National News

Haryana in debt trap of over Rs 2.29 lakh crore

Every child born in Haryana is saddled with a debt of Rs 1 lakh. This is true with the estimated total debt on the state increasing to over Rs 2.29 lakh crore.

The main opposition Congress, which was at the helm for a decade till 2014, has been blaming the BJP-JJP government for pushing the state into debt and taking it towards bankruptcy.

As per official figures, the state’s debt was Rs 70,931 crore in 2014-15 when the BJP assumed power in the state for the first time.

In the current fiscal, it is expected to touch a whopping Rs 229,976 crore by the end of this fiscal.

As per budget estimates of 2021-22, the debt to GSDP ratio is estimated at 23.27 per cent in 2020-21, while it was 16.23 per cent in 2014-15. For the next fiscal, it is estimated at 25.92 per cent.

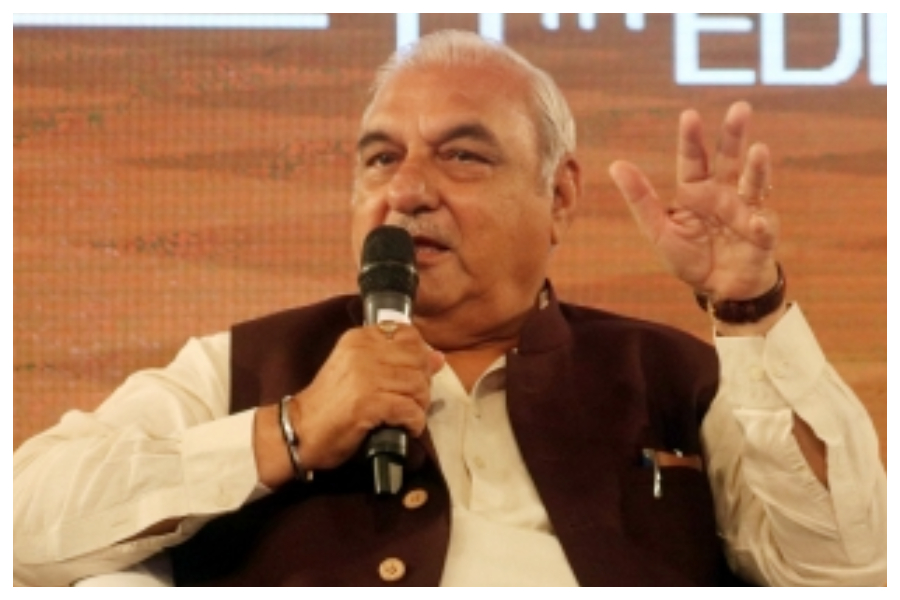

Leader of Opposition and two-time Chief Minister Bhupinder Singh Hooda told IANS that the BJP-JJP government is taking the state towards bankruptcy.

“That is why the debt figures were not clearly stated in the last budget speech. As per our estimations, the total debt has increased to Rs 2.25 lakh crore by March 2021,” he said.

Opposing the steep hike in development charges in areas falling under the civic bodies, Hooda said the Congress would question the government on issues of corruption, debt and unemployment in the upcoming Budget session of the Assembly.

He said the state had a debt of about Rs 70,000 crore when the BJP took over the reins of the state after the 2014 Assembly elections. Before handing over the helm several projects of national importance were commissioned by the Congress government.

“In the past seven years, the debt has increased to Rs 2.5 lakh crore,” said Hooda, adding no major project was established. “Where have these thousands of crores gone?”

According to Hooda, under the Congress government Haryana had become number one in per capita income, investment and generating employment.

“The neglect of 52,000 anganwadi workers is a living example of the negative thinking of the BJP-JJP government towards the daughters. Women workers say the government is not implementing the announcement made by the Prime Minister on September 10, 2018, to increase the honorarium of workers by Rs 1,500 and for helpers by Rs 750,” he said.

