Business

Gold Tumbles ₹950; Silver Nosedives ₹4,500 On Weak Demand

Gold prices tumbled by Rs 950 to Rs 71,050 per 10 grams in the local market here on Monday due to weak demand from jewellers.

According to the All India Sarafa Association, the precious metal of 99.9 per cent purity closed at Rs 72,000 per 10 grams in the previous session on Saturday.

Gold of 99.5 per cent purity also plunged Rs 1,650 to Rs 70,700 per 10 grams. On Saturday, it closed at Rs 72,350 per 10 grams.

Silver also declined Rs 4,500 to Rs 84,500 per kg on decreased offtake by coin makers and industrial units.

This marks the biggest single-day fall in silver prices in 2024. It ended at Rs 89,000 per kg in the previous session.

Traders said reduced demand from jewellers as well as retail buyers led to the fall in gold prices.

“Last week, Finance Minister Nirmala Sitharaman in the Budget announced a customs duty cut from 15 per cent to 6 per cent, weighing on the domestic front.

“Post the cut in import duty, gold premiums in India jumped to their highest level in a decade,” Manav Modi, Senior Analyst of Commodity Research at Motilal Oswal Financial Services Ltd, said.

However, on the global front, Comex gold is trading at USD 2,438.50 per ounce, up by USD 10.60 per ounce.

US Federal Reserve policymakers got fresh evidence of progress on their battle against inflation, fuelling expectations they will use their meeting to signal interest rate cuts starting in September, Modi said.

Focus this week will be on Fed policy meeting, US Consumer confidence, factory orders and jobs market data, he added.

The US Fed meeting will start on Tuesday and conclude on Wednesday.

In addition, silver was marginally higher at USD 28.28 per ounce in New York.

“Gold has started the week in positive with prices in the international market moving above USD 2,400 in early trades, on renewed safe-haven buying due to possible escalation in the Middle East tensions with additional support from a steady dollar against major currencies.

“Also focus remains on the three key central bank meetings this week, starting with the Bank of Japan, US Federal Reserve, and Bank of England,” Pranav Mer, Vice President, EBG – Commodity & Currency Research at JM Financial Services, said.

Business

Navi Mumbai: CIDCO’s 9.6-Km Kharghar Coastal Road Work To Begin In 2026, Promises Faster NMIA Connectivity By 2029

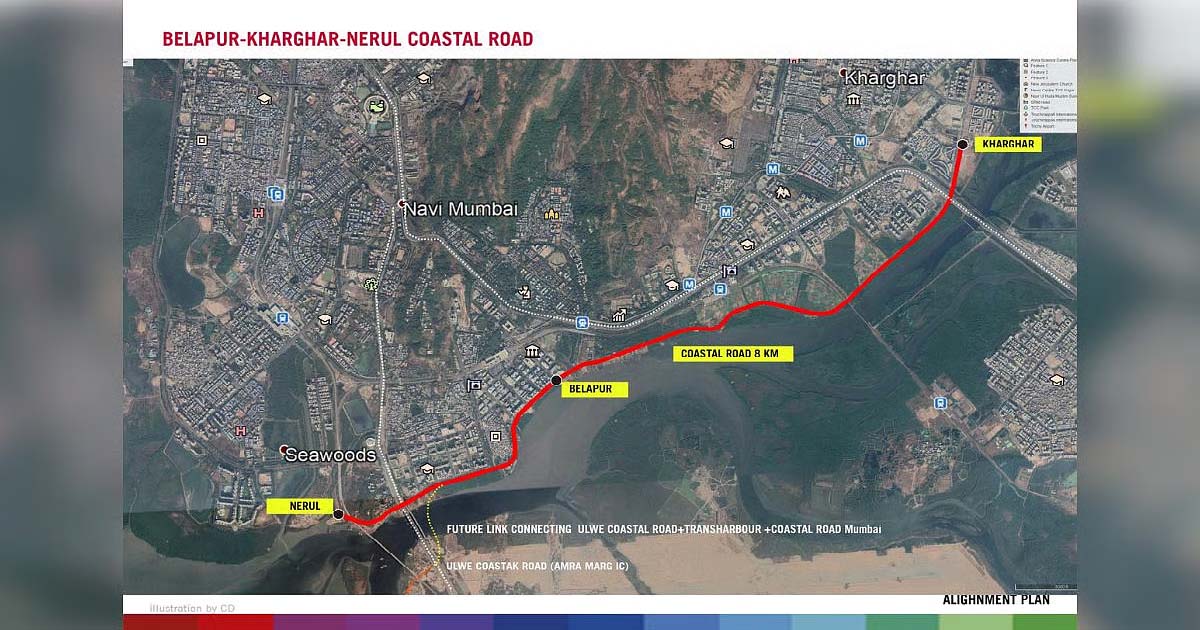

Navi Mumbai: Construction of the much-anticipated Kharghar Coastal Road — a key link that will enhance connectivity to the upcoming Navi Mumbai International Airport (NMIA) — is expected to commence in early 2026, following the receipt of mandatory forest clearances.

