Business

SEBI cracks down on firms diverting funds for personal use

Mumbai, March 21: The Securities and Exchange Board of India (SEBI) has cracked down on multiple companies for misappropriation of funds raised through rights issues in the stock markets, after receiving complaints from whistleblowers.

SEBI is reported to have initiated investigations against these companies for the alleged illegal diversion of funds by promoters to their relatives or front companies for personal use rather than the declared purpose for which the money was raised.

The capital markets watchdog is currently looking into four or five such entities and has discerned a pattern in the misuse of such funds. The issue is, therefore, also being taken up on a broader level.

Most of the cases relate to small and dormant companies which float a rights issue, in which shares are offered to existing shareholders at a discount to raise funds for further investment to expand the business. However, these funds are then diverted for personal use such as buying property.

Unlike pump and dump cases, fund diversion from rights issues does not have an immediate impact on the stock market. Hence, such misuse of funds is more difficult to detect and whistleblower complaints are the main source of information in unearthing the cases.

In an interim order passed on December 5, 2024, SEBI observed that Mishtann Foods Ltd. misused proceeds from its rights issue, transferring funds to promoters and group entities instead of their stated purpose. The company withdrew an initial Rs 150 crore rights issue and later issued smaller rights issues under Rs 50 crore, seemingly to avoid SEBI scrutiny.

The markets regulator has barred the company from raising public funds and prohibited the promoters from trading or accessing the capital markets.

Mishtann Foods was also asked to return Rs 49.82 crore misappropriated from its rights issue and Rs 47.10 crore diverted through fictitious transactions. To improve governance, SEBI has mandated the formation of a new audit committee to ensure strict compliance with regulations.

Additionally, BSE has been directed not to approve any further rights issues by the company. These directives will remain in force until further orders.

In another order passed on December 11, 2024, SEBI released an order against Debock Industries Ltd. The company was found to have engaged in financial misconduct, including manipulating its financial statements, submitting false bank statements, and siphoning off rights issue proceeds.

The company allegedly used fictitious preferential issues to migrate to the Main Board of the stock exchange. As a result, SEBI imposed strict restrictions, preventing the accused from dealing in securities or accessing the capital markets.

Business

Sensex, Nifty end flat amid mixed sectoral cues

Mumbai, Dec 30: Indian benchmark indices ended Tuesday’s session almost flat, but with a slight negative tone, as gains in PSU banks, metal and auto stocks were offset by selling pressure in IT, FMCG, realty and pharma shares.

The Sensex closed at 84,675.08, slipping 20.46 points or 0.02 per cent, while the Nifty settled marginally lower at 25,938.85, down 3.25 points or 0.01 per cent.

“The Nifty has also slipped below the 21 EMA, reinforcing the short-term downtrend. Immediate support is placed in the 25,850–25,870 zone,” market watchers stated.

“A decisive break below this level could intensify bearish sentiment, while resistance is placed at 26,000,” analysts mentioned.

Markets witnessed a cautious mood as investors balanced sector-specific buying against profit booking in select heavyweights.

On the Sensex, stocks such as Eternal, Infosys, Asian Paints, UltraTech Cement and Bajaj Finance ended among the top losers, weighing on the index.

On the other hand, M&M, Tata Steel, Bajaj Finserv and Axis Bank provided support and closed higher.

The broader market also saw mild weakness. The Nifty Midcap 100 index ended lower by 0.15 per cent, while the Nifty Smallcap 100 declined 0.28 per cent.

Sector-wise, real estate, IT and pharma stocks remained under pressure. The Nifty Realty index fell 0.84 per cent, while the Nifty IT and Pharma indices declined 0.74 per cent and 0.17 per cent, respectively.

In contrast, strong buying was seen in PSU bank, metal and auto stocks. The Nifty PSU Bank index jumped 1.69 per cent, the Nifty Metal index rose 2.03 per cent, and the Nifty Auto index gained 1.08 per cent.

Analysts said that the market ended the day on a flat note as investors preferred selective buying, with sectoral trends driving movement rather than broad-based participation.

“Fresh buying at lower levels, along with short covering in banking, auto, and metal stocks following the expiry of monthly derivative contracts, helped the Nifty recoup most of its intraday losses and close the session largely flat,” market watchers mentioned.

