National News

Prez Murmu, PM Modi and HM Shah set to visit MP between February 23 to 26

Bhopal, Feb 13: President Droupadi Murmu, Prime Minister Narendra Modi and Union Home Minister Amit Shah will visit Madhya Pradesh between February 23 to 26.

Prime Minister Modi will arrive at Bageshwar Dham in Chhatarpur district, where he will lay the foundation stone for a cancer hospital on February 23.

Bageshwar Dham’s head priest Dhirendra Shastri is building a cancer hospital.

Later in the day, PM Modi will arrive in Bhopal and stay overnight at Raj Bhawan.

Next morning, he will inaugurate the Global Investment Summit (GIS) in Bhopal on February 24, in which around 4,000 industrialists, and business representatives from several overseas countries, including the US, UK, Japan and Germany will participate.

Chief Minister Mohan Yadav has confirmed that the state government has requested PM Modi to inaugurate GIS-2025, and got approval from PMO.

Union Home Minister Shah is also scheduled to attend GIS on the concluding day on February 25. He is supposed to address the gathering of industrialists during the closing ceremony of GIS.

On February 26, President Murmu is scheduled to arrive in Chhatarpur to attend a mass marriage ceremony at Bageshwar Dham.

The marriage of 251 girls will be solemnised between February 22 and 26. Out of them, 108 girls belong to the tribal community.

For the GIS, the MP government organised a curtain-raiser event at the Taj Hotel in Delhi on Wednesday, wherein, the state’s new investment policy was highlighted.

During the event, Chief Minister Mohan Yadav held one-on-one and round table discussions with industrialists and invited them to GIS Bhopal on February 24 and 25.

He said, “I am happy that we have worked on ease of doing business for us. Industrialists are getting the benefit of this. Land in Madhya Pradesh is much cheaper than in Delhi and Mumbai. I went to Japan, and met the industrialists there, they said there is a huge potential for the cotton industry in Madhya Pradesh. We have water, the largest land after Rajasthan. We have the largest network of highways and six airports. And we guarantee 200 per cent return. All of you come and invest in Madhya Pradesh.”

Mumbai Press Exclusive News

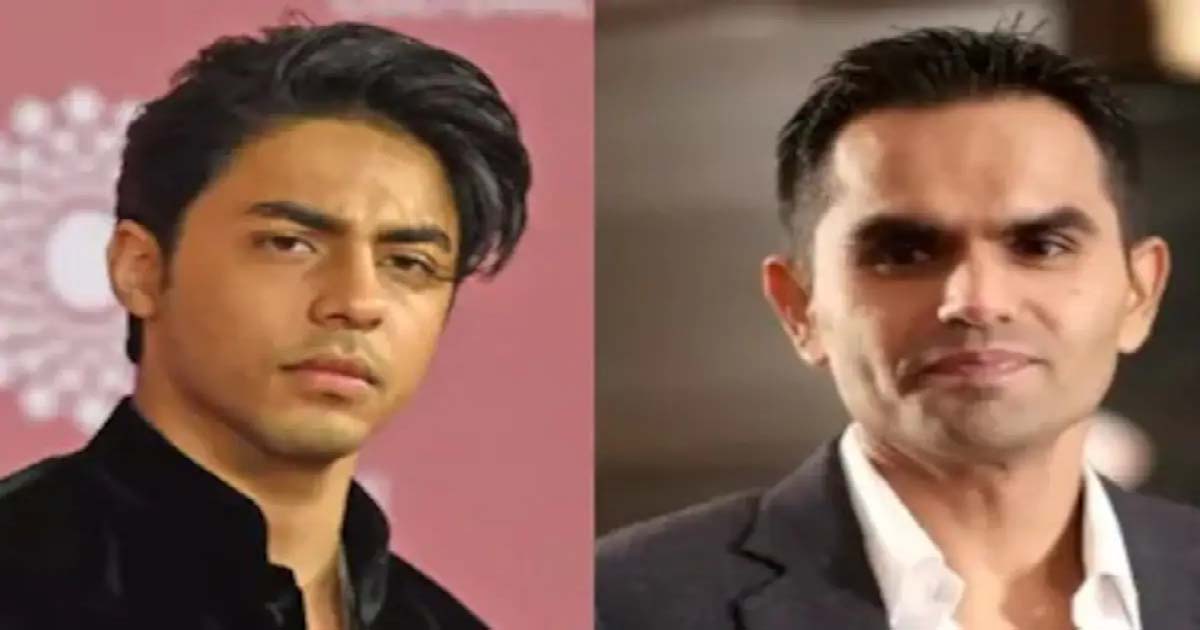

Mumbai Dandoshi Court dismisses Sameer Wankhede’s defamation case against Bads of Bollywood, Delhi High Court dismisses case

Mumbai: IRS officer Sameer Wankhede has filed a defamation case against The Bads of Bollywood in the City Civil Court, Mumbai, Dandoshi. Wankhede had earlier filed a case in the Delhi High Court against The Bads of Bollywood, Netflix, Meetha and other agencies, which the court had dismissed saying that the matter was not within its jurisdiction, so Wankhede should file a case in Mumbai in this matter, after which the court has allowed Sameer Wankhede to file a defamation case in Mumbai. Today, Sameer Wankhede has officially filed a case against film actor Shah Rukh Khan’s company Red Chillies Entertainment and related social media platforms and has demanded damages. Earlier, Wankhede had demanded a compensation of Rs 2 crore and this compensation he is going to pay as a donation to the cancer hospital Tata Memorial Hospital.

