Business

Air India among airlines skipping US airports over 5G safety dispute

Air India joined at least nine other international airlines that have modified or cancelled flights to the US amid conflicting reports on what new 5G cell phone services can do to critical airplane technologies.

Carriers are taking a variety of approaches to the spiraling crisis. Air India, Emirates, All Nippon Airways, Japan Airlines, Lufthansa and British Airways have announced changes to some of their flights.

Air India said it would suspend the service between Delhi and San Francisco, Chicago and JFK as well as a Mumbai to Newark flight. It will continue to fly into Washington Dulles.

Both ANA and Japan Airlines said they cancelled some flights scheduled to use Boeing 777 aircraft, but will operate some flights using Boeing 787s instead.

Emirates suspended flights into Boston, Chicago O’Hare, Dallas Fort Worth, George Bush Intercontinental in Houston, Miami, Newark, Orlando, San Francisco and Seattle.A

Emirates continued flying into New York’s John F. Kennedy airport, Los Angeles International and Washington Dulles.

Lufthansa cancelled a flight between Frankfurt and Miami and said it would swap Boeing 747-8 aircraft for 747-400s on flights from Frankfurt to Los Angeles, Chicago and San Francisco.

CNN Business quoted a British Airways spokesman that the airline “had to make a handful of cancellations” because a decision by telecom operators to delay activating the new 5G service at some locations didn’t cover all the airports the airline serves.

Virgin Atlantic and Air France-KLM said they had not cancelled any flights but were monitoring the situation.

Delta Air Lines said it is planning for the possibility of weather-related cancellations as early as Wednesday due to the new 5G service in the vicinity of dozens of US airports.

US air transport regulator, Federal Aviation Administration (FAA), has been concerned that the version of 5G that was scheduled to be switched on could interfere with some airplane instruments. Some aviation industry groups shared those fears. This is despite reassurances from federal telecom regulators and well as wireless carriers.

Specifically, the FAA has been worried that 5G cellular antennas near some airports – not air mobile devices – could throw off readings from some aircraft equipment designed to tell pilots how far they are from the ground.

The systems, radar altimeters, are used throughout a flight and are considered critical. (Radar altimeters differ from standard altimeters, which rely on air pressure readings and do not use radio signals to gauge altitude.)

In December, the FAA had forbidden pilots from using the potentially affected altimeters around airports where low-visibility conditions would otherwise require them.

That new rule could keep planes from getting to some airports in certain circumstances, because pilots would be unable to land using instruments alone.

“We are frustrated by the FAA’s inability to do what nearly 40 countries have done, which is to safely deploy 5G technology without disrupting aviation services, and we urge it to do so in a timely manner,” an AT&T spokesperson said.

Earlier this week, mobile carriers AT&T and Verizon agreed to pause the rollout of the new high-speed 5G wireless service near major airports.

The Biden administration welcomed the halt, saying this “will avoid potentially devastating disruptions to passenger travel, cargo operations, and our economic recovery, while allowing more than 90 per cent of wireless tower deployment to occur as scheduled.”

“While this is a positive development toward preventing widespread disruptions to flight operations, some flight restrictions may remain,” Delta said.

In a Tuesday letter, CEOs from some airlines told the Biden administration to push back the already-delayed rollout.

Airlines estimate 1,000 flight disruptions per day because of possible interference with radar altimeters that pilots use to land in low visibility conditions.

The telecom industry has not commented on the CEOs letter, but has said fears are unfounded since there have not been problems in other countries where 5G is already deployed.

According to a service map by the Federal Communications Commission (FCC), areas in California, Florida, New England, Texas and the midwest will gain 5G coverage. But aviation groups warn that it could jeopardize some of the largest airports, including in Los Angeles, New York and Houston.

The 5G signals will travel over radio frequencies that are collectively known as the C-Band. This band of airwaves is attractive to wireless carriers because it offers a good balance between cellular range and capacity – two key features of any wireless network. (Other sets of airwaves besides the C-Band are also used to carry 5G, but the current debate focuses on just the C-Band frequencies.)

On the spectrum of radio frequencies used for wireless communications, the C-Band sits right next to the band of frequencies used by the aircraft altimeters. The two are intentionally separated by a so-called guard band – essentially “blank” airwaves – to safeguard against interference.

To further address any aircraft risks, Verizon and AT&T have offered in November to limit the power of their 5G antennas and to take other precautionary measures.

But that hasn’t been enough to allay the concerns of the FAA, whose 11th-hour order would have “an enormous negative impact on the aviation industry,” the CEOs of Boeing and Airbus wrote in a letter Monday to the Department of Transportation.

The CEOs added: “We agree that 5G interference could adversely affect the ability of aircraft to safely operate.”

The letter cites an estimate published by the industry group Airlines for America, which predicts the FAA restrictions will disrupt 345,000 passenger flights, 32 million passengers and 5,400 cargo flights. The FAA’s own order estimates that 6,800 US airplanes could be affected by the plan, along with 1,800 helicopters.

