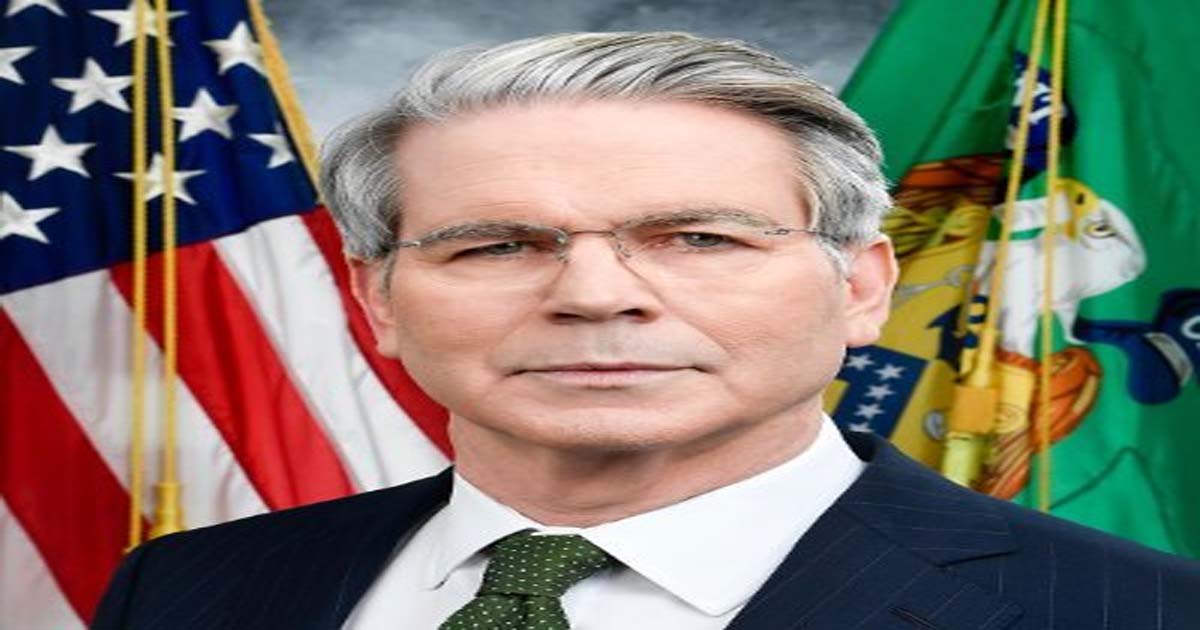

US has reached a ‘substantial framework’ with China to avert tariffs: US Treasury Secretary Bessent

Washinton, Oct 27: US Treasury Secretary Scott Bessent has said that he believes the US has reached a framework agreement with China to avoid imposing an additional 100 per cent tariff on Chinese imports.

“I think we’ve reached a substantial framework for the two leaders who will meet next Thursday… that tariffs will be averted,” Bessent said on Sunday to media from Kuala Lumpur, Malaysia, where President Donald Trump arrived on Saturday for a weeklong Asia diplomacy tour.

Trump is expected to meet with Chinese leader Xi Jinping in South Korea later this week.

Earlier, Chinese International Trade Representative Li Chenggang said the US and China had reached “preliminary consensus” on trade issues during discussions in Malaysia, according to Chinese media.

Bessent did not provide details about the framework but said on media that he anticipates the US would get “some kind of deferral” on rare-earth export controls.

The minerals have been central to trade tensions between the top global economies.

Bessent said the framework sets up Trump and Xi “to have a very productive meeting,” adding, “I think it will be fantastic for US citizens, for US farmers, and for our country in general.”

Bessent indicated that an escalation in tariffs on China is “effectively off the table” following what he described as “very good” trade talks with his Chinese counterparts.

President Trump had threatened an additional 100 per cent tariff on China from November 1 over Beijing’s efforts to impose export controls on critical rare earths, ratcheting up tensions between the US and China.

Asked about the status of those tariffs, Bessent told media on Sunday that tariff threat has “gone away” after two days of talks in Malaysia.

