Business

RBI maintains a pause on rates in step with global markets – it helps

The markets have been on a high for the past few sessions, particularly the Nifty, which consistently touched and even crossed the 18,000 mark earlier this week.

The Reserve Bank of India (RBI) earlier this month decided to maintain a pause on key policy rates for the second time in a row.

While in April when the RBI had first paused the repo rates, real estate firms’ shares had enjoyed good growth, mainly owing to positive sentiments among homebuyers, as the decision meant EMIs would not be raised.

But when the central bank decided to maintain a pause on the key rates this month again, no such enthusiasm was visible in real estate shares.

If experts are to be believed, there was nothing unusual in the bourses touching new highs as RBI’s decision was already factored in by markets.

Ashu Madan, managing director of JM Financial Services Ltd said: “There was no surprise element in the recent jump seen in stock markets, as it was on expected lines since global rates are on a pause.”

He added that there was no quantitative easing and there were no liquidity issues, therefore the RBI’s decision to hold rates did not lead to the bull run in the markets.

“Some things are normal and markets discount these developments (rate pause by RBI) in advance. Such factors are pre-empted,” Madan further said.

He, in fact, went on to say that markets should consolidate now, after touching highs.

Emphasising on the reasons behind bourses touching highs, Madan said that this phenomenon has occurred as people have become bullish about quick returns through investments in stocks.

He noted that post Covid, people started investing in stocks and engaged in short term benefits for quick profits.

Foreign institutional investors or FIIs too have a role to play in markets reaching new highs, as they are now buying, Madan said.

Also since derivatives and auction have arrived, investors have become traders and are focussing on short term gains, market watchers observed.

Madan on his part said that while real estate stocks rose in April due to growth in sector, in the coming days, metals and IT sector stocks should consolidate.

Business

Jharkhand: Robbery and firing on trader sparks shutdown in Dhanbad market

Dhanbad, Nov 10: Traders on Monday launched a massive protest after a businessman was robbed and shot at inside the government-run Market Committee complex in the Barwadda police station area in Dhanbad, Jharkhand, late Sunday evening.

The incident has caused concerns over rising crime in Jharkhand’s coal capital, prompting traders to shut all 417 shops in the market complex for the day.

The attack took place around 8.30 p.m. on Sunday when three bike-borne assailants intercepted trader Shyam Bhimsariya while he was closing his shop.

The miscreants fired at him, snatched a bag containing Rs 4 lakh, and sped off. Bhimsariya narrowly escaped the bullet, which reportedly grazed past him. The incident created panic among shopkeepers and customers, many of whom rushed to safety.

On Monday morning, hundreds of traders assembled at the main gate of the Market Committee complex, raising slogans against the administration and demanding immediate arrests. They alleged that the market, which witnesses a heavy footfall, has long been operating without proper security measures.

The Market Committee complex is one of the busiest business hubs in Dhanbad, recording a daily turnover of Rs 7-8 crore.

“We will not tolerate this kind of atmosphere where traders fear for their lives every evening,” a member of the traders’ association said, adding that if the culprits are not arrested within 48 hours, the protest may spread to other markets across the district.

BJP MP Dhullu Mahto, addressing traders, said criminals are “roaming fearlessly” in Dhanbad. “The morale of criminals has gone up due to weak policing. The police must act immediately to restore confidence among traders,” he said.

Jharia Congress MLA Ragini Singh accused the state government of complete failure on the law and order front. “When crime is discussed in the Assembly, the government remains silent. People are living in fear while criminals are dictating terms,” she remarked.

Outgoing Mayor Chandrashekhar Agarwal demanded urgent security measures in the market area, suggesting that CCTV cameras be installed. He said a permanent police post must be established to prevent the recurrence of such incidents.

Dhanbad District Chamber of Commerce president Chetan Goenka strongly condemned the attack and criticised authorities for ignoring repeated requests for better security.

“It is shocking that a market with a daily business of Rs 7-8 crore has neither CCTV surveillance nor police patrolling. Traders cannot operate under fear. The administration must take permanent measures,” Goenka said.

Business

Sensex, Nifty open in green amid positive global cues

Mumbai, Nov 10: Indian benchmark indices opened the week in the green zone on Monday, amid positive global cues and investor optimism of FII coming back to India due to loss in artificial intelligence (AI) stocks.

As of 9.25 am, Sensex was up 115 points, or 0.14 per cent at 83,331 and Nifty inched up 35 points, or 0.14 per cent to 25,521.

The broadcap indices outperformed benchmarks in terms of gains, with the Nifty Midcap 100 up or 0.37 per cent, and the Nifty Smallcap 100 adding 0.27 per cent.

Asian Paints, L&T and Hindalco were among the major gainers in the Nifty Pack, while losers included Trent, Apollo Hospitals, Max Healthcare, Maruti Suzuki and Dr Reddy’s Labs.

Nifty IT, Metal and Pharma were among the biggest sectoral gainers, adding 0.56 to 0.79 per cent. All the sectoral indices were trading in the green except Nifty Media.

Analysts said that FIIs, particularly the hedge funds, who have been consistently selling in India and taking money out for playing the AI trade, are now likely to pause and slowly reverse the AI trade in favour of non-AI trade in countries like India.

“The strong earnings growth in the US has been a fundamental support that pushed up AI stock valuations to elevated valuations. Countries regarded as AI winners such China, South Korea and Taiwan also have benefited from this AI rally,” said market watchers.

