Business

April oilmeal exports up 10% Year on Year, overall Q1FY23 exports seen lower

India’s oilmeal exports for the month of April 2022 were provisionally reported at 333,972 tonne as compared to 303,705 tonne in the same month of 2021 i.e, a rise of 10 per cent year-on-year, data compiled by Solvent Extractors’ Association of India showed on Wednesday.

Residues after the extraction of oil from oilseeds are called oilmeals and are widely used as livestock feed.

The rise in overall oilmeal in April was due to huge export of rapeseed meal, which shipped out around 229,207 tonne as compared to 93,984 tonne in the previous month, the association said.

Country-wise, during April, South Korea imported 142,208 tonne of oilmeals, Vietnam imported 62,979 tonne of oilmeals, Thailand imported 41,992 tonne of oilmeals, Bangladesh sourced rapeseed meal and rice bran extraction from India and imported 33,422 tonne of oilmeals, and Taiwan imported 13,191 tonne of oilmeals.

2021-22 was downturn for the export of oil meals and it came down to 23.8 lakh tonne from 36.8 lakh tonne in previous year; value-wise earning was down nearly 37 per cent Rs 5,600 crore from Rs 8,900 crore in 2020-21.

In the current year 2022-23, the performance during the first quarter (April-June) is likely to be lower as in case of soybean meal, India is totally out priced in the international market due to the high price of soybean in the domestic market, it said.

“Current price of soybean meal afree on board’ at Kandla (port) quoted at $730, while soybean meal Argentina CIF Rotterdam quoted at $510 and Brazil at $505.”

Export of rapeseed meal, however, is likely to increase due to higher crushing and solvent extraction of rapeseed cake as a derivative.

India is likely to be the competitive supplier to South Korea, Vietnam, Thailand and other fareastern countries, the association further said.

Business

Union Cabinet approves Pune Metro Rail Project Phase 2 with Rs 9,857 crore outlay

