Business

Paytm FY22 results: Revenue jumps 77% to Rs 4,974 cr, losses reduce 8% to Rs 1,518 cr

One97 Communications Limited (OCL) that owns the brand Paytm, Indias leading mobile payments and financial services company, announced its quarter-ending March 2022 and full financial year FY22 results. The company saw its revenue jump by 77 per cent in FY22 to Rs 4,974 crore from Rs 2,802 crore the previous year.

In Q4 alone, the company’s revenue grew 89% on a year-on-year basis to Rs 1,541 crore, while EBITDA (before ESOPs) for the quarter improved 12 per cent year-on-year.

The growth in revenue was led by the increase in consumer and merchant payments and disbursements of loans through its partners on Paytm.

The company’s EBITDA loss (before ESOP) for FY22 saw an improvement of 8 per cent year-on-year to Rs 1,518 crore from Rs 1,655 crore the previous year. In addition, the company had Rs 809 crore of non-cash ESOP expenses.

Paytm has reduced EBITDA (before ESOP cost) loss despite making investments in user growth, merchant device deployment and technology. The company’s cost structures in Q4 FY 2022 are largely sufficient to support its growth plans in FY 2023. As a result, the company believes it will show accelerated reduction in EBITDA losses and is well on track to achieve profitability (before ESOP) by September 2023 quarter.

Paytm has a strong two-sided ecosystem of consumers and merchants, where it is seeing the monetization strategy kick in to yield results. On the consumer payments side, the company is recording increasing usage of the Paytm app and Paytm Payment instruments. On the merchant payments side, the company serves the entire base of merchants through (i) QR for payments (typically free), (ii) soundboxes (which generate subscription revenues), (iii) card machines (which generate subscription and MDR revenues), and (iv) Payment Gateway for online merchants (which generates MDR revenues and platform fees). Leveraging this distribution and rich insights, Paytm offers financial products to its consumers and merchants, in partnership with financial institutions.

Increased consumer engagement and merchant base leads to higher revenue from Payment services. The company has recorded a jump in its average monthly transacting users in FY22 to 60.8 million, the average for the last quarter further increased to 70.9 million. Paytm’s merchant base has also grown to now have 26.7 million merchant partners, with 2.9 million devices deployed as of FY22.

The increased consumer engagement and merchant base has also led to increased revenue from Payment Services (both to consumers and merchants). Paytm’s Revenue from Payment Services to Consumers was up 58 per cent to Rs 1,529 crore in FY 2022 from Rs 969 Cr for the FY 2021. For the full year, Revenue from Payment Services to Merchants was up 87 per cent to Rs 1,892 crore in FY 2022 from Rs 1,012 crore for FY 2021.

One of the highlights of Q4FY22 and FY22 has been the rapid scale-up of Paytm’s loan disbursement business, where it offers Paytm Postpaid (Buy Now, Pay Later), personal loans and merchant loans. In April 2022, the company reached an annualised run rate of approximately Rs 20,000 crore of disbursement through its platform.

For the full year, the number of loans disbursed through the Paytm platform has grown 478 per cent year-on-year to 15.2 million in FY 2022 from 2.6 million in FY 2021. The value of loans disbursed has grown 441 per cent year-on-year from Rs 1,409 crore in FY 2021 to Rs 7,623 crore in FY 2022.

The number of Postpaid Loans disbursed grew 373 per cent year-on-year in Q4 FY 2022, while the value of Postpaid Loans grew 425 per cent year-on-year, thus highlighting increased usage by customers.

Personal Loans disbursed through partners on Paytm grew 948 per cent year-on-year in Q4 FY 2022, while the value of Personal Loans grew 1,082 per cent year-on-year. The number of Merchant Loans disbursed grew 123 per cent year-on-year in Q4 FY 2022, while the value of Merchant Loans grew 178 per cent year-on-year. The average ticket size has also increased in FY22, with personal loans ranging from Rs 85,000 to Rs 95,000 and merchant loans ranging from Rs 1,30,000 to Rs 1,50,000.

