Business

Maharashtra presents deficit budget, new tax burden on citizens

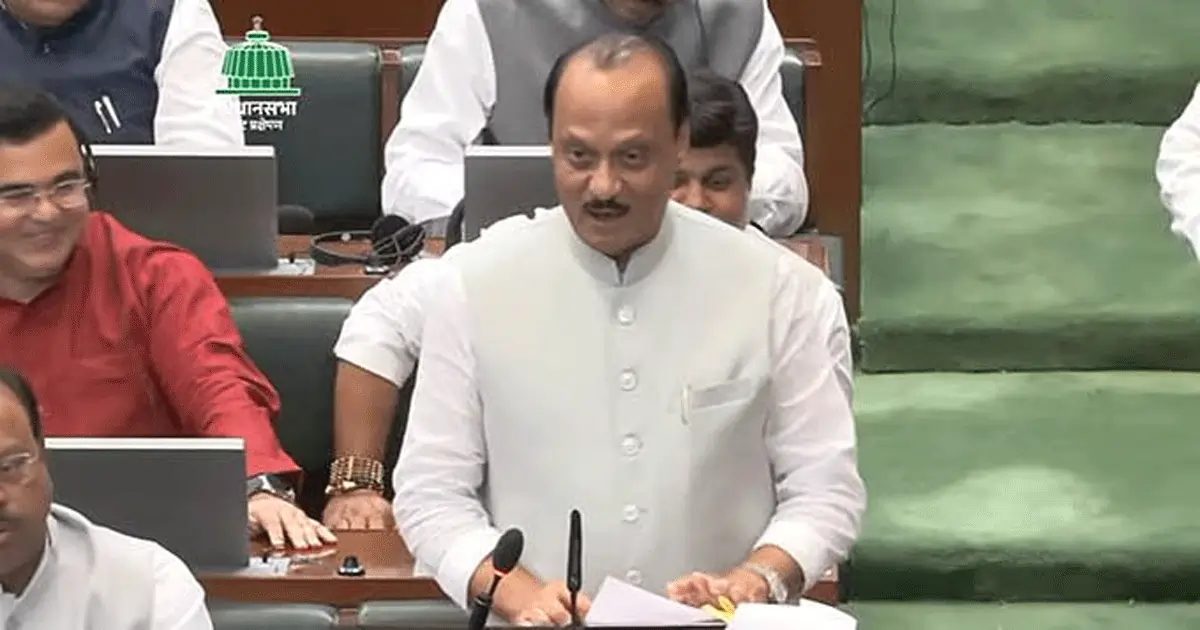

Mumbai: Finance Minister and Deputy Chief Minister Ajit Pawar presented the state budget in the Maharashtra Legislative Assembly today. The public has expressed confidence in us in the assembly elections, so Mahayuti is committed to maintaining their trust. In this budget, special concessions and facilities have been given to the middle class. An attempt has been made to solve the problems of the people. With this resolve, Ajit Pawar has presented the budget for 2025-26, which is the first annual budget presented by the Mahayuti government.

Presenting the budget in the Assembly, Ajit Pawar said in his speech that Maharashtra will not stop, development will not be delayed, he also claimed that large-scale projects will be completed in the state, which will increase employment opportunities and boost the economy.

The state has set a target of an economy of one lakh trillion. Work on the Bengaluru-Mumbai Industrial Corridor is underway. Along with better industrial facilities in the state, employment opportunities and a technical center in the state and establishment of Maharashtra Technical Textile Mission for development work have also been implemented. It has also been assured in the budget that electricity rates will be reduced in the state. Electricity rates in the state will be lower than the rates of other provinces.

Ajit Pawar has also promised to complete many facilities and projects in the state budget. The work of Navi Mumbai airport is 85 percent complete, while work has started on Nagpur airport. Establishment of markets for agriculture has been ensured. Rs 3610 crore has been allocated for the transport department, out of which work has started on a 41 km long metro route in Mumbai.

