Crime

New India Co-operative Bank Row: EOW Detains GM Hitesh Mehta, Accused Of ₹122 Crore Embezzlement

Mumbai: The Economic Offences Wing (EOW) of Mumbai Police detained Hitesh Mehta, the General Manager of New India Cooperative Bank, on Saturday. Earlier in the day, Mehta was booked for allegedly embezzling Rs 122 crore from the bank. His arrest comes just two days after the Reserve Bank of India (RBI) imposed strict restrictions on the bank’s operations due to financial irregularities and liquidity concerns.

Mehta Booked For ₹122 Crore Embezzlement

The case was registered at Dadar Police Station following a complaint filed by Devarshi Shishir Kumar Ghosh, the bank’s Acting CEO. The FIR, lodged under relevant sections of the Bharatiya Nyay Sanhita (BNS), names Mehta as the prime accused, along with several of his colleagues, including officials serving as General Manager and Head of Accounts.

The accused are alleged to have misused their positions, conspired and siphoned off Rs 122 crore. Given the scale of the financial crime, the investigation was handed over to the EOW and will be supervised by DCP Mangesh Shinde, who handles banking-related offenses.

RBI Restrictions On Transactions

The RBI, after noticing severe financial distress within the bank, imposed restrictions to safeguard customer interests. These restrictions, effective from February 13, 2025, will remain in force for six months. During this period, customers are barred from withdrawing money from their savings, current, or any other accounts. However, certain payments such as employee salaries, rent, and electricity bills will still be allowed. Additionally, the bank is prohibited from selling any assets during this time. The RBI’s intervention aims to assess whether the bank has sufficient funds and to prevent further financial instability.

The imposition of restrictions triggered panic among depositors, leading to chaotic scenes at various bank branches. Customers rushed to withdraw their funds but were met with refusal, heightening concerns about their savings. The situation underscores the growing scrutiny of cooperative banks and their financial health, with authorities now focusing on holding those responsible accountable.

Crime

मुंबई के पायधोनी में करोड़ों रुपये के ड्रग्स के साथ 9 आरोपी गिरफ्तार, इनमें 3 महिला तस्कर भी शामिल