Business

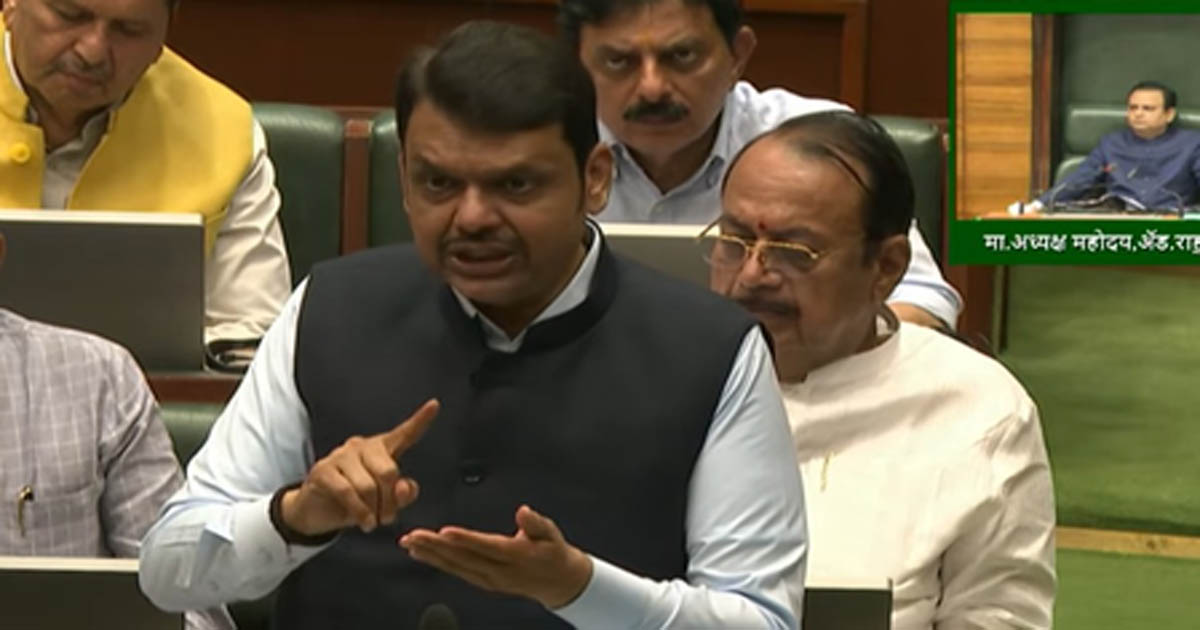

Maha govt presents supplementary demands worth Rs 11,995 crore in Assembly

Mumbai, Feb 24: Amid strain on state finances, Maharashtra Chief Minister Devendra Fadnavis, who holds the charge of planning and finance departments, on Tuesday tabled the supplementary demands worth Rs 11,995 crore for the remaining period of the fiscal 2025-26.

Of the Rs 11,995 crore, the state government has earmarked Rs 3,112.85 crore to meet the expenses incurred on the concession given in the electricity tariff to Agriculture pump, power loom and textile consumers in the state, and Rs 803.94 crore has been proposed as incentives to small, medium, large industries and mega projects under the package scheme of incentives.

The government has proposed Rs 4,792.02 crore for transferring the loan amount to the state power distribution company, Mahavitaran, which has been received from the Asian Infrastructure Investment Bank for the solar agriculture pump scheme. This allocation is aimed at pushing the government’s plan to use 52 per cent renewable energy by 2030 under the net zero mission.

The government has also proposed Rs 1,431.05 crore as an additional fund as part of the Central share for the implementation of the Jal Jeevan mission. In March 2025, Ajit Pawar had presented the budget with a revenue deficit of Rs 45,890 crore.

In June 2025, the government presented the supplementary demands worth Rs 57,509.71 crore, crossing the revenue deficit of Rs one lakh crore.

In the Winter Session during December 2025, with supplementary demands of Rs 75,286.37 crore, the revenue deficit had already touched the Rs two lakh crore mark. In addition to the revenue deficit of Rs 45,891 crore, the budget 2025-26 had projected that Maharashtra’s debt burden is set to rise to Rs 9.32 lakh crore. In Tuesday’s supplementary demands, the state government has not only refrained from proposing any new and additional expenses but has focused solely on Power subsidies for farmers and Industry incentives.

CM Fadnavis will present the state budget for the year 2026-27 on March 6. He has already announced in the press conference on Sunday that there could be strict measures to maintain financial discipline.

Earlier, speaking at the World Economic Forum (WEF) annual meeting, the Chief Minister had said that the state is on track to generate 16 gigawatts (GW) of solar power by the end of this year. By 2032, the state aims to generate an additional 45 GW, with 70 per cent coming from solar. Renewable energy, which stood at 13 per cent four years ago, is projected to reach 52 per cent by 2030,” he said.

Following Prime Minister Narendra Modi’s vision, the state launched Asia’s largest decentralised solar scheme.

By shifting the entire agricultural load to solar power and establishing a dedicated company for farmer supply, the state is making every agricultural feeder independent.

“The cost of supplying power to farmers has dropped from Rs 8 to less than Rs 3 per unit. This transition is not only helping farmers but also reducing the financial burden on industries and households,” the Chief Minister noted.

The government is advancing a capital outlay for pumped storage hydro projects (combined capacity of 5,630 MW) with an estimated total investment of Rs 24,631 crore.

Business

Precious metals surge over growing geopolitical tensions

Mumbai, Feb 23: Gold and silver prices surged significantly on Monday, amid growing geopolitical tensions and the US dollar’s steep fall.

MCX gold April futures gained 1.83 per cent to Rs 1,59,749 per 10 grams on an intra-day basis. Meanwhile, MCX silver March futures gained 5.10 per cent to Rs 2,65,836 per kg.

Earlier in the day, gold had jumped 2 per cent while silver soared 6 per cent. Analysts attributed the surge to geopolitical tensions as US President Donald Trump’s 10-day deadline for a “meaningful deal” with Iran drew closer.

