Business

Markets Continue To Trade In Red; Sensex & Nifty Decline Further

The Indian markets opened flat on Monday, with Sensex at 79,571.37, down by 77.55 points or 0.10 per cent, and Nifty at 24,320.50, also down by 26.50 points or 0.11 per cent.

Nifty Bank in the morning session was trading low at 50,483.90, down by 94.05 points or 0.19 per cent.

From the Sensex pack, ICICI Bank, NTPC and Kotak Bank were among the major gainers in the morning session, whereas HDFC Bank, Asian Paints and Titans were among the laggards.

From the Nifty tranche, Apollo Hospital, ICICI Bank and Axis Bank were among the gainers, while Shriram Finance, BPCL and Tata Motors were among the losers.

The Indian rupee opened at 83.96 against the dollar.

Markets on Monday

The stock markets ended Friday on a lower note for both the BSE Sensex and the NSE Nifty.

On Monday, August 12, the BSE Sensex decreased by 25.46 points or 0.03 per cent, ending the day at 79,680.45. Similarly, the NSE Nifty dropped by 20.50 points or 0.08 per cent to close at 24,347.00.

Gainers and Losers

Gainers: On the BSE tranche, at the time of writing, major gainers included Axis Bank, JSW Steel and Infosys with gains of over 1 per cent. Voltas made mammoth gains of 10.40 per cent.

Losers: Amongst the losers, NTPC, Power Grid and Adani Ports made gains of over 1 per cent.

Energy and International Markets

U.S. West Texas Intermediate crude (WTI) decreased by 0.90 per cent to USD 79.34 a barrel at 09:08 IST. Brent crude prices also decreased by 0.92 per cent to USD 81.54 a barrel at 09:08 IST.

On Monday, both the S&P 500 and Nasdaq saw a collective jump in their numbers, meanwhile, Dow Jones Industrial Average also saw a drop its value.

The S&P 500 closed at 5,344.39, gaining 0.0043 per cent. The Dow Jones Industrial Average ended at 39,357.01, gaining 0.36 per cent.

Additionally, the Nasdaq Composite saw a rise of 0.21 per cent to reach 16,780.61.

The Asian indices started in Green, while Japan’s Nikkei 225 index gained 2.17 per cent to reach 35,785.55, at the opening of the day’s trade. Hong Kong’s Hang Seng index rose by 0.23 per cent to reach 17,150.75 points. South Korea’s KOSPI observed a drop in its numbers, as it decreased by 0.048 per cent to reach 2,617.05.

Business

IndiGo Crisis Day 7: Mumbai Feels The Heat As Week-Long Flight Issues Deepen Nationwide; 32 Cancellations Reported Today

Mumbai: air travel schedule remained heavily disrupted on Monday as IndiGo’s nationwide operational meltdown stretched into its seventh straight day, causing widespread cancellations across major Indian airports. While the crisis has affected passengers throughout the country, Mumbai, one of IndiGo’s busiest hubs, continued to witness major cancellations that derailed travel plans from early morning.

By 7 am, Mumbai’s Chhatrapati Shivaji Maharaj International Airport had recorded 32 IndiGo cancellations, 10 arrivals and 22 departures, impacting key routes to Chandigarh, Nagpur, Bengaluru, Hyderabad, Goa, Darbhanga, Kolkata and Bhubaneswar. Airport officials said the ripple effect of the disruptions was expected to continue through the day, adding to the nationwide tally of 309 flights impacted by Monday morning.

Across India, more than 224 cancellations were pre-planned and communicated to passengers, officials confirmed, as the airline attempted to manage the crisis strategically. IndiGo had reportedly begun processing 100 per cent refunds for passengers booked up to December 6, even as fresh cancellations continued to pile up.

Delhi’s Indira Gandhi International Airport reported the highest number of disruptions, with 134 IndiGo flights cancelled, 75 departures and 59 arrivals, making it the epicentre of the crisis. In response, the airport issued a public advisory urging passengers to check real-time flight status before heading out. Authorities said they were coordinating with airline teams to minimise chaos inside terminals.

