Business

Real GDP expected to grow at 8-9% YoY in Q2FY22

India’s real GDP is expected to grow at 8-9 per cent year-on-year (YoY) in Q2FY22, Motilal Oswal Financial Services (MOFSL) said.

The real GDP is the inflation adjusted figure of all the finished goods and services produced in a country within a specific time period.

In a report, MOFSL said its in-house estimates suggest India’s real GDP grew at 8-9 per cent YoY in Q2FY22, marginally higher than “our expectations”.

The second quarter GDP numbers have not yet been released. The macro-economic data points are slated to be released on November 30.

MOFSL said: “Looking at our EAI estimates, we believe that better growth was largely supported by massive government spending in 2QFY22.”

Besides, the report said the economic activity for October 2021 appeared promising.

“Most of the indicators – PMI manufacturing, toll collections, e-way or vahaan registrations, mobility indicators, and power generation – improved last month.”

However, the brokerage house’s preliminary estimates indicate that Economic Activity Index (EAI) for India’s GVA posted a seven-month low growth of 5.4 per cent YoY in September 2021 versus 11.7 per cent YoY in August 2021.

“Consequently, EAI-EVA grew 9.2 per cent YoY in 2QFY22 on account of lower growth in the aFarm and Non-Farm’ sectors.

This further indicates the favourable base effect is waning off.”

Business

Keralites gulped liquor worth over Rs 332 crore during Christmas

Thiruvananthapuram, Dec 26: The Kerala State Beverages Corporation (BEVCO) recorded a sharp surge in liquor sales during the Christmas week, with revenues touching a record Rs 332.62 crore, according to official figures.

The Christmas week sales are calculated for the four days from December 22 to December 25, and officials said this year witnessed a significant jump compared to previous years.

Data shows a 19 per cent increase in sales over the corresponding period last year, underlining a strong festive demand.

The sharpest spike was recorded on Christmas Eve, when liquor sales alone amounted to Rs 114.45 crore.

In comparison, sales on the same day last year stood at Rs 98.98 crore, indicating a substantial year-on-year rise.

Officials attributed the surge not only to the festive season but also to improved consumer facilities introduced by BEVCO over the past year.

The corporation had expanded its premium retail infrastructure, including the launch of new premium counters aimed at offering a better purchasing experience and a wider selection of high-end products.

Premium outlets were recently opened in key centres such as Thrissur and Kozhikode, and officials said these had a positive impact on overall sales figures.

The enhanced facilities helped reduce crowding at regular outlets and encouraged higher-value purchases, contributing to the increase in revenue.

The Corporation has traditionally seen a spike in sales during festival periods such as Onam and Christmas, but this year’s figures mark one of the highest Christmas week turnovers recorded by the state-run corporation.

The rise in liquor sales is expected to provide a significant boost to the State exchequer, as the corporation is a major contributor to Kerala’s revenue through taxes and duties.

Liquor is sold through state-run 325 retail outlets.

Studies have shown that around 10 per cent of the 3.30 crore Kerala population are tipplers, including around three lakh women.

In 2024–25, Kerala’s liquor sales rose to Rs 19,730.66 crore, up from Rs 19,069.27 crore in 2023–24, marking an annual growth of 3.5 per cent.

