Business

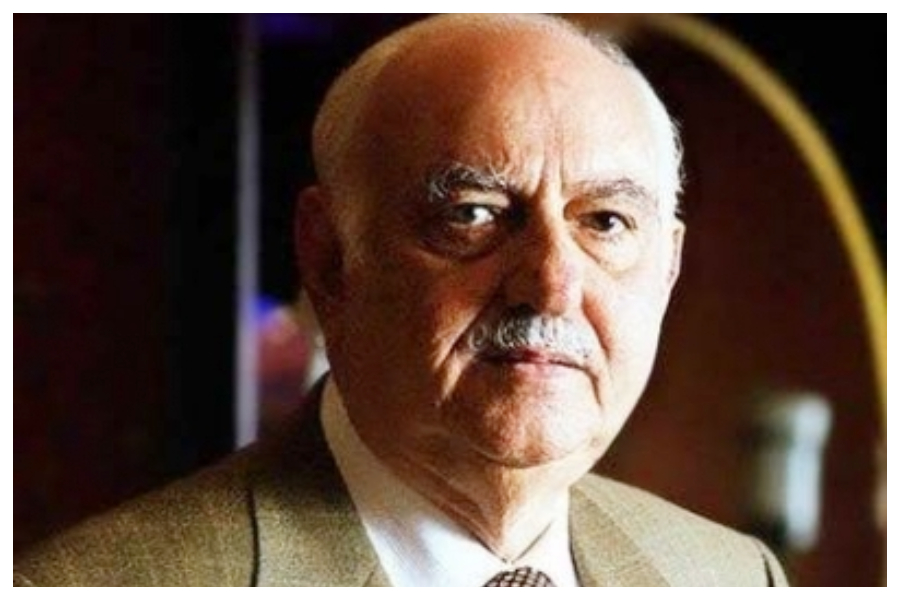

Business tycoon, billionaire Pallonji Mistry passes away at 93

Pallonji Shapoorji Mistry, the billionaire realtor and industrialist, and Chairman Emeritus of the venerable Shapoorji Pallonji Group, passed away at his home here late last night, official sources said here on Tuesday.

He was 93 and is survived by his sons Shapoorji and Cyrus P. Mistry — latter who was in the limelight for the huge corporate tussle with the Tata Group a few years ago, and two daughters, Laila and Aloo — the latter wedded to Noel Tata, half-brother of Ratan Tata.

Prime Minister Narendra Modi condoling the death of Mistry tweeted: “Saddened by the passing away of Shri Pallonji Mistry. He made monumental contributions to the world of commerce and industry. My condolences to his family, friends and countless well-wishers. May his soul rest in peace.”

“Pallonji Mistry, the end of an era. One of life’s greatest joys was to have witnessed his genius, his gentleness at work. My condolences to the family and his loved ones,” Union Minister for Women and Child Development Smriti Z Irani tweeted.

Born on June 1, 1929 in a Parsi family from Gujarat, Pallonji Mistry had his schooling in Mumbai and went to London for his higher studies and joined the family business later.

Pallonji Mistry enabled the business to venture into Middle East countries.

His father Shapoorji had bought shares in Tata Sons in 1930 and the stakes now are about 18 per cent.

It was in 2003, Pallonji Mistry surrendered his Indian citizenship and became an Irish citizen. He was married to an Ireland born national Patsy Perin Dubash.

Pallonji Mistry was awarded Padma Bhushan in 2016, India’s third highest civilian award for his contribution to industry.

The Sharpoorji Pallonji Group started in 1865 with a noteable construction history dating back to 1887 – Littlewood Pallonji & Co. was one of the companies that helped to build a large Malabar Hill reservoir – is now a global diversified conglomerate with 18 major companies operating in six business segments – Engineering & Construction, Infrastructure, Real Estate, Water, Energy and Financial Services.

