Business

FM Sitharaman goes for big push to job-led inclusive growth in Budget 2025-26

New Delhi, Feb 1: Finance Minister Nirmala Sitharaman on Saturday presented the Budget 2025-26 in the Parliament with an aim at accelerating employment-led inclusive growth, propelled by investments in the agricultural and rural sector, MSMEs and exports while sticking to the fiscal consolidation path.

“This budget is dedicated to accelerating growth, driven by our aspirations for a ‘Viksit Bharat.’ Our economy remains the fastest growing among all major economies,” the Finance Minister said on the floor of the Lok Sabha.

The key domains covered in the Union Budget include taxation, power, urban development, mining, the financial sector, and regulatory reforms. These areas are central to the government’s focus on driving growth, improving infrastructure, enhancing governance, and ensuring sustainable development across various sectors.

She has kept the budget deficit target on a declining path to 4.4 per cent of GDP in 2025-26 from 4.8 per cent of GDP in 2024-25.

The net market borrowing for the budget has been fixed at Rs 11.54 crore while the rest of the funds will come from small savings and other sources, the Finance Minister said. The government’s gross borrowing target for FY26 was revised upwards by 5.7 per cent to Rs 14.82 lakh crore from Rs 14.01 lakh crore in FY25.

In a major benefit for the middle class, Sitharaman announced that there will be no income tax on an annual income of up to Rs 12 lakh. For salaried people who enjoy a standard deduction of Rs 75,000, there would be no tax on income of up to Rs 12,75,000.

The move will place more money in the hands of the people to spend on goods and services which in turn would lead to higher growth in the economy.

In order to boost domestic manufacturing, she has also rationalised customs duties to increase tariffs on finished goods such as electronic products and reduce the duty on components used as inputs by local manufacturers.

The Finance Minister outlined specific proposals, starting with agriculture as the “first engine” to drive growth. Under the Prime Minister Krishi Yojana, a new initiative inspired by the success of the Aspirational District Programme, the government will launch an agricultural district programme in partnership with states. This will target 100 districts with low productivity, moderate crop intensity, and below-average credit parameters. The initiative is expected to benefit 1.7 crore farmers. The Finance Minister also announced an increase in the Kisan Credit Card (KCC) loan limit from Rs 3 lakh to Rs 5 lakh under the interest subvention scheme.

MSMEs have been identified as the second engine of growth, and the focus will be on the 5.7 crore MSMEs, which include over one crore registered businesses employing 7.5 crore people and contributing 36 per cent to India’s manufacturing. These MSMEs are crucial in positioning India as a global manufacturing hub, responsible for 45 per cent of the nation’s exports. To boost their growth and efficiency, the government will enhance the investment and turnover limits for MSMEs, increasing them by 2.5 times and 2 times, respectively. This move is expected to empower MSMEs to scale up, innovate, and generate more employment opportunities for the youth.

The Finance Minister announced that the government will implement specific policy and facilitation measures to boost the productivity, quality, and competitiveness of India’s footwear and leather sector products. This scheme is expected to create employment for 22 lakh people, generate over Rs 400 crore, and achieve exports of over Rs 1.1 lakh crore. In addition, measures will be introduced for the toy sector, building on the National Action Plan for Toys. A new scheme will aim to establish India as a global hub for toys, focusing on developing clusters, skills, and a manufacturing ecosystem that will produce high-quality, innovative, and sustainable toys, representing the “Made in India” brand, the Finance Minister said.

The Finance Minister emphasised investment as the third engine of growth, which includes investing in people, the economy, and innovation. As part of investing in people, the government is focusing on the Sashakt Anganwadi and Poshan 2.0 programmes, which provide nutritional support to over 8 crore children, pregnant women, lactating mothers, and around 20 lakh adolescent girls in aspirational districts and the Northeast region. The cost norms for these programs will be enhanced, Sitharaman added.

