Business

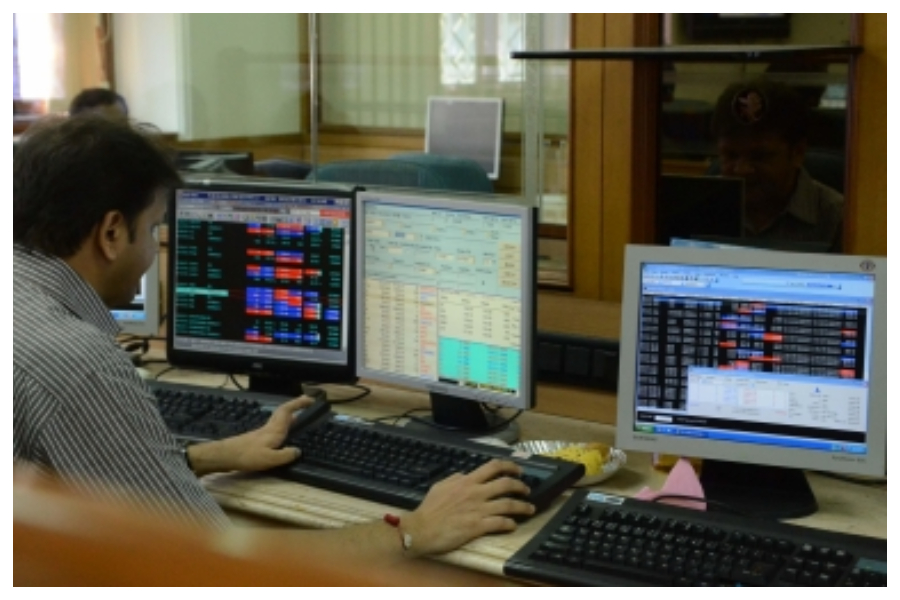

Indices decline in opening deals, RBI policy meet in focus

Domestic equity benchmark indices declined during early trade on Monday, weighed mainly by FMCG, IT and media stocks.

Even as the Reserve Bank of India is likely to raise policy rates in the monetary policy review meeting beginning on Monday, investors, however, await the actual degree of percentage hike before taking fresh positions in the markets.

Investors also await other macro economic forward looking guidances from the the central bank.

At 9.44 a.m., Sensex was 0.7 per cent down at 55,397 points, whereas nifty 0.6 per cent down at 16,489 points.

“For India elevated crude prices and a $23 billion trade deficit in May are areas of concern. Even though FPI selling has come down in early June they are likely to sell more at higher levels,” said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

“The US dollar index above 102 is negative for emerging markets equity. The positive factor for India is that the domestic institutional investors and retail investors consistently buying the dips.”

Besides, Asian shares made a muted start on Monday as caution gripped ahead of a critical reading on the US inflation, while the euro gained on the yen amid risk the European Central Bank will take a major step toward policy tightening this week, said Deepak Jasani, Head of Retail Research, HDFC securities.

Business

Gold prices slide 1 pc on MCX as Fed Rate cut hopes fade

Mumbai, Nov 24: Gold prices fell sharply on Monday as weak chances of a US Federal Reserve rate cut and easing geopolitical tensions weighed on investor sentiment.

A stronger US dollar also added pressure on the precious metal.

On the Multi Commodity Exchange (MCX), gold December futures dropped 1 per cent to Rs 1,22,950 per 10 grams.

Silver followed the trend, with December futures falling 0.61 per cent to Rs 1,53,209 per kg in early trade.

“In INR gold has support at Rs1,23,450-1,22,480 while resistance at Rs1,24,750-1,25,500,” analysts said.

“Silver has support at Rs1,53,050-1,52,350 while resistance at Rs1,55,140, 1,55,980,” they added.

Analysts said gold currently lacks any strong positive trigger to maintain its previous gains.

The latest US job market data reduced expectations of a 25-basis-point rate cut by the Federal Reserve in December, which has been a key reason behind the correction in prices.

The strong economic data pushed the US dollar index to nearly a six-month high on Friday.

The index remained above the 100 level on Monday, making gold more expensive for buyers holding other currencies and restricting demand.

Geopolitical concerns have also eased in recent days, further reducing gold’s safe-haven appeal.

Experts believe the combination of a stronger dollar, uncertainty over US tariff decisions, developments in the Russia-Ukraine conflict, and the upcoming Fed policy announcement may keep gold prices volatile in the near term.

Some market analysts expect further correction and advise investors to stay cautious before making fresh purchases.