A special project has been included in the budget for Mumbai, in which Rs 64,783 crore has been allocated for Versova to Madha, Versova to Bhayander Coastal Road, Malind to Goregaon, Thane to Borivali and Orange Gate to Marine Drive underground road to eliminate traffic problems in suburban areas. Thane to Navi Mumbai International Airport will be connected to the international airports of Thane, Dombivali, Kalyan and other important cities.

The work of the missing link at Khapoli-Khandala Ghat on Mumbai-Pune Highway will be completed by August 2025. Mumbai, Navi Mumbai Global Market will be established as well as Taluka Market Committee will be established across the state. Housing Scheme: Financial assistance of Rs 50,000 will be given for the house. Implementation of Pradhan Mantri Awas Yojana will be ensured in the state. Under this scheme, assistance of Rs 50,000 will be provided to each person. Under the Pradhan Mantri Surya Ghar Yojana, Rs 1.30 lakh has been allocated for domestic electricity and Rs 1,000 crore for power generation of more than 500 MW.

The state government has so far spent Rs 33,232 crore on Ladli Behan in the budget, while the Finance Ministry has allocated Rs 36,000 crore for it. A Hope Mall will be started in every district to establish savings banks and 10 malls will be set up in the first phase.

A 200-bed hospital will be built in Thane of Ratnagiri district, which will provide medical facilities to the citizens. The second phase of construction of metro route will be implemented in Pune. In the second phase, Rs 9894 crore has been allocated for two metro routes. Both the metro projects have been sent for approval from the Central Government. A statue of Chhatrapati Shivaji Maharaj will be installed in Sangameshwar. Apart from this, Maratha Shaurya Smarak will be built in Panipat. A statue of Chhatrapati Shivaji Maharaj will be built in Agra.

In this budget of the state government, a new tax has been imposed on the citizens. In this, a lump sum tax of 7% has been ensured on the purchase of cars. This tax has been imposed on electric cars and other things. This tax has been imposed on the purchase of cars worth more than 30 lakhs so that the common citizens do not face any problem. The state government has presented a budget of 7 lakh thousand crores. In this deficit budget, the burden of tax has been imposed on the citizens.

Business

Mumbai Infra: BMC Plans ₹220-Crore Flyover Between Mahim & Bandra East To Ease Congestion On WEH

Mumbai: In a bid to ease traffic congestion along a crucial stretch of the Western Express Highway (WEH), the Brihanmumbai Municipal Corporation (BMC) has revived plans to construct a flyover connecting Mahim and Bandra (East). The civic body has once again invited tenders for the long-pending project after earlier attempts failed to attract bidders.

The proposed flyover will link Machhimar Colony on Senapati Bapat Marg in Mahim to Bandra (East), providing an alternative route for motorists who currently face severe traffic snarls on the western express highway. The congestion typically begins at Mithi Chowk in Bandra (East) and extends up to Dadar, significantly slowing down traffic on the WEH.

The project is estimated to cost approximately Rs. 220.17 crore. The flyover will stretch for over one kilometre and is expected to ease pressure on existing routes between Mahim and Bandra (East), an area that already includes the Chunabhatti–BKC flyover and the old Kalanagar flyover.

This is not the first time the BMC has attempted to push the project forward. The initial tender, floated in 2022, was withdrawn due to technical issues. A second tender issued in July 2023 failed to receive any bids and eventually lapsed. The bridge department has now reissued the tender, expressing hope that contractors will come forward this time.

The project involves crossing areas near Mithi Chowk, which will require clearances from the Coastal Regulation Zone (CRZ) authorities and the Forest Department. The responsibility of securing these permissions will lie with the appointed contractor.

Once completed, the flyover is expected to streamline traffic flow between Mahim and Bandra (East) and provide relief to commuters using one of the city’s busiest arterial corridors.

