Politics

Ahead of Gujarat polls, Hardik Patel quits Congress

In a huge blow to the Congress, its Gujarat working president Hardik Patel has announced his resignation from the party. The party has however said it has not yet received his resignation letter.

The elections in Gujarat are due in a few months.

In the resignation letter, Hardik Patel has alleged that the Congress has no interest in Gujarat, just opposing policies and programmes, never becoming an option to the ruling party that people are looking for.

He has further alleged that even after several efforts, the party failed to act in national interest and for the society. The Congress was obstacle on issues like article 370, CAA-NRC and implementation of the GST. These were people’s aspirations and the need of the hour for which the Congress should have played a positive role, but it did not, Patel said.

The Congress party has said that it has not received Hardik’s resignation either in soft or hard copy. “The party leaders have heard this from social media, and through media that he has resigned,” said Manish Doshi, spokesman of the Congress.

The speculations are wild that he may join the BJP.

Hardik’s former colleague at PAAS (Patidar Anamat Andolan Samiti) and BJP worker Chirag Patel, in his first reaction has said that lakhs of BJP workers are unhappy and disappointed with Hardik, and they would be unhappy if he joins the BJP. At the same time he added that all of them are committed BJP workers and will respect party’s decision, if Hardik joins BJP.

Crime

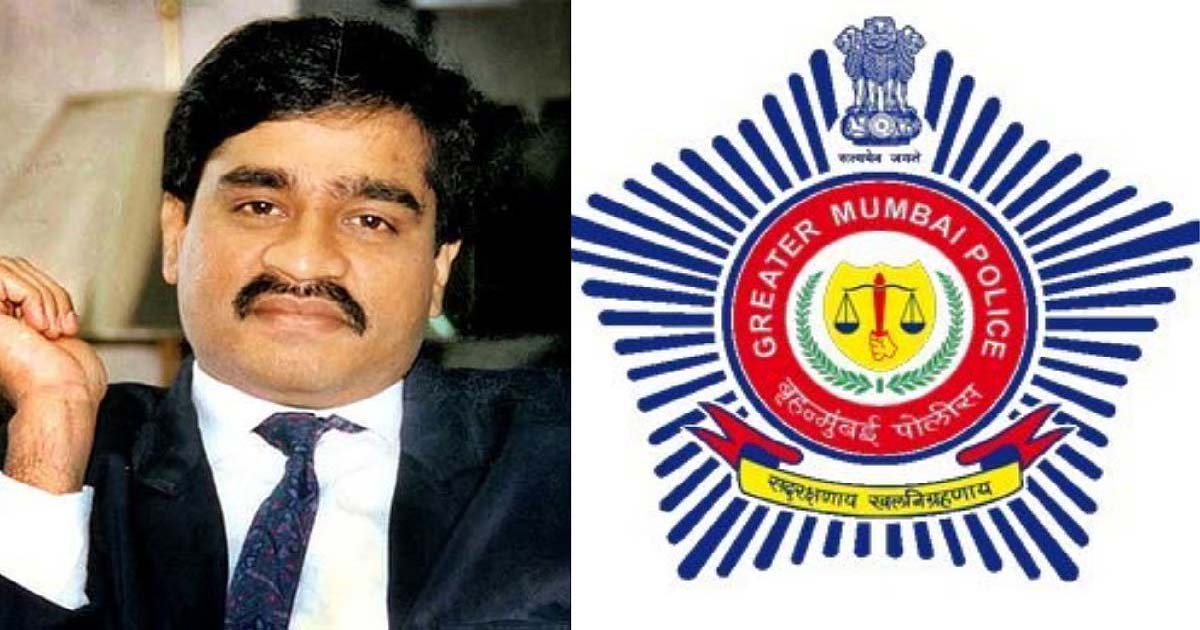

Dawood Ibrahim Got Call From Mumbai Cop Seeking Money For Daughter’s Wedding; Ex-DGP Sivanandhan Breaks Silence

Mumbai: In an intense conversation with Former Mumbai Police Commissioner and ex-DGP of Maharashtra D. Sivanandhan, Media Journalist Balakrishnan spoke about the nexus between some policemen and the underworld.

In a startling revelation, the Media journalist revealed that during his visit to Dubai some years back, he went to Dawood Ibrahim’s patatial house called the ‘White house’, where the underworld don had received a phone call from Assistant Mumbai Commissioner allegedly seeking money for the gangster’s daughter’s wedding.

In an exclusive conversation, Media Balakrishnan said, “While I was talking to him, his PA came and told him that there is a call for you.”

The journalist said that Dawood winked and told him to keep quiet. While listening to their conversation on speaker, Media journalist heard, “Sir apka beti ka shadi toh apka yaad aya meko.”

Dawood responded by asking, “Kitna Chahye?”

On this, the Assistant Police Commissioner replied saying, “Jo apko lage, Apka beti ka shaadi hai.” Dawood then reportedly sent him Rs 10 lakh.

Speaking on the issue, Sivanandhan explained that not every officer in Maharashtra’s 2.5 lakh with 50000 in Mumbai is corrupt, but since they are recruited from society, some do fall into its darker influences.”We recruit them from the society, and the society comes along with all black, yellow, green colours.”

