National News

SC agrees to hear plea against tree cutting in Aarey colony on Friday

The Supreme Court on Thursday agreed to examine a plea against the cutting of trees in Mumbai’s Aarey colony for a Metro car shed.

Senior advocate Gopal Sankaranarayan mentioned the matter before a bench of Justices D.Y. Chandrachud and Surya Kant, submitting that cutting of trees is going on overnight despite the stay order, which was issued earlier. The bench agreed to take up the matter.

Sankaranarayanan submitted that they have photographs and Chief Justice N.V. Ramana said the matter will be heard by this bench. Seeking urgent listing of the matter on Friday, counsel added that there is a probability that JCBs could be operated over the weekend and emphasised that the case should be heard urgently.

After hearing brief submissions in the matter, the bench agreed to list the matter for hearing on Friday.

Earlier this month, the Eknath Shinde-led state government removed the stay on construction of a Metro 3 car shed at Aarey Colony. The decision paved the way for construction of the Metro car shed at the green lung, which was stopped on November 29, 2019.

The stay was given by then Chief Minister Uddhav Thackeray, barely 24 hours after he assumed office on November 28, 2019, and he later declared around 800 acres of land in Aarey Colony as ‘forest’ and planned shifting the car-shed to a new site in Kanjurmarg. Tree felling in the colony has been opposed by green activists and local residents.

In 2019, the apex court had taken suo motu cognisance of a letter petition addressed to the Chief Justice of India by a law student urging the court to stay on felling of trees in the colony.

The top court restrained the authorities from felling trees in Aarey colony after Solicitor General Tushar Mehta, who was appearing for Maharashtra government, submitted that no further trees will be cut.

Business

Centre’s fertiliser supplies to states scale record high of 530 lakh metric tons in April-December

New Delhi, Jan 30: Fertiliser movement from the Centre to the states on Indian Railways, during the first nine months (April-December) of the financial year 2025-26, reached an all-time high with total supplies crossing 530.16 lakh metric tons to surpass the 500 lakh metric ton mark for the first time during this period, an official statement said on Friday.

This represents a 12.2 per cent increase over the corresponding period of FY 2024–25 and is 8.5 per cent higher than the previous record of FY 2023–24, it said.

The Centre has ensured sufficient availability of all major fertilisers across states, including the supply of 350.45 lakh metric tons of urea, against a requirement of 312.40 lakh metric tons in the first nine months (April-December) of the financial year 2025-26. Similarly, in the case of major P&K (phosphorous and potassium) fertilizers including DAP, MOP & NPKS, the total supply reached 287.69 lakh metric tonnes against the requirement of 252.81 lakh metric tonnes, consistently exceeding the assessed requirement and ensuring uninterrupted availability, the statement said.

Faster and smoother movement of fertiliser rakes enabled timely supplies to states, ensuring that farmers did not face any shortages during the critical stages of cultivation. Department of Fertilisers worked in close cooperation with the Ministry of Railways and stated that such coordinated efforts have helped ensure adequate availability of fertilisers across the country, the statement added.

During this period, average rake loading on Indian Railways increased to 72 rakes per day in July 2025, rose to 78 rakes per day in August 2025 and reached 80 rakes per day in September 2025, according to the official figures.

Urea rake movement rose to 10,841 rakes, registering an 8 per cent increase over last year, while P&K fertilisers recorded 8,806 rakes, marking an 18 per cent growth. Enhanced coordination with the Ministry of Railways, ports, state governments, and fertiliser companies ensured seamless and timely supply to states during peak agricultural seasons, the statement said.

Ensuring the timely availability of fertilisers to farmers has remained one of the government’s highest priorities. In this direction, the improved coordination between the Ministry of Railways and the Department of Fertilisers during Kharif 2025 and the ongoing Rabi season was clearly visible at the ground level. The states also took concerted measures to ensure last-mile availability to farmers, the statement added.

National News

Shinde Sena’s Sharmila Pimpolkar Set To Become Thane Mayor, BJP’s Krishna Patil Deputy Mayor; Both Elected Unopposed

Thane: Sharmila Rohit Pimpolkar of the Shiv Sena (Shinde faction) is set to be appointed as the Mayor of the Thane Municipal Corporation (TMC), while Krishna Dadu Patil of the Bharatiya Janata Party (BJP) will assume charge as the Deputy Mayor. Both leaders were elected unopposed after filing their nominations on the final day for submitting nomination papers for the mayoral posts.

Pimpolkar filed her nomination for the Mayor’s post, while Patil submitted his papers for the Deputy Mayor’s position. No other candidates entered the fray for either post, clearing the way for their unopposed election. The official announcement confirming their appointments is scheduled to be made on February 3.

A meeting related to the mayoral election process was held at the Thane Municipal Corporation headquarters in the presence of Deputy Chief Minister Eknath Shinde. Several senior leaders attended the meeting, including Transport Minister Pratap Sarnaik, Thane MP Naresh Mhaske, BJP MLA Niranjan Davkhare, Ravindra Phatak and other party functionaries.

