Business

PhonePe Payment Gateway helps small, medium businesses save upto Rs 8 lakhs

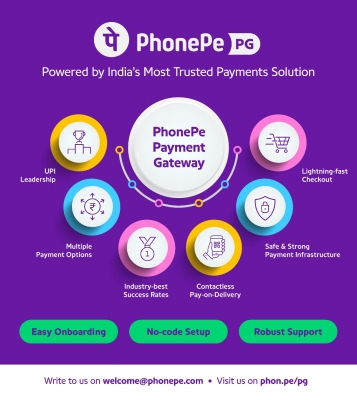

Leading fintech company PhonePe on Wednesday announced that its Payment Gateway enables small and medium businesses to save up to Rs 8,00,000.

While most payment gateways charge a standard transaction fee of 2 per cent, the PhonePe Payment Gateway has a special offer for new merchants to onboard for free, with no hidden charges, setup fees, or annual maintenance fees. For instance, if businesses with a monthly sales volume of Rs 1 crore choose the PhonePe Payment Gateway for free, they could potentially save around Rs 2 lakh per month.

With this limited-period offer from PhonePe Payment Gateway, businesses across India that join the platform can save up to Rs 8 lakh. This straightforward and transparent pricing helps merchants enhance their payment experience seamlessly, allowing them to invest the savings from onboarding costs into growing their businesses.

Talking about the true potential of PhonePe Payment Gateway, Suman Patra, Co-Founder, FlowerAura & Bakingo said: “As an e-commerce business, it is important to have a reliable payment gateway partner and we are happy to have PhonePe Payment Gateway as our growth partner because of their legacy and experience. PhonePe has helped us improve the customer experience, reduce drop-offs, and increase the overall success rate of payments. PhonePe’s smooth onboarding process and excellent merchant support have been key factors in our decision to continue working with them”.

PhonePe is already a market leader in UPI with over 50 per cent market share by value. The company’s ability to handle large-scale transactions and the strong consumer trust in the platform have translated into PhonePe launching its Payment Gateway business to provide the best-in-class payment experience to consumers and merchants alike.

The ease of use to enhance merchant experience which includes effortless integration, digital self-onboarding, and a seamless checkout experience for customers is making the PhonePe Payment Gateway a preferred choice among businesses and MSMEs across the country.

Nishchay AG, Co-Founder & CEO at Jar shares his experience of working with PhonePe Payment Gateway’s best-in-class payment experience: “When we started Jar, we were clear from day one that we wanted PhonePe as our payment partner because of its reach and responsiveness. PhonePe’s massive distribution network makes it a lot easier for us because users are already UPI-ready.

“The Payment Gateway team at PhonePe has been very collaborative throughout and has been working together to continuously improve the overall systems, which has resulted in higher success rates for us.”

Moreover, the company said that the PhonePe Payment Gateway is reliable and ensures 100 per cent uptime for merchants and comes with industry-best success rates. It proactively detects downtimes and ensures stable success rates of transactions with real-time instrument health-tracking capability.

The PhonePe Payment Gateway is also preferred by merchants as it comes with a hassle-free, no-code setup for effortless integration across all platforms. PhonePe helps its merchant partners and businesses to accept online payments across Android, iOS, mobile web, and desktop.

The PhonePe Payment Gateway is in compliance with RBI Laws to securely store customers’ tokenised cards in the PhonePe Card Vault after taking consumer consent.

Business

Indian rupee likely to bounce back strongly in 2nd half of next fiscal: SBI report

New Delhi, Dec 17: Geopolitical uncertainties driven by the delay in the India-US trade deal have been the single-most important reasons for the rupee sliding against the US dollar, an SBI Research report said on Wednesday, adding that the rupee is likely to bounce back strongly in the second half of the next fiscal.

India’s trade data shows the remarkable resilience in navigating through prolonged uncertainty, more protectionism and labour supply shocks.

“While the geopolitical risk index has moderated since April 2025, the current average value of the index for April-October 2025 is much greater than its decadal average, which indicates how much pressure global uncertainties are exerting on INR,” State Bank of India’s (SBI) Group Chief Economic Advisor, Dr Soumya Kanti Ghosh, said.

Dr Ghosh further stated that consistent with their empirical analysis, “the rupee is currently in a depreciating regime and is likely to exit it”.

After breaching the psychologically important mark of 90 per US dollar, the rupee crossed the 91-level on Tuesday.

However, the rupee staged a sharp recovery on Wednesday, trading as strong as 90.25 during the day, as the cooling of crude prices also contributed to improved sentiment.

