Business

Bank brokerages to continue reporting strong performance: Report

The domestic capital markets continue to remain on an upward trajectory after a strong performance in FY2021.

The average daily turnover (ADTO) increased to Rs 27.92 lakh crore in FY2021 from Rs 14.39 lakh crore in FY2020, registering an annual growth of 94 per cent. Transaction volumes remain strong in the current fiscal, with the markets clocking an ADTO of Rs 56.36 lakh crore in H1 FY2022.

As per ICRA, the market performance has been supported by favourable liquidity in both domestic and international markets, optimism related to a recovery after the graded reopening of the economy, progress on vaccination rollout and steady retail investor momentum.

Throwing more light, Samriddhi Chowdhary, Vice President & Sector Head – Financial Sector Ratings, ICRA says, “The pool of ICRA-rated bank brokerages reported a strong performance in FY2021 with the estimated average daily turnover (ADTO) increasing 28 per cent Y-o-Y to Rs 1.51 lakh crore from Rs 1.18 lakh crore in FY2020, led by the healthy growth in the retail segment.

Despite the changes in the margin requirements, the performance remained healthy in Q1 FY2022 with an estimated ADTO of Rs 1.64 lakh crore, driven by favourable retail investor sentiment. However, the market share of the sample pool of ICRA-rated bank brokerages in terms of transaction volumes declined in FY2021 and moderated further in Q1 FY2022 as they continue to lose share to discount brokers.”

Bank-brokerages reported a strong uptick in earnings in FY2021 registering a year-on-year (Y-o-Y) growth of 40 per cent in total revenues and 80 per cent in profit after tax. The cost structure and operational efficiency of the bank brokerage companies also improved over the past few years with focus on the rationalisation of branches coupled with cautious efforts towards the transition to a digital business model, thereby improving the operational efficiency across brokerages.

Bank-brokerages have been increasingly looking at other non-broking sources of income, namely capital market lending business, distribution income and investment banking revenue. Bank-brokerages have significantly scaled up the margin funding business over the past fiscal, moving in line with the capital market rally, which has resulted in an increase in their borrowing level.

The retail broking segment has witnessed a significant disruption in the last few years due to the growing prominence of discount brokerages. The competitively priced offerings of discount brokers and the no-frill basic accounts and services have resulted in the realignment of the pricing strategy across the industry.

Adds Chowdhary, “apart from attracting clients from full-service providers, discount brokerage houses have helped expand the market by bringing on board a large number of first-time investors. While the market share for bank brokerages in terms of active clients moderated in FY2021, primarily owing to the faster scaling up of the discount brokerage houses, they reported a strong performance as reflected by the healthy operating metrics and surge in earnings.”

ICRA expects bank brokerages to continue to build their retail franchise and focus more on technology and digital models for customer acquisition. Supported by these factors, bank brokerages are expected to register a healthy growth in client addition as well as transaction volumes, though their share in total active clients would moderate owing to the rapid expansion of the discount broking model. The blended yields are expected to compress going forward, though the focus on fee and fund-based income would support the profitability.

Adds Chowdhary, “Bank brokerages are expected to continue to enjoy better brand recall, trust, higher credibility and financial flexibility by virtue of being a part of banking groups and would, therefore, remain a prominent part of the industry value chain. Bank brokerages are also increasingly looking at the emerging demographic opportunities and new geographical base, which is facilitated through online channels. Going forward, the ability of the bank brokers to effectively ramp up their digital initiatives, attract millennial clients and expand to a newer geographical base such as Tier II and Tier III cities would be critical.”

ICRA expects the net operating income (NOI) of bank brokerages to grow 20-25 per cent year-on-year (Y-o-Y) in FY2022 supported by steady broking income along with an uptick in the margin funding and distribution businesses; the ramp-up of other capital markets related businesses could further support the earnings profile. The net profit for bank brokerages is expected to grow 17-20 per cent during the same period.