The conversation came in context about the nexus between some policemen and the underworld.

When ex-DGP of Maharashtra D. Sivanandhan was asked about the nexus between some policemen and the underworld, so much so that people used to talk about gang war within the police. On this, the ex-top cop defended, saying, “Tell me, from where do the policemen come? They come from the same society where the criminals are also coming.”

Further explaining, he also revealed, “In many of the cases where some shootout took place and when we went to raid the criminal’s house, we use to see a police uniform hanging. When we ask, the policeman’s sister was married to the gangster.”

“It’s a society where they live very, very closely,” the top cop confirmed. In another revelation, without sharing the identity, he also added, “There are also policemen working in gangs now.”

He added that, “So when policemen are accused of participating on behalf of some gang or other, I would wouldn’t deny that. I would agree. He added that the irresistable amount of money given to the gangster is unbelievable. Policemen are succumbing to that.”

The cop further raised questions on the government and said, “What was the guarantee or what was the support given by the government for policemen to insulate themselves from such kind of irresistable offers.” “When the policemen is prosecuted, not even a lawyer is given to them,” the ex-DGP said.

Crime

Mumbai Airport Customs Seize Drugs Worth ₹12.5 Crore, iPhones, Laptops And Liquor In Separate Cases; 6 Arrested

Mumbai: In four separate operations, the Airport Customs officials during the period of October till October 28, have seized drugs collectively worth Rs 12.50 crores and iPhones, laptops, liquor bottles and cigarettes totally worth Rs 56 lakh.

According to the agency sources, on the basis of specific intelligence, the Customs officers at Chhatrapati Shivaji Maharaj International Airport (CSMIA), intercepted three passengers arriving from Bangkok to Mumbai.

During the examination of the baggage, the Customs officers recovered 6.48 kg of suspected hydroponic weed (marijuana), with an illicit market value of approximately Rs 6.48 crores.

In another case, on the basis of specific information, the Customs officers intercepted two passengers arriving from Bangkok. During the examination of the baggage, the Customs officers recovered 3.98 kg of marijuana valued at Rs 3.98 crores.

In the third such case, on the basis of specific intelligence, the Customs officers intercepted one passenger arriving from Bangkok. During the examination of the baggage, the Customs officers recovered 1.94 kg marijuana, with an illicit market value of approximately Rs 1.94 crores.

In all the three cases, the narcotic substances were concealed inside the checked-in trolley bag carried by the six passengers, who were arrested under the provisions of the Narcotic Drugs and Psychotropic Substances (NDPS) Act.

In the fourth case, on the basis of profiling, the Customs officers at the airport intercepted three passengers arriving from Sharjah to Mumbai. During the examination of the baggage, the Customs officers recovered Apple Iphones 17 pro max (40 pieces), laptops (30 pieces), liquor bottles (12) and cigarettes collectively valued at Rs 56.55 lakh.

The said goods were concealed inside the checked-in trolley bag carried by the passengers, who were arrested under the provisions of Customs Act, 1962.

National News

National Herald case: Delhi court defers proceedings till Nov 7

New Delhi, Oct 30: A Special Delhi Court, hearing the money laundering case linked to the National Herald, has deferred the proceedings till November 7, seeking clarifications from the Enforcement Directorate (ED) on certain aspects of its chargesheet filed against Congress leaders Sonia Gandhi and Rahul Gandhi, among others.

Special Judge (PC Act) Vishal Gogne, presiding over the matter at Rouse Avenue Court, said the clarifications were necessary before the court could proceed to take cognisance of the prosecution complaint filed by the ED under the Prevention of Money Laundering Act (PMLA).

The case, which stems from the ED’s allegations that top Congress leaders conspired to acquire control over the assets of Associated Journals Limited (AJL) — the publisher of the National Herald newspaper — remains at the pre-cognisance stage.

In the previous hearing, the court had also directed the central agency to provide additional details regarding certain aspects of its investigation before any decision on taking cognisance could be made.

The ED, in its prosecution complaint, has accused Sonia Gandhi, Rahul Gandhi, and other senior Congress leaders of being involved in a conspiracy to usurp properties worth over Rs 2,000 crore belonging to AJL through Young Indian Pvt Ltd, a company in which the Gandhis hold a majority stake.

The Rouse Avenue Court had reserved its order on July 14 after hearing detailed arguments from the federal anti-money laundering agency as well as the proposed accused, including the Gandhis.

Senior advocate Abhishek Singhvi, representing Sonia Gandhi, had described the money laundering allegations as “really strange” and “unprecedented”, claiming that no tangible assets were involved.

Further, Rahul Gandhi claimed that the All India Congress Committee’s attempts to revive the pre-Independence era newspaper were “misconstrued” as a bid to sell its assets.

Highlighting the non-profit objectives of the company, senior advocate R.S. Cheema, representing Rahul Gandhi, said National Herald was never a commercial institution and the AICC just wanted to bring the newspaper back on the rails.

The controversy surrounding the National Herald’s assets first surfaced in 2012 when BJP leader Subramanian Swamy filed a complaint in a trial court, accusing Congress leaders of cheating and breach of trust in the acquisition of AJL.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra12 months ago

Maharashtra12 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report