Business

Rs 7,253 crore spent so far in 2025-26 on sprucing up railway stations in India: Vaishnaw

New Delhi, Dec 5: The government has spent Rs 7,253 crore so far (up to October), of the total budgetary allocation of Rs 12,118 crore for 2025–26, on the redevelopment of railway stations across the country under the Amrit Bharat Station Scheme, Railway Minister Ashwini Vaishnaw informed Parliament on Friday.

The minister stated in a written reply to a question in the Rajya Sabha that work is in progress at a good pace for the development of stations such as Tirupati, Yesvantpur, Rameswaram, and Safdarjung station in Delhi..

So far, 1,337 stations have been identified for development under this scheme since it was launched, of which 155 stations have been completed till now.

Vaishnaw said that the station development projects under the Amrit Bharat Station Scheme are primarily conceptualised with budgetary support. However, 15 stations have been identified to be explored for development under the Public Private Partnership (PPP) mode also and based on the experience gained from the same, further evolution of the scheme is envisaged.

He further stated that the ownership of stations and operations-related activity will be with the Indian Railways. However, for some identified major stations, specific activities or groups of activities may be entrusted to outside sources for specified tenures depending upon the type of activity, requirements of the station, demand, etc. The terms of the contract are decided on a case-by-case basis.

He said that the Amrit Bharat Station Scheme for the redevelopment of stations has been launched with a long-term approach.

The scheme involves the preparation of master plans and their implementation in phases to improve the stations. The master planning includes improvement of access to the station and circulating areas, integration of the station with both sides of the city, improvement of the station building and improvement of waiting halls, toilets, sitting arrangement, and water booths.

The redevelopment plans also include provision of wider foot over bridge or air concourse commensurate with passenger traffic, provision of lifts, escalators and ramps, improvement of platform surface and cover over platforms and provision of kiosks for local products through schemes like ‘One Station One Product’.

Besides, the construction of parking areas, multimodal integration, amenities for Divyangjans, better passenger information systems, provision of executive lounges, nominated spaces for business meetings and landscaping is being taken up, keeping in view the necessity at each station, Vaishnaw said.

The scheme also envisages sustainable and environment-friendly solutions, provision of ballastless tracks, etc., as per necessity, phasing and feasibility and creation of a city centre at the station in the long term, the minister added.

Business

Indian stock market ends holiday-shortened week in positive terrain

Mumbai, Dec 27: Indian equity markets ended the week in a positive terrain, buoyed by expectations of stronger domestic demand, a favourable liquidity outlook and optimism over potential Fed policy easing in 2026, analysts said on Saturday.

The holiday-shortened week opened with a bullish undertone; however, momentum tapered off as the days progressed.

On Friday, Sensex closed at 85,041.45, slipping 367.25 points or 0.43 per cent. Nifty also ended in the red, falling 99.80 points or 0.38 per cent to settle at 26,042.30.

According to market watchers, the year-end lull kept trading largely range-bound, with hopes for a Santa Claus rally diminishing amid the absence of fresh catalysts, limited progress in US–India trade talks, and caution ahead of the upcoming earnings season.

“Sectoral trends were mixed, marked by selective profit booking across most segments, while metals, FMCG, and media stocks offered notable resilience,” said Vinod Nair, Head of Research, Geojit Investments Ltd.

Nifty 50 ended the week at 26,042, continuing to respect its long-term rising channel on the daily chart. The index remains comfortably above the 20-day EMA cluster, preserving the medium-term bullish structure, said analysts, adding that as long as Nifty sustains above the 26,000–25,900 support zone, the overall bias remains positive.

On the domestic front, RBI’s liquidity interventions, such as open market operations and a USD/INR buy–sell swap, helped stabilise the rupee, though persistent FII outflows continued to weigh on sentiment.

