Business

Maharashtra presents deficit budget, new tax burden on citizens

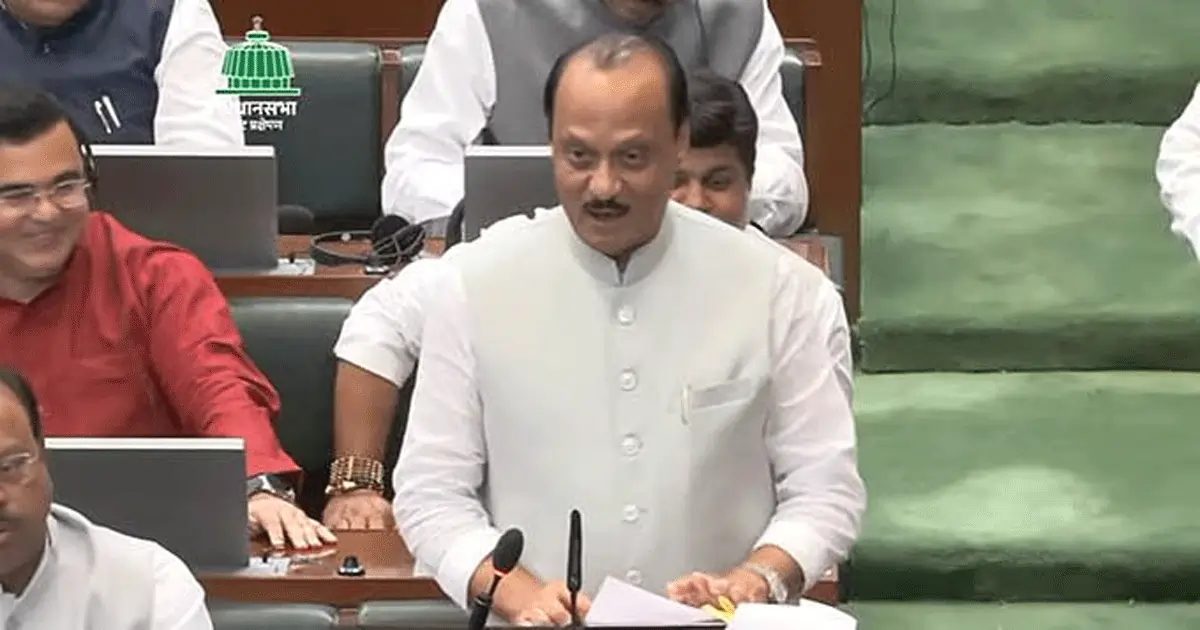

Mumbai: Finance Minister and Deputy Chief Minister Ajit Pawar presented the state budget in the Maharashtra Legislative Assembly today. The public has expressed confidence in us in the assembly elections, so Mahayuti is committed to maintaining their trust. In this budget, special concessions and facilities have been given to the middle class. An attempt has been made to solve the problems of the people. With this resolve, Ajit Pawar has presented the budget for 2025-26, which is the first annual budget presented by the Mahayuti government.

Presenting the budget in the Assembly, Ajit Pawar said in his speech that Maharashtra will not stop, development will not be delayed, he also claimed that large-scale projects will be completed in the state, which will increase employment opportunities and boost the economy.

The state has set a target of an economy of one lakh trillion. Work on the Bengaluru-Mumbai Industrial Corridor is underway. Along with better industrial facilities in the state, employment opportunities and a technical center in the state and establishment of Maharashtra Technical Textile Mission for development work have also been implemented. It has also been assured in the budget that electricity rates will be reduced in the state. Electricity rates in the state will be lower than the rates of other provinces.

Ajit Pawar has also promised to complete many facilities and projects in the state budget. The work of Navi Mumbai airport is 85 percent complete, while work has started on Nagpur airport. Establishment of markets for agriculture has been ensured. Rs 3610 crore has been allocated for the transport department, out of which work has started on a 41 km long metro route in Mumbai.

A special project has been included in the budget for Mumbai, in which Rs 64,783 crore has been allocated for Versova to Madha, Versova to Bhayander Coastal Road, Malind to Goregaon, Thane to Borivali and Orange Gate to Marine Drive underground road to eliminate traffic problems in suburban areas. Thane to Navi Mumbai International Airport will be connected to the international airports of Thane, Dombivali, Kalyan and other important cities.