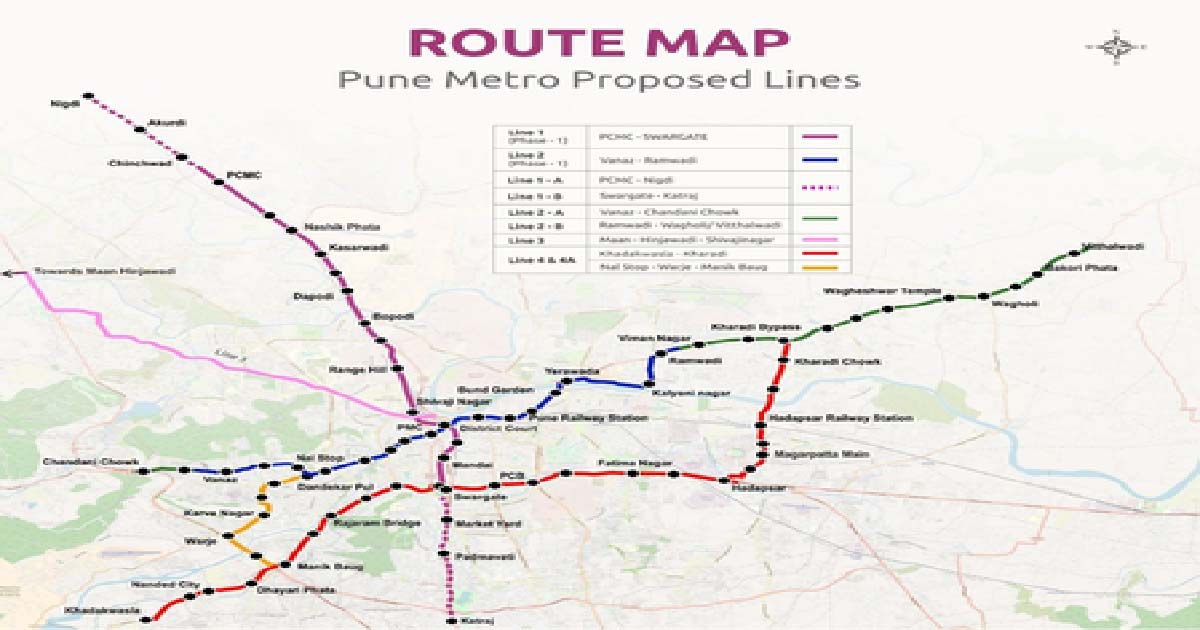

New Delhi, Nov 26: In a major boost for the public transport network in Pune, the Union Cabinet, chaired by Prime Minister Narendra Modi, on Wednesday approved Line 4 (Kharadi–Hadapsar–Swargate–Khadakwasla) and Line 4A (Nal Stop–Warje–Manik Baug) with Rs 9,857.85 crore outlay under Phase 2 of the Pune Metro Rail Project.

According to the Cabinet, this is the second major project approved under Phase-2, following the sanction of Line 2A (Vanaz–Chandani Chowk) and Line 2B (Ramwadi–Wagholi/Vitthalwadi). With this latest approval, Pune Metro’s network will expand beyond the 100-km milestone, a significant step in the city’s journey towards a modern, integrated, and sustainable urban transit system.

Spanning 31.636 km with 28 elevated stations, Line 4 and 4A will connect IT hubs, commercial zones, educational institutions, and residential clusters across East, South, and West Pune.

The project will be completed within five years at an estimated cost of Rs 9,857.85 crore, to be jointly funded by the Centre, the Maharashtra government, and external bilateral/multilateral funding agencies.

These lines are a vital part of Pune’s Comprehensive Mobility Plan (CMP) and will seamlessly integrate with operational and sanctioned corridors at Kharadi Bypass and Nal Stop (Line 2), and Swargate (Line 1).

“They will also provide an interchange at Hadapsar Railway Station and connect with future corridors towards Loni Kalbhor and Saswad Road, ensuring smooth multimodal connectivity across metro, rail, and bus networks,” a Cabinet communique said.

The project will be implemented by the Maharashtra Metro Rail Corporation Limited (Maha-Metro), which will carry out all civil, electrical, mechanical, and systems works.

Pre-construction activities such as topographical surveys and detailed design consultancy are already underway, according to the Cabinet.

According to projections, the daily ridership on Line 4 and 4A combined is expected to be 4.09 lakh in 2028, rising to nearly 7 lakh in 2038, 9.63 lakh in 2048, and over 11.7 lakh in 2058.

Of this, the Kharadi–Khadakwasla corridor will account for 3.23 lakh passengers in 2028, growing to 9.33 lakh by 2058, while the Nal Stop–Warje–Manik Baug spur line will rise from 85,555 to 2.41 lakh passengers over the same period.

These projections highlight the significant growth in ridership expected on Line 4 and 4A over the coming decades.

With Line 4 and 4A, Pune will not just get more metro tracks but will also gain a faster, greener, and more connected future. These corridors are designed to give back hours of commuting time, reduce traffic chaos, and provide citizens with a safe, reliable, and affordable alternative.

Business

Assam saw major drop in child marriage cases under BJP govt: CM Sarma

Guwahati, Nov 26: Assam Chief Minister Himanta Biswa Sarma on Wednesday underscored a “major turnaround” in the state’s battle against child marriage, saying a combination of stringent enforcement and systemic reforms has led to significant declines in the underage marriages and boosted legal accountability.

CM Sarma claimed that according to NFHS‑4 (2015-16) data, 31.8 per cent of women in Assam aged 20–24 were married before turning 18 – a rate that exceeded the national average.

Moreover, district-level fact sheets had recorded alarming prevalence in districts such as Dhubri, South Salmara, Barpeta and Nagaon, as high as 40–55 per cent.

However, the state now claims a decisive shift. Between 2023 and 2024 alone, more than 8,600 arrests were made in coordinated crackdowns under both the Protection of Children from Sexual Offences Act (POCSO) and the Prohibition of Child Marriage Act (PCMA).

According to the Chief Minister, in 2022 the number of cases registered stood at 224, sharply up from just 149 in 2021, indicating a steep rise in enforcement.