Business

Bharat Forge’s Q3 profit falls 17 pc, Rs 2 interim dividend announced

Mumbai, Feb 12: Bharat Forge on Thursday reported nearly 17 per cent year-on-year decline in its standalone net profit for the quarter ended December 2026 (Q3 FY26).

On a standalone basis, the company posted a net profit of Rs 288 crore lower than Rs 346 crore reported in the same quarter last financial year (Q3 FY25), according to its stock exchange filing.

Standalone revenue from operations saw a marginal dip of 0.6 per cent to Rs 2,083.7 crore in Q3 FY26.

On a consolidated basis, the performance was stronger. Revenue rose 25 per cent year-on-year to Rs 4,343 crore, compared with Rs 3,476 crore in the year-ago period.

Net profit increased 28.2 per cent to Rs 273 crore from Rs 213 crore in the corresponding quarter last financial year.

The company said the quarterly numbers included a one-time cost of Rs 55.7 crore, which had an impact on margins.

Earnings before interest, tax, depreciation and amortisation (EBITDA) grew 20 per cent to Rs 750 crore from Rs 624 crore a year ago.

However, EBITDA margin moderated to 17.3 per cent from 18 per cent in the same quarter last financial year.

The Board of Directors also declared an interim dividend of Rs 2 per equity share of face value Rs 2 each, which translates to a 100 per cent payout on the face value.

The dividend will be paid on or before March 12, 2026, and the record date for determining eligible shareholders has been fixed as February 18, 2026.

Commenting on the performance, B. N. Kalyani, Chairman and Managing Director of Bharat Forge, said the results continued to be impacted by de-stocking in the North American commercial vehicle market.

He added that strong growth in the domestic automotive business and execution of the defence order book helped support the overall performance.

On a sequential basis, standalone revenue rose 7 per cent quarter-on-quarter to Rs 2,084 crore.

EBITDA increased 4.6 per cent to Rs 569 crore, while margins stood at 27.3 per cent. Export revenue declined 3 per cent on a sequential basis, with auto exports falling 13 per cent, even as industrial exports grew 11 per cent.

Business

Sensex, Nifty open in red; IT index dips 3.58 pc

Mumbai, Feb 12: The Indian equity markets opened lower early on Thursday weighed down by IT stocks.

As of 9.25 am, Sensex lost 397 points, or 0.47 per cent, to reach 83,836, and Nifty lost 111 points, or 0.43 per cent, to settle at 25,842.

Main broad-cap indices posted stronger losses than benchmark indices, as the Nifty Midcap 100 declined 0.76 per cent, and the Nifty Smallcap 100 dipped 0.88 per cent.

All sectoral indices traded in the red except FMCG, private banks as well as oil and gas. Most notable losers were Nifty IT down 3.58 per cent, realty down 1.11 per cent and media down 1.04 per cent.

Immediate support for Nifty is placed at 25,800-25,850 zone, while resistance is anchored at 26,050-26,100 zone, market watchers said.

Analysts said that the latest US jobs data indicating addition of 1.3 lakh jobs last month and unemployment falling to 4.3 per cent points weakened hopes of rate cuts by the Fed in the near-term.

In India, market watchers said that the rate cutting cycle is over since growth is good and inflation is expected to inch back to the RBI’s long-term target by the end of FY27.

In Asian markets, China’s Shanghai index added 0.12, and Shenzhen gained 0.81 per cent, Japan’s Nikkei gained 0.1 per cent, and Hong Kong’s Hang Seng Index eased 0.97 per cent. South Korea’s Kospi gained 2.74 per cent.

The US markets ended largely in the red overnight as Nasdaq eased 0.16 per cent. The S&P 500 traded flat, and the Dow Jones lost 0.13 per cent.

On February 11, foreign institutional investors (FIIs) net bought equities worth Rs 944 crore, while domestic institutional investors (DIIs) were net sellers of equities worth Rs 125 crore.

Indian equities corrected in January amid global volatility and FII outflows; however, the medium-term outlook remains constructive, according to analysts.

-

Crime4 years ago

Crime4 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report