With a workforce of over 50,000 in over 50 countries, the group has developed several mega and iconic structures like RBI headquarters, SBI, HSBC, Grindlay Bank, Hongkong & Shanghai Bank and others in south Mumbai, besides other major infrastructure projects.

The Group had also produced the iconic Hindi film, K. Asif’s ‘Mughal-E-Azam’ (1960), then the most expensive one and till date it reigns among the top popular movies of Bollywood.

Business

Ashwini Vaishnaw flags off Swarnanagari Express, connecting Jaisalmer to Delhi

Jaipur, Nov 29: Railway Minister Ashwini Vaishnaw and Union Tourism Minister Gajendra Singh Shekhawat jointly flagged off the Swarnanagari Express on Saturday, which will connect Jaisalmer with Delhi.

During the inauguration ceremony, responding to the request of Union Minister Shekhawat and the locals, the Railways Minister announced the renaming of the newly-launched train from Jaisalmer–Shakur Basti–Jaisalmer to Swarnanagari Express.

He announced that the train will begin regular operations on December 1.

The minister said that development work at Jaisalmer railway station is in its final phase and is expected to be completed within a month.

“Efforts will be made to ensure that Prime Minister Narendra Modi inaugurates the upgraded station,” he said.

Union Minister Vaishnaw also confirmed that the railway line between Jaisalmer and Jodhpur will be upgraded soon.

According to officials, these initiatives will significantly improve connectivity, boost tourism, and strengthen strategic infrastructure in the border region.

Ashwini Vaishnaw said that the connectivity will strengthen national security.

Preparations are underway to connect several regions along the Rajasthan–Pakistan border with new railway lines.

He said that extending rail connectivity to these sensitive areas will significantly enhance the country’s security infrastructure.

Under this initiative, new railway lines are proposed for Anupgarh, Bikaner, Jaisalmer, Barmer, and Bhildi.

The minister arrived in Jaisalmer on Saturday to inaugurate a new train service to Delhi.

The minister also visited stalls under the One Station, One Product scheme and made purchases to promote local artisans.

He said that the Detailed Project Report (DPR) for the proposed border-area railway lines is being prepared and will be completed in the coming months.

“A complete effort will be made to connect the entire border region,” he assured.

He added that railway projects worth approximately Rs 55,000 crore are currently in progress across Rajasthan, including the redevelopment of 85 railway stations.

Work is also advancing on multiple new railway corridors and infrastructure projects.

The new initiatives, officials said, will improve connectivity, boost tourism, and strengthen strategic infrastructure in the border region.

Business

Nifty, Sensex rally for 2nd week over strong Q2 earnings, domestic inflows

Mumbai, Nov 29: The Indian equity benchmarks made marginal gains for the third consecutive week, supported by positive global cues, robust domestic inflows and strong Q2 earnings.

Benchmark indices Nifty and Sensex edged higher 0.34 and 0.52 per cent this week to close at 26,202 and 85,706, respectively.

Analysts said that global cues remained supportive, aided by softer US yields, renewed expectations of a Fed rate cut, and benign crude prices that helped temper inflation concerns.

Broader indices underperformed, with the Nifty Midcap100 and Smallcap100 ending the week down 0.11 per cent and 0.10 per cent respectively.

Gains during the week were led by pharma, PSU banks, media, and IT, while realty, consumer durables, and oil & gas lagged behind.

Indian equities navigated a highly eventful week characterised by alternating phases of volatility, resilience and profit booking, finally closing the week on a positive note.

Nifty reached an intra-day low of 25,842 before bouncing back and making a high of 26,310 on the last day of trading week.

Bharat K Gala, President, Technical Head, Ventura, said that key corrective zones traders should watch out for is the support zone at 25,851–25,566. A breach of this level can take the index to 25,337 and further to 25,107–24,780 zone.

Domestically, the stronger-than-expected Q2 GDP print, driven by resilient manufacturing, solid construction activity, and healthy private consumption, is set to support sentiment in the near term, market watchers said.