Iran has indicated it is prepared to make concessions on its nuclear programme in talks with the US in return for the lifting of sanctions and recognition of its right to enrich uranium, as it seeks to avert a US attack.

Further, the dollar fell after the US Supreme Court struck down a vast swathe of President Trump’s tariffs on Friday.

“The US Supreme Court’s decision to strike down a large swath of Trump’s tariffs has weakened his ability to threaten and impose tariffs at a moment’s notice, but it won’t end gnawing uncertainty for trade partners or companies,” said Manav Modi, Commodities Analyst, Motilal Oswal Financial services Ltd.

“Silver is witnessing a large draw of inventories from all warehouses especially, Comex very significantly indicating the tightness in supply and surge in demand as China remains shut,” the analyst said.

Concerns over slowing US economic growth are also supporting gold’s safe-haven appeal. The US GDP rose 1.4 per cent annually in the fourth quarter, down from 4.4 per cent in the July-September quarter and 3.8 per cent in the April-June quarter.

“Gold has support at Rs 1,54,400 and Rs 1,53,150 while resistance at Rs 1,59,100 and Rs 1,60,600. MCX silver has support at Rs 2,48,800 and Rs 2,42,000, and resistance is at Rs 2,57,700 and Rs 2,63,620,” an analyst said.

Markets remain keen on data from US factory orders, cues on consumer confidence data, and US Producer Price Index (PPI) data.

Business

RCOM loan fraud: Anil Ambani files affidavit in SC; reiterates not to leave country

New Delhi, Feb 19: Industrialist Anil D. Ambani has filed an undertaking/compliance affidavit before the Supreme Court reiterating that he will not leave the country without prior permission of the apex court in connection with the ongoing probe into alleged large-scale bank loan frauds linked to Reliance Communications Ltd (RCOM) and its group entities.

The affidavit has been filed in a pending public interest litigation (PIL) seeking a court-monitored probe into the allegations that more than Rs 1.50 lakh crore of debt of the Ambani-led RCOM group has been written off and that funds were siphoned off through multiple shell companies.

The affidavit formally reiterates the oral undertaking recorded before the apex court on February 4, when senior advocate Mukul Rohatgi, appearing on his behalf, assured that Ambani would not leave India without prior permission of the top court.

“By way of the present affidavit, I formally reiterate and place on record the said statement by virtue of the present affidavit as an undertaking before this Hon’ble Court,” Ambani stated.

He further deposed on oath: “That I have not left India since July 2025, i.e., since the inception of the present investigations, and presently have no plan or intention to travel outside India.”

He added that if any requirement of foreign travel arises, he would seek prior leave and permission of the Supreme Court before undertaking such travel.

Asserting that he is not a flight risk, the affidavit states: “In view of the above conduct, undertakings, and continued cooperation, it is evident that I am not a flight risk and have no intention, whatsoever, to evade the process of law.”

Ambani also stated that he has been fully cooperating with the investigating agencies. “That I, with utmost bona fide, have been fully cooperating with the investigating agencies in connection with the ongoing investigations and continue to extend complete cooperation,” the affidavit reads.

Referring to the ongoing probe under the Prevention of Money Laundering Act, 2002, he stated that examination under Section 50 of the PMLA is presently being conducted during the pendency of proceedings before the apex court.

“That I have been summoned by the Directorate of Enforcement to appear on 26.02.2025 and I undertake to appear and join the investigation on the said date,” the affidavit said, while also undertaking to fully cooperate with the authorities and “preventing any suggestion of evasion or selective presentation of facts.”

Clarifying his role in the group companies under scrutiny, Ambani submitted: “That I respectfully state that my role in the concerned companies had been that of a Non-Executive Director only, and I was not involved in the day-to-day management or operational affairs of the said companies.”

In the affidavit sworn on February 18, he stated: “That the present affidavit is being filed to ensure clarity, completeness, and procedural transparency in the judicial record with an intent that this Hon’ble Court remains seized of the broader issues arising from the same factual matrix.”

Ambani’s undertaking comes against the backdrop of the Supreme Court’s February 4 order, where a Bench headed by Chief Justice of India (CJI) Surya Kant had expressed serious concern over an “unexplained delay” by the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) in probing alleged bank loan frauds involving public funds estimated at around Rs 40,000 crore.

The CJI Kant-led Bench had directed the ED to constitute a Special Investigation Team (SIT) of senior officers and asked both Central agencies to take the investigation to its “logical conclusion” in a time-bound manner, while making it clear that no coercive or harsh orders were being passed at that stage.

During the hearing, apprehensions were raised by advocate Prashant Bhushan that the key accused could flee the country before completion of the probe, following which an undertaking not to travel abroad without apex court permission was recorded.

The Supreme Court had also directed the ED and the CBI to file detailed status reports on the progress of their investigations and questioned why only a single FIR had been registered despite complaints from multiple lenders, observing that each complaint constitutes a separate transaction warranting independent examination.

-

Crime4 years ago

Crime4 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report