According to the SBI report, the data also indicates that the current fall is the quickest (in terms of number of days) of the rupee, scaled to 5 per USD. In less than a year, the rupee has slid from 85 to 90 per dollar.

The current slide appears to be primarily driven by FPI outflows, chiefly equities (after two years of robust inflows) and uncertainty regarding the US-India trade deal.

Since April 2, 2025, when the US announced sweeping tariff hikes across economies, the Indian rupee (INR) has depreciated by 5.7 per cent against USD (most amongst the major economies), notwithstanding sporadic phases of appreciation owing to optimism over the US-India trade deal.

“While INR is the most depreciated currency, it is not the most volatile. This clearly indicates that the 50 per cent tariff imposed on India is one of the major factors behind the current phase of rupee depreciation,” the SBI report noted.

Business

Indian markets hit fresh highs in November, outshine global peers: Report

Mumbai, Dec 17: Indian equity markets touched fresh all-time highs in November and clearly outperformed global markets, a new report said on Wednesday.

The data compiled by PL Asset Management said India emerged as a bright spot at a time when many global markets struggled due to weak technology stocks, fading enthusiasm around artificial intelligence and soft economic data from China.

The report noted that record-low inflation, steady domestic growth and reasonable valuations improved the overall outlook for investors.

“While global markets remained uneven, India benefited from strong local demand, supportive liquidity and a predictable policy environment,” the report said.

Inflation played a major role in boosting market sentiment during the month. Consumer price inflation fell sharply to just 0.25 per cent, the lowest level on record and far below the Reserve Bank of India’s target of 4 per cent.

This sharp fall strengthened expectations of further interest rate cuts, which supported equity valuations. Reflecting confidence in the economy, the RBI raised its GDP growth forecast for FY26 to 7.3 per cent.

India also recorded strong GDP growth of 8.2 per cent in the second quarter of FY26, reinforcing its position as the fastest-growing major economy in the world, the report said.

Domestic economic indicators remained healthy despite global challenges. Manufacturing activity stayed strong, even though exports were slightly affected by tariffs.

Goods and Services Tax collections remained robust at Rs 1.70 lakh crore, as per the report.

Festive season spending also supported growth. In addition, India’s current account deficit improved to 1.3 per cent of GDP.

Global markets, meanwhile, showed signs of fatigue. US technology stocks faced profit booking, China and Hong Kong markets weakened due to poor economic data, and investors turned to precious metals for safety.

Crude oil prices softened amid expectations of interest rate cuts by the US Federal Reserve. Against this global backdrop, India’s stable fundamentals helped it continue to outperform.

Siddharth Vora, Head – Quant Investment Strategies & Fund Manager, PL Asset Management, said, “Indian markets continue to demonstrate relative resilience at a time when global risk assets are undergoing a phase of recalibration.”

Business

Centre releases over Rs 260 crore for rural local bodies in Kerala

New Delhi, Dec 15: The government on Monday said it has released Rs 260.20 crore to rural local bodies in Kerala as part of the 15th Finance Commission grants for the financial year 2025-26.

The amount represents the first instalment of untied grants and covers all 14 district panchayats, 152 block panchayats and 9,414 gram panchayats (GPs) in the state, according to an official statement.

Untied grants are meant to be utilised by rural local bodies/PRIs for location-specific felt needs under the 29 subjects listed in the Eleventh Schedule of the Constitution, except for salaries and other establishment expenditures.

Tied Grants, on the other hand, are earmarked for basic services relating to sanitation and maintenance of ODF (open defecation-free) status, including management and treatment of household waste, human excreta and faecal sludge, and supply of drinking water, rainwater harvesting, and water recycling.

Last week, the government released Rs 717.17 crore to strengthen rural local bodies in Maharashtra as part of the first instalment of untied grants for the financial year 2025-26. The funds were released to duly elected and eligible rural local bodies in the state, covering two district panchayats (Zilla Parishads), 15 block panchayats (panchayat samitis), and 26,544 gram panchayats.

The government, through the Ministry of Panchayati Raj and the Ministry of Jal Shakti (Department of Drinking Water and Sanitation), recommends release of 15th Finance Commission grants to states for Panchayati Raj Institutions, which are then released by the Ministry of Finance.

The allocated grants are recommended and released in two instalments in a financial year.

Earlier in November this year, the Centre released over Rs 223 crore for rural local bodies in Assam and another Rs 444.38 crore to strengthen panchayat bodies in Odisha as part of the 15th Finance Commission grants.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report