Gold is attempting to reclaim momentum as prices hover near $4,100, driven by growing expectations of a December Fed rate cut, now priced at 71 per cent probability after dovish hints from officials like Miran and Williams.

“Bullion has been choppy over the past three sessions, reflecting traders’ indecision, but with rate-cut bets rising and geopolitical risks lingering, dips in gold are likely to attract renewed buying interest in the coming week with next resistance seen around 125000 and support near 122000,” experts added.

Business

New labour codes to boost formalisation, gender parity of India’s workforce: Industry leaders

New Delhi, Nov 22: India’s top industry bodies and staffing leaders on Saturday labelled the implementation of the Four Labour Codes a landmark step toward formalising the workforce, expanding social security, and aligning India’s labour framework with global standards.

The India Electronics & Semiconductor Association (IESA) said the reforms would significantly benefit the high-technology sectors by enhancing workforce stability, improving safety standards, and enabling labour flexibility with social protection.

“Mandatory appointment letters, universal minimum wages, and pan-India social security coverage (including ESIC expansion) ensure greater formalisation. This strengthens worker confidence — critical for skill-intensive manufacturing such as fabs, ATMP, component manufacturing and design centres,” said Ashok Chandak, President, IESA and SEMI India.

Provisions for fixed-term employment, faster dispute resolution, single licensing, and simplified compliance directly support the scaling of high-tech manufacturing clusters, the statement said.

Meanwhile, parity of benefits for Fixed-Term Employees (FTE) and expanded social security protections ensure a balanced, worker-centric ecosystem, he added.

Sachin Alug, CEO of NLB Services, a technology and digital talent provider, said the reforms were long overdue for India’s gig economy and will offer protection to a fast-growing but previously unorganised workforce.

The new laws are also expected to promote gender parity in the workforce by opening doors to wider opportunities across diverse sectors. Additionally, other groups such as”

He also pointed out that new laws will promote gender parity and contract workers, youth workers, and fixed-term employees will benefit from clearer working-hour norms, expanded social security, minimum wage protections, and health benefits.

“By simplifying compliance and unifying the regulatory framework, the codes can significantly expand formal employment, bringing millions of workers, especially in industries that rely on contract, temporary, and project-based roles, into the fold of structured, protected work,” said Balasubramanian A, Senior Vice President, TeamLease Services.

“National floor minimum wage creates a consistent benchmark across states and is an important step in India’s evolution from a minimum-wage economy to a living-wage economy,” he noted.

Suchita Dutta, Executive Director of Indian Staffing Federation (ISF), said the codes simplify compliance for employers, reduce regulatory burdens, and foster a more flexible hiring environment — crucial for the staffing industry, which has long advocated for such changes to unlock formal job creation.

The government, on November 21, implemented the Four Labour Codes — the Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and Occupational Safety, Health and Working Conditions (OSHWC) Code (2020) — repealing and rationalising 29 existing central labour laws.

Business

Nifty, Sensex continue rally for second week despite FII outflows

Mumbai, Nov 22: Indian equity benchmarks made marginal gains for the second week, supported by stronger second quarter (Q2) earnings, easing inflation and optimism around the India-US trade negotiations.

Benchmark indices Nifty and Sensex edged higher 0.68 and 0.50 per cent during the week to close at 26,068 and 85,231, respectively.

Analysts said that a moderation in FII selling due to expectations of earnings upgrades in H2 FY26 also supported the rally. However, markets turned volatile on Friday amid weak global cues. The Nifty fell after failing to cross its previous all-time highs of 26,277, ending its two-day advance.

Broader indices underperformed, with the Nifty Midcap100 and Smallcap100 ending the week down 0.76 per cent and 2.2 per cent, respectively.

Though IT stocks faced selling pressure due to weakness in the US tech shares, it was the biggest weekly gainer. Nifty Auto and Services followed as the secoral gainers during the week. On Friday, metals and realty were the worst hit, both dropping over 2 per cent, followed by PSU banks, financial services and media.

A better-than-expected non-farm payroll dimmed hopes of a US Federal Reserve rate cut in December putting pressure on global equities. Resultantly gold also witnessed selling pressure while INR declined to a new low.

The oil prices declined due to the US’s renewed push for a Russia-Ukraine peace proposal.

“The market may witness some profit booking in the near term if the pressure on Indian rupee persists. In the week ahead, investors will also have a close vigil on trade developments and economic data like IIP and Q2 FY26 GDP data to get the market direction,” said Vinod Nair, Head of Research, Geojit Investments Limited.

Analysts said that they expect markets to remain firm next week supported by buying on dips, improving demand outlook in Q3 and resilient flows.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report