A revenue surplus state till 2008-09, Haryana has consistently been in deficit after that. In 2016-17, the debt burden was Rs 124,935 crore.

In 2017-18, the interest payments were pegged at Rs 11,257 crore — up from Rs 9,616 crore in 2016-17. In 2015-16, it was Rs 8,284 crore.

CRISIL’s last year study of the top 18 states, including Haryana and Punjab, says the aggregate indebtedness of states, measured by debt to gross state domestic product (GSDP), is expected to remain elevated at 33 per cent this fiscal, despite the post-pandemic recovery bolstering the shrinking revenue graph.

The ratio had risen to a decadal high of 34 per cent last fiscal. Sticky and elevated revenue expenditure and the need for higher capital outlay will keep borrowings up this fiscal, it adds.

For the rising financial debt, Chief Minister Manohar Lal Khattar, who also holds the finance portfolio, is blaming the Congress government for leaving behind a debt liability of Rs 98,000 crore.

“In 2014, when the BJP assumed power the state had a debt of Rs 98,000 crore, while the Opposition used to claim it to be Rs 61,000 crore,” he told the media on February 23.

Also he defends by saying the loan liability is increasing because the capital expenditure (money spent on creating assets) is also increasing.

“When the BJP came to power in 2014-15, a debt of Rs 27,860 crore of power distribution companies was included in the government’s debt under the Ujjwal Discom Assurance Yojana. For this reason, the total debt has increased. When the Congress tenure ended, the debt liability was Rs 70,900 crore. If the loan amount of Rs 27,860 crore taken by power discoms is added, the total debt is Rs 98,000 crore,” Khattar said.

He said revenue collection had dipped during the coronavirus period and an additional expenditure of Rs 1,500 crore was incurred.

Blaming the BJP-JJP government for the monstrous cycle of a huge debt, Congress general secretary Randeep Singh Surjewala said, “The BJP-led government has increased the state’s debt from Rs 68,000 crore to Rs 2 lakh crore in seven years of its rule.”

Officials said the outstanding debt by the end of Khattar’s maiden term from 2014 to 2019 was Rs 185,463 crore.

While presenting the budget in March 2021, Khattar said the debt liability of the state is likely to go up to Rs 229,976 crore as on March 2022 from Rs 199,823 crore as on March 2021, constituting 25.92 per cent of the gross state domestic product (GSDP).

Crime

Palghar Crime: ATM Card Swapping Fraud Cracked In 24 Hours; Pelhar Police Arrest 25-Year-Old Accused, Recover Cash And Vehicle

Palghar, Maharashtra, Dec 25: Pelhar Police have arrested one accused involved in an ATM card swapping fraud and recovered cash and a vehicle used in the crime, successfully cracking the case within 24 hours of its registration.

The incident occurred on December 21, 2025, around 5:00 pm, when the complainant, Ramashankar Devkinandan Tiwari (53), a resident of Nalasopara East, visited an Axis Bank ATM at Vasai Phata to withdraw cash.

According to police, three unidentified men entered the ATM booth and engaged the complainant in conversation, claiming that their transaction had failed. Taking advantage of the distraction, the accused allegedly swapped the complainant’s ATM card through sleight of hand and handed him a different Canara Bank ATM card before leaving the spot.

The accused later used the complainant’s ATM card at another location to withdraw ₹50,000 from his bank account, thereby committing financial fraud.

Following a complaint lodged by the victim, Pelhar Police registered a case on December 22, 2025, under relevant sections of the Bharatiya Nyaya Sanhita.

During the investigation, the Crime Detection Unit examined CCTV footage from the ATM and nearby areas, which revealed that the accused used a Maruti Suzuki WagonR car.

Tracing the vehicle’s ownership and conducting technical analysis led the police to apprehend the accused, identified as Mohammad Afzal Mohammad Aslam (25), a resident of Ulwe, Navi Mumbai.

During interrogation, the accused confessed to committing the offence along with two accomplices. Police recovered ₹40,000 in cash from the accused, part of the defrauded amount, and seized the car used in the crime. The case was solved within 24 hours of registration.

