Business

‘TN govt may get into reform mode after local body polls’

The DMK-led Tamil Nadu government may get into reform mode post the local body elections likely to be held by the end of 2021, say party leaders and industry experts.

“Though a white paper on the Tamil Nadu government finances spoke about the necessity to hike tax rates and other things for those who can bear it, the state budget that was presented was a usual one. Perhaps the state government may get into reform mode after the local body elections,” K.C. Palanisamy, former AIADMK MP and MLA, told IANS.

Palanisamy said the local body elections may be held before the end of 2021 or February 2022.

Finance Minister Palanivel Thiaga Rajan after declaring ‘once in a generation reforms a must’ and ‘business as usual’ approach cannot continue while presenting the white paper on the state government’s finances, came out with a relatively populist budget.

As per the white paper, reforms/restructuring in state government undertakings, statutory boards, power utilities, mobilisation of tax revenues, mode of subsidy deliveries were on the cards.

“As a debutant Finance Minister, he might have taken a soft approach with his first budget which is an interim budget,” Palanisamy said.

Industry experts said Finance Minister Rajan’s budget is nothing but a status quo or an extension of the previous AIADMK government’s budget.

“The white paper set the expectation that the Finance Minister will provide a reform budget to reduce the state debt. One could agree that he needed more time to come up with the actual reforms but least expected was the transformation roadmap, a timeline,” Sriram Seshadri, Founder and Managing Partner, Disha Consulting and formerly Partner and Managing Director, Accenture India, told IANS.

According to him, a white paper lays down the problem, analysis, probable solution.

On the other hand, the government’s white paper laid out the problem statement which was well known and the expectations were there on reform proposals in the budget which surprisingly did not happen, Seshadri said.

“As an economist, I feel satisfied that the budget didn’t provide for any of the poll promises. For an economist the white paper gave an expectation that there would be a reform and transformation roadmap but the budget was disappointing,” he added.

According to him, nothing was there in the budget for beefing up the state revenues while the debt was increasing.

“Tamil Nadu will cross the debt of Rs six lakh crore mark by 2021 end. Only solace is during the budget discussions in the state Assembly, the Finance Minister has said some of the poll promises will not be met such as revising the old pension scheme for government employees,” Seshadri added.

He said if there is a reform agenda with the DMK government it has to be rolled out soon and not wait for the next year’s budget.

However, he agreed that the government will take some reform steps mainly targeted subsidies to poor sections of the society, refine the rules for ration cards and revenue optimisation initiatives like tax reforms.

“Already Tamil Nadu’s economy is the fourth largest in the country and will slip to fifth or sixth place soon. Hence, the state should regain the momentum, cut the red tape and enable ease of doing business both in MSME and large industries,” Seshadri said.

While the government’s popularity endures it should take some tough decisions to reduce government spending, disinvestment and make announcements to attract investment, he said.

“Sterlite Copper (copper smelter unit of Vedanta Ltd in Tuticorin) closure is one of the stumbling blocks for investors to invest in a big way because there is no guarantee to their investment. The government should enable reopening of Sterlite within the guidelines of the pollution control norms. Likewise closely monitor to optimize revenue on the natural resources, mining and sand. The government gets less than Rs 1,000 crore revenue whereas the potential is much higher,” he added.

However, the signs of change in the government are seen in the budget by not implementing its populist poll promises like Rs 1,000 per month dole to the female head of the family.

“Instead the government had decided to conduct a study to identify eligible beneficiaries. This move is new as in the past the state government used to disburse financial assistance for almost all ration card holders,” K. Puhazhendi, Director, Perfint Healthcare, told IANS.

Referring to Rajan’s statement that the governance will be data-based, Puhazhendi said the government can mine data available in its own departments/municipal corporations.

The smart ration cards are linked with Aadhar cards.

Puhazendhi said the government employees themselves form a big database so that undeserved subsidies can be stopped.