The borrowings levels of bank brokerages are expected to increase in the current fiscal to support their margin funding business. The gearing levels of bank brokerages are expected to be in the range of 1.5-2 times in FY2022 at an industry level while the gearing across entities would vary between 1 to 3 times based on the scale of margin funding operations.

Business

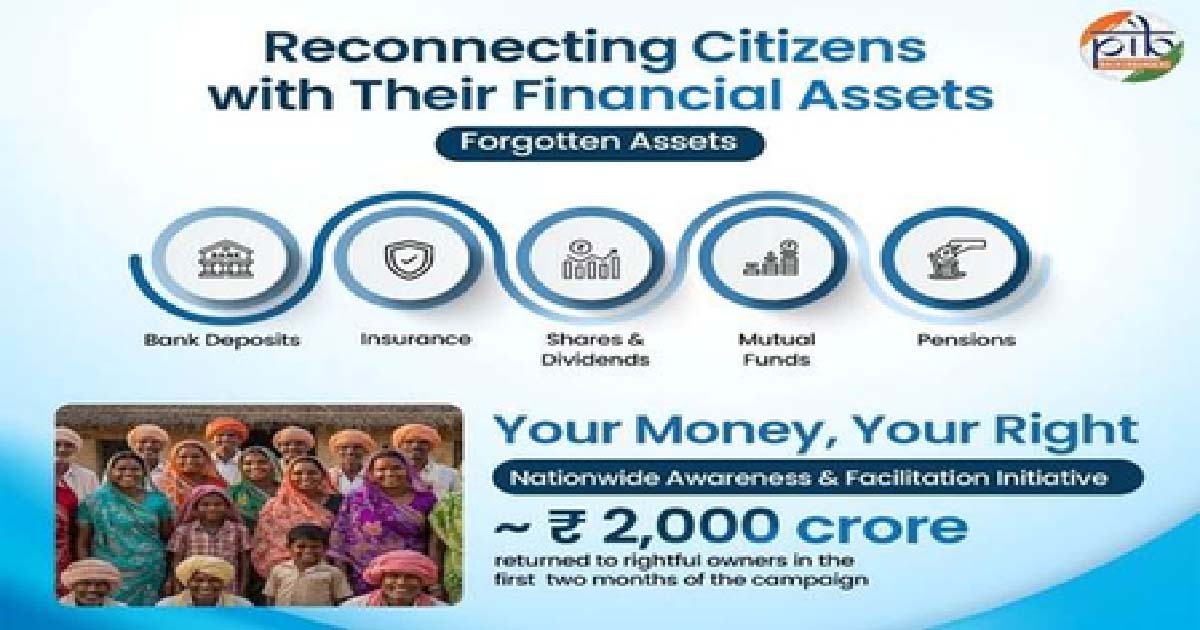

Govt drive returns Rs 2,000 crore unclaimed savings to rightful owners

New Delhi, Dec 26: The government has succeeded in returning to the rightful owners a total amount of nearly Rs 2,000 crore that was stuck as “unclaimed savings” across banks, insurance, mutual funds, dividends, shares, and retirement benefits held within the regulated financial system, according to an official statement issued on Friday.

The funds have been restored through the Centre’s “Your Money, Your Right” nationwide awareness and facilitation initiative, launched in October 2025 to help citizens identify and reclaim unclaimed financial assets. The initiative is being coordinated by the Finance Ministry’s Department of Financial Services, with financial sector regulators reaching across digital portals with district-level facilitation.

Across generations, Indian families have saved carefully through opening bank accounts, purchasing insurance policies, investing in mutual funds, earning dividends from shares, and setting aside money for retirement. These financial decisions are taken with a hope and responsibility, often to secure children’s education, support healthcare needs, and ensure dignity in old age.

