Tech

Apple iPhone 12 Pro left unharmed, falls from 26th floor

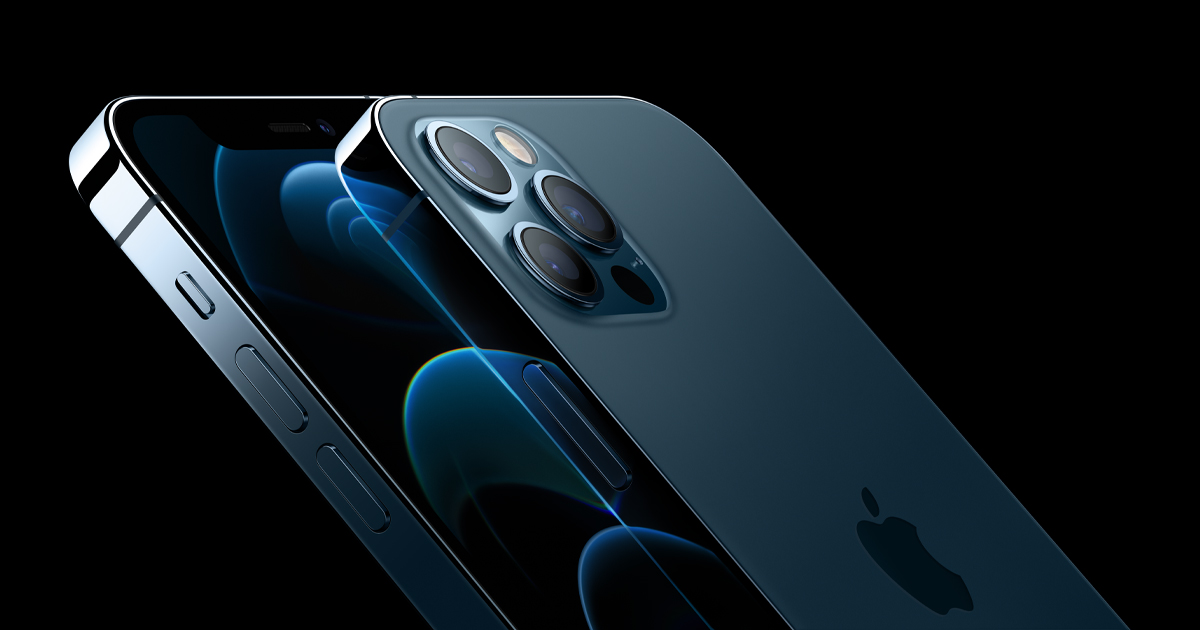

A Chinese woman has claimed that her Apple iPhone 12 Pro fell from the 26th floor of a building and yet was not destroyed.

The woman said that the smartphone slipped from her pocket while spreading her quilt on the balcony of the 26th floor of an apartment complex, reports Gizmochina.

This incident joins a growing collection of stories related to the iPhone.

The falling smartphone was inserted into a platform made of foam on the second floor of the building.

When the woman asked for assistance, a staff member went up to the second floor to get the iPhone and the screen of the device was not even damaged.

“The iPhone 12 Pro comes with some protection against damage when it falls. It has a super-ceramic panel and a matte textured glass back panel. It also comes with a stainless-steel frame which is of excellent quality,” the report said.

Previously, iPhones were also found inside the toilet, a river and even falling from an aeroplane.

Business

India should remain vigilant after Myanmar’s crackdown on cyber scam hubs

New Delhi, Oct 25: Amid the massive crackdown on cybercriminals in Myanmar, India needs to remain vigilant about numerous cyber scam centres in China-Myanmar border areas that target its citizens, according to a report.

The scam hubs in Kayin State, the Wa region, and the China-Myanmar border areas, where the central government’s reach is limited, lure victims with fake online job postings, confiscate passports, and force them to conduct fraudulent cryptocurrency and romance scams targeting victims worldwide, according to the report in India Narrative

“New Delhi, Beijing, and Bangkok have all demanded that Naypyidaw take action after hundreds of their citizens were trafficked into scam operations,” the report mentioned.

According to reports, a statement by Myanmar’s military information ministry said its forces had “cleared” KK Park, a synonymous with online fraud, money laundering and human trafficking for the past five years.

More than 2,000 people were detained, and around 30 Starlink satellite terminals used to maintain communications networks for scam operations were seized.

For India, these cyber hubs have become a mounting concern.