“Data on property taxpayers, land owners, vehicle registrations, power consumers, ration card holders, data about government employees, shops and business establishments, factories and other data are available with different departments,” Puhazhendi said.

The government can collate and gather from the people with help of door-to-door data gathering. This could be a starting point to build a database and target the subsidies and other government schemes, he added.

Stressing that the government’s focus should be on making each department, municipal corporations self-financing, Puhazhendi called for a freeze on government hiring and investment should be made in information technology systems to digitise the services.

It is high time the state government goes in for public-private partnership in the tourism sector. The state government owns several hotel properties which are in need of private investment and management.

Business

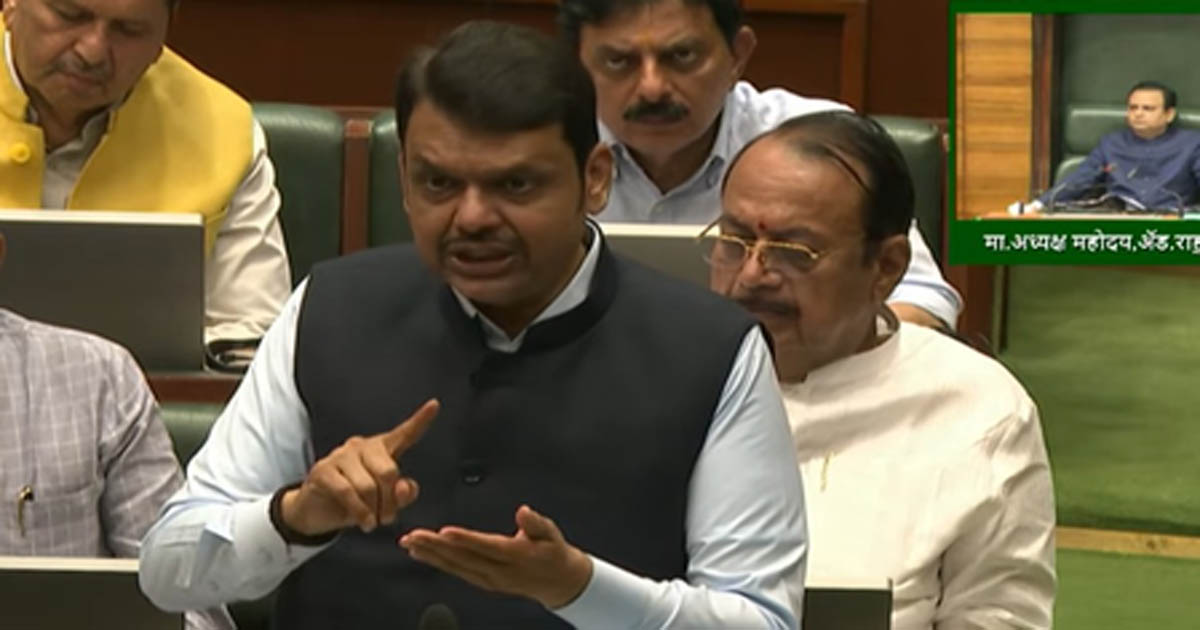

Maha govt presents supplementary demands worth Rs 11,995 crore in Assembly

Mumbai, Feb 24: Amid strain on state finances, Maharashtra Chief Minister Devendra Fadnavis, who holds the charge of planning and finance departments, on Tuesday tabled the supplementary demands worth Rs 11,995 crore for the remaining period of the fiscal 2025-26.

Of the Rs 11,995 crore, the state government has earmarked Rs 3,112.85 crore to meet the expenses incurred on the concession given in the electricity tariff to Agriculture pump, power loom and textile consumers in the state, and Rs 803.94 crore has been proposed as incentives to small, medium, large industries and mega projects under the package scheme of incentives.