Meanwhile, reports indicated that the Shinde Sena has categorically refused the BJP’s demand to rotate the Mayor’s post for two years in Thane. In the recently concluded Thane Municipal Corporation elections, the Shinde Sena emerged as the dominant force with 75 seats, while the BJP secured 28 seats. Citing its clear numerical strength, the Shiv Sena has reportedly conveyed at the local level that it will not hand over the Mayor’s post to the BJP even for a year.

Following the refusal, BJP leaders are said to have staked claim to key power centres within the civic body, including the Standing Committee, Transport Committee, various subject committees, ward committees and the Education Board. Shinde Sena reportedly proposed that the BJP accept the Deputy Mayor’s post, while committees and ward panels could be shared between the two parties for fixed tenures of three and two years respectively.

Crime

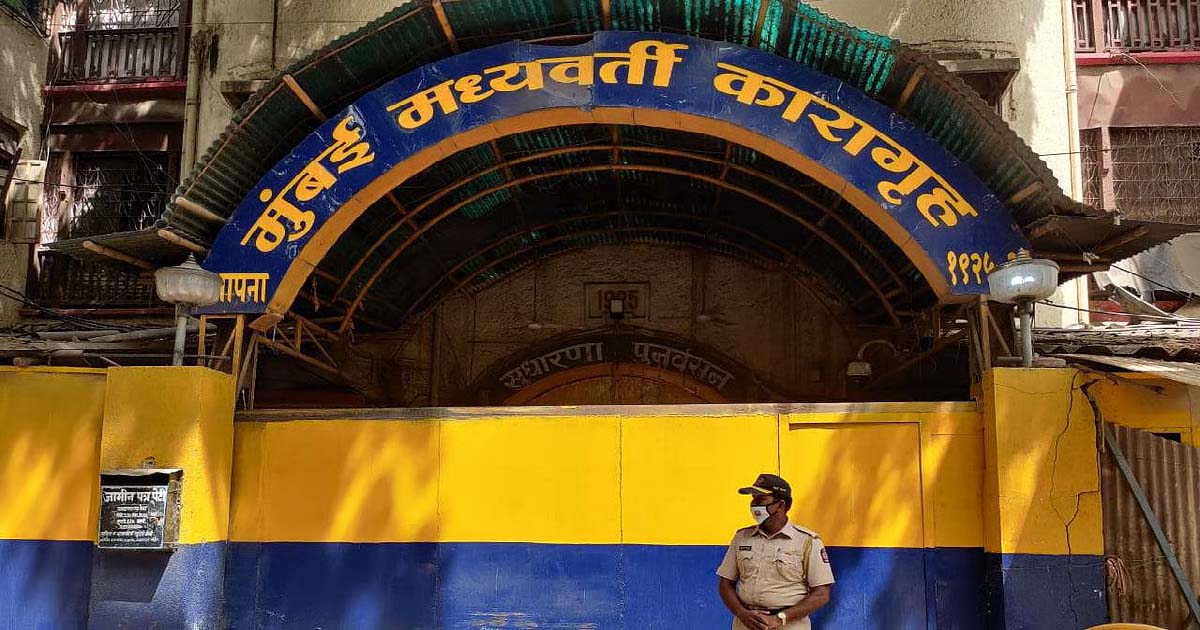

Mumbai Crime: Undertrial Prisoner Assaults Policeman Inside Arthur Road Jail, Case Registered

Mumbai: A shocking incident has come to light from Mumbai’s Arthur Road Jail, where an undertrial prisoner allegedly assaulted a police constable on duty.

The accused, Lokendra Uday Singh Rawat (35), is reported to have headbutted Police Constable Hani Baburao Wagh (30), causing injuries to his nose, and also abused and pushed other on-duty police personnel. A case has been registered in this connection at the N. M. Joshi Marg police station.

According to the FIR, the complainant, Police Constable Wagh, is attached to Armed Police Division–2, Tardeo. On January 27, he reported for his 24-hour day-duty shift at Arthur Road Jail at around 8 am and was assigned security duty at the main entrance of the prison.

At around 9 pm, Armed Police Constables Suresh Sandu Mali and Sachin Chavan brought undertrial Lokendra Rawat back to the jail after producing him before the Dindoshi Court. Rawat allegedly appeared agitated and, after entering the jail premises, sat near the gate and began verbally abusing the police personnel on duty.

Constable Wagh asked Rawat to calm down and refrain from using abusive language. However, Rawat allegedly became more aggressive and continued shouting abuses. When Wagh approached him again to pacify the situation, Rawat suddenly headbutted him on the nose with force.

As a result, Constable Wagh sustained injuries and started bleeding. Fellow constables Sachin Chavan and Suresh Mali immediately intervened, restrained the accused, and informed the on-duty prison authorities about the incident. Rawat was subsequently sent for medical examination to Sir J.J. Hospital.

After receiving medical treatment, the injured constable lodged a formal complaint on January 28 at the N. M. Joshi Marg police station. Based on the complaint, police have registered a case against the undertrial under relevant sections of the Bharatiya Nyaya Sanhita (BNS). Further investigation is ongoing.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report