The search for the remaining two absconding accused is ongoing. The arrested accused has been remanded to police custody until December 27, 2025.

National News

Maharashtra Politics: Thackeray Brothers’ Reunion Sparks Jubilation Among Shiv Sena-UBT & MNS Workers In Mira-Bhayandar

Bhayandar: Following the long-awaited confirmation of the alliance between the Thackeray brothers, which had the entire state of Maharashtra watching, an atmosphere of intense enthusiasm was seen among Shiv Sena and MNS workers in the Mira-Bhayandar area. The reunion of Uddhav Thackeray and Raj Thackeray after nearly two decades has triggered a wave of joy among party activists.

Against the backdrop of this historic development, Shiv Sena and MNS workers celebrated at the Golden Nest Circle in Bhayandar by distributing sweets, bursting firecrackers, and cheering in jubilation. The area resonated with slogans of “Thackeray Brothers Together.” Workers were seen dancing to the traditional beats of Dhol-Tasha.

Speaking on the occasion, activists stated that the alliance of the Thackeray brothers is a victory for Marathi pride (Asmita) and will have a significant impact on upcoming elections. They expressed confidence that the coming together of both parties would increase organizational strength and help address local issues more effectively.

Meanwhile, the political ripples of this alliance are being felt across Maharashtra, including Mira-Bhayandar. This partnership is being viewed as a crucial turning point for the upcoming Municipal Corporation and other elections. The reunion of the Thackeray brothers clearly signals the emergence of new equations in state politics.

Crime

ED raids Ruchi Group’s Indore, Mumbai premises; freezes assets, seizes cash in bank fraud case

Indore/Mumbai, Dec 25: The Directorate of Enforcement (ED), Indore Zonal Office, has conducted extensive search operations under the Prevention of Money Laundering Act (PMLA), 2002, at multiple locations in Indore and Mumbai, the investigation agency said on Thursday.

The raids on December 23 targeted premises linked to the Ruchi Group in connection with ongoing investigations into alleged bank fraud cases.

The probe stems from multiple FIRs registered by the Central Bureau of Investigation (CBI), Bhopal, against several Ruchi Group entities. These include M/s Ruchi Global Ltd. (now renamed M/s Agrotrade Enterprises Ltd.), M/s Ruchi Acroni Industries Ltd. (now M/s Steeltech Resources Ltd.), and M/s RSAL Steel Pvt. Ltd. (now M/s LGB Steel Pvt. Ltd.), it said.

The companies, promoted by the late Kailash Chandra Shahra and Umesh Shahra, are accused of orchestrating large-scale bank frauds through fund diversion, siphoning, and accounting manipulations, resulting in substantial wrongful losses to public sector banks.

The ED officials revealed that the investigation uncovered a sophisticated conspiracy involving the creation of numerous shell entities, the agency said.

These were used for round-tripping transactions, where spurious Letters of Credit and Cash Credit facilities were manipulated to divert funds for private gain.

Bogus sales and purchases were recorded, and deliberate losses inflicted to siphon off loan amounts obtained ostensibly for legitimate business purposes, it said.

Proceeds of crime generated from these frauds were allegedly concealed and layered to disguise their illicit origins.

During the searches, authorities froze bank balances exceeding Rs 20 lakh belonging to the accused persons and their family members. Additionally, cash amounting to over Rs 23 lakh was seized, along with significant incriminating documents and digital devices that establish the roles of the accused in the fraud, said the agency.

This action revives scrutiny on the Ruchi Group, which has faced prior allegations of financial irregularities.

Earlier CBI probes, dating back to 2021, had flagged similar issues in group companies, including a Rs 188 crore fraud case involving a bank consortium.

The current ED operation signals intensified efforts to trace and recover laundered assets, it said.

Further investigation is progressing, with sources indicating potential attachments of properties and deeper probes into the beneficiaries of the diverted funds.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report