Sameer Wankhede had arrested Shah Rukh Khan’s son Aryan Khan in the Cordelia Cruise drugs case, after which Wankhede has been his target. In Bollywood, Wankhede has been criticized. In Bads of Bollywood, Sameer Wankhede has been described as a clown officer and an actor has been presented as his likeness, in which this character has committed a crime due to Sameer Wankhede’s malice and prejudice. Not only that, he has desecrated the national emblem and phrase by pointing his finger and saying “Satyamev Jeete”. The court accepted the petition in this matter for hearing and ordered the parties concerned to be present to file their reply on February 12 and has also issued summons, due to which Shah Rukh Khan, Aryan Khan and Red Chillies Entertainment and other parties concerned have been shocked. In the petition, Wankhede has demanded compensation along with the removal and deletion of the controversial parts of the film.

Crime

Mumbai: Court Relies On Dying Declaration, Acquits Husband And Other Relatives In 2018 Dowry-Linked Murder Case

Mumbai: The sessions court has convicted two brothers for setting their sister-in-law ablaze while she was sleeping in Shivaji Nagar in March 2018. The two, Tejim Shaikh and Kafil Shaikh, were found guilty based on the victim, Farida Shaikh’s dying declaration and sentenced to life imprisonment.

According to the prosecution, the accused were residing with Farida and her husband Aftab Shaikh in Rafiq Nagar, Shivaji Nagar, due to work-related reasons. It was alleged that Farida was under physical and mental pressure following the death of her three-month-old daughter and was subjected to harassment over an insufficient dowry.

As per the case registered with the Shivaji Nagar police, a quarrel broke out on March 6, 2018, after Farida allegedly refused to allow Aftab to join his brothers. Later that night, around 2am, Farida felt kerosene being poured over her. She stated that Tejim was pouring the kerosene while Kafil stood nearby, and that Kafil then set her on fire with a matchbox.

Aftab later tried to extinguish the flames and rushed her to Rajwadi Hospital. Farida suffered burn injuries over about 92-95% of her body. Her statement was recorded by police during treatment, followed by a formal dying declaration before a Naib Tahsildar. She succumbed to her injuries on March 11, 2018, after which the accused were booked for murder and dowry harassment.

The defence argued that Farida had committed suicide by pouring kerosene on herself and challenged the dying declaration. However, the court rejected the claim and relied on her statement.

The court did not accept allegations of cruelty against the other family members, noting that they were vague and lacked specific details. It also acquitted Aftab, observing that Farida had not accused her husband of any role in the incident and had instead stated that he attempted to save her after she was set on fire.

Crime

Maharashtra Shocker: Man Arrested For Killing 6-Year-Old Daughter To Meet Two-Child Norm For Panchayat Polls

Hyderabad: A man from Maharashtra killed one of his three children to overcome the two-child norm to contest the upcoming Panchayat elections in that state.

Pandurang Kondmangale, a resident of Kerur village in Mukhed taluka of Maharashtra’s Nanded district, pushed her six-year-old daughter into a canal in Telangana’s Nizamabad district.

Nizamabad Police on Monday announced the arrest of Pandurang (28) and village sarpanch Ganesh Ramachandra Shinde.

Nizamabad Police Commissioner P. Sai Chaitanya told media persons that the body of a girl was found in the Nizam Sagar canal in Yedapally a few days ago. The investigation led to her identification as Prachi (6), a resident of Kerur village in neighbouring Nanded district of Maharashtra.

Police picked up her father for questioning. He tried to mislead the police by stating that she was undergoing treatment at a health centre. When grilled by the investigating officer, he confessed to killing the child.

What he revealed during the questioning was shocking for everyone. Pandurang, who runs a barber shop in his village, was keen to contest the upcoming Panchayat elections. As he had a three-year-old boy and twin girls aged six, he was ineligible to contest in view of the two-child norm for candidates contesting local body polls in Maharashtra.

He consulted his friend and current sarpanch of the village, Ganesh Shinde how to overcome the norm. They conspired to get rid of one of his children, Prachi, the elder of the twins.

According to police, they initially considered putting Prachi up for adoption. But that would not have served the purpose because she would still be registered as his child in the birth certificate.

Pandurang also thought of abandoning the child, but was worried about the consequences in the event of her return. They then conspired to kill the child and make it seem like an accident.

As Nizamabad district is only a few kilometres away from his village, Pandurang took Prachi on a motorcycle to the Nizam Sagar canal. He pushed her into the canal and fled. Some villagers who were working in the field nearby heard something plunge into the water and rushed there to find the girl’s lifeless body floating in the canal. They alerted the police, which launched an investigation.

The girl’s pictures were circulated widely on social media. Someone from the Maharashtra village identified Prachi when they saw her photo as the display picture on the WhatsApp number of one of the police personnel.

A police team reached the village and began an investigation, which led to the arrest of Pandurang and the sarpanch.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report