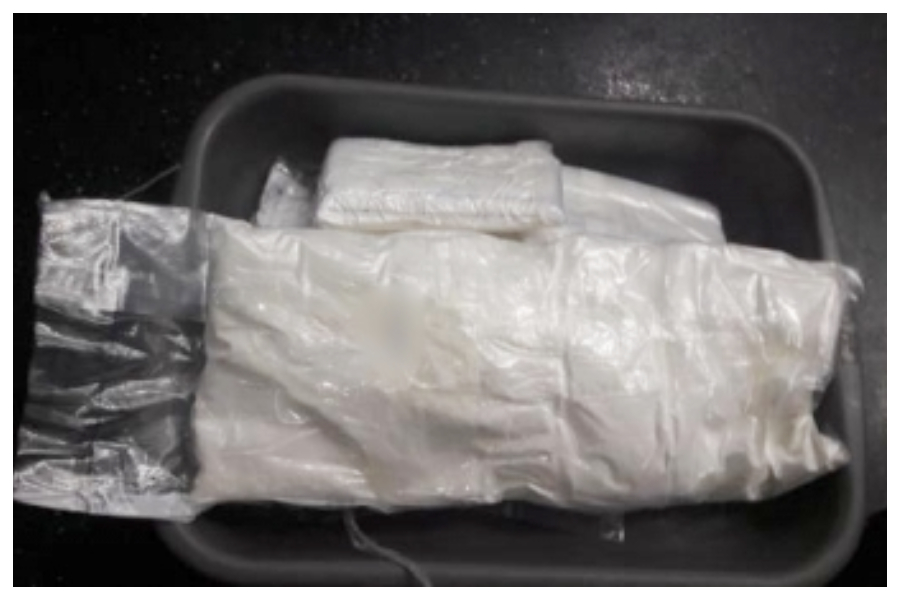

मुंबई : ड्रग्स के खिलाफ एक बड़े ऑपरेशन में, पायधोनी पुलिस ने 1 करोड़ रुपये से ज़्यादा की हेरोइन ज़ब्त करने और दो पुरुष और दो महिला ड्रग पेडलर को गिरफ्तार करने का दावा किया है। जानकारी के मुताबिक, 16 दिसंबर को दोपहर 2:30 बजे पायधोनी पुलिस स्टेशन की सीमा में पी.डी.मेलो रोड पर एक सर्च के दौरान, 37 साल के राम नटवर ठक्कर और 27 साल के वसीम सैयद के पास से 326 ग्राम से ज़्यादा हेरोइन बरामद की गई। आरोपियों को गिरफ्तार कर लिया गया और उन पर एनडीपीएस एक्ट के तहत मामला दर्ज किया गया। जांच के दौरान, आरोपियों ने बताया कि वे ड्रग्स कहां से लाए थे। उसके बाद, पुलिस ने 30 साल की रुबीना सैयद को गिरफ्तार किया। उसने बताया कि वह शबनम शेख के संपर्क में थी। उसे राजस्थान के अजमेर से गिरफ्तार किया गया। जब यह पता लगाने के लिए जांच की गई कि इन दोनों महिलाओं ने ड्रग्स कहां से हासिल किए थे, तो शबनम शेख को ड्रग्स बेचने वाले व्यक्ति, मुस्कान समीउल्लाह शेख 19 साल को मस्जिद बंदर इलाके से गिरफ्तार किया गया। पुलिस को जानकारी मिली थी कि अब्दुल कादिर शेख और मेहरबान अली मुस्कान को ड्रग्स सप्लाई करने आ रहे हैं, जिस पर पुलिस ने जाल बिछाकर अब्दुल कादिर को गिरफ्तार कर लिया। उसके पास से ड्रग्स भी बरामद हुए। जोगेश्वरी में उसके घर की तलाशी के दौरान नवजीत गुलाबी खान, शारिक सलमानी, समद गुलाबी के पास हेरोइन मिली। उनके पास से कुल 33 करोड़ से ज़्यादा कीमत के ड्रग्स ज़ब्त किए गए। इस ऑपरेशन में पुलिस ने तीन महिलाओं और 6 पुरुषों को गिरफ्तार किया और करोड़ों रुपये के ड्रग्स ज़ब्त किए। यह ऑपरेशन मुंबई पुलिस कमिश्नर देविन भारती के निर्देश पर डीसीपी विजय सागरे ने किया।

Crime

Family members of Unnao rape survivor, activists protest outside Delhi HC against Sengar’s bail

New Delhi, Dec 26: The family members of the Unnao rape survivor, along with women’s rights activists, on Friday staged a protest outside the Delhi High Court against the suspension of the sentence of Kuldeep Sengar, who was convicted in the Unnao rape case. The demonstrators raised slogans and expressed anger over the court’s decision to grant him conditional bail.

Protesters gathered near the court premises, holding placards and chanting slogans such as “Peedit rahe asurakshit aur balatkari kare aish? Humein nahi manzoor,” in support of the survivor and demanding strict action against the convicted former MLA. The protesters said the decision had “shaken public faith and sent a wrong message regarding crimes against women”.

Speaking to Media, the survivor’s mother said she still had faith in the justice system and the Supreme Court.

“If the Public Prosecutor stands with me and supports my lawyer, and if the CBI Public Prosecutor also takes a firm stand, there is hope. Honestly, I do not have much faith in the CBI, but I do have faith in the Public Prosecutor. I trust the Supreme Court and will keep knocking on its doors,” she said.

She further added that the bail should be cancelled and demanded the strictest punishment for the guilty.

“Any MLA, irrespective of religion or caste, who commits such a crime against a girl or a minor should be given capital punishment. That is all we want. I believe we will get justice,” she said.

Social activist Yogita Bhayana also criticised the system, stating that the survivor had been failed at multiple levels.

“First, she was raped and then gang-raped by a powerful person. It was not an ordinary criminal, but someone with influence. When a powerful person is involved, the system is often manipulated. It is very unfortunate that someone like Mr Sengar, who was extremely powerful, managed to get relief,” she said.

Bhayana added that activists would continue their fight for justice.

“We are seeking relief, and we should get it. If we do not get relief here, we will approach the Supreme Court,” she said.

The Delhi High Court on Tuesday suspended the jail sentence of Sengar.

A bench comprising Justices Subramonium Prasad and Harish Vaidyanathan Shankar granted him bail, directing him to furnish a personal bond of Rs 15 lakh along with three sureties of the same amount.

Crime

Mumbai Crime: Malwani Doctor Arrested For Allegedly Molesting Minor Girl In Clinic; Unauthorised Practice Suspected

Mumbai: The Malwani police have arrested a 44-year-old doctor following allegations of sexual abuse and molestation involving a 12-and-a-half-year-old girl. The incident reportedly took place within the confines of his clinic during a medical examination, sparking concerns over patient safety and the legitimacy of the practitioner’s medical credentials.

The victim, a resident of the local area, had visited the clinic alone to seek treatment for a lip fracture. , the doctor, a resident of Kandivali who has operated the Malwani-based clinic for several years, allegedly exploited the situation.

The minor alleged that during the procedure, the doctor instructed her to lie down and proceeded to touch her inappropriately. The victim reported experiencing severe mental distress and embarrassment following the encounter, which led to the formal complaint.

Upon receiving the complaint, Police Sub-Inspector Shivaji Mohite registered the initial First Information Report. The case was later handed over to Assistant Police Inspector Prashant Mundhe, who led the investigation and moved to take the accused into custody. According to the report, the 44-year-old has been booked under relevant sections of the Bharatiya Nyaya Sanhita (BNS) and Sections 10 and 12 of the Protection of Children from Sexual Offences (POCSO) Act.

Beyond the criminal charges of assault, the investigation has expanded into the doctor’s professional background. Initial inquiries revealed that while the accused holds a degree in acupuncture, he was allegedly performing a wide range of medical treatments for which he may not have been authorized. Police officials stated that they are currently in the process of verifying all degrees and certificates displayed at the clinic to determine if the accused was practicing medicine beyond his legal scope. The accused was produced before the sessions court on December 24.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report