Crime

Delhi: Heroin worth Rs 1 cr seized in multiple operations, 4 held

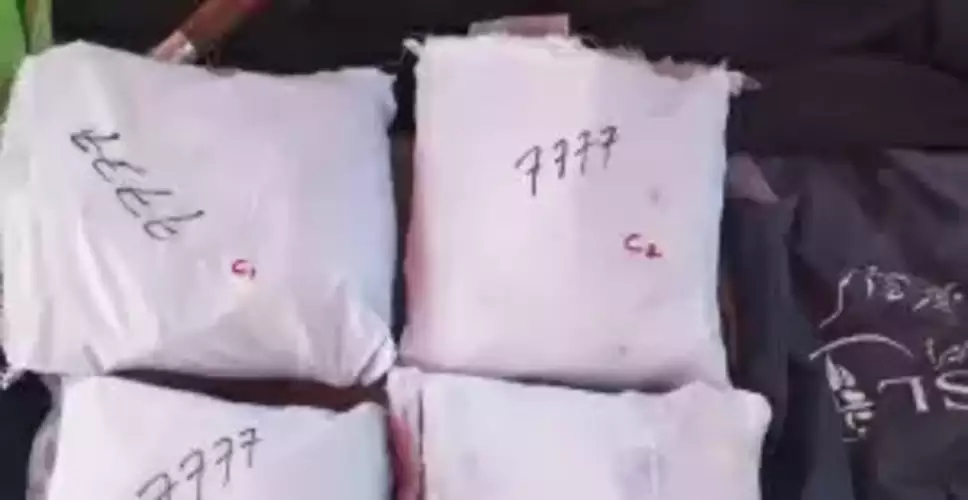

In a series of operations, the Crime Branch of Delhi Police has arrested four men and recovered 930 grams of heroin worth Rs 1 crore in the international market, an official said on Friday.

According to police, in the first operation, after receiving specific inputs, a raid was conducted in the Sultanpuri area and one habitual drug trafficker, identified as Rakesh Singh (46) was arrested.

“During his house search, the police team recovered 258 gram heroin, Rs 4.2 lakh (earned from selling of heroin),” said Ravindra Singh Yadav, the Special Commissioner of Police (Crime).

In the second operation, the sleuths of Delhi Police nabbed Shadaab, a native of Badaun in Uttar Pradesh and presently residing at New Usmanpur, indulged in heroin trafficking from his house.

“A tip-off was received regarding Shadab and it was also revealed that he had brought heroin in huge quantities and had concealed that heroin at his rented premise. After verifying the information and obtaining a search warrant of his house, a raid was conducted and Shadab was apprehended from the house,” said the Special CP.

A total of 262 gram heroin in many small polythenes, one electronic weighing machine (being used for weighing the heroin) were found and seized from his house.

“During the raid, accused Shadab broke his phone after throwing it on the ground to remove the evidence,” said the Special CP.

In yet another operation, a 25-year-old man was arrested under the Wazirabad flyover and 410 grams of heroin was recovered from his possession.

“During investigation, at the instance of the accused identified as Mohan Gupta, police have also nabbed the receiver identified as Pradeep, a resident of Najafgarh to whom the contraband was to be supplied,” said the official.

Crime

Mumbai Police Arrest Navi Mumbai-Based Bar Owner In ATC Personnel Theft–Extortion Case

Mumbai: In a significant development in the alleged theft and extortion case involving RCF police Anti-Terrorism Cell (ATC) personnel, the Mumbai police have arrested Navi Mumbai-based bar owner Ramesh Shetty alias Ramesh Anna for his alleged role in the offence. His arrest follows the earlier arrest and suspension of four ATC personnel attached to the RCF police station.

Previously, API Vijay Sutar, head constable Yogesh Khandge, and police constables Nemade and More were arrested on allegations that they stole cash and gold ornaments during raids conducted to identify Bangladeshi nationals allegedly residing illegally in Navi Mumbai. The Chembur police are conducting further investigation in the case.

The case came to light after a social activist lodged a complaint, prompting an internal inquiry into the conduct of the police personnel during official raids. Investigators found that valuables allegedly seized during the raids were not recorded through any panchnama or official documentation.

Several items were later reported missing, following which an FIR was registered under relevant sections of the Bharatiya Nyaya Sanhita (BNS) Act. The accused police personnel were subsequently arrested and placed under suspension, a senior police officer said.

According to the police sources, the complainant, Asma Poly, a suspected Bangladeshi national, has been residing in Kopri village, Sector 26, Koparkhairane, Navi Mumbai, for the past 12 years and works at a bar in Turbhe.

In her complaint, Asma stated that on January 2, 2026, at around 8.30 am, a woman in plain clothes along with three to four men visited her residence and demanded her identity proof. When she opened the door, the group entered her house. An agent who allegedly assists police in identifying Bangladeshi nationals was also present.

Based on their questioning, Asma said she realised they were police officials, who later disclosed their identities. She was allegedly asked to sit inside a police vehicle and was taken to the RCF police station. Asma claimed she was unaware that her house was being searched during this period.

