National News

Parliament proceedings | Lok Sabha passes Bills to replace British-era criminal laws

The Lok Sabha on Wednesday passed three amended Bills that seek to repeal and replace criminal laws which date back to colonial times. This criminal law reform brings terrorism offences into a general crime law for the first time, drops the crime of sedition, and makes mob lynching punishable by death.

The Bharatiya Nyaya (Second) Sanhita Bill (BNSS) will replace the Indian Penal Code, 1860; the Bharatiya Sakshya (Second) Bill (BSS) will replace the Indian Evidence Act, 1872; and the Bharatiya Nagarik Suraksha (Second) Sanhita Bill (BNSSS) will replace the Code of Criminal Procedure, 1898. All three were discussed and passed with a voice-vote, in the absence of the majority of Opposition members from INDIA bloc parties, as 97 of them have been suspended during this session.

Home Minister Amit Shah said that the three Bills stressed justice rather than punishment, and have been designed to last for the next century, keeping technological advancements in mind. “This is a pure Indian law after removing all the British imprints. As long as we are in power, we cannot become a police State,” the Minister said.He moved an amendment to the BNSS, which will exclude doctors from criminal prosecution for death due to medical negligence, and will make hit-and-run accident cases punishable by ten years imprisonment.

‘No sympathy for terrorists’

Noting that more than one lakh people have been killed in terror attacks across the country over the past 75 years, Mr. Shah said that the BNSS had, for the first time, defined terrorism and included it as a separate category in the general crime law.

Also read | The Bharatiya Nyaya Sanhita needs a relook

“Some members pointed out that UAPA [the Unlawful Activities Prevention Act] already exists. But in places where they were in power, they never invoked UAPA and those who committed acts of terrorism escaped under the provisions of general law,” Mr. Shah said. “We have shut the doors for such people to escape punishment by including terrorism in the criminal law. Terrorism is the biggest enemy of human rights. Such people should get the harshest of punishment. This is not Congress or British rule, how can you defend terrorists?” he asked.

Mr. Shah insisted that there was no scope for misuse of the terror provisions in the BNSS, but claimed that there was undue fear which made some Opposition MPs oppose the laws. “I insist that this fear should persist. There should be no sympathy for people who commit terrorist acts,” he said.

Earlier in the debate, Shiromani Akali Dal (SAD) leader Harsimrat Kaur Badal, while speaking about Punjabi youth who took to militancy swayed by emotions, claimed that the two men who had jumped inside the Lok Sabha chamber on December 13 had also been affected by their emotions on the issues of unemployment, Manipur violence, and farmers’ rights. The two men, along with four associates, have been booked under UAPA, among other charges. The SAD leader also flagged the absence of a majority of the Opposition members, saying that key Bills should not be passed in such a manner.

Rajdroha vs deshdroha

The Home Minister said that sedition has been repealed in the new law. “We have replaced an individual with the country. Rajdroha (sedition or offence against the government) has been replaced with deshdroha (offence against the nation or country). Gandhi, Tilak, Patel all went to jail under this particular British law, yet it was never scrapped by the Opposition when they were in power. It continued all these years,” he said.

“[AIMIM MP Asaduddin] Owaisi ji is thinking that we have merely changed the name of sedition. I want to say that this is an independent country. Nobody will be sent to jail for criticising the government, but you cannot say anything against the country or do anything against the interests of the country. If you harm the flag or the property of the country, you will be sent to jail,” Mr. Shah said.

Also read |Revised criminal law bills: Key changes explained

‘Muslims, Dalits will be hurt’

Earlier, Mr. Owaisi said that the new laws would impact minority and underprivileged communities the most, adding that they did not have any safeguards against police excess and fabricated evidence. “Most undertrial prisoners are Adivasi, Dalits and Muslims. The conviction rate of Muslim inmates is 16% and their population is 14%. As many as 30% detenues in jails are Muslims. 76% backward class, Dalits and religious minorities are on death-row. You are reforming [the law] for the powerful; this will not benefit the poor,” Mr. Owaisi said.

He pointed out that Clause 187 of the BNSSS permits police custody of up to 90 days, as against the 15-day custody allowed till now. The law also prevents any third party from filing mercy petitions on behalf of convicts on death-row.

Mr. Owaisi added that it was an irony that people accused of terror charges themselves were also speaking in Parliament on the Bill. The BJP MP from Bhopal, Pragya Singh Thakur, faces charges under UAPA, with regard to her alleged involvement in the 2008 Malegaon blast where six people were killed. She spoke during the debate on the Bill, claiming that the British-era laws had been misused to torture her in police custody for 13 days.

