National News

Viksit Bharat Young Leaders Dialogue kicks off, youth can pitch their ‘vision’ directly to PM Modi

New Delhi, Jan 10: The Department of Youth Affairs, under the leadership of Union Minister of Youth Affairs & Sports Mansukh Mandaviya kicked off the Viksit Bharat Young Leaders Dialogue at Bharat Mandapam on Friday and is set to see an exciting array of activities over the next three days.

The event aims to provide a unique platform for the youth to present innovative solutions for Viksit Bharat.

Union Minister Mansukh Mandaviya took to X to inform that the event will facilitate bright and talented youths from across the nation to present their visionary ideas for a Viksit Bharat to PM Modi.

A total of 3,000 dynamic and motivated youths have been selected to participate in the Viksit Bharat Young Leaders Dialogue, following a merit-based, multi-level selection process designed to identify and showcase the most promising voices from across the nation.

The selected 3,000 participants include 1,500 from the Viksit Bharat Track, representing the top 500 teams from State Championships; 1,000 from the Traditional Track, chosen through state-level youth festivals and cultural programmes and exhibitions on the themes of innovation in Science & Technology by young innovators; and 500 Pathbreakers, invited for their groundbreaking contributions across ten thematic tracks.

The participants are set to showcase their innovative ideas at Bharat Mandapam, marking a historic convergence of youth leadership and a vision for Viksit Bharat.

On Friday, a variety of competitions in painting, story writing, music, dance, declamation, and poetry will allow participants to express their vision for a developed India. Later in the evening, a dinner will be hosted by Union Ministers and Members of Parliament. This opportunity will enable participants to interact directly with policymakers while bridging the gap between the aspirations of youth and governmental actions.

On Day 2, the event will commence with the inaugural session led by Union Minister of Labour & Employment and Youth Affairs & Sports, Dr Mansukh Mandaviya and Union Minister of State for Youth Affairs and Sports Raksha Khadse along with the other dignitaries from the Ministry.

Participants will be taken to 10 designated venues where deliberations will be conducted on 10 identified themes and will see the participation of mentors and domain area experts, including S. Somnath, Pawan Goenka, Amitabh Kant, Sachin Bansal, Ronnie Screwvala, Anand Kumar, Ritesh Aggarwal, Bhaichung Bhutia, Chavvi Rajawat, Kalpana Saroj, and others.

A Viksit Bharat Exhibition will be displayed showcasing youth-focused initiatives from the State and Central Ministries. It will offer interactive experiences to engage participants with opportunities in education, skill development, entrepreneurship, and culture.

January 12, celebrated as National Youth Day to honour the birth anniversary of Swami Vivekananda will prove to be a defining moment for every participant. This day will feature the most highly anticipated segment of the event.

Prime Minister Narendra Modi will inaugurate a specially curated Coffee Table Book which will be a compilation of the best essays from each of the ten identified themes. PM Modi will also launch the Youth Anthem, a powerful musical piece created to inspire and unite the youth of India under a common vision of national progress and development.

The grand plenary session, led by the Prime Minister will form the centrepiece of concluding day. He will address the gathering and will motivate the youth gathered to achieve the goal of Viksit Bharat.

National News

Mumbai: BMC-Run KEM Hospital Commissions Ultra-Modern Modular OTs For Heart Transplants And Complex Surgeries

Mumbai, Dec 26: Mumbai’s BMC-run KEM Hospital has strengthened its advanced healthcare infrastructure with the commissioning of ultra-modern steel modular operation theatres (OTs) designed for heart transplants and other complex surgeries. Following the completion of sterilisation protocols, cardiac surgeries have already commenced in the new facility.

The newly installed modular OTs feature steel walls, ceilings, frames and panels, making them resistant to dust, moisture and water. This design significantly improves cleanliness and simplifies sterilisation, thereby reducing the risk of post-operative infections.