With robust GDP momentum and improving credit growth providing a solid backdrop for earnings acceleration in H2, the medium-term outlook remains positive, they added.

Investors look for cues next week from a critical lineup of macro data, including India and US PMI releases, US core PCE inflation and the RBI’s policy decision.

Business

India in talks with 50 nations on fair trade deals: Piyush Goyal

New Delhi, Nov 28: Commerce and Industry Minister Piyush Goyal said on Friday that India is currently engaged in discussions on fair and balanced trade deals with 14 countries or groups representing nearly 50 nations, including the United States, the European Union, GCC countries, New Zealand, Israel, Eurasia, Canada, South Africa and the Mercosur group.

Addressing the annual general meeting of the Federation of Indian Chambers of Commerce and Industry (FICCI) here, the minister underlined that balanced and equitable trade agreements have already been concluded with Australia, the UAE, Mauritius, the United Kingdom and the four-nation EFTA bloc.

Highlighting broader global developments, the minister said that recent geopolitical and economic challenges have underscored the need for trusted partners and resilient supply chains. He stated that India’s expanding network of free trade agreements (FTAs) and economic partnerships is aimed at building long-term cooperation anchored in fairness, transparency and mutual benefit.

Goyal said that the idea of self-reliance is central in India’s civilisational ethos, recalling references from the Bhagavad Gita and Mahatma Gandhi’s emphasis on Swadeshi. He said that self-reliance has historically guided India’s progress and continues to remain central to the country’s economic strategy. He added that this vision has been strengthened through the focus on Atmanirbhar Bharat under the leadership of Prime Minister Narendra Modi.

Referring to the recent EFTA agreement, the minister noted that the bloc has committed to invest $100 billion in India across innovation and precision manufacturing. He underscored India’s cost competitiveness in research and innovation, stating that high-quality innovation undertaken in India can be achieved at a fraction of the cost compared to Europe or the United States.

The Minister highlighted India’s strengths in innovation and technology, supported by a young demographic, increasing digital adoption and a growing talent pool. He said that India’s large number of STEM graduates and widespread internet access create strong potential in emerging areas such as applied artificial intelligence, automation, robotics and deep-tech innovation.

He noted that the recently announced $12 billion Research, Development and Innovation (RDI) fund, along with ongoing support to startups and deep-tech industries, will further accelerate India’s innovation ecosystem.

Goyal emphasised the importance of strengthening skilling to prepare India’s youth for future opportunities. He said that unlike many developed economies facing ageing populations, India’s youthful demographic is quick to adapt to emerging technologies and has already demonstrated high engagement with digital platforms. He added that this readiness positions India to play a major role in the global technology landscape.

The minister outlined India’s strengths through the ‘PESTLE’ framework, noting that Prime Minister Modi has consistently advanced the vision of self-reliance across sectors. He said that politically, a stable and predictable government committed to “Minimum Government, Maximum Governance” has enhanced investor confidence. In the economic domain, initiatives such as the National Manufacturing Mission and the Rs 25,000 crore Export Promotion Mission are supporting India’s rise towards becoming the world’s third-largest economy.

On the social front, he highlighted that the four Labour Codes ensure better wages and protections, while the Antyodaya approach has supported the fulfilment of basic needs.

In the technology sector, Goyal pointed to initiatives aimed at reducing external dependence, including the Semiconductor Mission (Rs 76,000 crore) and the Rs 7,000 crore programme for permanent magnet production, which strengthen domestic manufacturing and supply chain security. In the legal domain, he referred to ongoing reforms, including progress toward Jan Vishwas 3.0, designed to enhance ease of doing business.

He further noted that the ‘Atomic Energy Bill 2025’ marks a historic shift by opening up the nuclear sector to strengthen energy sovereignty.

The Minister urged FICCI to adopt a mission-driven approach to promoting innovation, deepening research and development, strengthening industry-academia linkages and supporting India’s journey towards becoming a developed nation by 2047.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report