Business

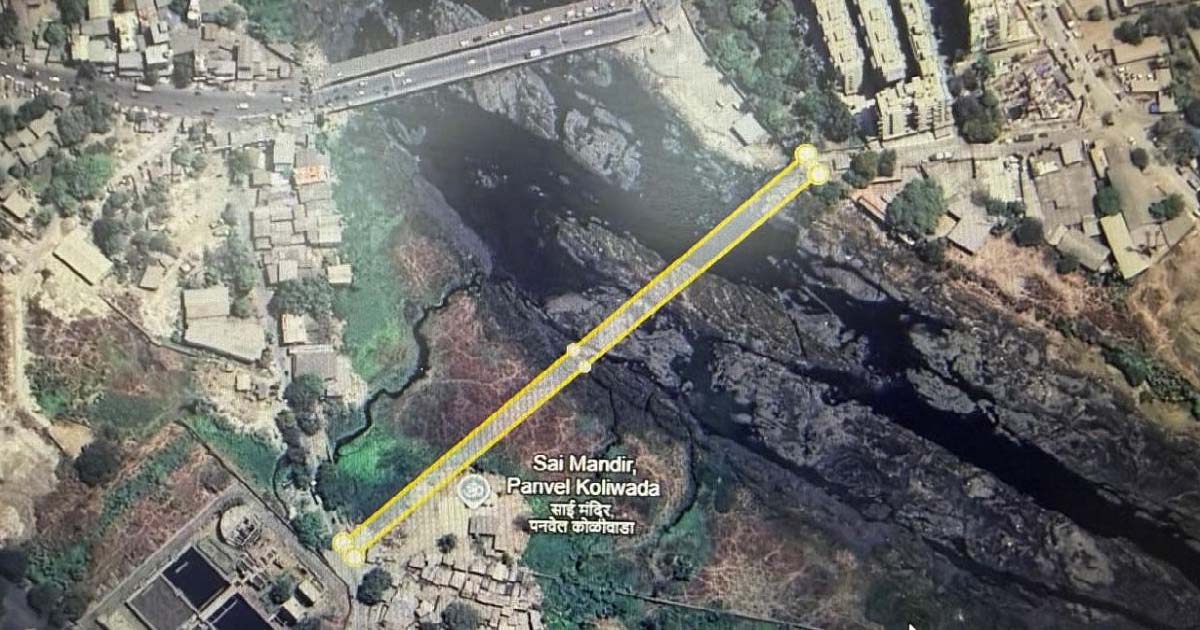

Panvel Municipal Corporation Clears ₹48.40 Crore Gadhi River Bridge Project To Ease Traffic Congestion On Panvel–Karanjade Stretch

Panvel, November 14: In a major infrastructure push aimed at reducing traffic congestion and improving connectivity, the Panvel Municipal Corporation has cleared a proposal to construct a new bridge over the Gadhi River near the Karanjade sewage pumping station.

Municipal Commissioner and Administrator Mangesh Chitale approved the plan following demands raised by Panvel MLA Prashant Thakur and Uran MLA Mahesh Baldi, who highlighted the daily inconvenience faced by commuters travelling between Panvel, Karanjade and Vadghar’s CIDCO colonies.

According to civic officials, the existing bridge toward Karanjade routinely experiences heavy traffic, often resulting in prolonged congestion. With the upcoming Navi Mumbai International Airport expected to increase traffic volumes even further, the civic body believes the new bridge will be a “critical link” on the Panvel–Karanjade stretch.

The project, with an estimated cost of Rs 48.40 crore, received administrative approval in the General Body. Construction is expected to begin soon.

As per the sanctioned plan, the bridge will feature four lanes, a length of 240 metres, and a width of 21.5 metres. “It will connect Panvel Municipal Corporation’s 40-feet-wide road on the eastern side with CIDCO’s 20-metre-wide road leading to the Karanjade node on the western side.

This connection will significantly streamline traffic and support future vehicular growth,” said Additional Commissioner Ganesh Shete.

For the project, No Objection Certificates (NOCs) will be sought from CIDCO, the Water Resources Department, and the Public Works Department. The conceptual design will undergo technical review and approval by either IIT Mumbai or VJTI Mumbai, City Engineer Sanjay Katekar confirmed.

The civic administration expects the bridge to provide major relief to residents and improve overall mobility in the rapidly developing Panvel–Karanjade region.

Business

Stock market ends on positive note over NDA’s huge victory in Bihar polls

Mumbai, Nov 14: Indian equity indices recovered from early losses to end the session on a positive note on Friday as the National Democratic Alliance (NDA) headed towards a landslide win in the Bihar elections.

The key indices remained volatile throughout the session as counting for votes for Bihar’s Assembly election continues.