The government has proposed Rs 4,792.02 crore for transferring the loan amount to the state power distribution company, Mahavitaran, which has been received from the Asian Infrastructure Investment Bank for the solar agriculture pump scheme. This allocation is aimed at pushing the government’s plan to use 52 per cent renewable energy by 2030 under the net zero mission.

The government has also proposed Rs 1,431.05 crore as an additional fund as part of the Central share for the implementation of the Jal Jeevan mission. In March 2025, Ajit Pawar had presented the budget with a revenue deficit of Rs 45,890 crore.

In June 2025, the government presented the supplementary demands worth Rs 57,509.71 crore, crossing the revenue deficit of Rs one lakh crore.

In the Winter Session during December 2025, with supplementary demands of Rs 75,286.37 crore, the revenue deficit had already touched the Rs two lakh crore mark. In addition to the revenue deficit of Rs 45,891 crore, the budget 2025-26 had projected that Maharashtra’s debt burden is set to rise to Rs 9.32 lakh crore. In Tuesday’s supplementary demands, the state government has not only refrained from proposing any new and additional expenses but has focused solely on Power subsidies for farmers and Industry incentives.

CM Fadnavis will present the state budget for the year 2026-27 on March 6. He has already announced in the press conference on Sunday that there could be strict measures to maintain financial discipline.

Earlier, speaking at the World Economic Forum (WEF) annual meeting, the Chief Minister had said that the state is on track to generate 16 gigawatts (GW) of solar power by the end of this year. By 2032, the state aims to generate an additional 45 GW, with 70 per cent coming from solar. Renewable energy, which stood at 13 per cent four years ago, is projected to reach 52 per cent by 2030,” he said.

Following Prime Minister Narendra Modi’s vision, the state launched Asia’s largest decentralised solar scheme.

By shifting the entire agricultural load to solar power and establishing a dedicated company for farmer supply, the state is making every agricultural feeder independent.

“The cost of supplying power to farmers has dropped from Rs 8 to less than Rs 3 per unit. This transition is not only helping farmers but also reducing the financial burden on industries and households,” the Chief Minister noted.

The government is advancing a capital outlay for pumped storage hydro projects (combined capacity of 5,630 MW) with an estimated total investment of Rs 24,631 crore.

Business

Precious metals surge over growing geopolitical tensions

Mumbai, Feb 23: Gold and silver prices surged significantly on Monday, amid growing geopolitical tensions and the US dollar’s steep fall.

MCX gold April futures gained 1.83 per cent to Rs 1,59,749 per 10 grams on an intra-day basis. Meanwhile, MCX silver March futures gained 5.10 per cent to Rs 2,65,836 per kg.

Earlier in the day, gold had jumped 2 per cent while silver soared 6 per cent. Analysts attributed the surge to geopolitical tensions as US President Donald Trump’s 10-day deadline for a “meaningful deal” with Iran drew closer.

Iran has indicated it is prepared to make concessions on its nuclear programme in talks with the US in return for the lifting of sanctions and recognition of its right to enrich uranium, as it seeks to avert a US attack.

Further, the dollar fell after the US Supreme Court struck down a vast swathe of President Trump’s tariffs on Friday.

“The US Supreme Court’s decision to strike down a large swath of Trump’s tariffs has weakened his ability to threaten and impose tariffs at a moment’s notice, but it won’t end gnawing uncertainty for trade partners or companies,” said Manav Modi, Commodities Analyst, Motilal Oswal Financial services Ltd.

“Silver is witnessing a large draw of inventories from all warehouses especially, Comex very significantly indicating the tightness in supply and surge in demand as China remains shut,” the analyst said.

Concerns over slowing US economic growth are also supporting gold’s safe-haven appeal. The US GDP rose 1.4 per cent annually in the fourth quarter, down from 4.4 per cent in the July-September quarter and 3.8 per cent in the April-June quarter.

