Business

Nil tax till Rs 12 lakh: How taxpayers will benefit from tax slab changes in Budget 2025-26

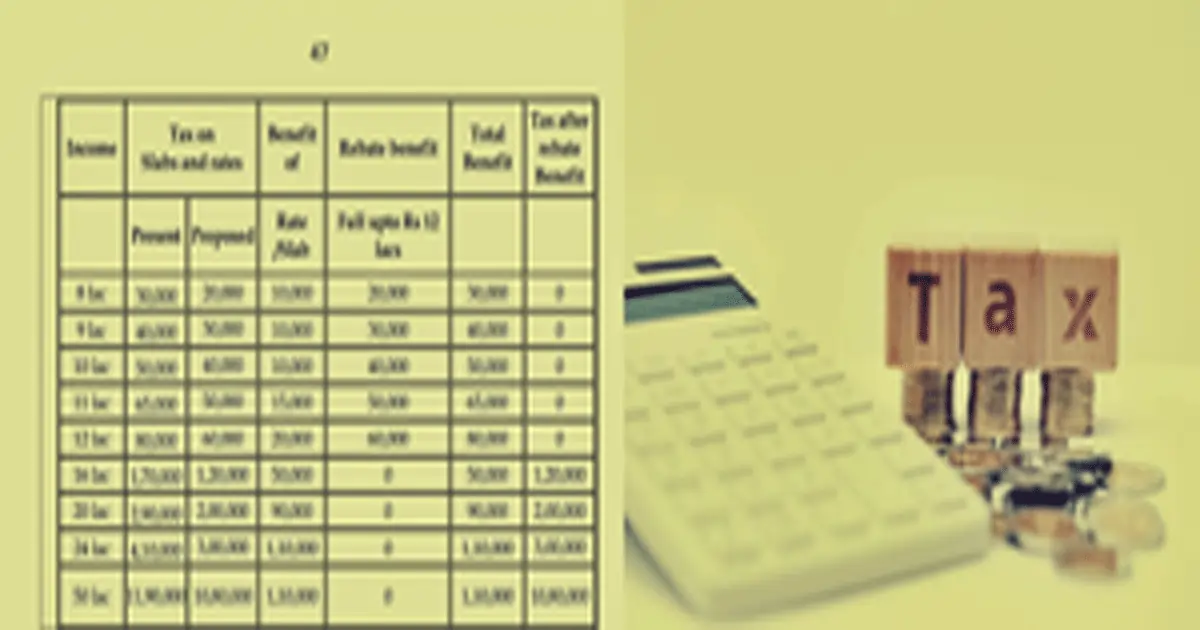

New Delhi, Feb 1: The big-ticket announcement by Finance Minister Nirmala Sitharaman regarding the income tax slab for an income up to Rs 12 lakh has brought wide cheers to the faces of the middle-class and taxpayers.

By bringing down their tax liability to nil, FM Sitharaman unveiled the bonanza at a time when they least expected it. However, these changes are applicable only to the New Tax Regime.

Under the proposed budgetary changes in Union Budget 2025-26, those with an income of up to Rs 12 lakh will no longer have to pay any income tax, a significant shift from the previous practice where they had to pay anywhere between Rs 60,000 – Rs 80,000.

“The New tax regime is the default regime. To avail benefits of the rebate allowable under proposed provisions of the new tax regime, only a return is to be filed otherwise no other step is required to be taken,” said an official release.

Also, there exists a standard deduction of Rs 75,000 available to taxpayers in the new regime. Therefore, a salaried taxpayer will not be required to pay any tax where his income before the standard deduction is less than or equal to Rs 12,75,000.

Below are some Q&As regarding new income tax slabs:

What was the earlier income limit for nil tax?

Earlier, the limit of income for nil tax payment was Rs 7 lakh. By increasing this limit to Rs 12 lakh, around one crore assesses who were earlier required to pay tax varying from Rs 20,000 to Rs 80,000 will now pay nil tax.

Who will benefit from changes in tax slabs?

The new tax regime applies to a person, or Hindu undivided family or association of persons [other than a co-operative society], or body of individuals, whether incorporated or not, or an artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2.

Accordingly, changes in tax slabs will benefit all these persons.

What benefits a taxpayer can avail?

Any individual, who earlier was required to pay a tax of Rs 80,000 (in the new regime) for an income of Rs 12 lakh, will be required to pay nil tax on such income.

Business

Gross enrolment under Atal Pension Yojana surpasses 8.34 crore: FM Sitharaman

New Delhi, Dec 1: Gross enrolment under the Atal Pension Yojana (APY), a bid to create a universal social security system for all, especially the poor, the under-privileged and the workers in the unorganised sector, has reached 8,34,13,738 (as on October 31), the Parliament was informed on Monday.

APY was launched in 2015 with the objective of creating a universal social security system for all Indians. It is open to all citizens of India between 18 and 40 years of age who have a savings account in a bank or post office.