Yet, over time, a significant portion of these hard-earned savings has remained unclaimed. The money has not vanished, nor has it been misused. It lies safely with regulated financial institutions, separated from its rightful owners due to a lack of awareness, outdated records, changes in residence, or missing documentation. In many cases, families are simply unaware that such assets exist.

The volume of unclaimed financial assets in India is significant and spans multiple segments of the formal financial system. Indicative estimates suggest that Indian banks together hold around Rs 78,000 crore in unclaimed deposits. Unclaimed insurance policy proceeds are estimated at nearly Rs 14,000 crore, while unclaimed amounts in mutual funds are about Rs 3,000 crore. In addition, unclaimed dividends account for around Rs 9,000 crore, according to official figures.

Together, these amounts underline the scale of unclaimed savings belonging to citizens that continue to remain unused, despite being securely held within the financial system.

Your Money, Your Right is a nationwide effort to reconnect citizens with these forgotten financial assets and ensure that money that belongs to individuals and families ultimately finds its way back to them.

These unclaimed financial assets arise when money held with financial institutions is not claimed by the account holder or their legal heirs for a prolonged period. Such assets include:

*Bank deposits such as savings accounts, current accounts, fixed deposits, and recurring deposits that have not been operated for ten years or more.

*Insurance policy proceeds that remain unpaid beyond the due date

*Mutual fund redemption proceeds or dividends that could not be credited due to reasons such as a change in bank account, bank account closure, incomplete bank account in records, etc.

*Dividends and shares that remain unclaimed and are transferred to statutory authorities

*Pension and retirement benefits that are not claimed within the normal course

In most cases, assets may become unclaimed because of routine life events such as migration for work, changes in contact details, closure of old bank accounts, or lack of information among family members and legal heirs.

The Government is coordinating with the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Securities and Exchange Board of India (SEBI), the Investor Education and Protection Fund Authority (IEPFA), and the Pension Fund Regulatory and Development Authority (PFRDA) to help citizens identify, access and reclaim financial assets that legally belong to them, using simple processes and transparent systems.

Business

2026 set to break new records with ‘Make in India’ and PLI schemes firmly in place

New Delhi, Dec 26: India’s electronics and semiconductor journey has moved from intent to execution – creating several new highs this year — and 2026 is set to break new records with ‘Make in India’ and production-linked incentive (PLI) schemes firmly in place — establishing India as a competitive and trusted electronics manufacturing destination globally.

According to government data, electronics production has increased sharply from about Rs 1.9 lakh crore in 2014-15 to around Rs 11.3 lakh crore in 2024–25. Electronics exports have also risen from Rs 38,000 crore to more than Rs 3.27 lakh crore during the same period.

India had only two mobile phone manufacturing units in 2014-15, which has now increased to around 300 units. Mobile phone production has grown from Rs 18,000 crore to Rs 5.45 lakh crore, while exports have surged from Rs 1,500 crore to nearly Rs 2 lakh crore.

Electronics exports have risen from Rs 38,000 crore to more than Rs 3.27 lakh crore during the same period.

Meanwhile, the Modified Electronics Manufacturing Clusters (EMC 2.0), located in 10 states with projected investments of Rs 1,46,846 crore, have estimated to generate about 1.80 lakh jobs.

Over the past decade, India’s manufacturing base, particularly in electronics and mobile phones, has expanded substantially, and the country has emerged as a net exporter in several key sectors.

According to Pankaj Mohindroo, Chairman, ICEA, this year marked a defining phase for ‘Make in India’, with the PLI framework firmly establishing India as a competitive and trusted electronics manufacturing destination.

“PLI has accelerated scale, deepened localisation, expanded exports and integrated India into global value chains. As we head into the next phase that is 2026. The sustained policy continuity, faster approvals and focus on component ecosystems will be critical to moving India from volume led manufacturing to high value, innovation-driven production,” he said in a statement.

Ashok Chandak, President of the India Electronics and Semiconductors Association (IESA) and SEMI India, said that India’s electronics growth story is no longer episodic — it is structural.

