National News

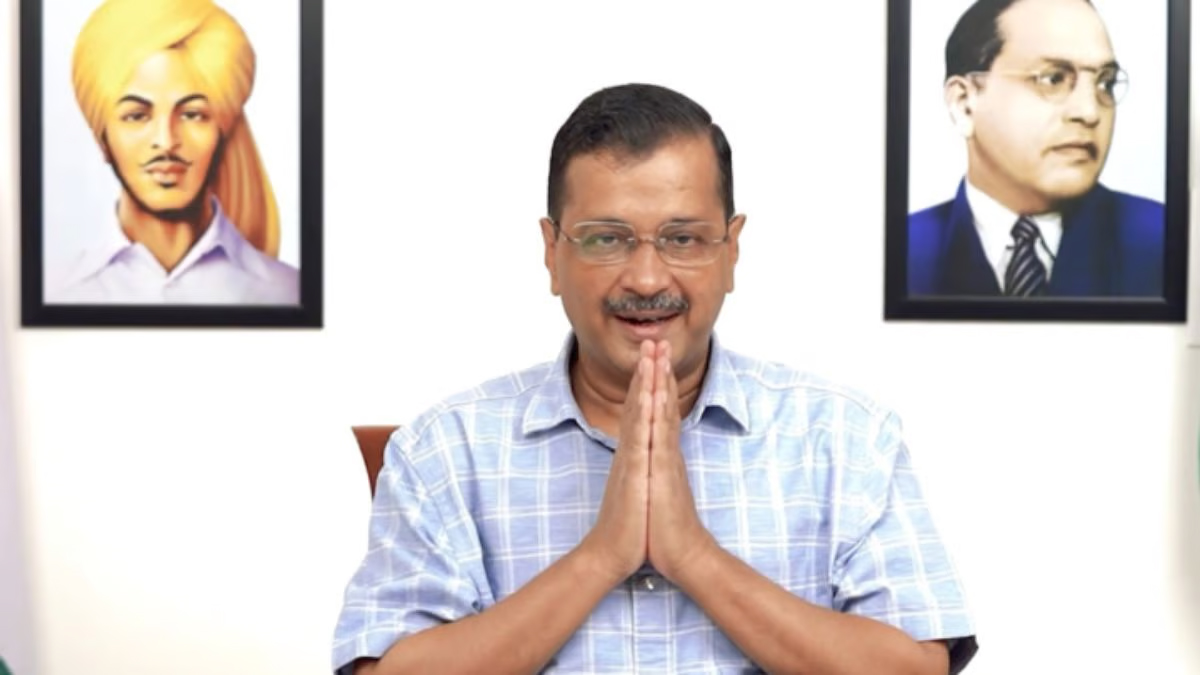

Arvind Kejriwal Skips ED Summon In Excise Policy Case; Delhi CM Calls Notice ‘Illegal And Politically Motivated’

New Delhi: Delhi CM Arvind Kejriwal will not appear for questioning before the Enforcement Directorate (ED) on Thursday (November 2) as he skipped the ED summon in the Excise Policy Case. He will instead hold a road show, along with Punjab CM Bhagwant Mann, in Singrauli, in the poll bound state of Madhya Pradesh, reported. Delhi Chief Minister Arvind Kejriwal, who was summoned by the Enforcement Directorate (ED) on Thursday in connection to the excise policy case, also responded to the ED’s notice to appear before the agency for questioning.

Delhi CM’s response to notice

The Delhi CM in his response called the summon notice as “illegal and politically motivated.”

The Delhi CM also accused that the notice was sent at the behest of the BJP, alleging political vendetta.

Kejriwal said that the notice was sent to ensure that he is “unable to go for election campaigning in four states.” The states of Madhya Pradesh, Rajasthan, Mizoram, Telangana and Chhatisgarh will see voting this month and the counting for the same will be on December 3.

“ED should withdraw the notice immediately.”

Delhi CM Arvind Kejriwal demanded that the notice issued to him should be withdrawn immediately.

What is the Excise Policy Case?

The Central Bureau of Investigation (CBI) and the Enforcement Directorate are probing the Delhi government’s excise policy for 2021-22 that was later scrapped. The policy allegedly favoured certain liquor dealers, accused the opposition BJP in Delhi, a charge that has denied.

Lieutenant Governor V K Saxena recommended a CBI probe

Based on a report of the chief secretary of the Delhi government, Lieutenant Governor V K Saxena recommended a CBI probe in July, 2022, into alleged irregularities in the formulation and implementation of the policy.

Alleged irregularities

The report cited various alleged irregularities including a waiver of Rs 144 crore to the retail licensees under the policy in the name of COVID-19-impacted sales and a refund of Rs 30 crore to a successful bidder for the airport zone who failed to obtain a no objection certificate for opening liquor stores there, officials said.

Another allegation was that the commission of wholesale licensees was raised from five per cent to 12 per cent in an instance of “quid pro quo.”

National News

Navi Mumbai: Kharghar Residents Halt PCMC Roadwork, Demand Permanent Fix To Pothole Woes

Navi Mumbai: Residents of Kharghar, led by Kharghar Citizen Forum President Leena Garad, on Tuesday halted ongoing road resurfacing work near JJ Rasoi Hotel on the Utsav Chowk–Tata Hospital stretch, accusing the Panvel City Municipal Corporation (PCMC) of wasting public money on poor-quality, repetitive patchwork instead of providing lasting road solutions.

The protest came after newly resurfaced roads once again developed potholes within months of completion. “Every year, the same twenty to twenty-two spots in Kharghar develop potholes, and every year only patchwork is done. This cycle has continued for nearly eight years despite repeated complaints,” said Garad.