Meanwhile, gold advanced on safe-haven demand, while crude prices hovered near multi-year lows, though U.S. steps to tighten pressure on Venezuelan oil shipments could exert upward pressure in the near term

Looking ahead, market sentiment is likely to stay cautious as investors brace for the upcoming earnings season while remaining attuned to global developments and currency movements, said analysts.

Attention will also turn to next week’s data releases, including India’s industrial and manufacturing output figures, manufacturing PMI, and the US FOMC minutes, said Nair.

Business

Keralites gulped liquor worth over Rs 332 crore during Christmas

Thiruvananthapuram, Dec 26: The Kerala State Beverages Corporation (BEVCO) recorded a sharp surge in liquor sales during the Christmas week, with revenues touching a record Rs 332.62 crore, according to official figures.

The Christmas week sales are calculated for the four days from December 22 to December 25, and officials said this year witnessed a significant jump compared to previous years.

Data shows a 19 per cent increase in sales over the corresponding period last year, underlining a strong festive demand.

The sharpest spike was recorded on Christmas Eve, when liquor sales alone amounted to Rs 114.45 crore.

In comparison, sales on the same day last year stood at Rs 98.98 crore, indicating a substantial year-on-year rise.

Officials attributed the surge not only to the festive season but also to improved consumer facilities introduced by BEVCO over the past year.

The corporation had expanded its premium retail infrastructure, including the launch of new premium counters aimed at offering a better purchasing experience and a wider selection of high-end products.

Premium outlets were recently opened in key centres such as Thrissur and Kozhikode, and officials said these had a positive impact on overall sales figures.

The enhanced facilities helped reduce crowding at regular outlets and encouraged higher-value purchases, contributing to the increase in revenue.

The Corporation has traditionally seen a spike in sales during festival periods such as Onam and Christmas, but this year’s figures mark one of the highest Christmas week turnovers recorded by the state-run corporation.

The rise in liquor sales is expected to provide a significant boost to the State exchequer, as the corporation is a major contributor to Kerala’s revenue through taxes and duties.

Liquor is sold through state-run 325 retail outlets.

Studies have shown that around 10 per cent of the 3.30 crore Kerala population are tipplers, including around three lakh women.

In 2024–25, Kerala’s liquor sales rose to Rs 19,730.66 crore, up from Rs 19,069.27 crore in 2023–24, marking an annual growth of 3.5 per cent.