Bengaluru’s Kempegowda International Airport confirmed 127 cancellations, 65 arrivals and 62 departures. Officials said the next status update would be provided later in the evening. Hyderabad’s Rajiv Gandhi International Airport recorded 77 disruptions, splitting between 38 arrivals and 39 departures.

At Srinagar Airport, 16 flights (8 arrivals and 8 departures) were cancelled, while Ahmedabad reported 18 cancellations by 8 am. Passenger crowds were also reported at terminals in Chennai, Jaipur and Mumbai, where many travellers waited for updates amid confusion.

Amid the escalating crisis, aviation regulator DGCA granted IndiGo CEO Pieter Elbers and COO Isidro Porqueras a one-time extension until 6 pm Monday to respond to the show-cause notice issued on December 6. The airline sought extra time citing “operational constraints linked to the scale of nationwide disruptions.” The DGCA, however, warned that no further extension will be granted, and said it would proceed ex parte if the reply is not submitted on time.

Business

Sensex, Nifty open lower amid lack of domestic triggers

Mumbai, Dec 8: Indian stock markets started the week on a weak note on Monday as benchmark indices opened lower in the absence of strong domestic cues.

The Sensex slipped by 93 points, or 0.11 per cent, to trade around 85,619. The Nifty also drifted lower and was seen at 26,137, down 50 points or 0.19 per cent.

Analysts said that Nifty is expected to trade within a defined range today, with near-term resistance placed around 26,300-26,350, where profit-booking may emerge.

“On the downside, support is seen around 26,000-26,050, a zone that has held firm through recent consolidation,” experts said.

Several heavyweight stocks dragged the indices in early trade. Shares of Bajaj Finance, BEL, NTPC, Asian Paints, Power Grid, Trent, Sun Pharma, and ICICI Bank were among the biggest losers on the Sensex.

At the same time, some major technology and auto names helped limit the downside. Eternal, Tech Mahindra, TCS, Tata Motors PV, Infosys, HCL Tech and Tata Steel were the top gainers.

The broader market also showed signs of pressure. The Nifty MidCap index slipped 0.12 per cent, while the Nifty SmallCap index fell more sharply, declining 0.40 per cent.

Sector-wise, real estate, public sector banks, and pharmaceutical stocks were under the most selling pressure, with the Nifty Realty, PSU Bank, and Pharma indices falling between 0.3 per cent and 0.5 per cent.

On the other hand, the Nifty IT index managed to rise 0.5 per cent, supported by gains in large tech stocks. The Nifty Metal index also inched up by 0.2 per cent.

Analysts said that the market mood remained cautious in early trading as investors awaited fresh triggers to set the direction for the day.

“Given the prevailing conditions, a buy-on-dips strategy remains appropriate. Traders may consider adding long positions if Nifty pulls back toward 26,000-26,050 or if Bank Nifty finds stability above 59,400,” market watchers added.