She added that in 2022–23, the forum had written to the civic body highlighting the recurring issue, and in 2024, they even conducted a micro-survey and submitted video proof demanding a permanent fix.

However, she alleged that instead of addressing the problem, the civic body launched roadwork projects worth Rs 200–300 crore after the Assembly elections, turning them into a “drama of pothole filling” meant for publicity rather than real improvement.

Garad further alleged that even well-constructed CIDCO roads, which earlier had no damage, were unnecessarily resurfaced through four contractors, resulting in fresh potholes.

“Roads that were smooth and strong under CIDCO have become pothole-ridden due to poor-quality, profit-driven work. Kharghar’s roads have turned into a gold mine for some contractors and officials,” she said.

After the citizens stopped the ongoing work, municipal officials arrived at the site and assured that no patchwork would be done and the entire road would be resurfaced properly. However, Garad questioned whether the civic body would act against companies allegedly linked to relatives of ruling party MLAs.

Calling it a case of “patchwork politics,” Garad demanded an independent expert audit of all Kharghar roads, legal action against responsible contractors and officials, and transparency in tender processes. She also urged the civic body to stop the annual farce of superficial patchwork and use modern, permanent repair technology.

“We are citizens, not subjects in a pothole empire. Our tax money should build durable roads, not fund corruption and repeated repairs,” Garad who was also a former corporator, asserted, warning that residents would continue to hold the administration accountable until lasting solutions are implemented.

Crime

Punjab: Janata Party chief moves High Court for protection from arrest

Chandigarh, Oct 15: A day after a confrontation between Chandigarh Police and Punjab Police over the custody, Janata Party president Navneet Chaturvedi, who allegedly forged the signature of legislators on nomination papers for the lone Rajya Sabha seat, on Wednesday moved the Punjab and Haryana High Court, seeking protection from arrest in the criminal case registered against him.

In the petition, Chaturvedi sought protection from arrest for 10 days and directions to the Punjab Police to produce the first information report (FIR) registered against him before the court. He also alleged attempts to abduct him by the Punjab Police on Tuesday.

Punjab Police have also moved a petition in the high court seeking his custody. After the FIR was registered in Ropar, a Punjab Police team went to Chandigarh to arrest him, but the Chandigarh Police took him into their custody.

Punjab Police on Monday reportedly registered multiple FIRs after several Aam Aadmi Party MLAs alleged that their signatures were forged on nomination papers submitted by Chaturvedi, who claims to be the national president of the Janata Party for the Rajya Sabha bypoll.

Advocate General Maninderjit Singh Bedi and Additional Advocate General Chanchal Singla sought transfer of custody of the accused to the Punjab Police, and initiation of contempt and departmental action against the officials responsible for defiance of court orders.

The Punjab Police have initiated legal action following receipt of complaints from sitting Members of the Punjab Vidhan Sabha (MLAs) regarding the alleged forgery of their signatures on nomination papers submitted by Chaturvedi.

A spokesperson for Punjab Police on Monday said the complainant MLAs have stated that they received messages and social media posts indicating that their names had been mentioned as proposers in the nomination papers filed by Chaturvedi before the Secretary of the Vidhan Sabha. Chaturvedi has filed two nominations, one on October 6 and another on October 13.

In their complaint, MLAs stated that it was found that a handwritten list of proposers, purportedly bearing the signatures of these MLAs, had been attached to the nomination papers, and the same was being circulated on digital platforms.

The MLAs have categorically denied having signed or supported the said nomination, and have alleged that their names and signatures were forged and fraudulently used without consent.

The forged documents, submitted before a constitutional authority, constitute a serious offence involving forgery, cheating, and criminal conspiracy. Based on these complaints, FIRs have been registered at different police stations in the constituencies of the complainant MLAs against said Chaturvedi.

National News

MVA Leaders, Raj Thackeray Meet Maharashtra CEO Over Voter List Issues

Mumbai: Maha Vikas Aghadi (MVA) leaders, along with MNS chief Raj Thackeray, visited the Maharashtra Election Commission office in Mumbai on Wednesday for a meeting with the Chief Election Officer (CEO).

Shiv Sena UBT chief Uddhav Thackeray, UBT leader Aaditya Thackeray and Congress leader Vijay Wadettiwar were also present in the election meeting.

Speaking to reporters, Uddhav Thackeray stated that they have demanded that the poll panel rectify the voter list and conduct elections after rectification.

The Shiv Sena (UBT) chief said, “Before the assembly elections of 2024, MVA had written a letter to the EC that the BJP is adding people to the voter list because it wanted to bring to your notice. We had clearly stated that until these flaws are rectified, elections should not be conducted. Also, another important point raised is that those till 31st July who have turned 18 years will only be allowed to vote. The cutoff of July 31st is unacceptable.” “Our first focus is to rectify the voter list and then prevent vote theft… We have an objection to EVM. Now, they don’t want to use VVPAT. Is it because they want to destroy the proofs? It is against democracy. When all party delegations met the Election Commission, we also called the BJP leaders, but they did not attend the meeting…” he added.

Meanwhile, in a post on X, Congress leader Vijay Wadettiwar said that they met the Election Commission officials to discuss the need to ensure that the upcoming local body elections in the state are completely transparent, fair and uphold democratic values.

The post reads, “A multi-party delegation met with the Chief Election Officer and the State Election Commissioner today to discuss ensuring that the upcoming local self-government institution elections in the state are conducted in a completely transparent, impartial manner, upholding democratic values. The foundation of democracy is trust and transparency; to sustain this trust, it is essential that every election process is flawless. This demand was made on this occasion.”

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra11 months ago

Maharashtra11 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report