The work of the missing link at Khapoli-Khandala Ghat on Mumbai-Pune Highway will be completed by August 2025. Mumbai, Navi Mumbai Global Market will be established as well as Taluka Market Committee will be established across the state. Housing Scheme: Financial assistance of Rs 50,000 will be given for the house. Implementation of Pradhan Mantri Awas Yojana will be ensured in the state. Under this scheme, assistance of Rs 50,000 will be provided to each person. Under the Pradhan Mantri Surya Ghar Yojana, Rs 1.30 lakh has been allocated for domestic electricity and Rs 1,000 crore for power generation of more than 500 MW.

The state government has so far spent Rs 33,232 crore on Ladli Behan in the budget, while the Finance Ministry has allocated Rs 36,000 crore for it. A Hope Mall will be started in every district to establish savings banks and 10 malls will be set up in the first phase.

A 200-bed hospital will be built in Thane of Ratnagiri district, which will provide medical facilities to the citizens. The second phase of construction of metro route will be implemented in Pune. In the second phase, Rs 9894 crore has been allocated for two metro routes. Both the metro projects have been sent for approval from the Central Government. A statue of Chhatrapati Shivaji Maharaj will be installed in Sangameshwar. Apart from this, Maratha Shaurya Smarak will be built in Panipat. A statue of Chhatrapati Shivaji Maharaj will be built in Agra.

In this budget of the state government, a new tax has been imposed on the citizens. In this, a lump sum tax of 7% has been ensured on the purchase of cars. This tax has been imposed on electric cars and other things. This tax has been imposed on the purchase of cars worth more than 30 lakhs so that the common citizens do not face any problem. The state government has presented a budget of 7 lakh thousand crores. In this deficit budget, the burden of tax has been imposed on the citizens.

Business

Sensex, Nifty open marginally lower amid mixed global cues

Mumbai, Sep 19: The Indian benchmark indices opened marginally lower on Friday, with IT stocks leading the losses in early trade.

As of 9.26 am, Sensex was down 241 points or 0.29 per cent at 82,772 and Nifty was down 63 points or 0.25 per cent at 25,360.

The US Federal Reserve resumed interest rates cut cycle by reducing rates by 25 basis points but the outlook on further easing in the months ahead failed to meet the investors’ dovish expectations, while markets awaited more cues into US policy path, according to analysts.

Nifty Midcap 100 inched up by 0.16 per cent, and the Nifty Small cap 100 lost 0.04 per cent.

Hero MotoCorp, Shriram Finance, Maruti Suzuki, NTPC, Tech Mahindra were among major gainers on Nifty, while losers were ICICI Bank, Bajaj Finance, Tata Consumer and Titan Company.

Among sectoral indices, Nifty IT, the top loser, lost 0.40 per cent. Nifty FMCG and Nifty Private bank also weighed down on the indices. Except Nifty Realty and PSU Bank all other sectoral indices were trading in the red or with marginal gains.

The Nifty50 held firmly above the 25,400 mark in the previous session, signalling investor confidence with upside momentum intact.

Analysts said that while buying interest is visible at lower levels, the 25,500–25,600 zone remains a stiff hurdle on the upside. On the downside, support is placed at 25,300–25,100 for any minor pullback.

“Market is on an uptrend and is well positioned to set new records soon. Fundamentals, technicals and sentiments are favourable for a steady uptrend. Earnings are likely to improve from Q3 onwards. Technically, short covering is happening and can accelerate,” said Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited.

From the market sentiment perspective, a US-India trade deal without the penal tariff and a lower reciprocal tariff is likely, he added.

Major US indices made gains overnight as the Nasdaq added 0.94 per cent, the S&P 500 edged up 0.48 per cent and the Dow inched up 0.27 per cent.

Most of the Asian markets were trading in the green during the morning session. While China’s Shanghai index dipped 0.12 per cent, and Shenzhen advanced 0.23 per cent, Japan’s Nikkei edged up 0.77 per cent, while Hong Kong’s Hang Seng Index moved up 0.12 per cent. South Korea’s Kospi lost 0.46 per cent.

On Thursday, foreign institutional investors (FIIs) purchased equities worth Rs 366 crore, while domestic institutional investors (DIIs) were net buyers of equities worth Rs 3,326 crore.

Business

Stock market rises for 3rd consecutive day on US Fed rate cut, buying in IT sector

Mumbai, Sep 18: The Indian equity indices extended the gaining momentum for the third consecutive session on Thursday amid buying in IT stocks after the US Fed announced a rate cut.

Sensex closed at 83,013.96, up 320.25 points or 0.39 per cent.

The 30-share index opened with a decent gap-up at 83,108.92 against the last session’s closing of 82,693.71 after the US Fed announced a rate cut. However, the index remained range-bound throughout the session amid a mixed approach across sectors except IT.