“Equipped with laminar airflow systems and HEPA filters, the operation theatres ensure a continuous supply of clean, controlled air by filtering out bacteria, viruses, dust particles and other airborne contaminants,” said hospital officials, adding that the advanced setup will support not only heart transplants but also other organ transplants, surgeries for congenital disorders and complex paediatric procedures.

To further enhance efficiency, especially in emergency organ transplant cases, the hospital has developed special internal connectivity and separate entry points. These allow donor organs to be transported directly to the designated operation theatre, minimising time delays and reducing associated risks.

With this upgrade, KEM Hospital is expected to play a more significant role in organ transplantation and advanced surgical care in Mumbai and across Maharashtra.

Business

Keralites gulped liquor worth over Rs 332 crore during Christmas

Thiruvananthapuram, Dec 26: The Kerala State Beverages Corporation (BEVCO) recorded a sharp surge in liquor sales during the Christmas week, with revenues touching a record Rs 332.62 crore, according to official figures.

The Christmas week sales are calculated for the four days from December 22 to December 25, and officials said this year witnessed a significant jump compared to previous years.

Data shows a 19 per cent increase in sales over the corresponding period last year, underlining a strong festive demand.

The sharpest spike was recorded on Christmas Eve, when liquor sales alone amounted to Rs 114.45 crore.

In comparison, sales on the same day last year stood at Rs 98.98 crore, indicating a substantial year-on-year rise.

Officials attributed the surge not only to the festive season but also to improved consumer facilities introduced by BEVCO over the past year.

The corporation had expanded its premium retail infrastructure, including the launch of new premium counters aimed at offering a better purchasing experience and a wider selection of high-end products.

Premium outlets were recently opened in key centres such as Thrissur and Kozhikode, and officials said these had a positive impact on overall sales figures.

The enhanced facilities helped reduce crowding at regular outlets and encouraged higher-value purchases, contributing to the increase in revenue.

The Corporation has traditionally seen a spike in sales during festival periods such as Onam and Christmas, but this year’s figures mark one of the highest Christmas week turnovers recorded by the state-run corporation.

The rise in liquor sales is expected to provide a significant boost to the State exchequer, as the corporation is a major contributor to Kerala’s revenue through taxes and duties.

Liquor is sold through state-run 325 retail outlets.

Studies have shown that around 10 per cent of the 3.30 crore Kerala population are tipplers, including around three lakh women.

In 2024–25, Kerala’s liquor sales rose to Rs 19,730.66 crore, up from Rs 19,069.27 crore in 2023–24, marking an annual growth of 3.5 per cent.

