Business

Aluminium industry stares at critical coal shortage

Steel Industry.

The highly power-dependent aluminium industry is in for a tough time. This is because of Coal India Ltd’s (CIL) recent move to significantly reduce coal supplies and railway rakes for Captive Power Plants (CPPs), resulting in coal crunch for the Indian Aluminium Industry.

Aluminium is a metal of strategic importance and an essential commodity for diversified sectors, crucial for the nation’s economy. Aluminium smelting requires uninterrupted and high-quality power supply for production which can be met only through in-house CPPs.

Hence, such drastic curtailment of coal supplies, without any advance notice, will bring the industry to a standstill as it has been left with no time to devise any mitigation plan to continue sustainable operations. Also, resorting to imports at such a short notice is not feasible.

The aluminium industry CPPs have signed FSA (Fuel Supply Agreement) with CIL and its subsidiaries for assured long term coal supply. Any abrupt stoppage of this secured coal supply brings the industry to a grinding halt and has a severe impact on the SMEs in downstream sector resulting in increased prices of finished products and burdening end consumers.

Aluminium is a continuous process based highly power intensive industry wherein coal accounts for ~40 pr cent of aluminium production cost. Huge investments of Rs 1.2 lakh crore ($20 billion) have been made to double the domestic production capacity to 4.1 mtpa to cater to the country’s increasing aluminium demand. The Indian aluminium industry has set up ~9000 MW CPP capacity to meet its power requirement for the Smelter and refinery operations and reduce dependence on power grids.

Any power outage/or failure (2 hours or more) results in freezing of molten Aluminium in the pots which leads to shutting down of the aluminium plant for at least six months rendering heavy losses and restart expenses, and once restarted it takes almost a year to get the desired metal purity.

The Indian aluminium industry is already struggling to remain globally competitive due increasing production costs in India primarily due to increased power cost over the past few years with rising coal prices, increase in various duties, cess and RPO. Also, the high incidence of unrebated Central and state taxes and duties, constitutes ~15 per cent of aluminium production cost which is amongst the highest in the world. This is adversely impacting the sustainability and competitiveness of the Indian aluminium industry.

Being a continuous process-based power intensive industry, The Aluminium Association of India has sought the following support from Coal India to continue sustainable operations and to reduce the load on the power grid:

1) Resumption of adequate coal supply against secured linkages for sustainable industry operations.

2) Allocation of railway rakes on priority for coal dispatch to the Aluminium industry.

3) Allocation of coal dispatches through rakes in proportion of 75 per cent (power) and 25 per cent (non-power), as per the MoC circular for auction linkage, dated February 15, 2016.

4) Any decision for stopping or curtailing secured coal supplies should not be taken on an ad hoc basis. The CPP based industry should be give prior notice well in advance (2 to 3 months) to devise mitigation plans for coal or power imports

Business

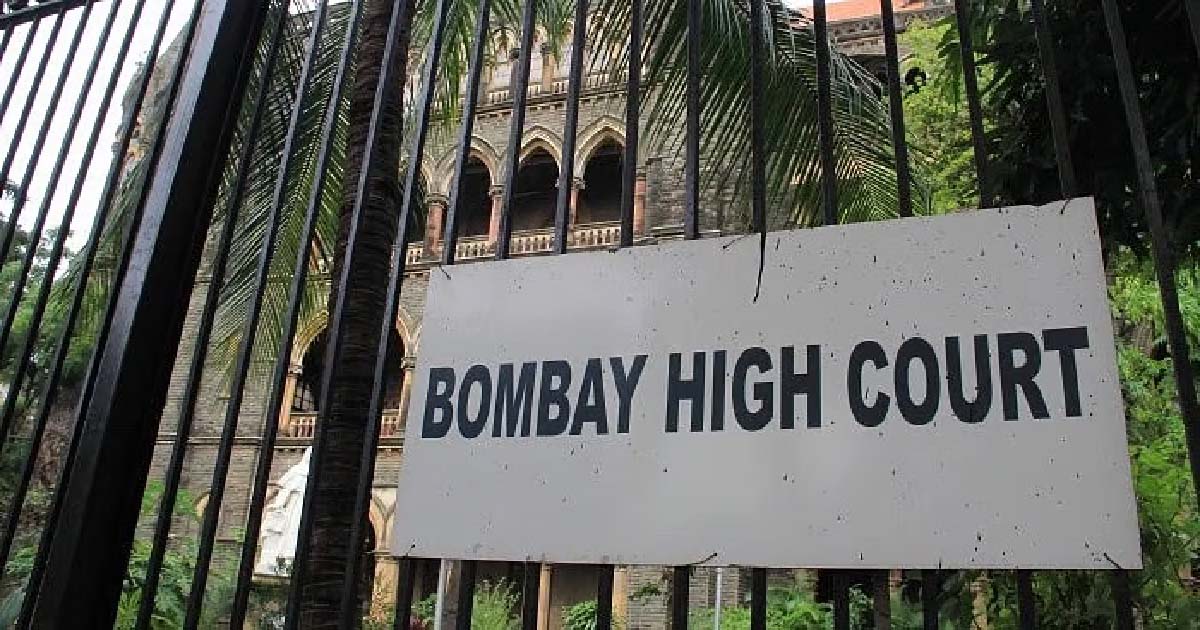

Nescafé Premix Qualifies As ‘Instant Coffee’, Attracts Lower 8 Per Cent Sales Tax: Bombay HC

Mumbai: In a significant ruling on product classification under the Bombay Sales Tax Act, 1959, the Bombay High Court has held that Nescafé Premix must be taxed at 8% as “coffee / instant coffee,” and not at the higher rate of 16% applicable to general beverage powders.