Nifty ended the session at 25,423.60, up 93.35 points or 0.37 per cent.

“Global equities traded in the green after the U.S. Federal Reserve cut rates by 25 bps to 4–4.25 per cent and signalled two more reductions this year to cushion rising job market risks. Mirroring the upbeat global sentiment, Indian markets opened with a positive gap-up and maintained a sideways trajectory through the first half of the session,” Ashika Institutional Equities said in a note.

Eternal, Sun Pharma, Infosys, HDFC Bank, PowerGrid, HCL Tech, ITC, Hindustan Unilever, Tata Steel, Axis Bank and Bajaj FinServ settled high amid the Sensex stocks. Bajaj Finance, Tata Motors, Trent, Ultratech Cement, and Asian Paints ended the session in negative territory.

The majority of sectoral indices remained in green amid value buying. Nifty Fin Services jumped 135 points or 0.51 per cent, Nifty Bank rose 234 points or 0.42 per cent, Nifty Auto moved up 34 points or 0.13 per cent, Nifty FMCG jumped up 201 points or 0.36 per cent, and Nifty IT surged 303 points or 0.83 per cent.

Broader indices continued their bullish run amid buying in midcap and small-cap stocks. Nifty Small Cap 100 jumped 53 points or 0.29 per cent, Nifty Midcap 100 increased 224 points or 0.38 per cent, and Nifty 100 ended the session 91 points or 0.35 per cent high.

“Rupee closed weaker by 0.26 at 88.09 despite the dollar index staying soft post-Fed policy, where a rate cut was announced but forward guidance remained mixed as the roadmap for further cuts was unclear and data-dependent on jobs,” said Jateen Trivedi of LKP Securities.

The rupee failed to gain as FII sentiment remained cautious, while ongoing India-US trade talks will be the next key trigger. Support for the rupee lies near 87.75, while resistance is seen at 88.25, he added.

Business

Fed Finally Cuts Interest Rates, But What’s Next For India’s Markets & Gold Prices?

Mumbai: The US central bank (Federal Reserve) has cut interest rates for the first time in 2025. This step is expected to support the US economy. Fed Chairman Jerome Powell said the decision was not due to political pressure, even though President Donald Trump had been demanding a rate cut for a long time.

The Fed has also hinted that it may cut rates two more times this year. This is to help the weak US job market. In the recent two-day meeting, almost all Fed members supported the 25 basis points cut. Only one member, Stephen Miran, voted against it.

Stephen Miran works with the White House and was earlier Trump’s economic advisor. He wanted a bigger cut—50 basis points. Trump had promised rate cuts during his election campaign.

New interest rate: 4 percent to 4.25 percent

Repo operation rate: 4.25 percent

Interest on reserve balance: 4.15 percent

Reverse repo rate: 4 percent

Prime credit rate: 4.25 percent

This US rate cut could help Indian markets. Lower US interest rates may push foreign investors to invest in India for better returns. This could lead to growth in the Indian stock market.

Gold may also get a boost. When interest rates fall, investors often look for safer and better returns—like gold. So gold prices might rise further.

The US job market is still weak. Looking at this and other economic risks, more rate cuts may happen in the coming months.

-

Crime3 years ago

Crime3 years agoClass 10 student jumps to death in Jaipur

-

Maharashtra12 months ago

Maharashtra12 months agoMumbai Local Train Update: Central Railway’s New Timetable Comes Into Effect; Check Full List Of Revised Timings & Stations

-

Maharashtra11 months ago

Maharashtra11 months agoMumbai To Go Toll-Free Tonight! Maharashtra Govt Announces Complete Toll Waiver For Light Motor Vehicles At All 5 Entry Points Of City

-

Maharashtra12 months ago

Maharashtra12 months agoFalse photo of Imtiaz Jaleel’s rally, exposing the fooling conspiracy

-

National News12 months ago

National News12 months agoMinistry of Railways rolls out Special Drive 4.0 with focus on digitisation, cleanliness, inclusiveness and grievance redressal

-

Maharashtra10 months ago

Maharashtra10 months agoMaharashtra Elections 2024: Mumbai Metro & BEST Services Extended Till Midnight On Voting Day

-

National News1 year ago

National News1 year agoJ&K: 4 Jawans Killed, 28 Injured After Bus Carrying BSF Personnel For Poll Duty Falls Into Gorge In Budgam; Terrifying Visuals Surface

-

Crime11 months ago

Crime11 months agoBaba Siddique Murder: Mumbai Police Unable To Get Lawrence Bishnoi Custody Due To Home Ministry Order, Says Report