As per the Scheme, the subscriber will receive pension benefits on attaining the age of 60 years.

“Hence, the pension benefit under APY is expected to start from 2035 onwards. However, the gross enrolment under Atal Pension Yojana as on 31.10.2025 is 8,34,13,738,” Finance Minister Nirmala Sitharaman told the Lok Sabha in a written reply to a question.

As on October 31, the female gross enrolment under APY is 4,04,41,135, which is 48 per cent of the total enrolment, she noted.

Further, in Bihar, the female gross enrolment under APY is 42,07,233, which is 57 per cent of the total enrolment in the state.

“As on 31.10.2025, a total of 7,153 Bank branches and 461 Post Office branches are enrolling people into APY in Bihar,” the Finance Minister stated.

The government and the Pension Fund Regulatory and Development Authority (PFRDA) have taken several steps to increase awareness and coverage of APY across the country, including rural and remote areas of Bihar.

These include periodic advertisements; APY Subscribers Information Brochure in 13 vernacular languages; and virtual capacity building programmes for Banking Correspondents (BCs) and field staff of Banks, Self Help Group (SHG) members, and bank-sakhis of State Rural Livelihoods Missions (SRLMs).

During the last five years, such programmes have been conducted across various districts of Bihar, including in Muzaffarpur, Patna, Bhojpur, and Nalanda.

Recently, financial inclusion campaigns for pension saturation were organised pan-India India including 8,093 such campaigns in Bihar, said Sitharaman.

Business

RBI to cut policy repo rate by 25 bp on Dec 5: HSBC

New Delhi, Dec 1: Since inflation is set to remain well below target for the foreseeable future, HSBC Global Investment Research on Monday projected that the RBI will cut rates by 25 bp during its monetary policy committee (MPC) meeting on December 5 — taking the policy repo rate to 5.25 per cent.

Growth has been strong so far, benefitting from the front loading of government spending and GST-cut led retail spending.

However, the November Flash manufacturing PMI (56.6) indicated that GST-led boost may have peaked with the overall new orders coming in soft, said the report.

“Growth is strong for now, but could soften in the March 2026 quarter as the fiscal impulse becomes contractionary and exports slow. We expect the RBI to ease policy rates in the upcoming December policy meeting,” the report mentioned.

The July-September quarter GDP growth came in at 8.2 per cent YoY, higher than 7.8 per cent in the previous quarter and higher than “our above-consensus forecast of 7.5 per cent”. While GVA growth came in at 8.1 per cent, nominal GDP grew 8.7 per cent.

The GDP momentum was clearly higher than our above-consensus forecast. There are some good reasons for the strength, said the report.

One, GST rate cuts were implemented on the September 22, but the announcement was made on August 15.

“We think that production picked up in anticipation of a rise in consumer demand. Two, our recent work indicates that lower income states are starting to rise, even growing faster than the higher income states,” the HSBC report mentioned.

This, too, could possibly explain the strength in India’s growth momentum. After all, national GDP is the sum of state Gross State Domestic Products (GSDP).

According to the report, India’s growth has held up decently despite the 50 per cent reciprocal tariff on India’s exports by the US since August.

Business

UPI transactions grow 32 pc in Nov as consumption remains robust

New Delhi, Dec 1: The unified payments interface (UPI) saw 32 per cent transaction count growth (year-on-year) at 20.47 billion in the month of November — along with registering 22 per cent annual growth in transaction amount at Rs 26.32 lakh crore, the National Payments Corporation of India (NPCI) data showed on Monday.

Average daily transaction amount in November stood at Rs 87,721 crore, the NPCI data showed.

The month of November recorded 682 million average daily transaction counts, up from 668 million registered in October.

Meanwhile, monthly transactions via instant money transfer (IMPS) stood at 6.15 lakh crore in November, up 10 per cent year-on-year, as transaction count stood at 369 million. Daily transaction amount via IMPS stood at Rs 20,506 crore.

In October, UPI witnessed 25 per cent transaction count growth (year-on-year) at 20.70 billion — along with registering 16 per cent annual growth in transaction amount at Rs 27.28 lakh crore.

Notably, UPI continues to dominate the country’s digital payments landscape, with transactions surging 35 per cent year-on-year (YoY) to reach 106.36 billion in the first half of 2025, data showed.

The total value of these transactions stood at a massive Rs 143.34 lakh crore — highlighting how deeply digital payments have become a part of everyday life in India, according to Worldline’s India Digital Payments Report (1H 2025).

Person-to-merchant (P2M) transactions grew 37 per cent to 67.01 billion, driven by the “Kirana Effect,” where small and micro businesses have become the backbone of India’s digital economy. India’s QR-based payment network also saw tremendous growth, more than doubling to 678 million by June 2025 — a 111 per cent rise from January 2024.

India’s Digital Public Infrastructure (DPI) has played a transformational role in enabling universal access to services, bridging urban–rural gaps and strengthening the country’s position as a global digital powerhouse.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report