“We had a very good two-day meeting. I would believe that the – so it would be an extra 100 per cent from where we are now, and I believe that that is effectively off the table.”

He added, “I would expect that the threat of the 100 per cent has gone away, as has the threat of the immediate imposition of the Chinese initiating a worldwide export control regime.”

US and Chinese trade negotiators reached a “basic consensus” on how to address their “respective concerns,” Chinese state media said on Sunday, following talks between the two sides over the weekend in Kuala Lumpur.

A delegation led by Chinese Vice Premier He Lifeng met with US officials including Treasury Secretary Scott Bessent and Trade Representative Jameson Greer for the talks, which come days ahead of a highly anticipated meeting between Chinese leader Xi Jinping and US President Donald Trump.

The two leaders are expected to meet on the sidelines of the APEC summit in South Korea, though Beijing, unlike Washington, has yet to confirm the meeting.

Earlier on Sunday, Bessent said the two sides had “set the stage for the leaders’ meeting” with a “very successful framework for the leaders to discuss”.

“The two sides engaged in candid, in-depth, and constructive exchanges and consultations on major economic and trade issues of mutual concern,” the Chinese state media readout said.

It listed out those issues as including US penalties on China’s maritime logistics and shipbuilding industry, reciprocal tariffs, fentanyl tariffs, agricultural trade, and export controls – a sweeping set of frictions that have set the world’s two largest economies at loggerheads.

“Two sides reached a basic consensus on arrangements to address each other’s concerns. Both sides agreed to further finalise the specific details and fulfil their respective domestic approval processes,” the readout said.

Trade and tech tensions between the world’s two biggest economies have heightened in recent weeks after the US expanded its export blacklist, hitting China’s access to American high-tech, while China ramped up its own export controls on rare earth minerals.

Business

Indian markets open higher on positive US-China trade talks

Mumbai, Oct 27: Indian stock markets opened on a positive note on Monday, supported by progress in trade talks between the United States and China.

Investors showed optimism after reports suggested that both countries are close to signing a deal to ease trade tensions.

The Sensex was trading at 84,450, up by 239 points or 0.28 per cent, while the Nifty stood at 25,874, gaining 79 points or 0.30 per cent.

On the weekly timeframe, the index witnessed a correction of nearly 311 points from its high, indicating heightened volatility and profit booking at higher levels.

“A breakdown below 25,670 could trigger weakness toward 25,500–25,400, while on the upside, resistance is placed at 25,950, followed by 26,000 and 26,100,” analysts said.

“Sustaining above these resistance levels will be crucial for the index to resume its upward trajectory,” they added.

Among the top performers on the Sensex were Tata Steel, Bharti Airtel, Tech Mahindra, and HDFC Bank, which rose up to 1.4 per cent.

On the other hand, stocks like Infosys, BEL, Kotak Mahindra Bank, and Bajaj Finance were among the laggards, falling up to 1.4 per cent.

Broader markets also traded in the green, with the Nifty MidCap index rising 0.46 per cent and the Nifty SmallCap index up 0.23 per cent.

The rally in domestic equities came after US Treasury Secretary Scott Bessen said on Sunday that President Trump’s proposed 100 per cent tariffs on Chinese goods were “off the table.”

He also mentioned that China is expected to increase soybean imports and delay restrictions on rare earth exports, easing global trade concerns.

All sectoral indices on the NSE were trading higher, with the Nifty Realty index leading the gains, up by 1 per cent.

Experts said that positive global cues and optimism around the US-China trade deal lifted market sentiment, helping Indian equities start the week on a strong note.

“Comments from the US treasury Secretary Scot Bessent that there is a “substantial framework for trade negotiations with China” indicate that a US-China trade deal is on the cards,” analysts said.

“For India, the fundamentals are also turning positive with brisk festival season sales and reports of a smart pick up in capital spending by the private sector. This long awaited trend has significant positive implications for India’s growth and stock market,” they mentioned.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra12 months ago

Maharashtra12 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report