Business

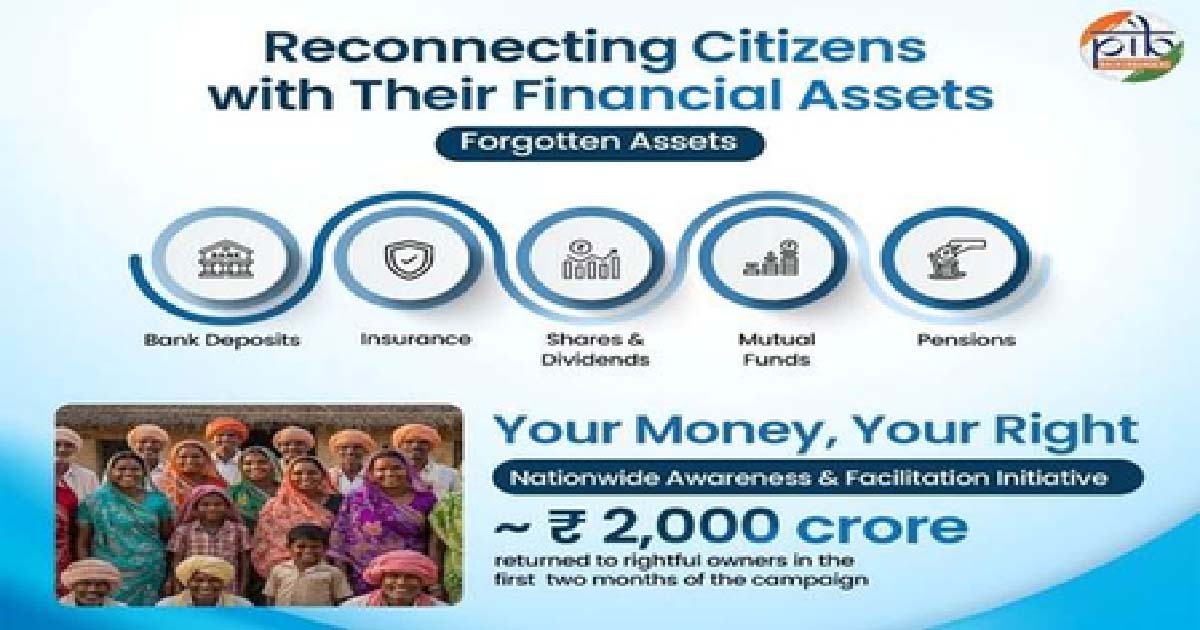

Govt drive returns Rs 2,000 crore unclaimed savings to rightful owners

New Delhi, Dec 26: The government has succeeded in returning to the rightful owners a total amount of nearly Rs 2,000 crore that was stuck as “unclaimed savings” across banks, insurance, mutual funds, dividends, shares, and retirement benefits held within the regulated financial system, according to an official statement issued on Friday.

The funds have been restored through the Centre’s “Your Money, Your Right” nationwide awareness and facilitation initiative, launched in October 2025 to help citizens identify and reclaim unclaimed financial assets. The initiative is being coordinated by the Finance Ministry’s Department of Financial Services, with financial sector regulators reaching across digital portals with district-level facilitation.

Across generations, Indian families have saved carefully through opening bank accounts, purchasing insurance policies, investing in mutual funds, earning dividends from shares, and setting aside money for retirement. These financial decisions are taken with a hope and responsibility, often to secure children’s education, support healthcare needs, and ensure dignity in old age.

Yet, over time, a significant portion of these hard-earned savings has remained unclaimed. The money has not vanished, nor has it been misused. It lies safely with regulated financial institutions, separated from its rightful owners due to a lack of awareness, outdated records, changes in residence, or missing documentation. In many cases, families are simply unaware that such assets exist.

The volume of unclaimed financial assets in India is significant and spans multiple segments of the formal financial system. Indicative estimates suggest that Indian banks together hold around Rs 78,000 crore in unclaimed deposits. Unclaimed insurance policy proceeds are estimated at nearly Rs 14,000 crore, while unclaimed amounts in mutual funds are about Rs 3,000 crore. In addition, unclaimed dividends account for around Rs 9,000 crore, according to official figures.

Together, these amounts underline the scale of unclaimed savings belonging to citizens that continue to remain unused, despite being securely held within the financial system.

Your Money, Your Right is a nationwide effort to reconnect citizens with these forgotten financial assets and ensure that money that belongs to individuals and families ultimately finds its way back to them.

These unclaimed financial assets arise when money held with financial institutions is not claimed by the account holder or their legal heirs for a prolonged period. Such assets include:

*Bank deposits such as savings accounts, current accounts, fixed deposits, and recurring deposits that have not been operated for ten years or more.

*Insurance policy proceeds that remain unpaid beyond the due date

*Mutual fund redemption proceeds or dividends that could not be credited due to reasons such as a change in bank account, bank account closure, incomplete bank account in records, etc.

*Dividends and shares that remain unclaimed and are transferred to statutory authorities

*Pension and retirement benefits that are not claimed within the normal course

In most cases, assets may become unclaimed because of routine life events such as migration for work, changes in contact details, closure of old bank accounts, or lack of information among family members and legal heirs.

The Government is coordinating with the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Securities and Exchange Board of India (SEBI), the Investor Education and Protection Fund Authority (IEPFA), and the Pension Fund Regulatory and Development Authority (PFRDA) to help citizens identify, access and reclaim financial assets that legally belong to them, using simple processes and transparent systems.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report