Business

Indian stock market trades flat, all eyes on RBI MPC meet

Mumbai, Feb 5 : The domestic benchmark indices traded almost flat early on Wednesday, after the stock market experienced a strong upward movement as the US trade tariff tensions eased.

After a positive opening, the Sensex and the Nifty were almost flat. At around 9.31 am, Sensex was trading at around 78,595.81, up marginally, while the Nifty was at 23,769.80, up almost 30 points or 0.13 per cent.

HDFC Bank, Infosys, Oil and Natural Gas Corp, Tata Consultancy Services and Bharat Petroleum Corp added to the Nifty 50 index.

On the other hand, Asian Paints, Larsen and Toubro, Titan and Nestle India weighed on the Nifty 50 index.

On NSE, nine sectors advanced, three declined out of 12. The NSE Nifty FMC declined the most, and the NSE Nifty Oil & Gas rose the most. The BSE Midcap and Smallcap indices were trading higher in early trade.

According to market watchers, after a positive opening, Nifty can find support at 23,600. On the higher side, 23,800 can be an immediate resistance, followed by 23,900 and 24,000.

After remaining net sellers for the 23 sessions, the foreign institutional investors (FIIs) turned net buyers on February 4, as they bought equities worth Rs 809 crore. On the contrary, 35 domestic institutional investors (DIIs) turned net sellers after remaining net buyers for the last 35 sessions, as they sold equities worth Rs 430 crore.

The strong buying interest helped the Nifty index close above the 23,700 mark. Additionally, global markets traded positively.

According to Sameet Chavan of Angel One, the US decision to pause tariffs triggered a strong recovery from lower levels in U.S. futures overnight, setting a positive tone for Asian markets.

“While the momentum remains positive, key overhead resistance levels need to be monitored at 23900 (89 DEMA), 24000 (200 DSMA), and 24250 (previous swing high),” he mentioned.

After a robust Union Budget, all eyes are on the RBI’s monetary policy committee (MPC) meeting on February 7 where a rate cut is expected.

National

CM Nitish meets Bihar Governor Arif Mohammad Khan, discusses key issues

Patna, July 3: Ahead of the Bihar Assembly elections, Chief Minister Nitish Kumar met Bihar Governor Arif Mohammad Khan at Raj Bhavan on Thursday, and reportedly discussed key issues.

CM Nitish reached Raj Bhavan around 11 a.m., and the meeting lasted for about 30 minutes, during which several important administrative issues were discussed.

According to sources, the meeting primarily focused on the appointments of Vice Chancellors in universities across Bihar.

“This meeting was not political but related to higher education and the appointment of Vice Chancellors and other officials in the state’s universities,” sources said.

The Bihar government, ahead of the Assembly elections, is working to resolve issues across departments, including Higher Education, ensuring timely appointments, fund releases, and smooth educational activities.

The appointment of Vice Chancellors is considered crucial to avoid administrative bottlenecks during the election period.

Bihar Assembly elections are expected to be held in October-November this year, and the Election Commission of India may announce the schedule soon.

Before the elections, the Nitish Kumar-led government is keen to clear pending administrative issues to ensure smoother governance and to prevent disruptions in universities during the election season.

Several universities in Bihar are awaiting appointments and transfers of Vice Chancellors, registrars, examination controllers and other officials. The Governor, as Chancellor of state universities, along with the Chief Minister, play a key role in these appointments.

Arif Mohammad Khan took charge as the Governor of Bihar in 2025 after serving as the Governor of Kerala from 2022 to 2025.

A senior politician, Khan has previously held important positions in the Central government as a BJP leader.

This meeting holds significance as the state gears up for elections, with the government looking keen to complete critical institutional appointments before the Model Code of Conduct comes into effect.

National

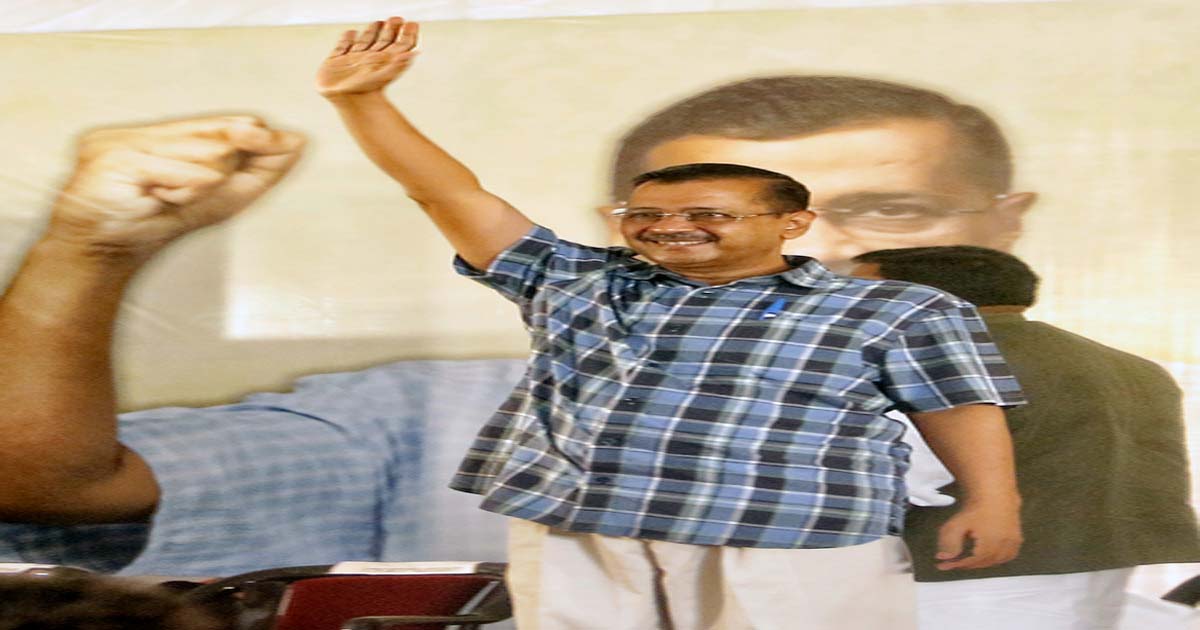

AAP’s decision to go solo in Bihar polls draws ‘publicity stunt’ jibe from INDIA bloc ally