Sensex settled at 84,562.78, up 84.11 points or 0.10 per cent. The share index started the session at 84,060.14, falling over 400 points against last day’s closing of 84,478.67 amid caution ahead of Bihar election results. However, the index jumped over 550 points from the day’s low to close in green.

Nifty closed at 25,910.05, up 30.90 points or 0.12 per cent.

“Indian markets today witnessed a roller-coaster session with the benchmark index Nifty showing sharp two-sided moves. In the first half, Nifty surged and tested the crucial 26,000 level before facing resistance and slipping lower later in the day,” Ashika Institutional Equities said in its note.

Volatility remained elevated as investors stayed cautious ahead of Bihar election results, which hold significant political importance.

Tata Motors, Eternal, Axis Bank, BEL, Trent, SBI, Sun Pharma, Bajaj Finance, Adani Airports, Hindustan Unilever, Asian Paints, ITC and NTPC were the top gainers from the Sensex basket. Infosys, Tata Steel, Tata Motors PV, ICICI Bank, Maruti Suzuki and Tech Mahindra ended the session lower.

Sectoral indices experienced a mixed approach with selling in the IT and auto sectors and buying in the FMCG, banking and finance stocks. Nifty Bank rose 135 points or 0.23 per cent, Nifty Fin Services jumped 95 points or 0.35 per cent, and Nifty FMCG closed 317 points or 0.57 per cent higher. While Nifty IT slipped 378 points or 1.03 per cent, and Nifty Auto fell 143 points or 0.52 per cent.

Broader market followed suit as well, with Nifty Midcap 100 closed flat, Nifty Small Cap 100 rose 68 points or 0.38 per cent, and Nifty 100 ended the session slightly up.

Rupee traded in a narrow range near 88.70 as the dollar index remained flat around $99.20, offering limited directional cues.

“With no major U.S. data releases due to the recent shutdown, the market stayed largely dependent on flows, where mixed FII activity and consistent DII buying kept the rupee in a confined band. Crude prices have begun to rebound, and if WTI sustains above $60, it may add fresh pressure on the rupee in the coming sessions. Overall, the rupee is expected to remain range-bound with levels seen between 88.45–88.95,” said Jateen Trivedi of LKP Securities.

Business

Anil Ambani skips ED questioning, no virtual appearance allowed (Lead)

New Delhi, Nov 14: The Enforcement Directorate (ED) will not grant any virtual appearance to Reliance ADAG Group Chairman Anil D. Ambani after the latter sought it in response to a summons sent by the investigative agency to appear before it for questioning in a money laundering case, according to sources on Friday.

Anil Ambani skipped the ED summons to appear for the second round of questioning at the agency’s Delhi headquarters on Friday (November 14).

As per ED sources, no virtual appearance will be given to Anil Ambani, as requested. The regulator, however, has received an email from him regarding his availability via virtual means.

Anil Ambani, in a media statement, said that he is “willing to offer to appear by virtual means”, adding that he will “fully cooperate with ED on all matters”.

The statement claimed that “ED summons to Anil D. Ambani relate to a Foreign Exchange Management Act (FEMA) inquiry and not to any matter under the Prevention of Money Laundering Act (PMLA)”.

The summons concerns a 2010 domestic EPC contract for the Jaipur–Reengus (JR) Toll Road and concerns issues associated with a road contractor, with no foreign exchange component, it said.

“Anil D. Ambani is not a member of the Board of Reliance Infrastructure. He served the company for about fifteen years, from April 2007 to March 2022, only as a non-executive director, and was never involved in the day-to-day management of the company,” it added.

The ED had summoned Anil Ambani again on November 14 for questioning in the money laundering case against the conglomerate. He faced a gruelling, around nine-hour interrogation regarding an alleged Rs 17,000-crore loan fraud case at ED headquarters in August.

The financial probe agency had earlier attached 42 properties worth over Rs 3,083 crore in the bank fraud cases of Reliance Communications Ltd. (RCOM), Reliance Commercial Finance Ltd., and Reliance Home Finance Ltd.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra1 year ago

Maharashtra1 year agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra1 year ago

Maharashtra1 year agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News1 year ago

National News1 year agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra1 year ago

Maharashtra1 year agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime1 year ago

Crime1 year agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report