“Gold has support at Rs 1,54,400 and Rs 1,53,150 while resistance at Rs 1,59,100 and Rs 1,60,600. MCX silver has support at Rs 2,48,800 and Rs 2,42,000, and resistance is at Rs 2,57,700 and Rs 2,63,620,” an analyst said.

Markets remain keen on data from US factory orders, cues on consumer confidence data, and US Producer Price Index (PPI) data.

Business

RCOM loan fraud: Anil Ambani files affidavit in SC; reiterates not to leave country

New Delhi, Feb 19: Industrialist Anil D. Ambani has filed an undertaking/compliance affidavit before the Supreme Court reiterating that he will not leave the country without prior permission of the apex court in connection with the ongoing probe into alleged large-scale bank loan frauds linked to Reliance Communications Ltd (RCOM) and its group entities.

The affidavit has been filed in a pending public interest litigation (PIL) seeking a court-monitored probe into the allegations that more than Rs 1.50 lakh crore of debt of the Ambani-led RCOM group has been written off and that funds were siphoned off through multiple shell companies.

The affidavit formally reiterates the oral undertaking recorded before the apex court on February 4, when senior advocate Mukul Rohatgi, appearing on his behalf, assured that Ambani would not leave India without prior permission of the top court.

“By way of the present affidavit, I formally reiterate and place on record the said statement by virtue of the present affidavit as an undertaking before this Hon’ble Court,” Ambani stated.

He further deposed on oath: “That I have not left India since July 2025, i.e., since the inception of the present investigations, and presently have no plan or intention to travel outside India.”

He added that if any requirement of foreign travel arises, he would seek prior leave and permission of the Supreme Court before undertaking such travel.

Asserting that he is not a flight risk, the affidavit states: “In view of the above conduct, undertakings, and continued cooperation, it is evident that I am not a flight risk and have no intention, whatsoever, to evade the process of law.”

Ambani also stated that he has been fully cooperating with the investigating agencies. “That I, with utmost bona fide, have been fully cooperating with the investigating agencies in connection with the ongoing investigations and continue to extend complete cooperation,” the affidavit reads.

Referring to the ongoing probe under the Prevention of Money Laundering Act, 2002, he stated that examination under Section 50 of the PMLA is presently being conducted during the pendency of proceedings before the apex court.

“That I have been summoned by the Directorate of Enforcement to appear on 26.02.2025 and I undertake to appear and join the investigation on the said date,” the affidavit said, while also undertaking to fully cooperate with the authorities and “preventing any suggestion of evasion or selective presentation of facts.”

Clarifying his role in the group companies under scrutiny, Ambani submitted: “That I respectfully state that my role in the concerned companies had been that of a Non-Executive Director only, and I was not involved in the day-to-day management or operational affairs of the said companies.”

In the affidavit sworn on February 18, he stated: “That the present affidavit is being filed to ensure clarity, completeness, and procedural transparency in the judicial record with an intent that this Hon’ble Court remains seized of the broader issues arising from the same factual matrix.”

Ambani’s undertaking comes against the backdrop of the Supreme Court’s February 4 order, where a Bench headed by Chief Justice of India (CJI) Surya Kant had expressed serious concern over an “unexplained delay” by the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) in probing alleged bank loan frauds involving public funds estimated at around Rs 40,000 crore.

The CJI Kant-led Bench had directed the ED to constitute a Special Investigation Team (SIT) of senior officers and asked both Central agencies to take the investigation to its “logical conclusion” in a time-bound manner, while making it clear that no coercive or harsh orders were being passed at that stage.

During the hearing, apprehensions were raised by advocate Prashant Bhushan that the key accused could flee the country before completion of the probe, following which an undertaking not to travel abroad without apex court permission was recorded.

The Supreme Court had also directed the ED and the CBI to file detailed status reports on the progress of their investigations and questioned why only a single FIR had been registered despite complaints from multiple lenders, observing that each complaint constitutes a separate transaction warranting independent examination.

-

Crime4 years ago

Crime4 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report