New Delhi, July 3: Aam Aadmi Party (AAP) chief Arvind Kejriwal’s announcement of contesting the upcoming Bihar Assembly elections alone has invited a slew of reactions from political parties. Various parties, its ally or adversary, reacted on expected lines; however, the harshest one came from the Congress party, its erstwhile alliance partner in the INDIA bloc.

From JD(U) to Congress and others, all elicited a common view that AAP remains a non-player in the Bihar electoral landscape and its political plunge will have no impact on the power equations there.

JD(U) leader Rajiv Ranjan said that AAP’s decision to contest all 243 seats in Bihar shows clear and deep cracks in the INDIA bloc.

“This alliance is already in ruins and is now headed for further decline, as Kejriwal has himself said that the INDIA bloc was formed for the 2024 elections,” he said.

He added that AAP’s foray into the Bihar arena will have a bearing on the INDIA bloc partners, including RJD, as Tejashwi Yadav and his party will find it difficult to rally support.

Congress leader Akhilesh Prasad Singh said this looks nothing more than a ‘publicity stunt’.

“AAP has no presence in Bihar, people don’t even know Kejriwal’s party name. By such announcements, he is trying to stay in the news. Kejriwal may be known to people here, but his party is non-existent in Bihar, he said.

Another Congress leader, Tariq Anwar, said AAP was welcome to contest elections in Bihar but warned of more backlash than support.

“Every party is independent to contest elections as per its own choice. AAP can also decide its fortunes in upcoming elections, but it is a fact that AAP has no base in Bihar, it has no elected representative in Bihar, even at the panchayat level,” he said.

“Deciding to take a political plunge in such a situation could incur more losses than benefits,” he added.

Notably, AAP supremo Arvind Kejriwal, addressing a press conference in Gujarat’s Gandhinagar on Thursday, said, “AAP will contest Bihar polls alone. The INDIA bloc was only for the Lok Sabha polls; there is no alliance with Congress now.”

When probed further, he said, “If there was any alliance, then why did Congress contest in Visavadar bypolls. They came to defeat us. BJP sent Congress to defeat us and cut the votes.”

National

Rahul Gandhi questions Maha govt over farmer suicides, BJP counters with facts during Cong-NCP rule

New Delhi, July 3: Leader of Opposition (LoP) in the Lok Sabha Rahul Gandhi on Thursday criticised the BJP-led Maharashtra government over farmer suicides and accused the Centre of ignoring their plight. This prompted a swift response from the BJP, which cited findings and facts about farmer deaths in the state during the Congress-NCP rule to set the record straight.

The political blame game on farmer suicides began over the Fadnavis government’s admission that 767 farmers committed suicide in the state in the past three months. The state government told the Legislative Assembly on Tuesday that 767 farmer suicides were reported in the state, primarily in the Vidarbha region.

The Congress MP used the farmers’ deaths to mount an attack on the Centre, accusing it of callousness and gross indifference to their plight. He said that 767 families have been devastated and shattered, but the government remains unmoved.

“Is this just a statistic? No. These are 767 shattered homes. 767 families that will never recover. And the government? Silent. Watching with indifference,” he asked on X.

Rahul further said the farmers are sinking deeper into debt every day, but the government continues to look away. Their plight remains ignored while there is no government assurance or promise on the Minimum Support Price (MSP) for agricultural products.

BJP IT cell chief Amit Malviya was quick to counter Rahul’s charge with facts and figures of farmers’ suicides, when the state was ruled by Congress-led governments in the past.

Amit Malviya said the Congress leader must think before blurting out baseless charges. He said that Rahul must look at the utter failures and misgovernance of the Congress-NCP governments, which saw a spate of farmer deaths during their reign.

Sharing details of farmers’ deaths, Amit Malviya stated that more than 55,000 deaths took place in the 15-year rule of the Congress-NCP government and asked, ‘Who was accountable for this?’

The graph shared by him, compiled with data gathered from NCRB and P. Sainath, shared details of ‘mass suicides’ in different government tenures, starting from 1999 to 2014.

“From 1999-2004, about 16,512 farmers committed suicide while from 2004-2009, about 20,566 farmers committed suicide while from 2009 to 2014, 18,850 farmers killed themselves,” it pointed out.

Notably, the Vidarbha region in Maharashtra has gained infamy over the years because of an abnormally high number of suicides by farmers. For decades now, the region has been hogging headlines over sorry state of affairs for the farming community.

Rahul Gandhi, further escalating his attack on the Centre, said that farmers’ demand for loan waivers remains ignored, but the Modi government continues to give big loans to corporates and billionaires.

“Modi ji promised to double farmers’ income – today, the reality is that the lives of those who feed the nation are being cut in half. This system is killing the farmers,” Congress MP claimed.

Giving a firm retort, Amit Malviya said that the politics of counting the dead looks repulsive, but it’s important to show Rahul Gandhi and Congress the mirror.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra9 months ago

Maharashtra9 months agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra9 months ago

Maharashtra9 months agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

Crime9 months ago

Crime9 months agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report

-

National News9 months ago

National News9 months agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra8 months ago

Maharashtra8 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News10 months ago

National News10 months agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface