National News

Centre extends Covid containment measures till Sep 30

The Ministry of Home Affairs (MHA) on Saturday extended the existing Covid-19 enforcement of containment measures till September 30 and asked the state governments and union territory administrations to strictly follow the earlier directions issued by the MHA and Union Health & Family welfare.

In an order issued by the Union Home Secretary Ajay Bhalla Saturday, the Ministry said, “In the exercise of powers, conferred under the Disaster Management Act, 2005, the undersigned hereby directs that the order of the Ministry of Home Affairs to ensure compliance to the containment measures for Covid-19, as conveyed vide Ministry of Health & Family Welfare will remain in force up to 30th September, 2021.”

Noting that the overall pandemic situation at the national level now appears to be largely stable, except for the localised spread of virus in few states, Bhalla said, “The total number of active cases and high case positivity in some districts continue to remain a matter of concern”.

In a separate communication with states and UTs, he noted that the weekly enforcement data received from across the country with regard to wearing face masks in public, maintaining social distancing norms and imposition of fines indicate a downward trend, but asked the state governments and UT administrations to augment their efforts for effectively checking transmission of the disease.

Bhalla also directed state administration to fix up responsibility of the district officials if any failures occure in effective enforcement of Covid-19 appropriate behaviour.

The Union Home Secretary also said that the states and UTs need to take suitable measures to avoid large gatherings during the coming festive seasons and if required, impose local restrictions with a view to curb such large gatherings.

“We need to continue our focus on the five-fold strategy — test, track, treat, vaccination and adherence to Covid appropriate behaviour”, he added.

Noting that the country has made a significant progress in vaccination, Bhalla also asked the states and the UTs to continue their vaccination programmes so as to inoculate the maximum number of eligible persons and also to ensure that areas having no virus or low virus transmission are adequately protected by increasing testing and other surveillance measures.

Crime

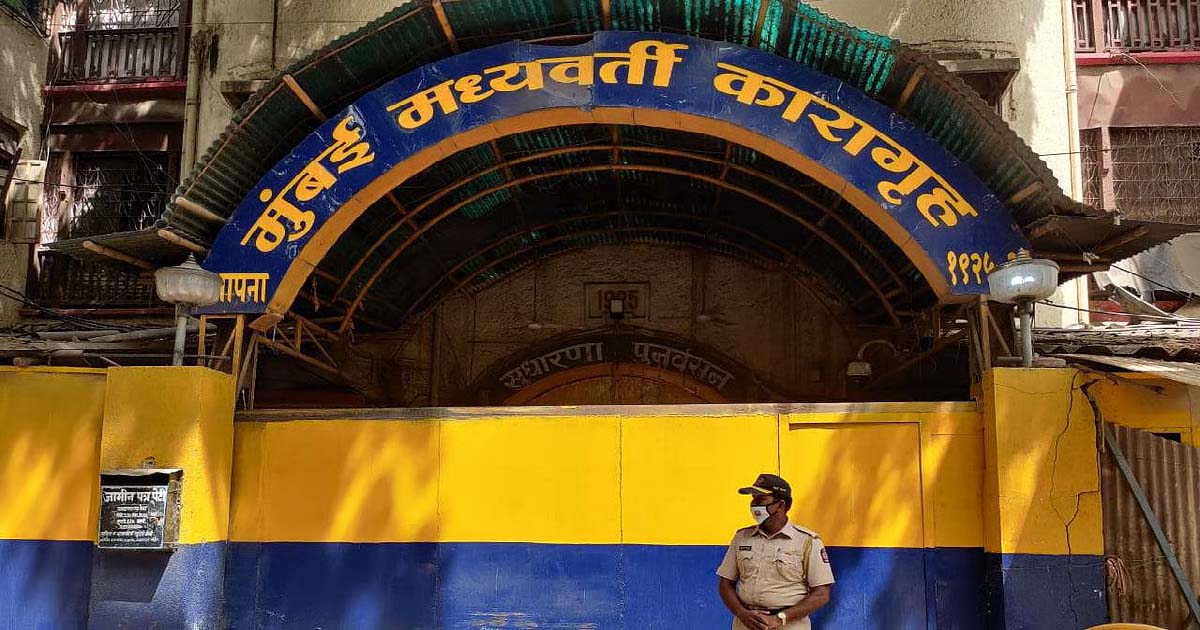

Mumbai Crime: Undertrial Prisoner Assaults Policeman Inside Arthur Road Jail, Case Registered

Mumbai: A shocking incident has come to light from Mumbai’s Arthur Road Jail, where an undertrial prisoner allegedly assaulted a police constable on duty.

The accused, Lokendra Uday Singh Rawat (35), is reported to have headbutted Police Constable Hani Baburao Wagh (30), causing injuries to his nose, and also abused and pushed other on-duty police personnel. A case has been registered in this connection at the N. M. Joshi Marg police station.

According to the FIR, the complainant, Police Constable Wagh, is attached to Armed Police Division–2, Tardeo. On January 27, he reported for his 24-hour day-duty shift at Arthur Road Jail at around 8 am and was assigned security duty at the main entrance of the prison.

At around 9 pm, Armed Police Constables Suresh Sandu Mali and Sachin Chavan brought undertrial Lokendra Rawat back to the jail after producing him before the Dindoshi Court. Rawat allegedly appeared agitated and, after entering the jail premises, sat near the gate and began verbally abusing the police personnel on duty.

Constable Wagh asked Rawat to calm down and refrain from using abusive language. However, Rawat allegedly became more aggressive and continued shouting abuses. When Wagh approached him again to pacify the situation, Rawat suddenly headbutted him on the nose with force.

As a result, Constable Wagh sustained injuries and started bleeding. Fellow constables Sachin Chavan and Suresh Mali immediately intervened, restrained the accused, and informed the on-duty prison authorities about the incident. Rawat was subsequently sent for medical examination to Sir J.J. Hospital.

After receiving medical treatment, the injured constable lodged a formal complaint on January 28 at the N. M. Joshi Marg police station. Based on the complaint, police have registered a case against the undertrial under relevant sections of the Bharatiya Nyaya Sanhita (BNS). Further investigation is ongoing.

Business

JCRA assigns landmark ratings to Adani Ports, Adani Green and Adani Energy Solutions

Ahmedabad, Jan 30: In a significant milestone for the Adani Group’s global credit journey, Japan Credit Rating Agency (JCRA) has initiated ratings of three Portfolio companies — Adani Ports and SEZ (APSEZ), Adani Green Energy Ltd. (AGEL) and Adani Energy Solutions Ltd. (AESL) — assigning long-term foreign currency credit ratings with a ‘Stable’ outlook to all three companies, it was announced on Friday.

Japan’s leading rating agency assigned Adani Ports and Special Economic Zone Ltd. (APSEZ) a A- (Stable) rating, representing a rare breach of the sovereign threshold by an Indian corporate by an international rating agency.

Moreover, Adani Green Energy Ltd. (AGEL) and Adani Energy Solutions Ltd. (AESL) have each been rated BBB+ (Stable). These ratings are at par with India’s sovereign rating of BBB+.

“These landmark ratings reflect the Adani Group’s commitment to disciplined financial management, strengthening balance sheet fundamentals, and world-class execution across our diversified infrastructure platform,” said Jugeshinder Singh, Group CFO, Adani Group.

“They reaffirm the depth and resilience of our business model and reflect the confidence global lenders, institutional investors, and capital markets place in our long-term strategy. This endorsement further strengthens our position as a leading partner in India’s infrastructure buildout and reinforces our commitment to delivering sustainable, high-quality growth,” Singh added.

Adani Ports’ strong rating underlines its strong credit profile, diversified asset base, and resilient cash-flow generation, and places it among a select group of Indian infrastructure companies to achieve an above-sovereign rating from a leading international rating agency.

The ratings also mark one of the first instances of Indian infrastructure platforms being assessed by JCRA at these levels, highlighting the Adani Group’s growing engagement with global rating agencies and its increasing alignment with international credit benchmarks.

APSEZ’s creditworthiness is at par with its subsidiary group, said the ratings agency, citing its superior infrastructure capabilities, consistently strong profitability, stable long-term cash flows, and prudent financial management — positioning the company above India’s sovereign foreign-currency rating, though capped by the country ceiling.

It continues to reinforce its leadership through a diversified portfolio of 15 domestic and 4 international ports, handling nearly 30 per cent of India’s cargo and 50 per cent of container volumes, supported by a comprehensive four-segment integrated logistics platform spanning ports, SEZs, logistics, and marine services.

Adani Ports delivered rapid EBITDA expansion — from Rs 7,566 crore in FY20 to Rs 19,025 crore in FY25, and Rs 11,046 crore in H1 FY26 — while maintaining a conservative 1.8x net-debt-to-EBITDA, long-tenor funding structure, and strong liquidity position.

On the other hand, AESL continues to strengthen India’s energy backbone through rapid expansion in transmission, distribution, smart metering, and cooling solutions — backed by stable, regulated cash flows and strong governance that support its consolidated credit profile, said the ratings agency.

“With a fast-growing network of 26,705 ckm of transmission lines, 97,236 MVA capacity, award-winning distribution reliability, and a rapidly expanding 7.37 million-meter smart metering portfolio, AESL is delivering far superior growth to the sector and redefining benchmarks in efficiency, customer service, and operational performance,” it noted.

With over 16.7 GW of operational capacity as of September 2025 and more than 90 per cent of EBITDA generated from renewables, AGEL has rapidly expanded from just 2.5 GW in FY20 — supported by best-in-class development, superior plant load factors, cost efficiency, and advanced ENOC-driven operations.

“EBITDA growth from Rs 1,855 crore (FY20) to Rs 10,532 crore (FY25) and Rs 6,324 crore in H1 FY26, coupled with improved equity levels, diversified global funding access, and extended 9.4-year average debt maturity, positions AGEL to sustain its ambitious growth pipeline while maintaining financial stability,” said JCRA.

National News

Mumbaikars! The Iconic Flower Festival Is Almost Here At Byculla Zoo, Get Ready To Immerse Yourself in Colours

Mumbai: As Mumbai prepares to welcome early signs of spring, the Brihanmumbai Municipal Corporation (BMC) and the Tree Authority are set to host the Mumbai Flower Show 2026, a three-day floral celebration at the Veermata Jijabai Bhosale Botanical Udyan and Zoo (Byculla Zoo) from February 6 to 8.

The flower show promises to turn the historic botanical garden into a vibrant canvas of colours, fragrances and greenery. Entry to the festival is free, making it easily accessible for families, students, senior citizens and nature lovers across the city.

The exhibition will feature around 5,000 plants, including a wide variety of flowering plants, fruit-bearing trees and medicinal species. One of the key attractions this year will be the display of 13 national symbols recreated through floral arrangements, adding both visual appeal and educational value to the event.

Adding to the experience, stalls offering gardening tools, plants, fertilisers and related supplies will be set up, catering to gardening enthusiasts as well as those looking to begin their green journey. For citizens interested in hands-on learning, gardening workshops will be conducted on all three days, with a participation fee of Rs 1,000.

The arrangements for the flower show are being overseen by Deputy Commissioner (Parks) Chanda Jadhav and Parks Superintendent Jitendra Pardeshi, ensuring smooth coordination and upkeep throughout the event.

With Mumbai slowly transitioning into warmer days, the flower show offers a calm, nature-filled retreat right in the heart of the city. The BMC has invited Mumbaikars to step into this floral haven, unwind amid lush surroundings, and reconnect with nature during the three-day celebration.

The flower festival has, over the years, grown into a much-awaited annual event for the city. Last year’s edition saw large crowds at the Byculla zoo, with visitors drawn to colourful floral installations and creative displays themed around India’s national symbols. The vibrant arrangements and lush settings had turned the botanical garden into a visual treat, making the festival a popular weekend outing for families and nature enthusiasts alike.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report