Business

Unheard of Rs 3.3 lakh Cr bank deposit bulge in Diwali week slumped in a fortnight

State Bank of India’s Economic Research Department has highlighted the curious case of Rs 3.3 lakh crore deposit bulge and the Rs 2.7 lakh crore deposit slump in alternate fortnights.

As per the provisional data released by RBI for the fortnight ended November 19, ASCB’s aggregate deposits have slumped by Rs 2.7 lakh crore during the fortnight. The slump in deposits follows an abrupt increase by Rs 3.3 lakh crore during the previous fortnight ended November 5. Interestingly, such growth in deposits was around 36 per cent of the incremental deposit growth at that point of time. This increase in deposits and subsequent slump is quite a contrarian trend, says Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

While it may be exactly difficult to decipher the increase and subsequent decline, it does pose questions on liquidity management/financial stability or a shift in behavioural trend in customer payment habits through digitisation and hence lower currency leakage and concomitant deposit bulge or both.

First, the fortnightly increase of Rs 3.3 lakh crore. This has never happened during a Diwali week as there is always a currency leakage and concomitant deposit decline. This is also the fifth largest increase in any fortnight in the last 24 years. Such huge incremental addition has happened only a few times, with higher deposits accretion (than the current year’s fortnight) occurring during the fortnight ended November 25, 2016 (Rs 4.16 lakh crore), September 30, 2016 (Rs 3.55 lakh crore), March 29, 2019 (Rs 3.46 lakh crore) and April 1, 2016 (Rs 3.41 lakh crore). However, the increase in November 2016 was because of demonetisation and the March and April fortnightly increases could be attributed to seasonal year-end bulge. In this respect, the current deposit bulge requires a detailed explanation, the report said.

Next, the fortnightly deposit slump in the subsequent fortnight. ‘We believe that it is possible that there was a large influx of deposits into the banking system for the fortnight ended November 5, 2021 in anticipation of a build up in rally in stock markets post primary issuances of new age companies and others. However, when such a rally did not materialise, the bulge in banking deposits slumped and almost 80 per cent of deposit bulge was withdrawn, the report said.

Interestingly, the amount of money parked in fixed reverse repo window jumped from Rs 0.45 lakh crore on October 19 to Rs 2.4 lakh crore on November 17, 2021 and has remained at such level till December 1. However, it must be noted that the significant jump in digital transactions has also resulted in lower usage of cash in the current fiscal and ideally could also have resulted in a surge in deposits for the Diwali week.

Meanwhile, if we look at the quarterly ASCB data, though the deposits growth remains same in Q2 (2.6 per cent) as compared to Q1 (2.5 per cent), sequentially at all-India level, apart from Metro regions, the deposits growth has decelerated in Q2 as compared to Q1, particularly in rural areas indicating that the current economic recovery is mostly urban led and rural economy is still recouping. Meanwhile, ASCB’s credit has increased by Rs 1.18 lakh crore (7.1 per cent YoY) during the fortnight ended November 5, which may be due to festive demands.

Business

Tomato Prices In Mumbai Surge – Know What Are The Current Rates

Navi Mumbai: The APMC wholesale vegetable market saw an increase in tomato prices by over 30 percent in first week of November as compared to the prices in October 2025. According to the report, prices of tomatoes in October were sold in APMC at Rs 16 -20 per kg and have now increased to Rs 20-28 per Kg.

The supply of tomatoes have also reduced on Monday, as report by Loksatta stated that only 2238 quintals of tomatoes arrived in the APMC Market.

According to the report, traders said that cold weather and imbalance production of tomatoes led to the increase in price, adding that in the last few days, the supply of goods from Nashik, Pune and Nagar areas also reduced.

According to the report, farmers have cautioned about crop damage caused by unseasonal rainfall and the current cold weather, stating that there is a significant chance that the produced crop’s flowers and buds will fall.

Several other reports added that the price of green peas, cluster beans have also gone up. Price of green peas increased to Rs 280 per kg, cluster beans reached Rs 200 per kg while that of Tinda (Indian round gourd) have rised to Rs 50 for 250 grams.

According to Regional Meteorological Center,Mumbai, the climate in Pune, Nashik is expected to see dry climate till November 15. Indian Meteorological Department (IMD) Mumbai scientist Shubhangi Bhute added that, “there are no signs of unseasonal rainfall currently. With the northeasterly winds prevailing, the temperature will drop. The weather will be dry and skies will be clear.”

Business

Sensex, Nifty open lower amid mixed global cues

Mumbai, Nov 11: The Indian benchmark indices opened mildly in red on Tuesday, amid progress on the US shutdown bill and optimism regarding an India-US trade deal soon.