Technology experts say that while 5G antennas could theoretically lead to interference around airports, the potential for interference is an ever-present feature of all wireless communications – not just 5G – and that so far regulators around the world have done a good job of handling it.

Business

Young innovators worldwide can find inspiration from confidence of India’s Gen Z: PM Modi

New Delhi, Nov 27: Prime Minister Narendra Modi on Thursday lauded India’s Generation Z for their confidence and capacity building.

Speaking via video conferencing at the inauguration of the Infinity Campus of Indian space startup Skyroot and unveiling its first orbital rocket, Vikram-I, PM Modi praised the country’s Gen Z for their positive mindset and creativity.

“Our youth, our Gen Z, are developing solutions to challenges in every sector. Young innovators around the world can find inspiration from the confidence of India’s Gen Z,” PM Modi said.

“The capacity building, positive mindset, and creativity of India’s Gen Z can set a global benchmark for Gen Z across the world,” he said.

Emphasising that India’s youth always place national interest above all and make the best use of every opportunity, PM Modi remarked that when the government opened the space sector, the country’s youth, especially the Gen-Z generation, came forward to take full advantage of it.

He highlighted that today more than 300 space startups are giving new hope to India’s space future, and noted that most of these startups began with small teams — sometimes two people, sometimes five, sometimes in a small rented room — with limited resources but with determination to reach new heights.

“This spirit has given birth to the private space revolution in India,” said the Prime Minister. He noted that Gen-Z engineers, designers, coders, and scientists are creating new technologies, whether in propulsion systems, composite materials, rocket stages, or satellite platforms.

PM Modi stressed that India’s youth are working in areas that were unimaginable just a few years ago.

He remarked that India’s private space talent is establishing a distinct identity across the world and added that today, for global investors, India’s space sector is becoming an attractive destination.

The Prime Minister remarked that the changes being witnessed in the space sector are part of the broader startup revolution taking place in India.

“Over the past decade, a new wave of startups has emerged across diverse sectors such as fintech, agri tech, health tech, climate tech, edu tech, and defense tech, with India’s youth, particularly the Gen-Z generation, providing innovative solutions in every field,” PM Modi said.

PM Modi emphasised that “India has now become the world’s third-largest startup ecosystem”.

There was a time when startups were confined to a few big cities, but today they are emerging from small towns and villages as well, the Prime Minister said, underlining that the country now has more than 1.5 lakh registered startups, with many of them having achieved unicorn status.

“India is no longer confined to apps and services but is now advancing rapidly towards deep-tech, manufacturing, and hardware innovation,” said the Prime Minister, thanking Gen-Z.

Business

Sensex smashes 86,000 for 1st time, Nifty hits new record

Mumbai, Nov 27: Indian stock markets continued their strong momentum on Thursday, with both the Sensex and Nifty hitting new record highs.

Investors remained optimistic as hopes of interest rate cuts in the US and India grew stronger, while steady buying by foreign investors further boosted sentiment across sectors.

The Nifty climbed to a fresh all-time high of 26,306.95, surpassing its previous record of 26,277.35 touched on September 27, 2024.

The Sensex also crossed a major milestone, moving past the 86,000 mark for the first time to reach 86,026.18.

Among the top performers in the Nifty50 pack were Bajaj Finance, Shriram Finance, Asian Paints, Bajaj Finserv and Larsen & Toubro, all gaining up to 2 percent.

These stocks helped support the market’s upward move. Foreign portfolio investors maintained their buying momentum, turning net buyers for the second consecutive session on Wednesday.

They invested Rs 4,778.03 crore in Indian equities, following an inflow of Rs 785.32 crore on Tuesday. This consistent buying helped keep domestic markets strong.

Market sentiment also stayed positive due to growing expectations that the US Federal Reserve may cut interest rates in December.

The Nifty had already recorded its best trading session in five months on Wednesday, closing at a 14-month high, supported by gains in rate-sensitive sectors ahead of the Reserve Bank of India’s policy meeting next week.

Asian markets were also trading higher, reflecting global optimism. Investors increased their bets that the US Fed will cut rates next month, with the CME FedWatch tool showing the probability rising sharply to around 85 per cent from just 30 percent a week earlier.

Major Asian indices, including South Korea’s Kospi, Japan’s Nikkei 225, Shanghai’s SSE Composite and Hong Kong’s Hang Seng, were all in the green.

US markets had also closed higher on Wednesday, adding to the positive global sentiment.