Later, API Sutar allegedly asked her to contact her sister, Rebecca, in Bangladesh and seek her birth certificate. During a phone conversation, Rebecca allegedly informed Asma that police personnel had searched her house and that several items were missing. Asma has claimed in her police complaint that approximately 15 tolas of gold and cash amounting to Rs20–25 lakh were kept in the house and were missing after the raid.

Asma alleged that when she questioned the officers about the missing valuables, she received evasive replies. As her suspicions grew, she reportedly raised an alarm at the police station. Police sources said that fearing the matter could escalate, the accused officers allegedly called the bar owner Ramesh Anna, where Asma worked to the police station.

According to the complaint, between January 5 and 6, head constable Khandge allegedly facilitated phone conversations between Asma and bar owner Ramesh Anna, during which it was conveyed that Rs6 lakh in cash and a gold necklace had been handed over. When Asma enquired about the remaining money and gold, she was allegedly given evasive responses.

The complaint further states that on January 23, API Sutar again called Asma to the police station and told her that her remaining valuables would be returned through the bar owner. On January 24, Asma was allegedly informed that another Rs5 lakh in cash along with the remaining gold ornaments had been handed over to Ramesh Anna. She has also alleged that head constable Khandge threatened her not to disclose the incident to anyone.

Police are also examining a separate allegation involving the same police personnel in Kalyan. In that case, a woman identified as Sharmeen Khatoon Attar has alleged that on December 25, the accused officers visited her residence and allegedly extorted Rs5 lakh by threatening her with police action. Officials said this allegation is under verification and no conclusion has yet been drawn.

Based on Asma’s complaint, Mumbai police have registered a case against four police personnel and one unidentified person under relevant sections of the BNS Act. Police officials said further investigation is underway to establish the exact role of each accused, recover the missing cash and jewellery, and ascertain whether more individuals were similarly targeted during such raids.

Crime

Mumbai Crime: Undertrial Prisoner Assaults Policeman Inside Arthur Road Jail, Case Registered

Mumbai: A shocking incident has come to light from Mumbai’s Arthur Road Jail, where an undertrial prisoner allegedly assaulted a police constable on duty.

The accused, Lokendra Uday Singh Rawat (35), is reported to have headbutted Police Constable Hani Baburao Wagh (30), causing injuries to his nose, and also abused and pushed other on-duty police personnel. A case has been registered in this connection at the N. M. Joshi Marg police station.

According to the FIR, the complainant, Police Constable Wagh, is attached to Armed Police Division–2, Tardeo. On January 27, he reported for his 24-hour day-duty shift at Arthur Road Jail at around 8 am and was assigned security duty at the main entrance of the prison.

At around 9 pm, Armed Police Constables Suresh Sandu Mali and Sachin Chavan brought undertrial Lokendra Rawat back to the jail after producing him before the Dindoshi Court. Rawat allegedly appeared agitated and, after entering the jail premises, sat near the gate and began verbally abusing the police personnel on duty.

Constable Wagh asked Rawat to calm down and refrain from using abusive language. However, Rawat allegedly became more aggressive and continued shouting abuses. When Wagh approached him again to pacify the situation, Rawat suddenly headbutted him on the nose with force.

As a result, Constable Wagh sustained injuries and started bleeding. Fellow constables Sachin Chavan and Suresh Mali immediately intervened, restrained the accused, and informed the on-duty prison authorities about the incident. Rawat was subsequently sent for medical examination to Sir J.J. Hospital.

After receiving medical treatment, the injured constable lodged a formal complaint on January 28 at the N. M. Joshi Marg police station. Based on the complaint, police have registered a case against the undertrial under relevant sections of the Bharatiya Nyaya Sanhita (BNS). Further investigation is ongoing.

Crime

Mumbai Crime: One Critical Among 5 Injured After Violent Group Clash Breaks Out In Nagpada, 13 Detained

Mumbai: A violent confrontation between two groups erupted in South Mumbai’s Nagpada area late Thursday night, leaving several people injured and sparking a massive police response. Authorities have confirmed that one individual remains in critical condition following the brawl, which has once again put the spotlight on the volatile security situation in the densely populated area.

According to the Mumbai Police, the altercation broke out between two local groups over a financial dispute that escalated rapidly. What reportedly began as a verbal spat soon turned into a physical battle.

A video of the clash has surfaced on the internet shows the exact moments of the violent situation. Two men can be seen lying on the road, probably unconsious after participating in the brawl. Five to six other men can be seen weilding rods and sticks engaged in a fight, in full public view.

The violence resulted in five to six individuals sustaining serious injuries. They were rushed to a nearby hospital for emergency treatment. Medical officials confirmed this morning that while most are stable, one victim is currently in critical condition and is battling for life in the intensive care unit.

The Nagpada Police arrived at the scene shortly after the violence peaked to disperse the crowd and restore order. Heavy police deployment remained in the area throughout the night to prevent any retaliatory attacks or further communal or localised tension.

In a swift crackdown following the incident, the Mumbai Police have detained 13 individuals suspected of involvement in the clash. The police have officially registered a case against the accused parties under various sections of the Indian Penal Code (IPC), including Section 109 and Section 191.

As of Friday morning, the situation in Nagpada is reported to be under control, though an uneasy calm prevails. Security has been beefed up at key intersections, and patrolling has been intensified.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report