Business

Attention Mumbaikars! Don’t Miss Out On Amazing Start-Of-The-Year Deals From Top Brands; Check Out Details

Mumbai: With the arrival of the new year, it’s an opportunity for a fresh and excellent beginning to the year. If you seek home decor or routine shopping, leading brands in Mumbai offer the finest deals available for you. Explore the additional information below to grab the top deals that the brands are offering, which you won’t want to overlook.

Ongoing Best Deals Deals

The start-of-the-year sales are a steal-deal for Mumbaikars with 50%-70% off on top brands like Suvasa, Akbarallys furniture, Soch, Jimmy Choo, Superdry, Emporio Armani, Vijay Sales, Metro Wholesale, Lifestyle, Smart Bazaar and many more.

Top Deals At Lifestyle

Lifestyle, the beloved clothing brand has started the year with Sale Of The Season deals with products available at flat 50% off. Visit their website at lifestylestores.com to avail the best offers by shopping online with yout leisure. You can also visit their stores at the mall nearest to you at Oberoi Mall, WE Highway Goregaon East or Phoenix Palladium.

Top Deals At Smart Bazaar

The people favourite brand for daily needs and more, Smart Bazaar is celebrating Makar Sankranti with big saver deals. The brand is offering ‘buy1 get 1’ offer on over 1500+ products along with Smart Style Sale with affordable fashionable clothing starting at ₹299. Save big crunch over fruits and and dry fruits along with party essential cold drinks. Visit the nearest Smart Bazaar store to avail the amazing deals.

Top Deals At Soch

The go-to store for all your traditional clothings, Soch has presented Mumbaikars with their special Red Dot Sale with upto 50% off on Salwat suits, Sarees, Kurtas. Kurta Sets, Dress Materials, Tunics and Kaftans. You can also get premium scented candle for just ₹498 of worth ₹2495. Visit nearest Soch store today to avail the amazing deal.

Top Deals At Akbarallys furniture

If you are looking to exchange your old furniture and welcome new teak and solid wood furniture at your home, look no further as Akbarallys furniture have extended their exchange dhamaka offer where you have the opportunity to save up to 60% by exhanging your old furniture to a new customised furniture. You are eligible to 40% off on goods without exchange. Visit their store in Fort or Chembur to avail the amazing deal.

Top Deals At Metro Wholesale

The people favourite wholesale mart, Metro, has a new year offer promising big savings. The ‘Naya Saal Badhi Bachat’ sale buyers have amazing deals on variety of daily products to home essential products discounts ranging from 10% upto 80% off. The customers have the opportunity to get ₹100 off on minimum purchase of ₹1000. Visit the Metro store in Bhandup between 8 AM to 10 PM, Borivali and Malad stores between 7 AM to 10 PM. The offer is only applied for Mumbai stores. Offer valid till January 9, 2025.

Amazing Deals At Phoenix Palladium

Phoenix Palladium has presented end of season sale starting January 3 onwards. Avail the chance to grab 40% off on luxury brands such as Jimmy Choo, TOD’S, Canali, Coach, Superdry, Emporio Armani, Diesel, Muji, Dune London and many more.

Top Deals At IKEA

IKEA is presenting its winter sale with limited time offer upto 70%. Shop at IKEA sale and decorate your home with our elegant designs. Hurry! Get your hands on amazing deals and massive discounts on stylish furniture and decor at IKEA Winter Sale. You can visit their official website or visit IKEA store at IKEA Worli City Store or IKEA Navi Mumbai.

Top Deals At Shoppers Stop

Shoppers Stop is presenting its BIG Fab sale with a limited-time offer upto 50%. Shop at their online portal shoppersstop.com, or visit stores nearest to you. Get your hands on amazing deals such as extra ₹2500 by using ‘FABSALE’ code on your purchase. Get massive discounts on latest fashion trends and and much more at the sale.

Top Deals At Titan

One of the top watch brands has presented exclusive sale upto 60% off. Grab the deal by visiting their official website titan.co.in or visit the Titan store near you to avail the exclusive sale offers of top products.

Other Top Deals In Mumbai

Options, Baby Bell, Green Bell and Boy London are offering upto 40% off on their products. Visit their social media pages, website optionsfashion.com or store in Vile Parle West.

Business

Sensex smashes 86,000 for 1st time, Nifty hits new record

Mumbai, Nov 27: Indian stock markets continued their strong momentum on Thursday, with both the Sensex and Nifty hitting new record highs.