In March this year, the Ministry of External Affairs confirmed that almost 300 nationals had been rescued from cyber-scam compounds in Southeast Asia, including in Myanmar. According to reports, up to 540 individuals were repatriated in a subsequent phase via Thailand.

Notably, a hybrid form of governance, blending armed-group control, corruption, and foreign criminal investment, has turned Kayin State into a cybercrime haven.

“For the Myanmar junta, the KK Park raid signals to neighbouring countries that it can enforce border security and control hybrid criminal-militia activities,” the report noted.

However, the challenges remain as the networks behind these compounds are deeply embedded in cross-border trafficking and crypto-fraud.

According to media reports, more than 5,400 Chinese suspects involved in telecom fraud in Myawaddy, Myanmar, have been repatriated in a joint crackdown on cross-border telecom fraud launched by China, Myanmar, and Thailand since the beginning of 2025.

Business

Gold records first weekly loss after nine-week surge

New Delhi, Oct 24: Gold ended a nine-week winning streak this week, with a sharp correction as the market reassessed a rally that had pushed prices into overbought territory.

The price of 24-carat gold (10 grams) ended at Rs 1,22,419 on Friday, down from Rs 1,23,827 from its previous close, according to data published by the India Bullion and Jewellers Association (IBJA).

Spot gold fell 0.3 per cent to close at $4,113.05 an ounce in New York, resulting in a weekly loss of approximately 3.3 per cent.

The price for 10 grams of bullion closed last week at Rs 1,30,874, and the price had been declining throughout the week. Analysts said that the pullback was sharp, but the yellow metal pared losses on Friday due to a weaker-than-expected U.S. inflation report, which bolstered expectations for further monetary easing by the Federal Reserve.

This development also led to a slight decline in bond yields and an increase in bullion prices. Traders anticipate two rate cuts before year-end, a scenario that bolstered gold prices.

Investors also assessed the potential for improved US-China relations as US President Donald Trump and his Chinese counterpart Xi Jinping prepare for their upcoming meeting. There are forecasts that a de-escalation of trade tensions may lessen demand for safe-haven assets like gold.

A recent correction occurred after a strong rally that started in mid-August, which saw prices reach an all-time high of $4,381.52 an ounce on Monday. Profit-taking and significant outflows from gold-backed ETFs intensified the selling pressure.

Gold is up by 57 per cent this year, driven by central-bank purchases, dovish signals from the US Federal Reserve and strong ETF inflows.

Earlier this week, a Ventura Securities report said that gold has generated returns of approximately 63 per cent in rupee terms since last Dhanteras, and a possible rally towards Rs.1.5 lakh per 10 grams is possible by 2026.

Business

Apple’s first foldable iPhone in late 2026 set to redefine experiences

New Delhi, Oct 25: Apple’s foldable, expected around late 2026, could redefine consumer expectations and push foldables into a new mainstream adoption phase, according to a new report.

The biggest structural shift is expected in late 2026, when Apple’s first foldable iPhone is expected to debut.

According to the Counterpoint Research report, Apple’s entry would instantly expand consumer awareness and accelerate replacement demand across high-income segments.

Given Apple’s ecosystem influence, its launch year could dramatically reshape brand dynamics, lifting total market volumes.

The report predicts the US foldable smartphone market to grow 68 per cent (on-year) in 2025, as it enters a period of solid growth after several years of experimentation.

The growth is being driven by broader form factor adoption, improved durability of foldable designs and more diversified portfolios from multiple brands.

This year, portfolio expansion and ecosystem readiness are defining the market.

Samsung is set to maintain its leadership with the refreshed Galaxy Z Fold and Flip lineup, having added an FE variant to broaden accessibility, while also preparing to unveil its long-awaited tri-fold device later in the year.

Meanwhile, Motorola is rapidly scaling its Razr series through wider carrier partnerships in the prepaid market, narrowing the share gap with Samsung faster than in prior cycles.

According to the report, Google’s Pixel 10 Pro Fold, launched in October 2025, sits between Samsung’s premium offerings and Motorola’s lifestyle-driven designs, testing how effectively the brand can turn its AI-first Android experiences into tangible hardware differentiation.

Liz Lee, Associate Director at Counterpoint Research said that while Samsung continues to lead in maturity and ecosystem strength in 2025, Motorola’s rapid expansion in the clamshell segment and Google’s AI-driven approach are reshaping competition.

Apple’s eventual arrival in 2026 will not only expand the market but also cement foldables as a mainstream premium smartphone format, Lee mentioned.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report