‘Definition of terror is too broad’

Krishna Devarayalu Lavu of the YSR Congress also objected to the clause permitting 90 days of police custody. He noted that recently, three contentious farm laws had been withdrawn after farmers staged a peaceful protest. “They protested so their rights can be taken care of. If you invoke sections pertaining to attack on sovereignty of the country, it does not make any sense. The definition of terrorist acts is too broad,” the YSR Congress MP said.

Mr. Shah, however, insisted that the total police custody would only be 15 days. “If, after the first seven days of police questioning, someone gets admitted in hospital, the person will have to appear before the police for another eight days after recovering or getting discharged. Meanwhile, courts can also grant bail,” he said.

National News

Mumbai: BMC-Run KEM Hospital Commissions Ultra-Modern Modular OTs For Heart Transplants And Complex Surgeries

Mumbai, Dec 26: Mumbai’s BMC-run KEM Hospital has strengthened its advanced healthcare infrastructure with the commissioning of ultra-modern steel modular operation theatres (OTs) designed for heart transplants and other complex surgeries. Following the completion of sterilisation protocols, cardiac surgeries have already commenced in the new facility.

The newly installed modular OTs feature steel walls, ceilings, frames and panels, making them resistant to dust, moisture and water. This design significantly improves cleanliness and simplifies sterilisation, thereby reducing the risk of post-operative infections.

“Equipped with laminar airflow systems and HEPA filters, the operation theatres ensure a continuous supply of clean, controlled air by filtering out bacteria, viruses, dust particles and other airborne contaminants,” said hospital officials, adding that the advanced setup will support not only heart transplants but also other organ transplants, surgeries for congenital disorders and complex paediatric procedures.

To further enhance efficiency, especially in emergency organ transplant cases, the hospital has developed special internal connectivity and separate entry points. These allow donor organs to be transported directly to the designated operation theatre, minimising time delays and reducing associated risks.

With this upgrade, KEM Hospital is expected to play a more significant role in organ transplantation and advanced surgical care in Mumbai and across Maharashtra.

Business

Keralites gulped liquor worth over Rs 332 crore during Christmas

Thiruvananthapuram, Dec 26: The Kerala State Beverages Corporation (BEVCO) recorded a sharp surge in liquor sales during the Christmas week, with revenues touching a record Rs 332.62 crore, according to official figures.

The Christmas week sales are calculated for the four days from December 22 to December 25, and officials said this year witnessed a significant jump compared to previous years.

Data shows a 19 per cent increase in sales over the corresponding period last year, underlining a strong festive demand.

The sharpest spike was recorded on Christmas Eve, when liquor sales alone amounted to Rs 114.45 crore.

In comparison, sales on the same day last year stood at Rs 98.98 crore, indicating a substantial year-on-year rise.

Officials attributed the surge not only to the festive season but also to improved consumer facilities introduced by BEVCO over the past year.

The corporation had expanded its premium retail infrastructure, including the launch of new premium counters aimed at offering a better purchasing experience and a wider selection of high-end products.

Premium outlets were recently opened in key centres such as Thrissur and Kozhikode, and officials said these had a positive impact on overall sales figures.

The enhanced facilities helped reduce crowding at regular outlets and encouraged higher-value purchases, contributing to the increase in revenue.

The Corporation has traditionally seen a spike in sales during festival periods such as Onam and Christmas, but this year’s figures mark one of the highest Christmas week turnovers recorded by the state-run corporation.

The rise in liquor sales is expected to provide a significant boost to the State exchequer, as the corporation is a major contributor to Kerala’s revenue through taxes and duties.

Liquor is sold through state-run 325 retail outlets.

Studies have shown that around 10 per cent of the 3.30 crore Kerala population are tipplers, including around three lakh women.

In 2024–25, Kerala’s liquor sales rose to Rs 19,730.66 crore, up from Rs 19,069.27 crore in 2023–24, marking an annual growth of 3.5 per cent.