Investors remained optimistic as hopes of interest rate cuts in the US and India grew stronger, while steady buying by foreign investors further boosted sentiment across sectors.

The Nifty climbed to a fresh all-time high of 26,306.95, surpassing its previous record of 26,277.35 touched on September 27, 2024.

The Sensex also crossed a major milestone, moving past the 86,000 mark for the first time to reach 86,026.18.

Among the top performers in the Nifty50 pack were Bajaj Finance, Shriram Finance, Asian Paints, Bajaj Finserv and Larsen & Toubro, all gaining up to 2 percent.

These stocks helped support the market’s upward move. Foreign portfolio investors maintained their buying momentum, turning net buyers for the second consecutive session on Wednesday.

They invested Rs 4,778.03 crore in Indian equities, following an inflow of Rs 785.32 crore on Tuesday. This consistent buying helped keep domestic markets strong.

Market sentiment also stayed positive due to growing expectations that the US Federal Reserve may cut interest rates in December.

The Nifty had already recorded its best trading session in five months on Wednesday, closing at a 14-month high, supported by gains in rate-sensitive sectors ahead of the Reserve Bank of India’s policy meeting next week.

Asian markets were also trading higher, reflecting global optimism. Investors increased their bets that the US Fed will cut rates next month, with the CME FedWatch tool showing the probability rising sharply to around 85 per cent from just 30 percent a week earlier.

Major Asian indices, including South Korea’s Kospi, Japan’s Nikkei 225, Shanghai’s SSE Composite and Hong Kong’s Hang Seng, were all in the green.

US markets had also closed higher on Wednesday, adding to the positive global sentiment.

Business

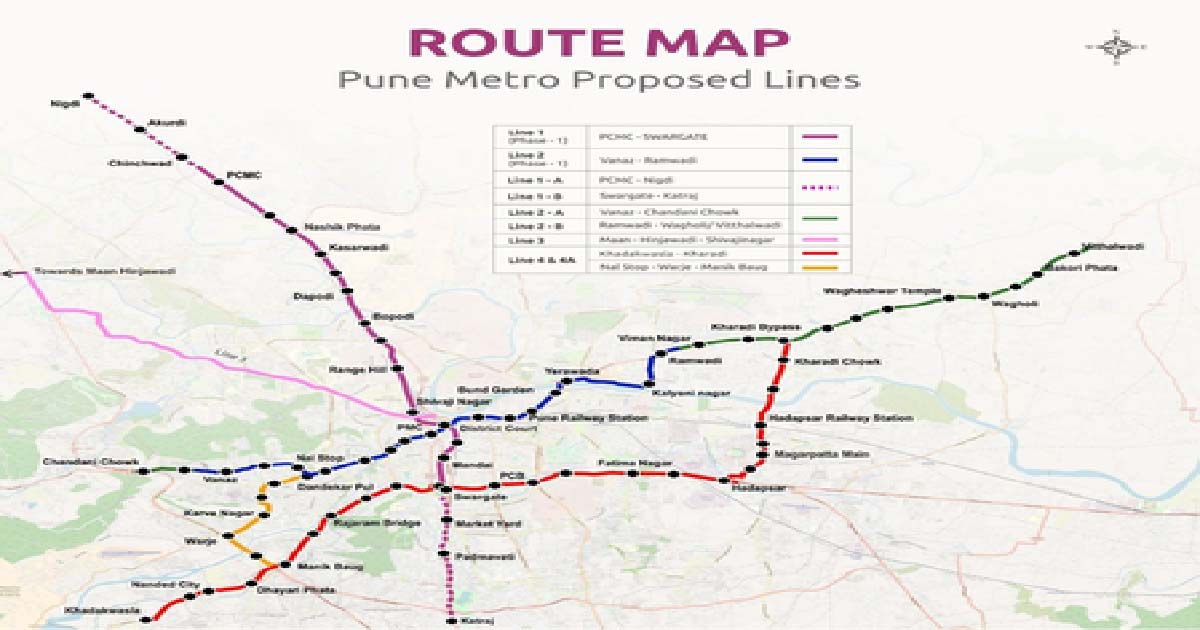

Union Cabinet approves Pune Metro Rail Project Phase 2 with Rs 9,857 crore outlay

New Delhi, Nov 26: In a major boost for the public transport network in Pune, the Union Cabinet, chaired by Prime Minister Narendra Modi, on Wednesday approved Line 4 (Kharadi–Hadapsar–Swargate–Khadakwasla) and Line 4A (Nal Stop–Warje–Manik Baug) with Rs 9,857.85 crore outlay under Phase 2 of the Pune Metro Rail Project.