Business

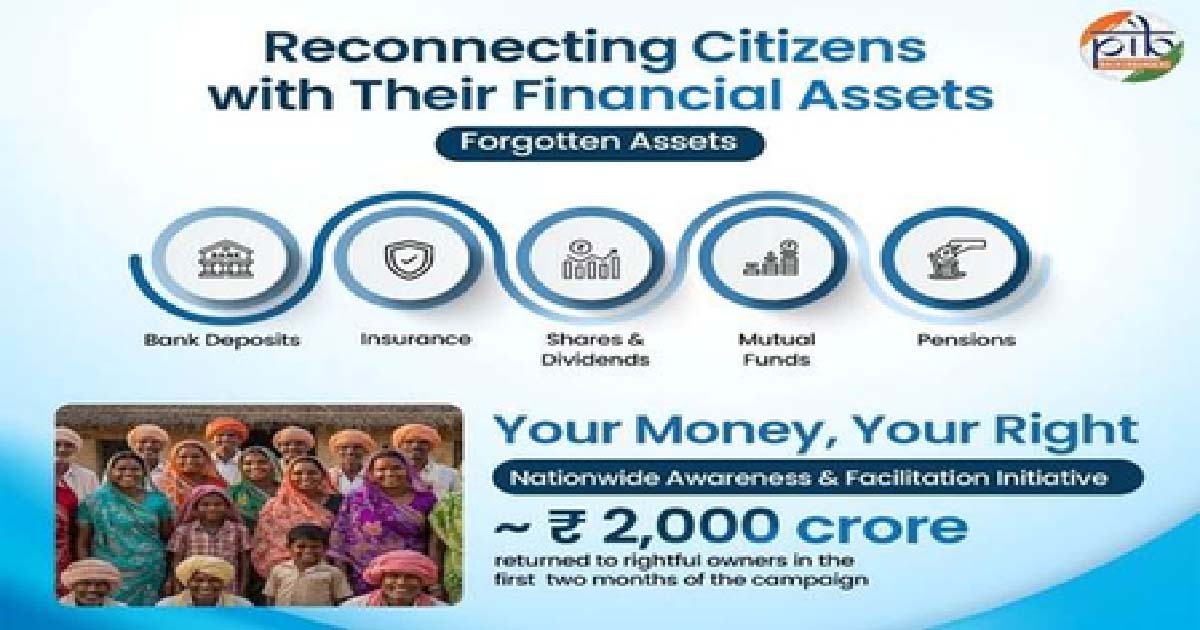

Govt drive returns Rs 2,000 crore unclaimed savings to rightful owners

New Delhi, Dec 26: The government has succeeded in returning to the rightful owners a total amount of nearly Rs 2,000 crore that was stuck as “unclaimed savings” across banks, insurance, mutual funds, dividends, shares, and retirement benefits held within the regulated financial system, according to an official statement issued on Friday.

The funds have been restored through the Centre’s “Your Money, Your Right” nationwide awareness and facilitation initiative, launched in October 2025 to help citizens identify and reclaim unclaimed financial assets. The initiative is being coordinated by the Finance Ministry’s Department of Financial Services, with financial sector regulators reaching across digital portals with district-level facilitation.

Across generations, Indian families have saved carefully through opening bank accounts, purchasing insurance policies, investing in mutual funds, earning dividends from shares, and setting aside money for retirement. These financial decisions are taken with a hope and responsibility, often to secure children’s education, support healthcare needs, and ensure dignity in old age.

Yet, over time, a significant portion of these hard-earned savings has remained unclaimed. The money has not vanished, nor has it been misused. It lies safely with regulated financial institutions, separated from its rightful owners due to a lack of awareness, outdated records, changes in residence, or missing documentation. In many cases, families are simply unaware that such assets exist.

The volume of unclaimed financial assets in India is significant and spans multiple segments of the formal financial system. Indicative estimates suggest that Indian banks together hold around Rs 78,000 crore in unclaimed deposits. Unclaimed insurance policy proceeds are estimated at nearly Rs 14,000 crore, while unclaimed amounts in mutual funds are about Rs 3,000 crore. In addition, unclaimed dividends account for around Rs 9,000 crore, according to official figures.

Together, these amounts underline the scale of unclaimed savings belonging to citizens that continue to remain unused, despite being securely held within the financial system.

Your Money, Your Right is a nationwide effort to reconnect citizens with these forgotten financial assets and ensure that money that belongs to individuals and families ultimately finds its way back to them.

These unclaimed financial assets arise when money held with financial institutions is not claimed by the account holder or their legal heirs for a prolonged period. Such assets include:

*Bank deposits such as savings accounts, current accounts, fixed deposits, and recurring deposits that have not been operated for ten years or more.

*Insurance policy proceeds that remain unpaid beyond the due date

*Mutual fund redemption proceeds or dividends that could not be credited due to reasons such as a change in bank account, bank account closure, incomplete bank account in records, etc.