CM Sarma said, “Beyond arrests, Assam has formed district-level task forces, headed by superintendents of police, to track and intercept impending child marriages. Community-level workers – including ASHAs, Anganwadi staff and schoolteachers – are now required to report suspected cases in real time.”

“Several districts have also reportedly established digital databases and child-protection tracking mechanisms,” he added.

The CM claimed that these measures have borne fruit: In hotspot districts, the incidence of child marriage fell by 8–17 per cent within a year, and more than 3,000 planned child marriages were prevented in 2023–24 alone.

Notably, the Assam government’s recent actions – from sustained crackdowns to setting up institutional safeguards – reflect a far more aggressive stance on child marriage than seen in earlier years, when the practice was largely treated as a social issue rather than a crime.

Business

Revanth Reddy urges PM Modi to declare Bengaluru-Hyderabad as defence & aerospace corridor

Hyderabad, Nov 26: Telangana Chief Minister A. Revanth Reddy, on Wednesday, appealed to Prime Minister Narendra Modi to declare Bengaluru-Hyderabad as a defence and aerospace corridor.

The Chief Minister said this during the inauguration of the French aerospace major Safran’s largest MRO centre for the CFM International LEAP engines in Hyderabad.

The Chief Minister stated that declaring Bengaluru-Hyderabad as a defence and aerospace corridor will contribute to Viksit Bharat.

The Safran Aircraft Engine Services India (SAESI) facility at the GMR AeroPark (SEZ) near Shamshabad will be operational in 2026.

The Chief Minister congratulated Safran for choosing Hyderabad for a big investment and thanked it for its trust and continued partnership with Telangana.

He stated that this new facility marks an important milestone for Telangana’s growth in the aerospace and defence sector.

Revanth Reddy noted that this is the first-ever Maintenance, Repair and Overhaul (MRO) centre for LEAP engines in India. Set up with an investment of ₹1,300 crore, the centre will employ over 1,000 skilled technicians and engineers, while also generating new business opportunities for local MSMEs and precision engineering firms, he said.

He said that the foundation stone was also laid today for Safran’s M88 Military Engine MRO, which will support both the Indian Air Force and the Indian Navy.

The Chief Minister emphasised that Hyderabad has emerged as a major aerospace and defence hub, home to more than 25 major global companies and over 1,500 MSMEs. He added that Telangana’s progressive industrial and MSME policies are ranked among the best in India.

He said that Hyderabad’s world-class infrastructure, aerospace parks and SEZs continue to attract mega investments from leading global companies, making the city a top choice for highly complex precision engineering projects.

He noted that Hyderabad is already a preferred destination for companies such as Safran, Boeing, Airbus, Tata, and Bharat Forge for manufacturing and R&D activities, and has become one of India’s leading MRO and aero-engine hubs.

The Chief Minister highlighted that Telangana’s aerospace and defence exports doubled last year, reaching ₹30,742 crore in just nine months, surpassing the state’s pharma exports for the first time.

He also mentioned that Telangana has consistently won the Best State Award for Aerospace from the Ministry of Civil Aviation.

He underscored that skilling is a key factor in attracting aerospace investments. Telangana has upgraded 100 Industrial Training Institutes into Advanced Technology Centres in partnership with Tata Technologies, ensuring youth are job-ready for advanced manufacturing.

He added that the Young India Skills University is offering specialised training in aircraft maintenance and invited Safran to be a lead partner in aerospace and MRO skilling initiatives.

Reaffirming Telangana’s commitment to supporting partners like Safran with world-class infrastructure, the Chief Minister spoke about the upcoming Bharat Future City, being developed across 30,000 acres as a planned, fully green, net-zero global destination – India’s answer to New York, Tokyo, Dubai and Singapore.

He extended an invitation to the Prime Minister to attend the ‘Telangana Rising 2047 – Global Summit’ at Bharat Future City on December 8 and 9, where the state’s long-term vision will be unveiled. Telangana aims to become a $1 trillion economy by 2035 and a $3 trillion economy by 2047.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report