As of 9.25 am, the Sensex was down 177 points, or 0.21 per cent at 85,338 and the Nifty inched down 51 points, or 0.20 per cent to 25,523.

The broadcap indices performed better than benchmarks, with the Nifty Midcap 100 down only 0.09 per cent and the Nifty Smallcap 100 losing 0.06 per cent.

TCS, Tech Mahindra and Dr Reddy’s Labs were among the major gainers in the Nifty Pack, while losers included Bajaj Finance, Bajaj Finserv, Shriram Finance and Asian Paints.

Sectoral indices were trading mixed with most of them trading with mild negative bias. Nifty IT was the standout gainer up 0.31 per cent, while financial services, FMCG, Pharma and PSU Bank down 0.71 per cent, 0.49 per cent, 0.16 per cent and 0.57 per cent respectively.

“Nasdaq bounced back 2.2 per cent after the AI trade was weak last week. The return from AI stocks may take longer than expected, but there is no bubble in AI stocks, unlike the Tech bubble that crashed in 2000,” said market watchers.

They noted that Nasdaq PE was above 70 and many tech stocks were above 150 in March 2000, and AI stock PE valuations now range from 28 to 51, while Nasdaq’s PE is 32.

Most of the Asia-Pacific markets rose in early trading sessions on Tuesday tracking Wall Street gains on revived optimism regarding artificial intelligence stocks.

The US markets ended in the green zone overnight, as Nasdaq jumped 2.27 per cent, the S&P 500 added 1.54 per cent, and the Dow inched up 0.81 per cent.

In Asian markets, China’s Shanghai index lost 0.46 per cent, and Shenzhen dipped 0.67 per cent, Japan’s Nikkei added 0.43 per cent, while Hong Kong’s Hang Seng Index eased 0.29 per cent. South Korea’s Kospi jumped 1.38 per cent.

On Monday, foreign institutional investors (FIIs) sold equities worth Rs 4,889 crore, while domestic institutional investors (DIIs) were net buyers of equities worth Rs 1,787 crore.

Business

Jharkhand: Robbery and firing on trader sparks shutdown in Dhanbad market

Dhanbad, Nov 10: Traders on Monday launched a massive protest after a businessman was robbed and shot at inside the government-run Market Committee complex in the Barwadda police station area in Dhanbad, Jharkhand, late Sunday evening.

The incident has caused concerns over rising crime in Jharkhand’s coal capital, prompting traders to shut all 417 shops in the market complex for the day.

The attack took place around 8.30 p.m. on Sunday when three bike-borne assailants intercepted trader Shyam Bhimsariya while he was closing his shop.

The miscreants fired at him, snatched a bag containing Rs 4 lakh, and sped off. Bhimsariya narrowly escaped the bullet, which reportedly grazed past him. The incident created panic among shopkeepers and customers, many of whom rushed to safety.

On Monday morning, hundreds of traders assembled at the main gate of the Market Committee complex, raising slogans against the administration and demanding immediate arrests. They alleged that the market, which witnesses a heavy footfall, has long been operating without proper security measures.

The Market Committee complex is one of the busiest business hubs in Dhanbad, recording a daily turnover of Rs 7-8 crore.

“We will not tolerate this kind of atmosphere where traders fear for their lives every evening,” a member of the traders’ association said, adding that if the culprits are not arrested within 48 hours, the protest may spread to other markets across the district.

BJP MP Dhullu Mahto, addressing traders, said criminals are “roaming fearlessly” in Dhanbad. “The morale of criminals has gone up due to weak policing. The police must act immediately to restore confidence among traders,” he said.

Jharia Congress MLA Ragini Singh accused the state government of complete failure on the law and order front. “When crime is discussed in the Assembly, the government remains silent. People are living in fear while criminals are dictating terms,” she remarked.

Outgoing Mayor Chandrashekhar Agarwal demanded urgent security measures in the market area, suggesting that CCTV cameras be installed. He said a permanent police post must be established to prevent the recurrence of such incidents.

Dhanbad District Chamber of Commerce president Chetan Goenka strongly condemned the attack and criticised authorities for ignoring repeated requests for better security.

“It is shocking that a market with a daily business of Rs 7-8 crore has neither CCTV surveillance nor police patrolling. Traders cannot operate under fear. The administration must take permanent measures,” Goenka said.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

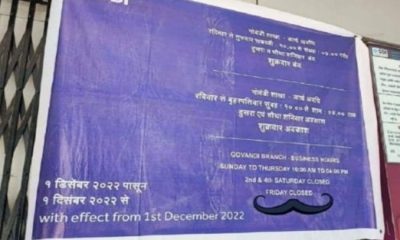

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra12 months ago

Maharashtra12 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report