*Dividends and shares that remain unclaimed and are transferred to statutory authorities

*Pension and retirement benefits that are not claimed within the normal course

In most cases, assets may become unclaimed because of routine life events such as migration for work, changes in contact details, closure of old bank accounts, or lack of information among family members and legal heirs.

The Government is coordinating with the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Securities and Exchange Board of India (SEBI), the Investor Education and Protection Fund Authority (IEPFA), and the Pension Fund Regulatory and Development Authority (PFRDA) to help citizens identify, access and reclaim financial assets that legally belong to them, using simple processes and transparent systems.

Business

2026 set to break new records with ‘Make in India’ and PLI schemes firmly in place

New Delhi, Dec 26: India’s electronics and semiconductor journey has moved from intent to execution – creating several new highs this year — and 2026 is set to break new records with ‘Make in India’ and production-linked incentive (PLI) schemes firmly in place — establishing India as a competitive and trusted electronics manufacturing destination globally.

According to government data, electronics production has increased sharply from about Rs 1.9 lakh crore in 2014-15 to around Rs 11.3 lakh crore in 2024–25. Electronics exports have also risen from Rs 38,000 crore to more than Rs 3.27 lakh crore during the same period.

India had only two mobile phone manufacturing units in 2014-15, which has now increased to around 300 units. Mobile phone production has grown from Rs 18,000 crore to Rs 5.45 lakh crore, while exports have surged from Rs 1,500 crore to nearly Rs 2 lakh crore.

Electronics exports have risen from Rs 38,000 crore to more than Rs 3.27 lakh crore during the same period.

Meanwhile, the Modified Electronics Manufacturing Clusters (EMC 2.0), located in 10 states with projected investments of Rs 1,46,846 crore, have estimated to generate about 1.80 lakh jobs.

Over the past decade, India’s manufacturing base, particularly in electronics and mobile phones, has expanded substantially, and the country has emerged as a net exporter in several key sectors.

According to Pankaj Mohindroo, Chairman, ICEA, this year marked a defining phase for ‘Make in India’, with the PLI framework firmly establishing India as a competitive and trusted electronics manufacturing destination.

“PLI has accelerated scale, deepened localisation, expanded exports and integrated India into global value chains. As we head into the next phase that is 2026. The sustained policy continuity, faster approvals and focus on component ecosystems will be critical to moving India from volume led manufacturing to high value, innovation-driven production,” he said in a statement.

Ashok Chandak, President of the India Electronics and Semiconductors Association (IESA) and SEMI India, said that India’s electronics growth story is no longer episodic — it is structural.

Policymakers, global and Indian industry leaders, and ecosystem stakeholders are now aligned on building resilient, sustainable, and globally competitive value chains, he mentioned.

“As discussions in 2025 highlighted — spanning policies and incentives, electronics value addition, skilling, academic partnerships, and industry collaboration — the next phase must focus on execution, joint R&D, and technology transfer. The increased use of locally made semiconductors and components will be central to deeper value addition and the long-term success of India’s electronics industry,” Chandak noted.

India’s semiconductor journey has also moved from intent to execution, marking a clear structural shift.

Policymakers, global and Indian industry leaders, and ecosystem stakeholders are aligned on building resilient and competitive semiconductor value chains.

Key priorities discussed in 2025, including semiconductor policies and incentives, human capital development, fabs, advanced packaging and OSAT, academic partnerships, and industry engagement, underscore the need for joint R&D, technology transfer, and well-defined pathways to scale.

Under the Semicon India Programme, 10 units have been approved with an investment of Rs 1.6 lakh crore, which include silicon fab, silicon carbide fab, advanced packaging, and memory packaging.

“Over the next three years, disciplined execution and localisation across design, manufacturing, and advanced packaging will be critical to enable chips for high-volume electronic products consumed locally,” said Chandak.

The government also launched a production-linked incentive scheme (PLI) for large-scale electronics manufacturing of mobile phones and certain specified components. The scheme has attracted investment of Rs 14,065 crore up to October 2025.

To target the manufacturing of IT Hardware, the government launched PLI for IT Hardware for promoting the manufacturing of laptops, tablets, servers and ultra small form factor (USFF) devices. PLI for IT hardware have attracted investment of Rs 846 crore till October 2025.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report