According to the Cabinet, this is the second major project approved under Phase-2, following the sanction of Line 2A (Vanaz–Chandani Chowk) and Line 2B (Ramwadi–Wagholi/Vitthalwadi). With this latest approval, Pune Metro’s network will expand beyond the 100-km milestone, a significant step in the city’s journey towards a modern, integrated, and sustainable urban transit system.

Spanning 31.636 km with 28 elevated stations, Line 4 and 4A will connect IT hubs, commercial zones, educational institutions, and residential clusters across East, South, and West Pune.

The project will be completed within five years at an estimated cost of Rs 9,857.85 crore, to be jointly funded by the Centre, the Maharashtra government, and external bilateral/multilateral funding agencies.

These lines are a vital part of Pune’s Comprehensive Mobility Plan (CMP) and will seamlessly integrate with operational and sanctioned corridors at Kharadi Bypass and Nal Stop (Line 2), and Swargate (Line 1).

“They will also provide an interchange at Hadapsar Railway Station and connect with future corridors towards Loni Kalbhor and Saswad Road, ensuring smooth multimodal connectivity across metro, rail, and bus networks,” a Cabinet communique said.

The project will be implemented by the Maharashtra Metro Rail Corporation Limited (Maha-Metro), which will carry out all civil, electrical, mechanical, and systems works.

Pre-construction activities such as topographical surveys and detailed design consultancy are already underway, according to the Cabinet.

According to projections, the daily ridership on Line 4 and 4A combined is expected to be 4.09 lakh in 2028, rising to nearly 7 lakh in 2038, 9.63 lakh in 2048, and over 11.7 lakh in 2058.

Of this, the Kharadi–Khadakwasla corridor will account for 3.23 lakh passengers in 2028, growing to 9.33 lakh by 2058, while the Nal Stop–Warje–Manik Baug spur line will rise from 85,555 to 2.41 lakh passengers over the same period.

These projections highlight the significant growth in ridership expected on Line 4 and 4A over the coming decades.

With Line 4 and 4A, Pune will not just get more metro tracks but will also gain a faster, greener, and more connected future. These corridors are designed to give back hours of commuting time, reduce traffic chaos, and provide citizens with a safe, reliable, and affordable alternative.

Business

Assam saw major drop in child marriage cases under BJP govt: CM Sarma

Guwahati, Nov 26: Assam Chief Minister Himanta Biswa Sarma on Wednesday underscored a “major turnaround” in the state’s battle against child marriage, saying a combination of stringent enforcement and systemic reforms has led to significant declines in the underage marriages and boosted legal accountability.

CM Sarma claimed that according to NFHS‑4 (2015-16) data, 31.8 per cent of women in Assam aged 20–24 were married before turning 18 – a rate that exceeded the national average.

Moreover, district-level fact sheets had recorded alarming prevalence in districts such as Dhubri, South Salmara, Barpeta and Nagaon, as high as 40–55 per cent.

However, the state now claims a decisive shift. Between 2023 and 2024 alone, more than 8,600 arrests were made in coordinated crackdowns under both the Protection of Children from Sexual Offences Act (POCSO) and the Prohibition of Child Marriage Act (PCMA).

According to the Chief Minister, in 2022 the number of cases registered stood at 224, sharply up from just 149 in 2021, indicating a steep rise in enforcement.

CM Sarma said, “Beyond arrests, Assam has formed district-level task forces, headed by superintendents of police, to track and intercept impending child marriages. Community-level workers – including ASHAs, Anganwadi staff and schoolteachers – are now required to report suspected cases in real time.”

“Several districts have also reportedly established digital databases and child-protection tracking mechanisms,” he added.

The CM claimed that these measures have borne fruit: In hotspot districts, the incidence of child marriage fell by 8–17 per cent within a year, and more than 3,000 planned child marriages were prevented in 2023–24 alone.

Notably, the Assam government’s recent actions – from sustained crackdowns to setting up institutional safeguards – reflect a far more aggressive stance on child marriage than seen in earlier years, when the practice was largely treated as a social issue rather than a crime.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report