Business

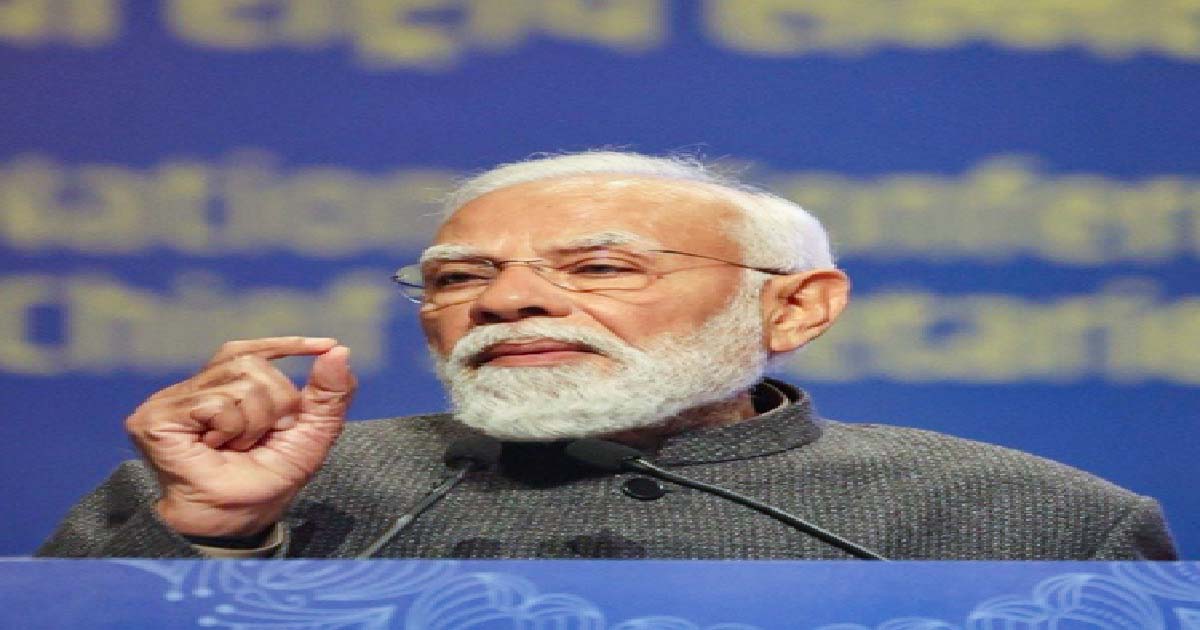

From labour laws to market reforms, India’s growth story built on credibility and stability: PM Modi

New Delhi, Dec 30: Prime Minister Narendra Modi on Tuesday said that India’s growth story is being shaped by credibility, stability, and long-term confidence, driven by a series of sustained reforms across sectors ranging from labour laws and trade agreements to logistics, energy, and market reforms.

In a post on X, the Prime Minister referred to Union Minister Hardeep Singh Puri’s write-up on “Reform Express 2025”, which reflects the “quiet but consistent work of governance that has helped clear long-pending bottlenecks week after week”.

PM Modi said these steady reforms are laying a strong foundation for India’s future growth.

“Union Minister Hardeep Singh Puri writes on Reform Express 2025. He reflects on the quiet, cumulative work of governance that cleared bottlenecks week after week,” he said.

“From labour laws and trade agreements to logistics, energy and market reforms, India’s growth story is being built on credibility, stability and long-term confidence,” he added.

In his article, Union Petroleum and Natural Gas Minister Puri highlighted how the PM Modi government’s reform push is improving ease of doing business and strengthening investor confidence.

Puri had described “Reform Express 2025” as the cumulative impact of consistent governance, where obstacles are addressed regularly rather than through sudden, disruptive changes.

He had said that in an uncertain global environment marked by political instability, the steady leadership of Narendra Modi stands out.

Puri had pointed out that key steps such as modern labour codes, major trade agreements, the Securities Market Code Bill and the Indian Ports Act 2025 are creating a solid base for long-term economic expansion.

He also said that the SHANTI Bill is a major step towards modernising India’s civil nuclear framework.

According to the minister, these reforms follow a clear pattern of cleaning up outdated laws, decriminalising minor offences, modernising labour compliance, strengthening market oversight, digitising trade processes, improving logistics, and reducing risks in long-term energy investments.

Business

Sensex, Nifty trade flat amid mixed global cues

Mumbai, Dec 29: Indian benchmark indices traded flat with a mild positive bias early on Monday, tracking mixed global cues and subdued year-end participation.

As of 9.30 am, Sensex moved up 40 points, or 0.04 per cent to 85,081 and Nifty gained 14 points, or 0.05 per cent to 26,057.

Main broad-cap indices performed in line with benchmark indices, with the Nifty Midcap 100 advanced 0.14 per cent, while the Nifty Smallcap 100 added 0.18 per cent.

Tech Mahindra, Tata Steel and NTPC were among the major gainers in the Nifty Pack, while losers included Bajaj Finserv, Axis Bank, Bajaj Finance and Tata Consumer.

Among sectoral gainers, the Nifty Metal index was the top performer, rising 1.11 per cent, followed by Nifty Auto and Nifty Realty, which gained 0.26 per cent and 0.25 per cent, respectively.

According to analysts, immediate support is placed at 25,850–25,900 zone, while 26,150–26,200 remains a crucial resistance band. Stable crude prices and a relatively steady rupee continue to offer underlying support, preventing sharp downside.

They further said that underperformance of India compared to most developed and emerging markets in 2025 is set to change in 2026 as Indian macros are in the ‘Goldilocks’ zone, with robust economic growth and recovery in earnings from Q3 FY26.

However, these factors are not enough to spark a rally soon, market watchers said. The market needs a US-India trade deal with positive surprises for India to rebound. A consolidation phase is likely in the near term in the absence of such surprises, they added.

Asia-Pacific markets traded mixed in the morning session, as investors kicked off the final trading week of the year.

In Asian markets, China’s Shanghai index advanced 0.31 per cent, and Shenzhen edged up 0.03 per cent, Japan’s Nikkei lost 0.31 per cent, while Hong Kong’s Hang Seng Index gained 0.39 per cent. South Korea’s Kospi added 1.52 per cent.

The US markets ended in the red zone on the last trading day, as Nasdaq lost 0.09 per cent, the S&P 500 eased 0.03 per cent, and the Dow moved down 0.04 per cent.

On December 26, foreign institutional investors (FIIs) sold equities worth Rs 317 crore, while domestic institutional investors (DIIs) were net buyers of equities worth Rs 1,772 crore.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report