Planned by the City and Industrial Development Corporation (CIDCO), the 9.678-kilometre-long and 30-metre-wide arterial road will connect the airport to major nodes such as Belapur and Nerul, significantly improving regional mobility and supporting economic growth across Navi Mumbai.

The project will also provide direct high-speed access to the International Corporate Park (ICP) being developed on the lines of Bandra Kurla Complex (BKC), the Golf Course, and the FIFA-standard Centre of Excellence (COE) at Kharghar.

A grade-separated interchange over the Sion-Panvel Expressway is part of the plan to ensure smooth traffic flow and reduce congestion between the airport and nearby business and recreational hubs.

Of the total road length, 6.96 kilometres will be newly developed, while the remaining portion will integrate with the existing network. The corridor will also cater to the anticipated transport demand from upcoming projects such as the Water Transport Terminal and Pradhan Mantri Awas Yojana (PMAY) housing schemes in the area.

CIDCO has awarded the construction contract to the J Kumar–J M Mhatre Joint Venture. Officials said the project will not only boost airport connectivity but also strengthen Kharghar’s position as a major residential and commercial hub, linking it seamlessly to Taloja and Navde.

“Known for its well-planned infrastructure, green cover, and educational institutions, Kharghar is poised to witness a new phase of growth once the coastal road becomes operational. Kharghar coastal road is estimated to be ready by 2029 if everything goes as per plan,” an official from CIDCO said.

Business

Telecom operators embrace AI to bolster revenues, drive efficiency globally

New Delhi, Nov 8: Leading telecoms globally are deploying artificial intelligence (AI) across network operations, customer service, and fraud prevention to drive efficiency and reduce costs, according to a new report.

These initiatives are already contributing to EBITDA margin gains, with predictive maintenance and automated support systems leading the way, according to an IDC report.

AI also enables personalised offerings and dynamic pricing, boosting average revenue per user (ARPU) and reducing churn.

Fraud detection systems enhanced by AI are helping reduce losses, reinforcing customer trust and regulatory compliance. With AI accelerating time-to-market for new services, telecoms can better monetize emerging technologies like 5G and edge computing.

“In the longer term, as AI continues to evolve, it will be increasingly recognized not as a mere technological enhancement, but as a strategic enabler poised to drive sustainable growth for telecommunications operators,” said the report.

Meanwhile, worldwide spending on telecommunication and pay TV services is projected to reach $1,532 billion in 2025, representing an increase of +1.7 per cent year-on-year, according to the IDC report.

The latest forecast is slightly more optimistic compared to the forecast published earlier this year, as it assumes a 0.1 percentage point higher growth of the total market value.

The regional dynamics remain mixed, with inflationary effects, competition, and Average Revenue per User (ARPU) trends playing a central role in shaping market trajectories, said Kresimir Alic, research director, Worldwide Telecom Services at IDC.

The breakdown by telecom service type confirms that established trends remain intact, despite adjustments to overall market forecasts.

Mobile continues to dominate, driven by rising data consumption and the expansion of M2M applications, which are offsetting declines in traditional voice and messaging revenues.

Fixed data services are also expected to grow steadily, fuelled by increasing demand for high-bandwidth connectivity.

The global connectivity services market is projected to grow at a compound annual rate of 1.5 per cent over the next five years, maintaining a cautiously optimistic outlook.

Business

Govt plans AI-based eKYC, global credential verification in DigiLocker

New Delhi, Nov 8: The Ministry of Electronics and IT on Saturday announced plans for AI-based eKYC and global credential verification in the DigiLocker platform.

The platform has evolved from a secure document storage service into a trust layer that connects citizens with ministries and departments, according to an official statement.

National e-Governance Division (NeGD), Ministry of Electronics and IT organised the National Conference on DigiLocker to discuss and showcase how DigiLocker evolves into a cornerstone of trust, convenience, and efficiency across government, education, and industry sectors.

The conference underscored the transformative role of DigiLocker in facilitating paperless governance, inclusive education, and secure digital services.

“DigiLocker serves as the trust layer connecting citizens, ministries, and departments—enabling secure, interoperable, and accountable digital governance. Our vision is a future where every digital interaction is trusted, every citizen empowered, and every institution accountable” said S. Krishnan, Secretary of MeitY, who chaired the conference.

Krishnan said that the platform advances India’s digital journey from connectivity to capability, service delivery to self-reliance and now from digitalisation towards trust.

Abhishek Singh, Additional Secretary of the Ministry of Electronics and IT, outlined the future of DigiLocker with AI-based eKYC and global credential verification, positioning it as a global model for paperless governance.

Presentations were made on integration of Digi Locker with Pension and Treasury systems in Maharashtra and with over 500 services through Sewa Setu Portal in Assam, the statement noted.

Seven states, including Assam, Himachal Pradesh, Madhya Pradesh, Meghalaya, Kerala, Maharashtra, and Mizoram, have been recognised as “DigiLocker Accelerators” for their distinct achievements.

DigiLocker allows citizens to access, verify, and share IDs, financial credentials and certificates securely.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra12 months ago

Maharashtra12 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report