Analysts noted that there are signs of this AI trade losing steam as evidenced by the 3 per cent decline in Nasdaq last week. If this healthy trend persists without high volatility, it will make the US market robust, preempting a bubble formation and its eventual burst, they added.

Further, Wall Street stocks gained as reports suggested the longest shutdown of the US Federal Government might end.

The US markets ended in the green zone in the last trading session, as Nasdaq dipped 0.22 per cent, the S&P 500 added 0.13 per cent, and the Dow inched up 0.16 per cent.

Most of the Asian markets were trading in the green during the morning session. While China’s Shanghai index lost 0.03 per cent, and Shenzhen dipped 0.59 per cent, Japan’s Nikkei added 1.04 per cent, while Hong Kong’s Hang Seng Index added 0.57 per cent. South Korea’s Kospi jumped 3.04 per cent.

On Friday, foreign institutional investors (FIIs) sold equities worth Rs 4,889 crore, while domestic institutional investors (DIIs) were net buyers of equities worth Rs 1,787 crore.

Business

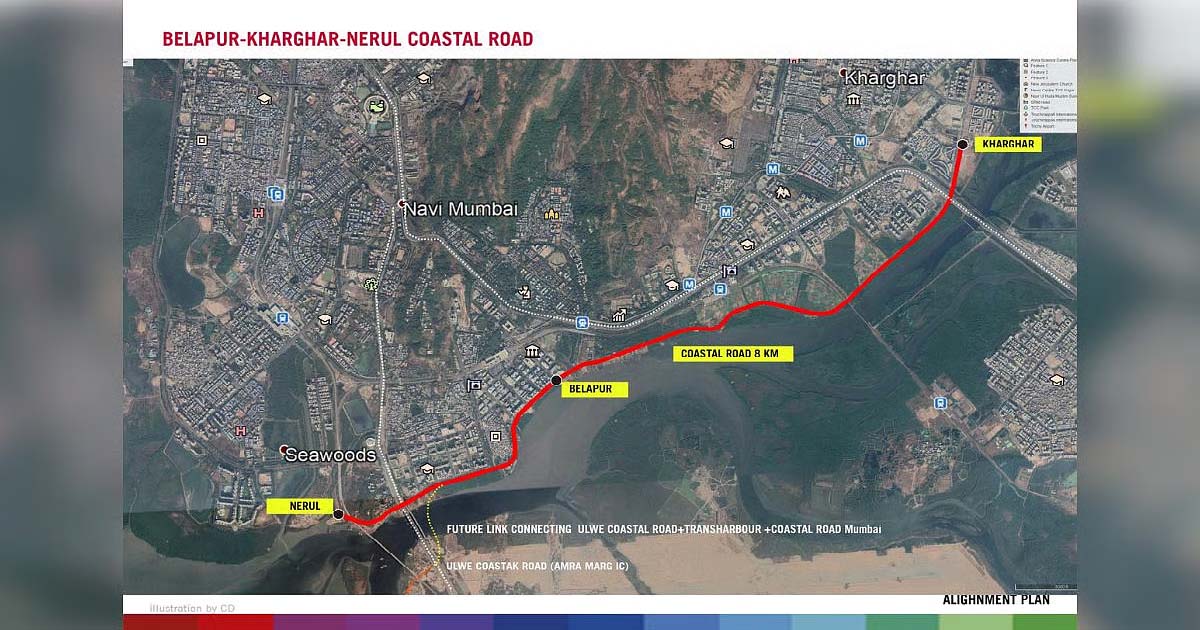

Navi Mumbai: CIDCO’s 9.6-Km Kharghar Coastal Road Work To Begin In 2026, Promises Faster NMIA Connectivity By 2029

Navi Mumbai: Construction of the much-anticipated Kharghar Coastal Road — a key link that will enhance connectivity to the upcoming Navi Mumbai International Airport (NMIA) — is expected to commence in early 2026, following the receipt of mandatory forest clearances.

Planned by the City and Industrial Development Corporation (CIDCO), the 9.678-kilometre-long and 30-metre-wide arterial road will connect the airport to major nodes such as Belapur and Nerul, significantly improving regional mobility and supporting economic growth across Navi Mumbai.

The project will also provide direct high-speed access to the International Corporate Park (ICP) being developed on the lines of Bandra Kurla Complex (BKC), the Golf Course, and the FIFA-standard Centre of Excellence (COE) at Kharghar.

A grade-separated interchange over the Sion-Panvel Expressway is part of the plan to ensure smooth traffic flow and reduce congestion between the airport and nearby business and recreational hubs.

Of the total road length, 6.96 kilometres will be newly developed, while the remaining portion will integrate with the existing network. The corridor will also cater to the anticipated transport demand from upcoming projects such as the Water Transport Terminal and Pradhan Mantri Awas Yojana (PMAY) housing schemes in the area.

CIDCO has awarded the construction contract to the J Kumar–J M Mhatre Joint Venture. Officials said the project will not only boost airport connectivity but also strengthen Kharghar’s position as a major residential and commercial hub, linking it seamlessly to Taloja and Navde.

“Known for its well-planned infrastructure, green cover, and educational institutions, Kharghar is poised to witness a new phase of growth once the coastal road becomes operational. Kharghar coastal road is estimated to be ready by 2029 if everything goes as per plan,” an official from CIDCO said.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra12 months ago

Maharashtra12 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report