Business

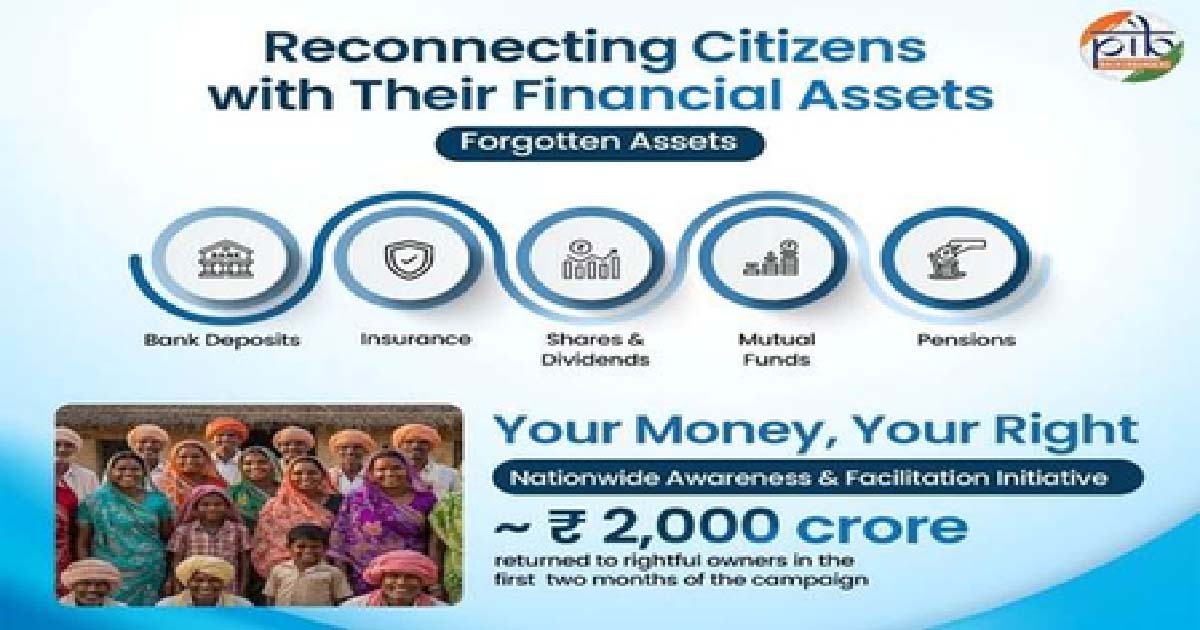

Govt drive returns Rs 2,000 crore unclaimed savings to rightful owners

New Delhi, Dec 26: The government has succeeded in returning to the rightful owners a total amount of nearly Rs 2,000 crore that was stuck as “unclaimed savings” across banks, insurance, mutual funds, dividends, shares, and retirement benefits held within the regulated financial system, according to an official statement issued on Friday.

The funds have been restored through the Centre’s “Your Money, Your Right” nationwide awareness and facilitation initiative, launched in October 2025 to help citizens identify and reclaim unclaimed financial assets. The initiative is being coordinated by the Finance Ministry’s Department of Financial Services, with financial sector regulators reaching across digital portals with district-level facilitation.

Across generations, Indian families have saved carefully through opening bank accounts, purchasing insurance policies, investing in mutual funds, earning dividends from shares, and setting aside money for retirement. These financial decisions are taken with a hope and responsibility, often to secure children’s education, support healthcare needs, and ensure dignity in old age.

Yet, over time, a significant portion of these hard-earned savings has remained unclaimed. The money has not vanished, nor has it been misused. It lies safely with regulated financial institutions, separated from its rightful owners due to a lack of awareness, outdated records, changes in residence, or missing documentation. In many cases, families are simply unaware that such assets exist.

The volume of unclaimed financial assets in India is significant and spans multiple segments of the formal financial system. Indicative estimates suggest that Indian banks together hold around Rs 78,000 crore in unclaimed deposits. Unclaimed insurance policy proceeds are estimated at nearly Rs 14,000 crore, while unclaimed amounts in mutual funds are about Rs 3,000 crore. In addition, unclaimed dividends account for around Rs 9,000 crore, according to official figures.

Together, these amounts underline the scale of unclaimed savings belonging to citizens that continue to remain unused, despite being securely held within the financial system.

Your Money, Your Right is a nationwide effort to reconnect citizens with these forgotten financial assets and ensure that money that belongs to individuals and families ultimately finds its way back to them.

These unclaimed financial assets arise when money held with financial institutions is not claimed by the account holder or their legal heirs for a prolonged period. Such assets include:

*Bank deposits such as savings accounts, current accounts, fixed deposits, and recurring deposits that have not been operated for ten years or more.

*Insurance policy proceeds that remain unpaid beyond the due date

*Mutual fund redemption proceeds or dividends that could not be credited due to reasons such as a change in bank account, bank account closure, incomplete bank account in records, etc.

*Dividends and shares that remain unclaimed and are transferred to statutory authorities

*Pension and retirement benefits that are not claimed within the normal course

In most cases, assets may become unclaimed because of routine life events such as migration for work, changes in contact details, closure of old bank accounts, or lack of information among family members and legal heirs.

The Government is coordinating with the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Securities and Exchange Board of India (SEBI), the Investor Education and Protection Fund Authority (IEPFA), and the Pension Fund Regulatory and Development Authority (PFRDA) to help citizens identify, access and reclaim financial assets that legally belong to them, using simple processes and transparent systems.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report