Business

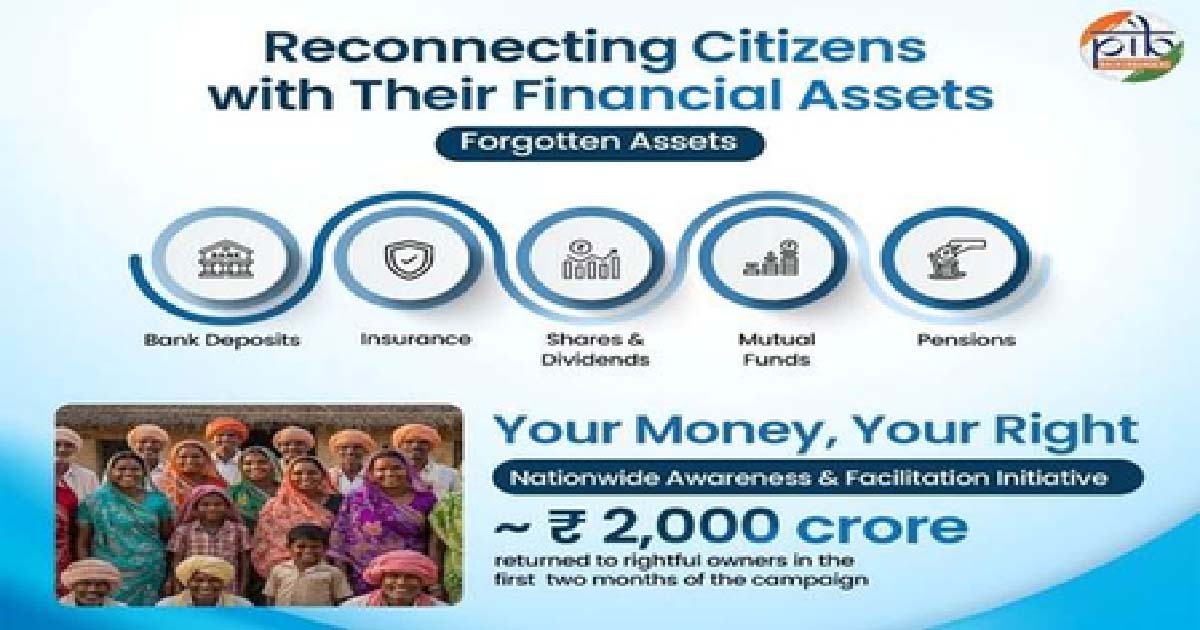

Govt drive returns Rs 2,000 crore unclaimed savings to rightful owners

New Delhi, Dec 26: The government has succeeded in returning to the rightful owners a total amount of nearly Rs 2,000 crore that was stuck as “unclaimed savings” across banks, insurance, mutual funds, dividends, shares, and retirement benefits held within the regulated financial system, according to an official statement issued on Friday.

The funds have been restored through the Centre’s “Your Money, Your Right” nationwide awareness and facilitation initiative, launched in October 2025 to help citizens identify and reclaim unclaimed financial assets. The initiative is being coordinated by the Finance Ministry’s Department of Financial Services, with financial sector regulators reaching across digital portals with district-level facilitation.

Across generations, Indian families have saved carefully through opening bank accounts, purchasing insurance policies, investing in mutual funds, earning dividends from shares, and setting aside money for retirement. These financial decisions are taken with a hope and responsibility, often to secure children’s education, support healthcare needs, and ensure dignity in old age.

Yet, over time, a significant portion of these hard-earned savings has remained unclaimed. The money has not vanished, nor has it been misused. It lies safely with regulated financial institutions, separated from its rightful owners due to a lack of awareness, outdated records, changes in residence, or missing documentation. In many cases, families are simply unaware that such assets exist.

The volume of unclaimed financial assets in India is significant and spans multiple segments of the formal financial system. Indicative estimates suggest that Indian banks together hold around Rs 78,000 crore in unclaimed deposits. Unclaimed insurance policy proceeds are estimated at nearly Rs 14,000 crore, while unclaimed amounts in mutual funds are about Rs 3,000 crore. In addition, unclaimed dividends account for around Rs 9,000 crore, according to official figures.

Together, these amounts underline the scale of unclaimed savings belonging to citizens that continue to remain unused, despite being securely held within the financial system.

Your Money, Your Right is a nationwide effort to reconnect citizens with these forgotten financial assets and ensure that money that belongs to individuals and families ultimately finds its way back to them.

These unclaimed financial assets arise when money held with financial institutions is not claimed by the account holder or their legal heirs for a prolonged period. Such assets include:

*Bank deposits such as savings accounts, current accounts, fixed deposits, and recurring deposits that have not been operated for ten years or more.

*Insurance policy proceeds that remain unpaid beyond the due date

*Mutual fund redemption proceeds or dividends that could not be credited due to reasons such as a change in bank account, bank account closure, incomplete bank account in records, etc.

*Dividends and shares that remain unclaimed and are transferred to statutory authorities

*Pension and retirement benefits that are not claimed within the normal course

In most cases, assets may become unclaimed because of routine life events such as migration for work, changes in contact details, closure of old bank accounts, or lack of information among family members and legal heirs.

The Government is coordinating with the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Securities and Exchange Board of India (SEBI), the Investor Education and Protection Fund Authority (IEPFA), and the Pension Fund Regulatory and Development Authority (PFRDA) to help citizens identify, access and reclaim financial assets that legally belong to them, using simple processes and transparent systems.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report