Policymakers, global and Indian industry leaders, and ecosystem stakeholders are now aligned on building resilient, sustainable, and globally competitive value chains, he mentioned.

“As discussions in 2025 highlighted — spanning policies and incentives, electronics value addition, skilling, academic partnerships, and industry collaboration — the next phase must focus on execution, joint R&D, and technology transfer. The increased use of locally made semiconductors and components will be central to deeper value addition and the long-term success of India’s electronics industry,” Chandak noted.

India’s semiconductor journey has also moved from intent to execution, marking a clear structural shift.

Policymakers, global and Indian industry leaders, and ecosystem stakeholders are aligned on building resilient and competitive semiconductor value chains.

Key priorities discussed in 2025, including semiconductor policies and incentives, human capital development, fabs, advanced packaging and OSAT, academic partnerships, and industry engagement, underscore the need for joint R&D, technology transfer, and well-defined pathways to scale.

Under the Semicon India Programme, 10 units have been approved with an investment of Rs 1.6 lakh crore, which include silicon fab, silicon carbide fab, advanced packaging, and memory packaging.

“Over the next three years, disciplined execution and localisation across design, manufacturing, and advanced packaging will be critical to enable chips for high-volume electronic products consumed locally,” said Chandak.

The government also launched a production-linked incentive scheme (PLI) for large-scale electronics manufacturing of mobile phones and certain specified components. The scheme has attracted investment of Rs 14,065 crore up to October 2025.

To target the manufacturing of IT Hardware, the government launched PLI for IT Hardware for promoting the manufacturing of laptops, tablets, servers and ultra small form factor (USFF) devices. PLI for IT hardware have attracted investment of Rs 846 crore till October 2025.

Business

Govt committed to boost ease of living, continue reform trajectory, says PM Modi

New Delhi, Dec 26: Prime Minister Narendra Modi on Friday said that his government is committed to boosting ‘Ease of Living’ and the reform trajectory will continue with even more vigour in the coming times.

Replying to a thread on X social media platform posted by the MyGovIndia handle, PM Modi said the government has worked towards the direction of empowering millions.

“Ours is a Government committed to boosting ‘Ease of Living’ and this thread below gives examples of how we have worked in that direction. Our reform trajectory will continue with even more vigour in the coming times,” the Prime Minister stated.

The MyGovIndia handle posted that the real test of reform is whether it reduces stress for people.

“2025 marked a clear shift in governance, with reforms focused on outcomes, not complexity. Simpler tax laws, faster dispute resolution, modern labour codes, and decriminalised compliance reduced friction for citizens and businesses alike. The emphasis was on trust, predictability, and long-term growth, showing how well-designed policy can quietly improve everyday life,” it wrote on the social media platform.

For millions of Indians, tax relief became real. Incomes up to Rs 12 lakh attract zero tax. Middle-class families now retain more of what they earn, giving them flexibility to spend, save and invest with greater confidence.

“A new tax law for a New India. Replacing the 1961 Income-tax Act, the Income Tax Act, 2025 streamlines compliance and brings clarity, transparency, and fairness to the direct tax system, making it more taxpayer-friendly and aligned with today’s needs,” it further stated.

Small businesses can now grow without fear of losing benefits. Higher investment and turnover limits allow MSMEs to expand while retaining access to loans and tax incentives. This encourages scaling up, hiring more workers, and building stronger local enterprises, according to MyGovIndia.

Twenty-nine labour laws were simplified into four clear codes covering wages, safety, social security, and relations. Rights are clearer, compliance is easier, and women benefit from assured maternity and workplace protections, it added.

With streamlined tax slabs, easier registration, automated processes, and faster refunds, the next generation of GST reforms is improving the ease of doing business

“The impact is clear in record Diwali sales of Rs 6.05 trillion and the strongest Navratri shopping in over a decade,” it noted.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report