A bench of Justices M. S. Sonak and Advait Sethna reiterated the cardinal principle that specific tax entries must prevail over general ones. Applying the common parlance test, the court concluded that Nescafé Premix, as marketed and consumed, had created a clear perception of “instant coffee”.

The case arose from a dispute between Nestlé India Ltd. and the Sales Tax Department regarding whether Nescafé Premix — containing 8.5% soluble coffee powder, 54% sucrose, 37% partially skimmed milk powder and 0.5% maltodextrin — should be classified under Schedule Entry C-II-3 (8%) or Entry C-II-18(2) (16%).

The Commissioner of Sales Tax had earlier ruled in 1998 that the product fell under the higher-taxed general entry for powders used in non-alcoholic beverages, emphasising that the coffee content was “minuscule 8.5%”.

The Maharashtra Sales Tax Tribunal reversed this decision in 2001, holding that ingredient percentage was not decisive — relying on Supreme Court precedent that even small quantities, like salt in food, do not alter the essential character of the final product.

Upholding the Tribunal’s order, the HC stressed that the product’s actual use and consumer understanding were crucial. “Ultimately, in all such matters, we must go by the common parlance test,” the bench said.

It noted that the premix was expressly marketed as Nescafé Premix and used to dispense Nescafé from vending machines simply by adding hot water. “The resultant product, in common parlance, was nothing but Nescafé,” the Court observed.

Rejecting the Department’s argument that low coffee content disqualified it from being considered instant coffee, the Court agreed with the Tribunal that removing coffee powder altogether would fundamentally change the product’s identity — demonstrating that the coffee component, though proportionally small, was determinative of classification.

The bench also emphasised that Entry C-II-3, covering “coffee” and “instant coffee”, was a specific entry and therefore prevailed over the general entry for beverage powders under C-II-18(2). “The concept of instant coffee must conform to modern development and modern perceptions,” the Court added.

Business

Indian stock market ends in bullish tone after RBI rate cut

Mumbai, Dec 6: Indian equity benchmarks made marginal losses after hitting record highs and three weeks of consecutive gains due to profit booking. However, the market ended the week in a bullish tone after the Reserve Bank of India (RBI) delivered a 25 bps rate cut that lifted investor sentiment.

Benchmark indices Nifty and Sensex dipped 0.37 and 0.27 per cent during the week to close at 26,186 and 85,712, respectively.

Early optimism driven by strong Q2 GDP print and robust auto sales was overshadowed by persistent FII outflows, sharp rupee depreciation, and uncertainty over trade negotiations.

Broader indices underperformed, with the Nifty Midcap100 and Smallcap100 down 0.73 per cent and 1.80 per cent, respectively in a week.

Sentiment reversed on Friday after the RBI surprised markets with a 25-bps rate cut, supported by lower inflation forecasts and liquidity measures.

Gains during the week were led by auto, IT due to festive demand and favourable currency tailwinds. Banks, Finances, consumer durables, power, chemicals and oil & gas lagged.

As long as Nifty sustains above the 26,050–26,000 band, the bullish structure remains valid. Immediate resistance now lies at 26,350–26,500 zone and a break below 26,000 could lead to profit booking, said market experts.

With India’s economic growth remaining resilient despite tariff pressures and global headwinds, the Indian equity market is well-positioned to benefit if global fund flows begin to rotate back into emerging markets, market watchers said.

Investors are keen on cues from the US Federal Reserve’s monetary policy decision next week. Markets have already begun pricing in a 25 bps rate cut, supported by dovish commentary from several Fed officials and recent data pointing to softening labour market conditions.

Analysts said that shift in US Fed’s policy stance could sway currency movements and materially influence foreign portfolio investor flows into emerging markets including India.

Business

IndiGo Crisis: 75-Yr-Old Woman Waits Hours For Luggage Without Medicines At Mumbai T2 Airport

Mumbai, Dec 05: When IndiGo’s nationwide operational meltdown began disrupting flights earlier this week, thousands of passengers were caught in chaos across the country. Among them was a 75-year-old woman whose ordeal at Mumbai’s Terminal 2 gained attention after her daughter shared a distressed post on X. Thankfully, the woman has now reached home safely, but her experience reflects the scale of frustration travellers are facing.

In her post on X, Punita Toraskar wrote that her elderly mother had been waiting at T2 since noon, and even by 4:42 pm, she still hadn’t received her luggage. The situation was more alarming because the 75-year-old needed to take her medicines but was stuck waiting on an empty stomach, stranded amid the airport chaos.

Toraskar’s post quickly resonated with passengers across India who have been struggling with severe delays, cancellations, and a complete breakdown of communication from India’s largest airline.

IndiGo is currently grappling with one of the biggest operational crises in its history. Nearly 900 flights have been cancelled since Tuesday, triggered by a mix of staff shortages and the airline’s struggle to adapt to stringent new crew duty regulations.

Passengers at major airports — Delhi, Hyderabad, Bengaluru, and Kolkata — are facing hours-long queues, mounting delays, and skyrocketing airfares as alternative flight options shrink. Hotels are filling up, tempers are rising, and social media is flooded with frustration.

IndiGo has issued public apologies and claims it is rebooting its systems and schedules to stabilise operations. But for many travellers like Toraskar’s mother, the damage is already done.

Despite the turmoil, Punita confirmed later that her mother had finally reached home safely, a small relief in a week of aviation chaos.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report