Business

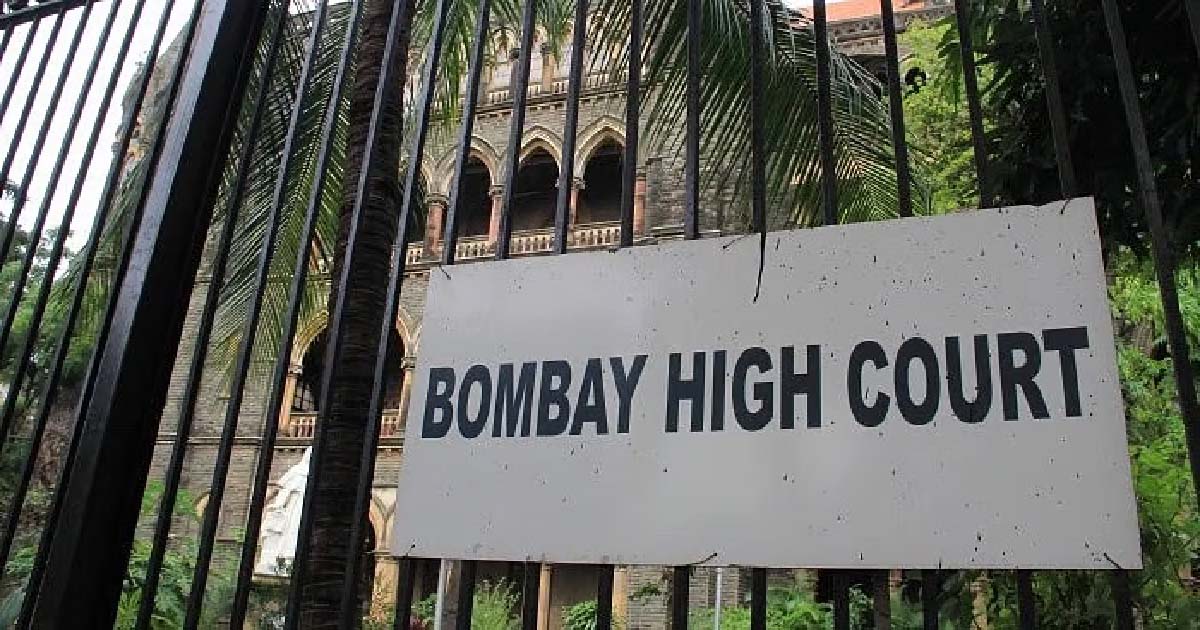

Nescafé Premix Qualifies As ‘Instant Coffee’, Attracts Lower 8 Per Cent Sales Tax: Bombay HC

Mumbai: In a significant ruling on product classification under the Bombay Sales Tax Act, 1959, the Bombay High Court has held that Nescafé Premix must be taxed at 8% as “coffee / instant coffee,” and not at the higher rate of 16% applicable to general beverage powders.

A bench of Justices M. S. Sonak and Advait Sethna reiterated the cardinal principle that specific tax entries must prevail over general ones. Applying the common parlance test, the court concluded that Nescafé Premix, as marketed and consumed, had created a clear perception of “instant coffee”.

The case arose from a dispute between Nestlé India Ltd. and the Sales Tax Department regarding whether Nescafé Premix — containing 8.5% soluble coffee powder, 54% sucrose, 37% partially skimmed milk powder and 0.5% maltodextrin — should be classified under Schedule Entry C-II-3 (8%) or Entry C-II-18(2) (16%).

The Commissioner of Sales Tax had earlier ruled in 1998 that the product fell under the higher-taxed general entry for powders used in non-alcoholic beverages, emphasising that the coffee content was “minuscule 8.5%”.

The Maharashtra Sales Tax Tribunal reversed this decision in 2001, holding that ingredient percentage was not decisive — relying on Supreme Court precedent that even small quantities, like salt in food, do not alter the essential character of the final product.

Upholding the Tribunal’s order, the HC stressed that the product’s actual use and consumer understanding were crucial. “Ultimately, in all such matters, we must go by the common parlance test,” the bench said.

It noted that the premix was expressly marketed as Nescafé Premix and used to dispense Nescafé from vending machines simply by adding hot water. “The resultant product, in common parlance, was nothing but Nescafé,” the Court observed.

Rejecting the Department’s argument that low coffee content disqualified it from being considered instant coffee, the Court agreed with the Tribunal that removing coffee powder altogether would fundamentally change the product’s identity — demonstrating that the coffee component, though proportionally small, was determinative of classification.

The bench also emphasised that Entry C-II-3, covering “coffee” and “instant coffee”, was a specific entry and therefore prevailed over the general entry for beverage powders under C-II-18(2). “The concept of instant coffee must conform to modern development and modern perceptions,” the Court added.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report