Business

Union Cabinet approves Pune Metro Rail Project Phase 2 with Rs 9,857 crore outlay

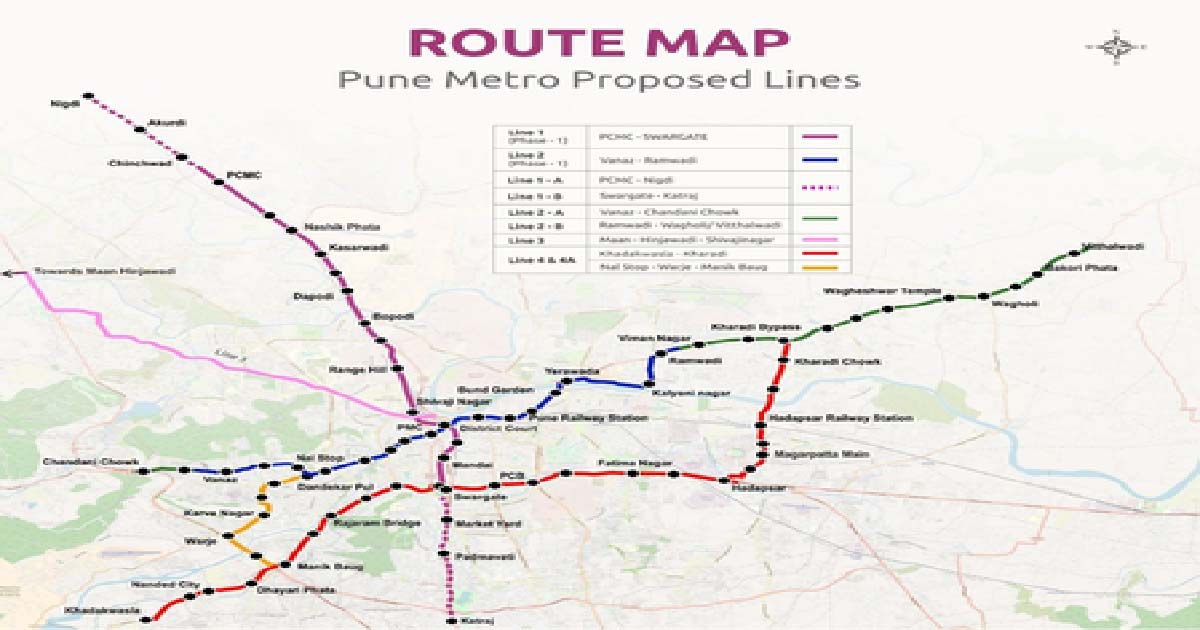

New Delhi, Nov 26: In a major boost for the public transport network in Pune, the Union Cabinet, chaired by Prime Minister Narendra Modi, on Wednesday approved Line 4 (Kharadi–Hadapsar–Swargate–Khadakwasla) and Line 4A (Nal Stop–Warje–Manik Baug) with Rs 9,857.85 crore outlay under Phase 2 of the Pune Metro Rail Project.

According to the Cabinet, this is the second major project approved under Phase-2, following the sanction of Line 2A (Vanaz–Chandani Chowk) and Line 2B (Ramwadi–Wagholi/Vitthalwadi). With this latest approval, Pune Metro’s network will expand beyond the 100-km milestone, a significant step in the city’s journey towards a modern, integrated, and sustainable urban transit system.

Spanning 31.636 km with 28 elevated stations, Line 4 and 4A will connect IT hubs, commercial zones, educational institutions, and residential clusters across East, South, and West Pune.

The project will be completed within five years at an estimated cost of Rs 9,857.85 crore, to be jointly funded by the Centre, the Maharashtra government, and external bilateral/multilateral funding agencies.

These lines are a vital part of Pune’s Comprehensive Mobility Plan (CMP) and will seamlessly integrate with operational and sanctioned corridors at Kharadi Bypass and Nal Stop (Line 2), and Swargate (Line 1).

“They will also provide an interchange at Hadapsar Railway Station and connect with future corridors towards Loni Kalbhor and Saswad Road, ensuring smooth multimodal connectivity across metro, rail, and bus networks,” a Cabinet communique said.

The project will be implemented by the Maharashtra Metro Rail Corporation Limited (Maha-Metro), which will carry out all civil, electrical, mechanical, and systems works.

Pre-construction activities such as topographical surveys and detailed design consultancy are already underway, according to the Cabinet.

According to projections, the daily ridership on Line 4 and 4A combined is expected to be 4.09 lakh in 2028, rising to nearly 7 lakh in 2038, 9.63 lakh in 2048, and over 11.7 lakh in 2058.

Of this, the Kharadi–Khadakwasla corridor will account for 3.23 lakh passengers in 2028, growing to 9.33 lakh by 2058, while the Nal Stop–Warje–Manik Baug spur line will rise from 85,555 to 2.41 lakh passengers over the same period.

These projections highlight the significant growth in ridership expected on Line 4 and 4A over the coming decades.

With Line 4 and 4A, Pune will not just get more metro tracks but will also gain a faster, greener, and more connected future. These corridors are designed to give back hours of commuting time, reduce traffic chaos, and provide citizens with a safe, reliable, and affordable alternative.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report